(Bloomberg) — Apple Inc.’s earnings report is unlikely to give investors the catalyst they’ve been looking for to revive the iPhone maker’s struggling stock price.

Most Read from Bloomberg

The technology behemoth is expected to post profit and revenue growth that severely lags the industry when it reports its fiscal third-quarter results Thursday after the market closes.

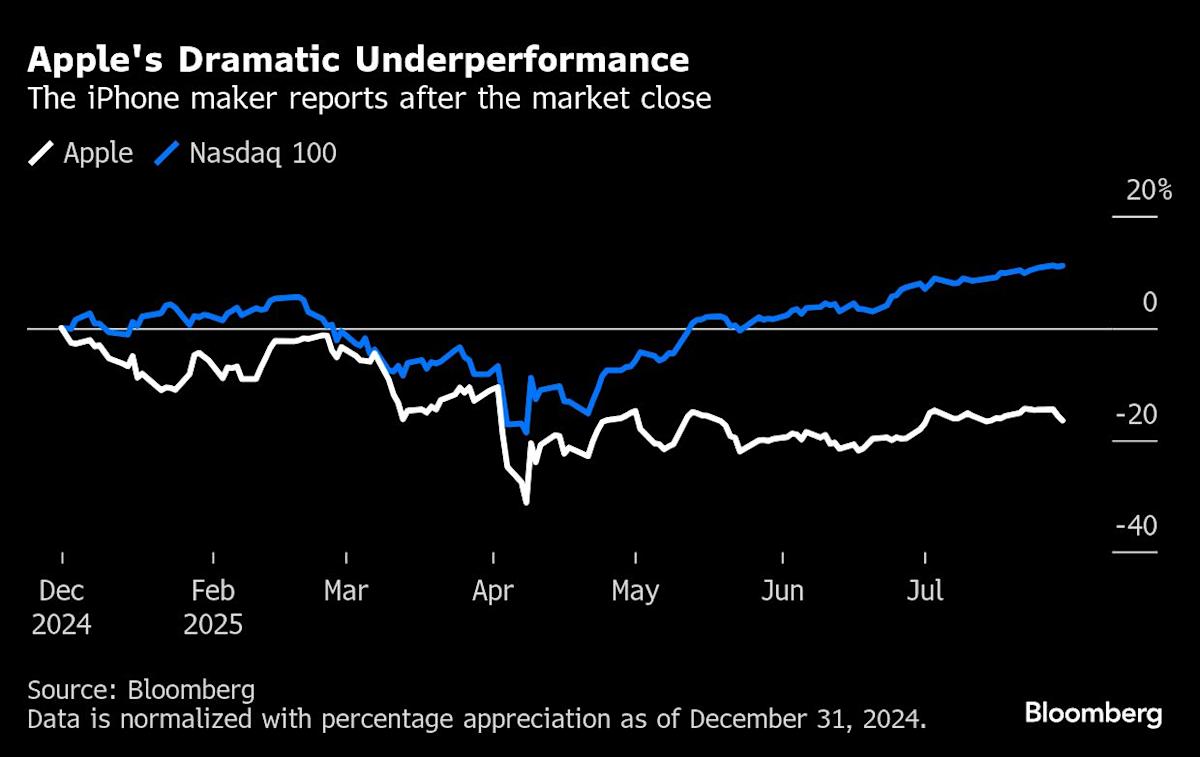

Apple shares are down almost 17% this year. Compounded by the lack of a strong artificial intelligence strategy, high exposure to tariff risk and regulators targeting its highly profitable relationship with Alphabet Inc., it’s hard to see them rebounding any time soon — especially as they continue to trade at a premium valuation.

“Apple’s embarrassing AI shows how it has lost its mojo with innovation, and the lack of innovation speaks to the lack of revenue growth, and that speaks to why we don’t see upside in the stock,” said Peter Andersen, founder and chief investment officer of Andersen Capital Management. “It is valued like a growth stock, but I’m very skeptical about the potential for a significant inflection in growth, and I think it will eventually lose that premium.”

Analysts expect the company to report a 2.4% rise in quarterly profits on a 4.1% gain in revenues, according to data compiled by Bloomberg. The overall tech sector’s anticipated earnings growth is 16.8% on a 13% jump in revenue, according to Bloomberg Intelligence.

The stock dipped 0.2% on Thursday.

This helps explain why Apple is among the 15 worst-performing stocks in the Nasdaq 100 Index this year and why it lags every one of the Magnificent Seven tech giants other than Tesla.

But even with this year’s slide, Apple’s stock still trades at almost 28 times estimated earnings, higher than its 10-year average of 21. The shares are pricier than the Nasdaq 100 as well as megacap peers that are far better positioned in AI, like Alphabet, Meta Platforms, and Amazon.com Inc.

Negative Sentiment

The combination of tepid growth and a high valuation is why sentiment toward the one-time consensus favorite has become “fairly negative,” according to Bank of America. In a sign of their historically weak momentum trends, shares have been below their 200-day moving average since March 10, a 98-session streak — as of Wednesday’s close — that matches its longest since February 2023. Should it close below the key technical level on Thursday, that would represent its longest streak in almost a decade.

Apple’s failure to capitalize on AI is particularly important to investors, who are calling for a dramatic pivot in strategy. Many would like to see a management shakeup — or even a big acquisition, something Apple has historically shunned in favor of in-house development.

The problem is Apple’s in-house AI features, such as those unveiled at its Worldwide Developers Conference in June, have been delayed or underwhelmed. The company has reportedly considered using AI tech from outside companies to power a new version of its Siri digital assistant. Executives have also discussed making an offer for AI startup Perplexity AI, Bloomberg News reported last month.

Apple’s failure to establish a firm AI strategy stands in contrast to its big-tech rivals, which have largely carved out niches in the technology and have put up impressive earnings this season.

After the market closed Wednesday, Microsoft reported significantly better-than-expected revenue on the back of strong cloud demand, while Meta Platforms — which has poached major AI talent from Apple with substantial pay packages — posted healthy results and gave a far better than anticipated outlook. Both stocks soared. Last week, Alphabet said that strong demand for its AI services boosted quarterly sales.

Amazon.com also reports Thursday after the close, and investors are looking for signs that AI is having an impact across the company’s business, not only in its cloud-computing division, and improving efficiencies.

“It’s hard to be excited about Apple when you can look to the other Magnificent Seven stocks and find double-digit growth that should continue for a while amid the AI wave, especially since those are often cheaper,” said Bill Stone, chief investment officer at Glenview Trust Co., who owns the stock but hasn’t been adding to positions amid the selloff.

“Apple would be a lot more interesting if the multiple was lower, since it remains an extremely high-quality business with great cash flow and an ecosystem that will be tough to dislodge,” he added. “But what finally gets growth going again is the biggest question.”

Top Tech Stories

-

Meta Platforms Inc. is taking advantage of its lucrative advertising business and stepping up spending next year, with executives saying now is the time to seize on investment opportunities in artificial intelligence.

-

Apple iPhone exports to the US from India will remain untouched by Donald Trump’s latest 25% tariffs on the South Asian nation, for now.

-

Microsoft Corp. said it will spend more than $30 billion in the current quarter to build out the data centers powering its artificial intelligence services.

-

EBay Inc. shares jumped after the company projected sales that topped analysts’ estimates, suggesting optimism for continued consumer resilience at a time of shifting US tariff proposals.

-

Qualcomm Inc., the biggest maker of chips that run smartphones, fell after reporting lackluster growth in that market, fueling concerns that tariffs will take a toll on the industry.

-

Sam Altman OpenAI will expand its Stargate project to Europe with the construction of a new data center in Norway.

Earnings Due Thursday

-

Earnings Premarket:

-

Arrow Electronics Inc. (ARW US)

-

Comcast Corp. (CMCSA US)

-

Insight Enterprises Inc. (NSIT US)

-

InterDigital Inc. (IDCC US)

-

Earnings Postmarket:

-

Cohu Inc. (COHU US)

-

Cable One Inc. (CABO US)

-

DXC Technology Co. (DXC US)

-

Appfolio Inc. (APPF US)

-

Apple Inc. (AAPL US)

-

Asure Software Inc. (ASUR US)

-

Axt Inc. (AXTI US)

-

Cloudflare Inc. (NET US)

-

Dolby Laboratories Inc. (DLB US)

-

Five9 Inc. (FIVN US)

-

GSI Technology Inc. (GSIT US)

-

Grid Dynamics Holdings Inc. (GDYN US)

-

KLA Corp. (KLAC US)

-

MicroStrategy Inc. (MSTR US)

-

Monolithic Power Systems Inc. (MPWR US)

-

Pros Holdings Inc. (PRO US)

-

Rimini Street Inc. (RMNI US)

-

Riot Platforms Inc. (RIOT US)

-

Rogers Corp. (ROG US)

-

Universal Display Corp. (OLED US)

-

Workiva Inc. (WK US)

–With assistance from Matt Turner and Subrat Patnaik.

(Updates to afternoon trading.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.