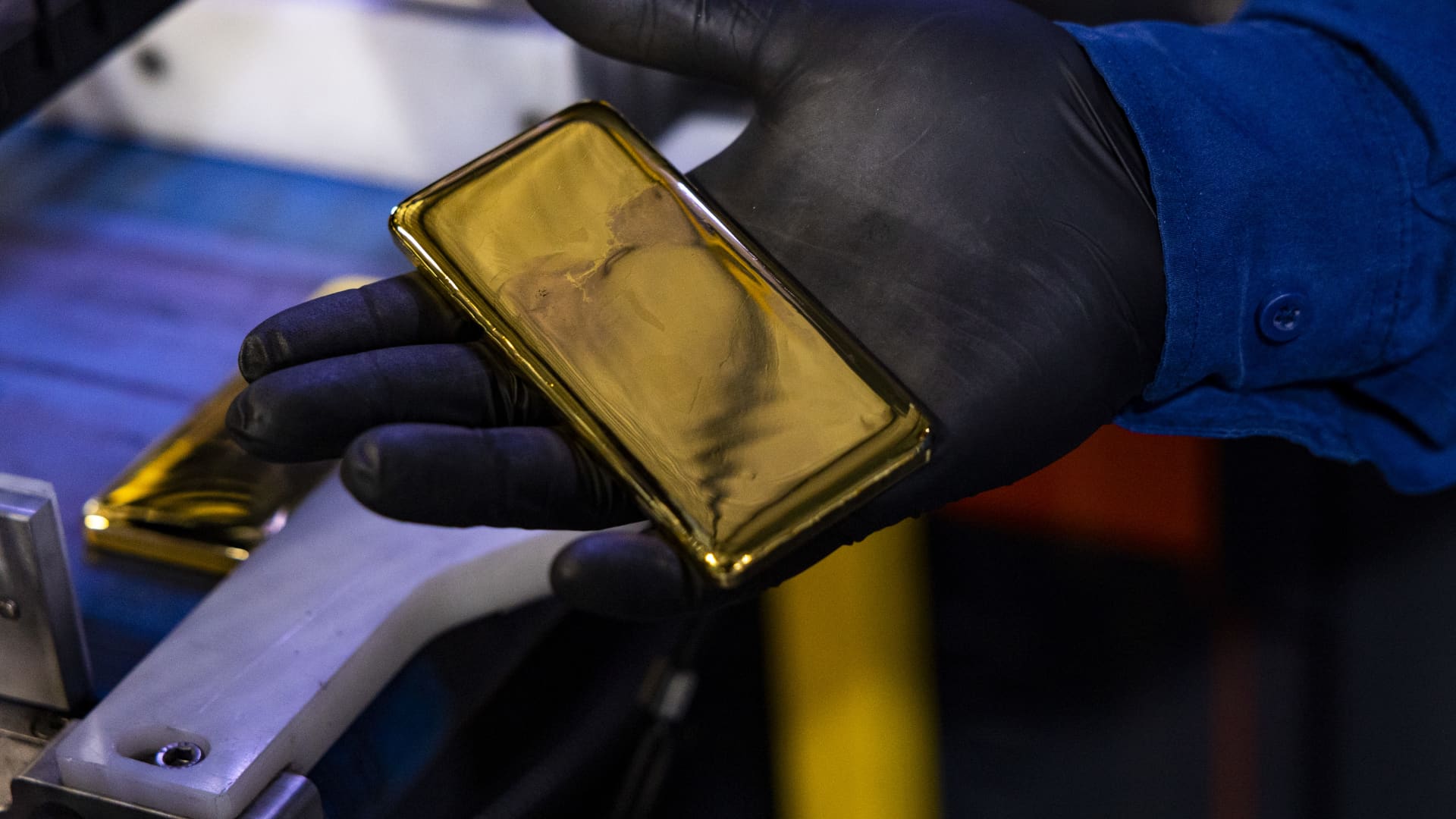

Gold traded below the $4,000-per-ounce mark again on Tuesday as the dollar remained resilient at over three-month highs, while reduced chances of another U.S. interest rate cut in December and easing U.S.-China trade tensions blunted bullion’s demand.

Bloomberg | Bloomberg | Getty Images

Gold profits are glittering in 2025 — but cashing in may trigger a bigger tax bill than you might think.

The price of gold futures hit $4,000 per ounce in October, for the first time ever. While the precious metal dropped in price on Friday as part of a broader market decline, year-to-date returns still sat at nearly 50%, with a price around $4,100.

Exchange-traded funds backed by physical gold — like SPDR Gold Shares (GLD), iShares Gold Trust (IAU), and abrdn Physical Gold Shares ETF (SGOL) — are up by a similar amount.

By comparison, the S&P 500 U.S. stock index is up about 15% in 2025, as of Friday’s close.

Heady returns in 2025 follow a year in which gold recorded its best annual performance since 2010, about 26%, according to the World Gold Council.

But investment profits from physical gold and funds that track gold are taxed differently from those of traditional assets like stocks and bonds, according to tax experts.

The upshot is that investors — especially those in the top tax brackets — may pay a higher federal tax rate on gold profits relative to assets like stocks and bonds.

That could leave gold investors with a surprise tax bill.

“I’ve seen missteps quite a few times, especially this year with the run that gold has had,” said Tommy Lucas, a certified financial planner and enrolled agent at Moisand Fitzgerald Tamayo, which was No. 69 on the CNBC’s Financial Advisor 100 list for 2025.

Not all gold ETFs are taxed the same

“Long-term” tax rates on investment profits — known as capital gains — are preferential relative to the marginal income tax rates that investors might pay on wages and other income, for example.

For example, the top federal rate on long-term capital gains, 20%, is lower than the top marginal income tax rate, 37%.

Long-term capital gains rates apply when an investor has owned an asset for more than one year.

However, physical gold and funds backed by physical gold are treated as collectibles for tax purposes — and collectibles have a top 28% rate on long-term capital gains.

“There’s no getting around that [collectibles rate] just because it’s held in an ETF wrapper,” Lucas said.

This also applies to other precious metals like silver.

Funds that hold gold futures contracts — instead of physical gold — have yet a different tax structure, with a top federal tax rate of 26.8%, said Jeffrey Levine, a certified public accountant and certified financial planner based in St. Louis.

“Just because you have a gold ETF doesn’t mean it’s going to be taxed exactly the same,” said Levine, the chief planning officer at Focus Partners Wealth.

In both cases — collectible and futures — investors in the top tax bracket would pay a higher rate on long-term profits than a traditional asset like a stock, he said.

Of course, this tax discussion only applies to gold held in a taxable brokerage account and sold for a profit. It doesn’t apply to investors who hold gold ETFs in a tax-preferred retirement account, like an IRA.

Breaking down tax on collectibles and futures

There are three long-term capital-gains rates: 0%, 15% and 20%, depending on an investor’s annual income.

Short-term capital gains, which apply to assets held for a year or less, are different. Profit on such sales is taxed at ordinary income tax rates, like those that apply to wages, for example. There are seven marginal tax rates, ranging from 10% up to 37%.

Collectibles are taxed like short-term capital gains but are capped at 28%. That means an investor in the 32%, 35% or 37% income tax brackets wouldn’t own more than 28% in long-term capital gains on collectibles profits.

I’ve seen missteps quite a few times, especially this year with the run that gold has had.

Tommy Lucas

certified financial planner and enrolled agent at Moisand Fitzgerald Tamayo

Meanwhile, capital gains for futures contracts are assessed based on a 60/40 tax structure, said Levine. That is, 60% of their profits are taxed as long-term capital gains, and the remaining 40% as short-term capital gains.

In the case of gold futures funds, here’s how the math works for someone in the top tax bracket: 60% of 20%, which is the top long-term rate for capital gains, is 12%; and 40% of 37%, the top marginal income tax rate, is 14.8%.

Added together, that’s a top capital-gains rate of 26.8% for gold futures contracts, Levine said.

While some higher-income investors might think it’s a better idea from a tax perspective to buy gold futures funds, there are also downsides, he said.

For example, such investors would get a K-1 tax form since the funds are often structured as partnerships, Levine said. That could make it more challenging and costly to file an annual tax return, he said.