There’s no shortage of experts telling firms to diversify their supply chains: “Move away from the US” or “develop a China+1 strategy.” Sure, that’s useful advice. But it’s not achievable for every business. In fact, it’s not achievable for most. It costs a mountain of money to find new suppliers, test products, and build relationships with manufacturers. Suggestions that firms can simply “diversify” are too simplistic. But that doesn’t mean firms should sit still. There’s plenty that can be done now that won’t break the bank.

1. Know your exposures

Why don’t you have to diversify your supply chains to understand your vulnerabilities? Map your suppliers, your markets, and your key inputs. Who do you rely on most? Which markets are most exposed to tariffs or trade disruptions?

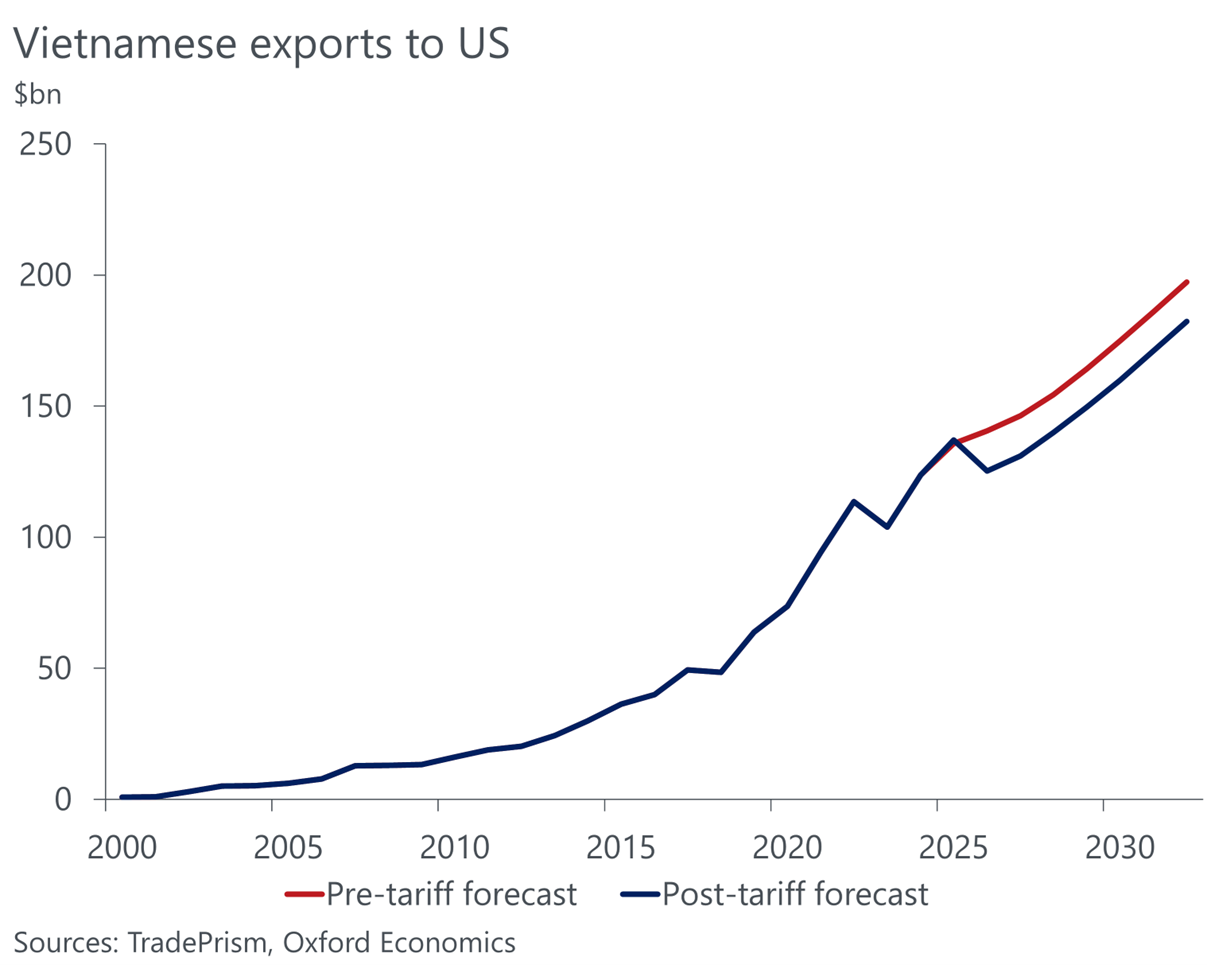

For instance, our TradePrism data shows Vietnam is a major importer of semiconductors, with much of that used in the manufacture of consumer goods headed for the US. If US-Vietnam tensions escalate, we could see part of this trade drop, denting Vietnamese demand for semiconductor inputs. As Vietnam’s major supplier of semiconductors, firms in Hong Kong, China, Korea, Singapore, Malaysia and Japan are exposed to the winds of upstream trade disputes.

See how Oxford Economics can help you navigate the tariff changes

Get in touch

You don’t have to diversify your supply chains to understand your vulnerabilities. Map your suppliers, your markets, and your key inputs. Who do you rely on most? Which markets are most exposed to tariffs or trade disruptions?

For instance, our TradePrism data shows Vietnam is a major importer of semiconductors, with much of that used in the manufacture of consumer goods headed for the US. If US-Vietnam tensions escalate, we could see part of this trade drop, denting Vietnamese demand for semiconductor inputs. As Vietnam’s major supplier of semiconductors, firms in Hong Kong, China, Korea, Singapore, Malaysia and Japan are exposed to the winds of upstream trade disputes.

Consider indirect effects too. US tariffs on steel and copper, for example, can ripple through global markets, hitting input costs even for firms that don’t export to the US. Many businesses don’t fully appreciate how complex their supplier networks are until something breaks – and by then, it’s too late.

2. Identify opportunities

Trade disruptions don’t just create losers; they can create openings. Where are competitors’ costs likely to rise? Does that create opportunities to enter new markets?

If you’re an exporter, build relationships in those markets now. Even if you can’t shift volumes immediately, you’ll be better placed to pivot when the opportunity arises.

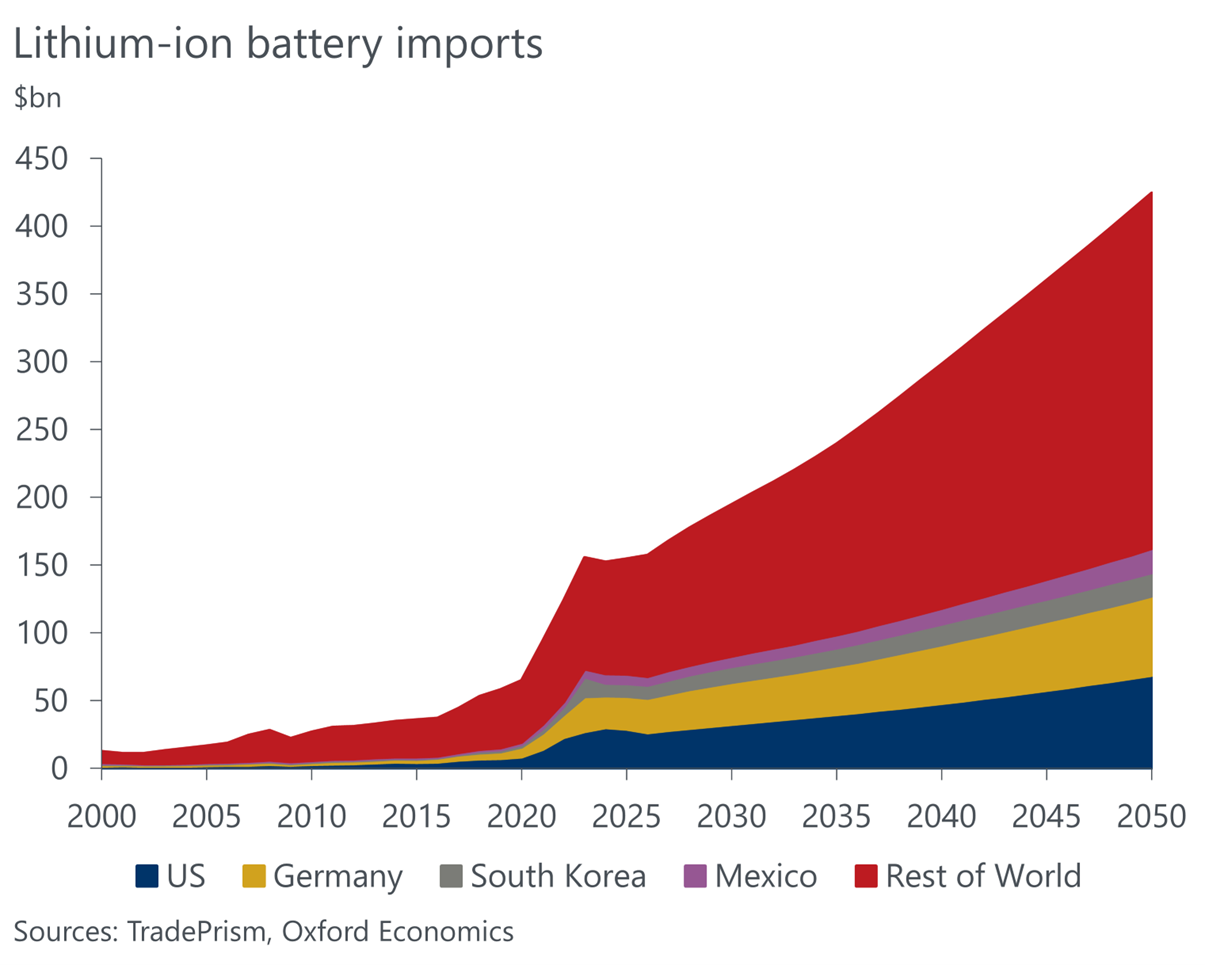

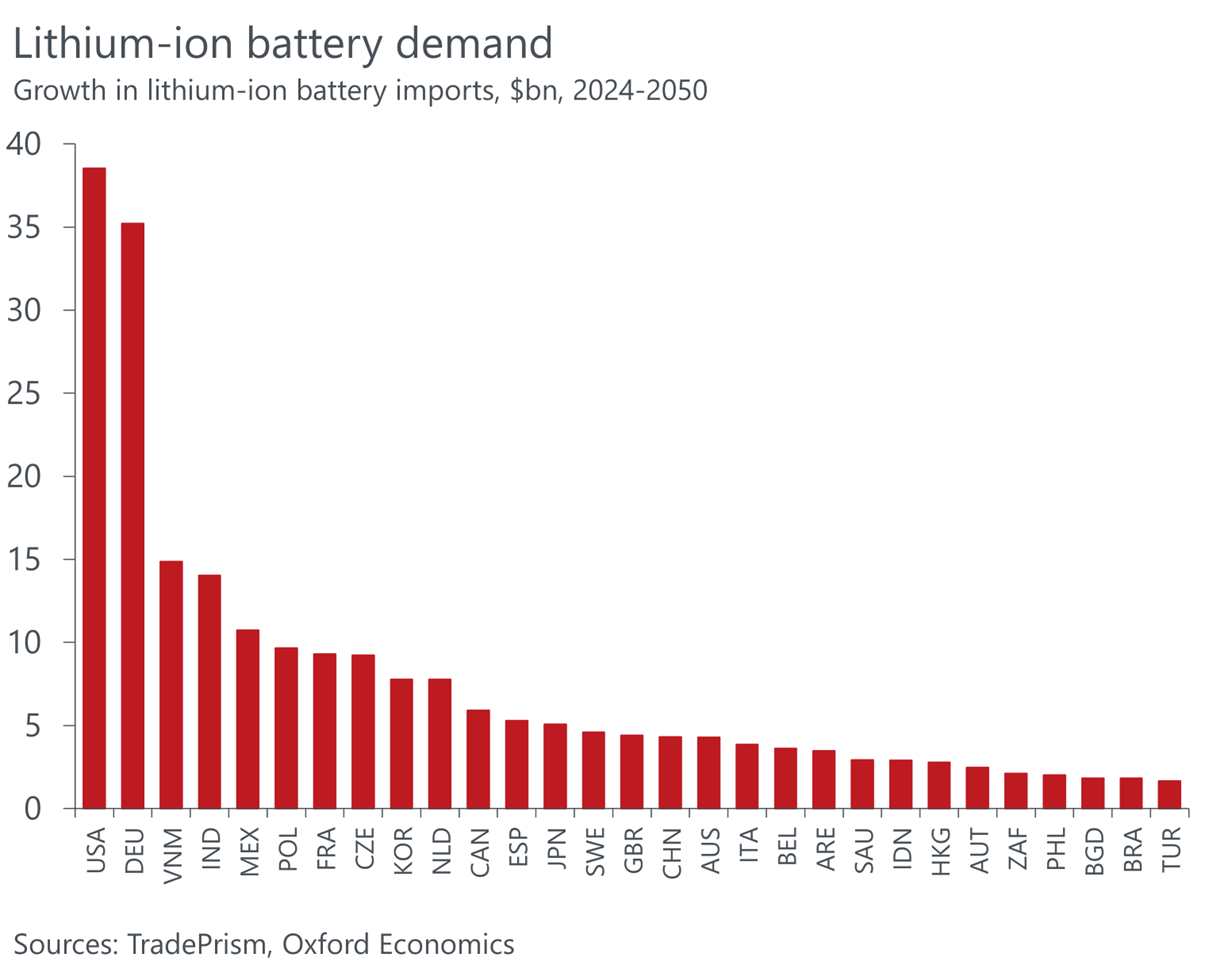

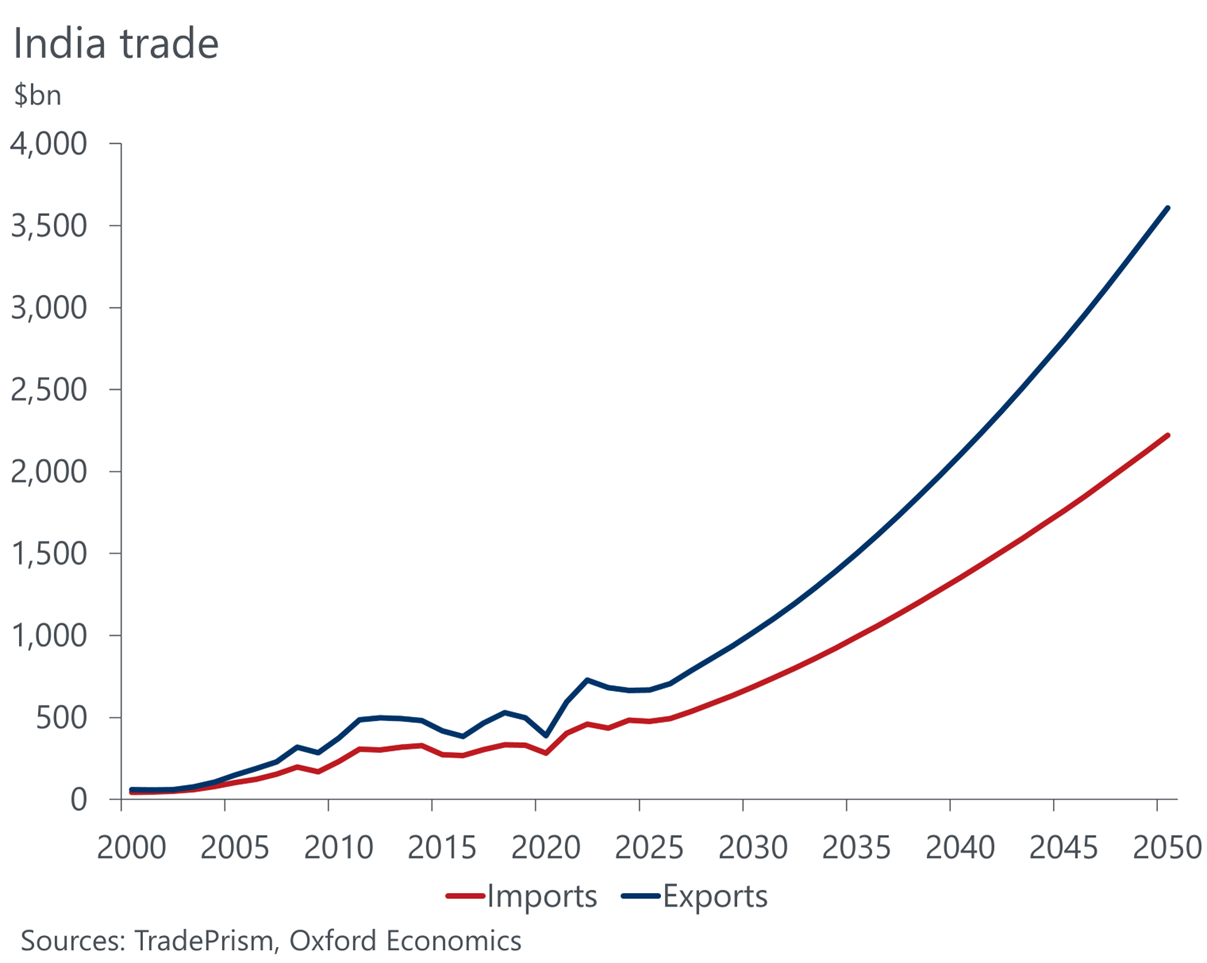

Our detailed 4-digit HS code forecasts show where these growth areas are. For instance, chart 3 shows projected demand for lithium-ion batteries to 2050. Importantly, the bulk of that growth is expected to be driven by countries not currently in the top handful of importers.

Why? Well, changing industry structures and economic growth mean economies like

Vietnam, India and Poland will need more and more batteries – both as inputs into manufacturing and to power their economies. Being ahead of the curve in identifying these dynamics allows firms to make moves now, establishing ties in the economies with the fastest-growing demand. Don’t wait for others to get in first.

If you’re an exporter, build relationships in those markets now. Even if you can’t shift volumes immediately, you’ll be better placed to pivot when the opportunity arises.

Our detailed 4-digit HS code forecasts show where these growth areas are. For instance, chart 3 shows projected demand for lithium-ion batteries to 2050. Importantly, the bulk of that growth is expected to be driven by countries not currently in the top handful of importers.

3. Rethink competitive dynamics

Today’s best deal may not be tomorrow’s. Tariffs flip competitiveness on its head. Suppliers you’ve long assumed were the cheapest may suddenly be undercut by competitors from lower-tariff markets. Conversely, suppliers in the direct line of fire may be forced to discount heavily to hold onto business. This could create opportunities to switch suppliers and lock in lower input costs.

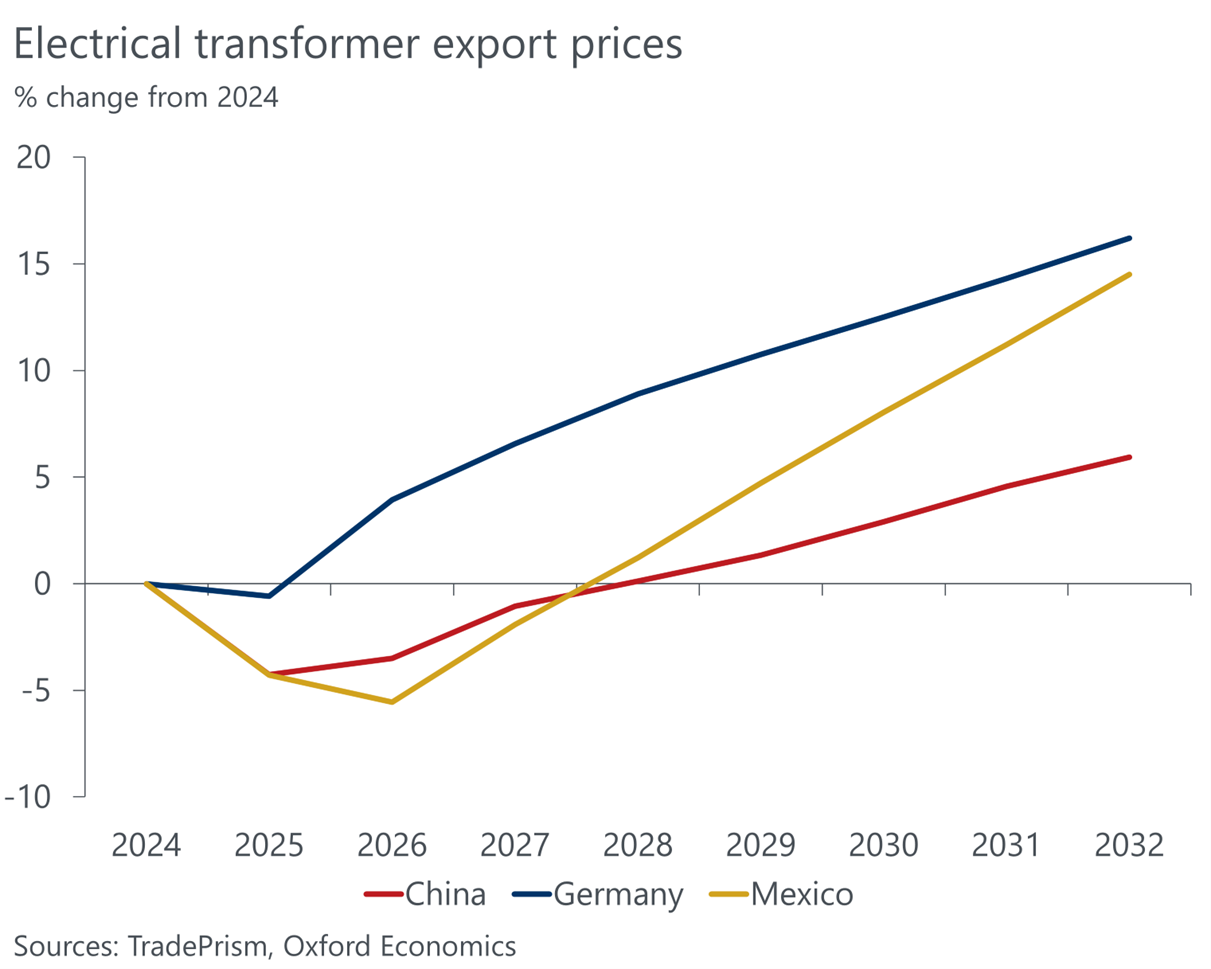

Take electrical transformers, for example. Chart 4 shows the change in export prices for the three largest exporters of electrical transformers. Two of them – China and Mexico – are in the crosshairs for President Trump’s tariffs. As US demand dries up, manufacturers in these economies will need to cut prices to stay competitive and break into new markets. Meanwhile, German export prices are more insulated, aided by relatively lower US tariffs; still, the 10% duty on EU exports is enough to see prices effectively flatline this year. As import tariffs on Mexico come down through the second half of 2026, growth in electrical transformer export prices will outpace those from China; we expect US tariffs on imports from China to stay elevated indefinitely.

Electrical transformers are key inputs into the manufacture of battery systems, consumer electronics, computers and industrial equipment. Finding cheaper suppliers can save manufacturers of these types of goods a pretty penny.

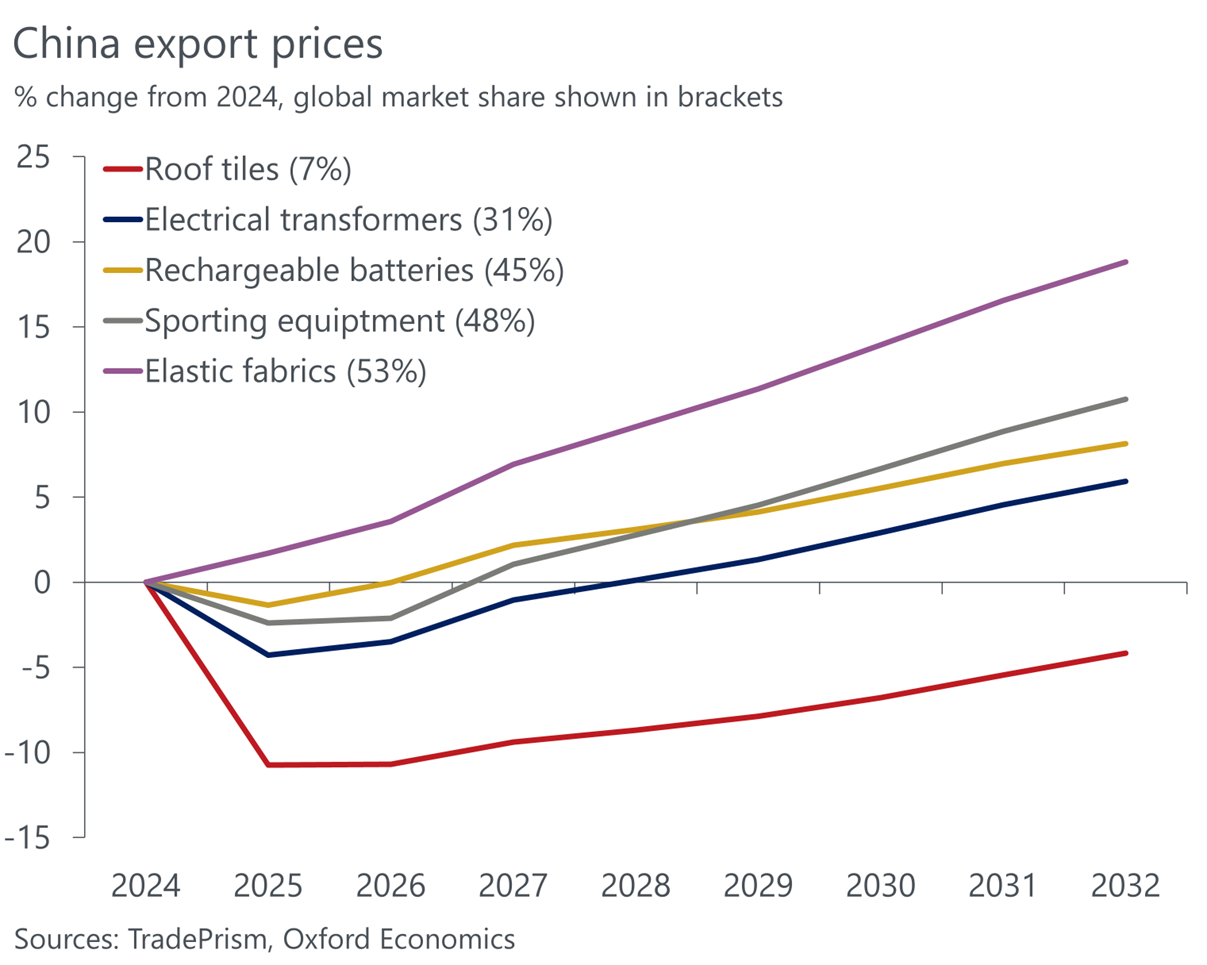

These types of price dynamics play out across the entire trade map. But the shifts are not linear. For goods which China has a larger market share, prices are stickier. For instance, China accounts for more than half the world’s export of elastic fabrics (think spandex and Lycra). Given China’s dominance (and the world’s lack of alternative suppliers), prices are still able to rise this year and next, despite tariffs. In contrast, China is only a minor player in the roof tile exports, meaning US buyers have more options to find cheaper suppliers. As buyers look elsewhere, prices are expected to fall more than 10% this year.

4. Leverage trade agreements

While the US raises barriers, other countries are opening doors. In July, the UK and India struck a wide-ranging trade deal. India is also negotiating with the EU and Australia on expanded deals expected to be signed later this year.

These agreements can lower supplier costs and open new markets for your products. Do the work to understand how your business can benefit. Would a new agreement make it cheaper to source from a particular country? Could it help you reach customers you couldn’t before?.

5. There are certainties in uncertain times

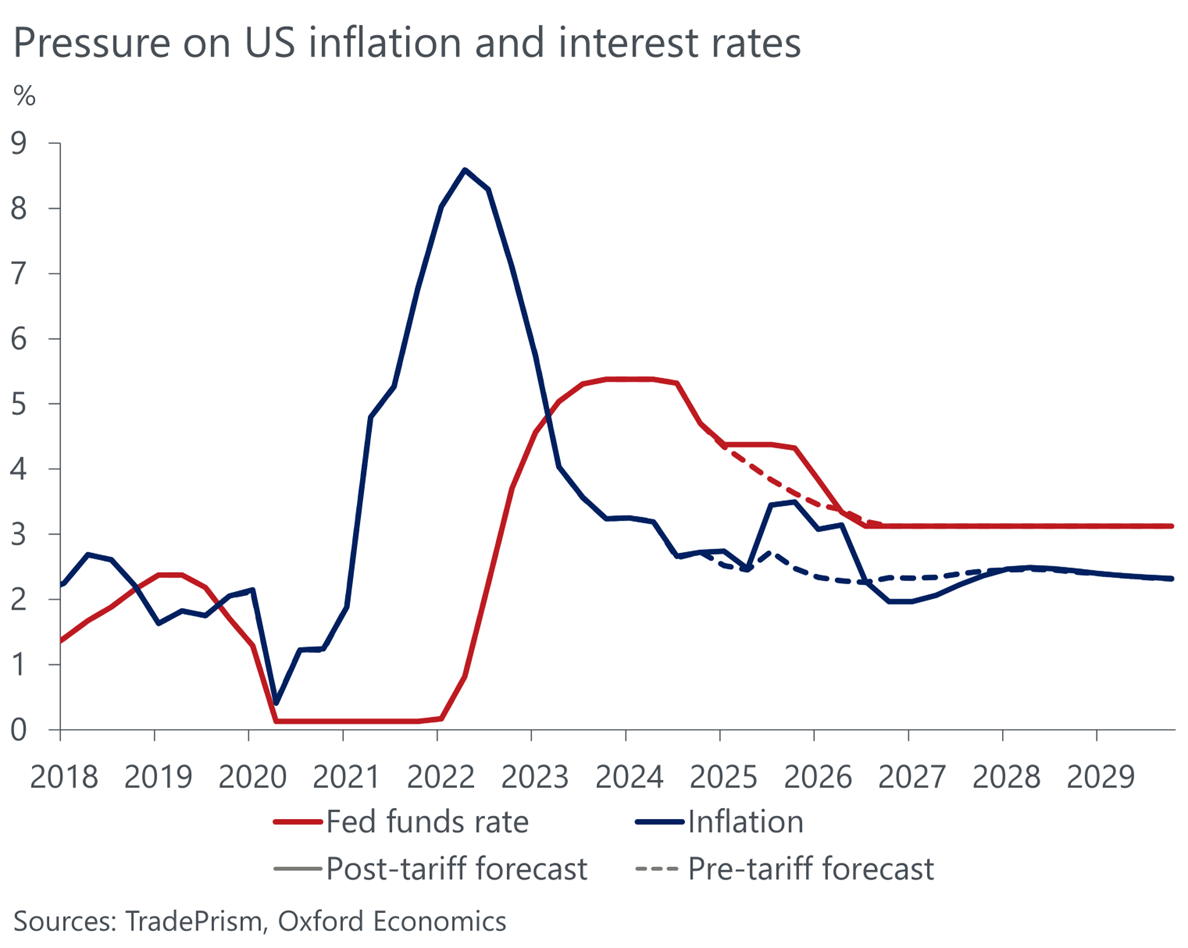

Uncertainty can be paralysing, but some outcomes are predictable. Tariffs are inflationary for the economy that imposes them. So are big spending programs like Trump’s One Big Beautiful Bill. That means higher inflation and elevated interest rates in the US this year.

Another certainty? Markets seek safe havens during chaos. Usually, that’s the US dollar. But with political interference in key US institutions – from the Federal Reserve to the Bureau of Labour Statistics – investors are looking elsewhere. That will likely push the greenback lower over time.

Sticky US rates and a softer US dollar can create opportunities to hedge currency exposures and take advantage of interest rate differentials.

Our forecasts are rooted in economics, helping businesses identify opportunities and risks beyond just trade.

The bottom line

The global trade environment is volatile and politically charged. But businesses don’t have to be paralysed.

By knowing your exposures, scanning for opportunities, reassessing competitive dynamics, leveraging trade agreements, and acting on economic certainties, firms can move decisively – even when the world is turbulent.

For the latest reports on trade and tariffs, please visit our topic page.

Join our upcoming webinar to stay updated on the evolving landscape of US trade policy and get your questions answered by industry experts.

Want to deepen your understanding of how trade tariffs and HS codes impact global trade? Read our comprehensive guide here.