(Bloomberg) — Consumers and businesses are using stablecoins – digital tokens pegged to the dollar – to make real-world purchases and payments at an accelerating pace since the July passage of the first US legislation to regulate that niche of the cryptocurrency sector.

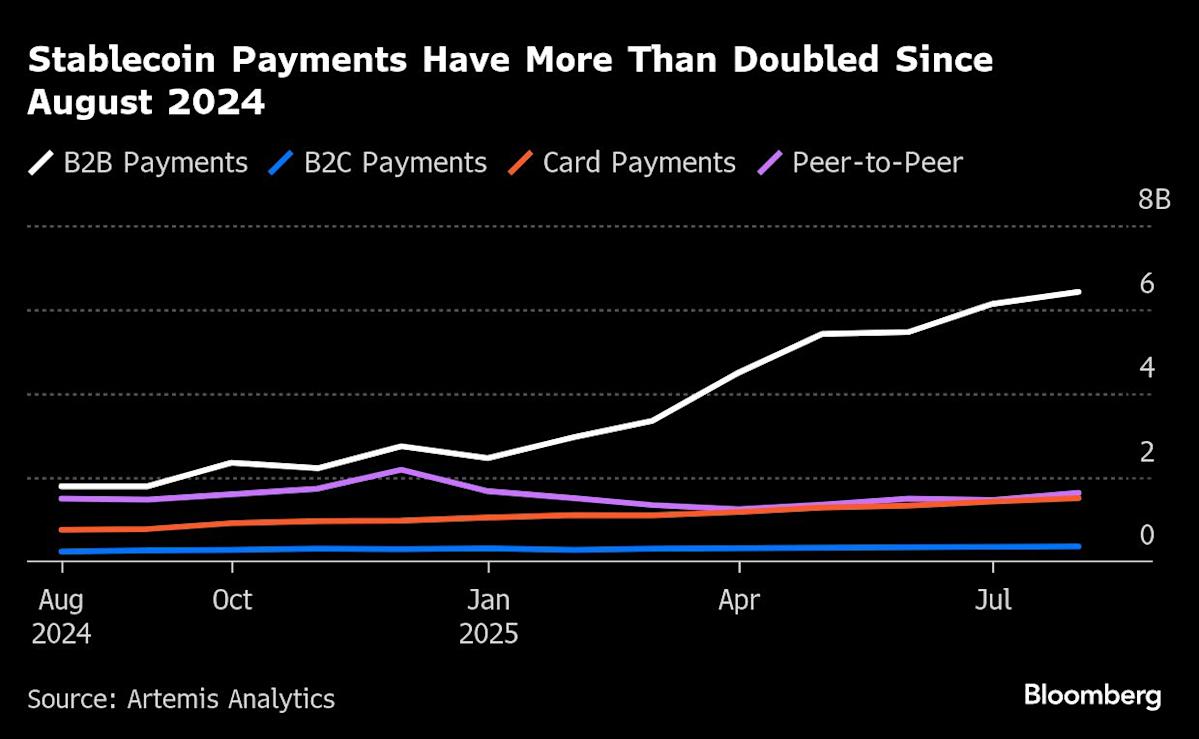

Over $10 billion was moved through stablecoins in August for goods, services, and transfers, up from $6 billion in February and more than double the volume from August 2024, according to a report from Artemis, a blockchain data provider. At this pace, stablecoin payments could reach $122 billion over a full year, Artemis researchers said.

Most Read from Bloomberg

This growth follows President Donald Trump’s signing of the Genius Act into law on July 18, which established federal regulations for stablecoin issuers and requires them to back their tokens with highly liquid assets such as Treasury bills.

While stablecoin payments are growing rapidly, they remain tiny compared to traditional systems. At a $122 billion annual pace, stablecoin payments represent a small fraction of conventional payment volumes. Still, this gives stablecoin advocates optimism about the instrument’s growth prospects.

“If you look at stablecoin supply on a certain trend, and then right after Genius passed, the trend does inflect even more,” said Andrew Van Aken, data scientist at Artemis, noting the report’s illustration of an increase in the growth rate of stablecoin supply. “We certainly think it has had an incremental impact.”

Business-to-business transfers make up the most of stablecoin payments at $6.4 billion monthly – nearly two-thirds of the total and up 113% since February, the report said. This marks the first time business payments have exceeded peer-to-peer consumer transactions, which held steady at $1.6 billion monthly, according to Artemis.

Companies are using stablecoins to bypass traditional international banking delays. Businesses are “fed up with this very cumbersome send deposit here to this bank, which then sends another bank, which sends another bank,” Van Aken said.

With an average business stablecoin payment of $250,000, Van Aken said larger purchases are where speed matters most. Companies can use stablecoin to avoid the delays of routing payments through multiple correspondent banks in the traditional system, he said.