The Nightcrawler joked that he “broke Pedro”, though not in the super-powered combat fans might expect

In a playful and revealing chat on Jimmy Kimmel…

The Nightcrawler joked that he “broke Pedro”, though not in the super-powered combat fans might expect

In a playful and revealing chat on Jimmy Kimmel…

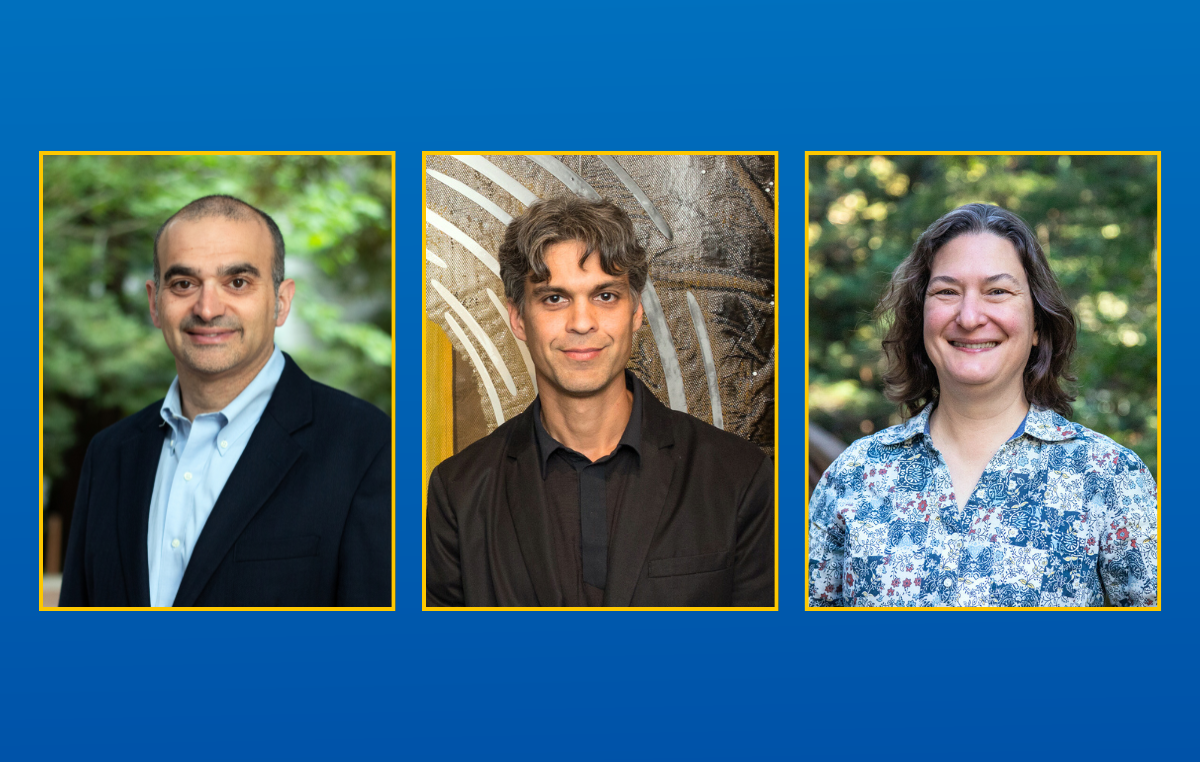

The American Astronomical Society (AAS) honored four scientists affiliated with the University of California, Santa Cruz, for outstanding contributions to the field. At the 247th AAS meeting, the society named Science Division Dean Bryan…

It’s a new year, and Pokémon Center’s bringing back the fan-favorite Monthly Pins line—this time with a focus on Legendary Pokémon! The Legendary Moments Monthly Pin collection will feature a…

New partnership supports ICAO’s ‘No Country Left Behind’ strategic goal, fostering knowledge-sharing and digital innovation

ICAO and Amadeus have formalized a Memorandum of Understanding in support of ICAO’s No Country Left Behind strategic goal. The partnership seeks to enhance the capacity of States to adopt advanced digital technologies that improve the efficiency, safety and sustainability of international air transport systems.

The collaboration will help ICAO Member States advance in their digital transformation journeys and more rapidly realize the social and economic benefits that air transport brings.

Under the terms of the agreement, Amadeus will contribute its technical expertise, share knowledge, and support initiatives to foster innovation in aviation and travel, in alignment with ICAO policies, strategies, plans, standards, and specifications.

Amadeus will support this effort by leveraging its experience in travel technology, digital identity, biometrics, and data management — areas that are increasingly vital to the modernization of air transport systems.

8 January 2026

The deadline to apply for the Government of Newfoundland and Labrador’s Home Heating Supplement Program is Wednesday, January 15, 2026.

Residents can apply online. To ensure the most efficient processing time, please make sure your application is complete. This includes:

The supplement, which ranges from $200 to $500, is available to residents of the province whose adjusted family income for 2024 was $150,000 or less and who have directly incurred costs for the purchase of furnace or stove oil to heat their principal residence.

For more information, please email OilSupplement@gov.nl.ca or call 709-729-4645 (toll-free 1-844-729-4645).

-30-

2026 01 08

12:41 pm

Needle stick injuries (NSIs) remain among the most frequent and preventable occupational risks for healthcare providers, particularly nurses, with substantial consequences for personal safety, patient care, and institutional…

Venezuela says many of Maduro’s security were killed “in cold blood”