Fire after blast at US embassy in Riyadh – report

A fire broke out at the US embassy in the Saudi capital of Riyadh after a blast, Reuters is reporting, citing two sources.

Loud explosions were heard and clouds of smoke seen in the city’s…

A fire broke out at the US embassy in the Saudi capital of Riyadh after a blast, Reuters is reporting, citing two sources.

Loud explosions were heard and clouds of smoke seen in the city’s…

MILWAUKEE (AP) — Giannis Antetokounmpo is back for the Milwaukee Bucks after a calf strain that forced the two-time MVP to miss 15 games.

Coach Doc Rivers said during his pregame availability that Antetokounmpo would play Monday night against…

Cadillac will become F1’s newest arrival in 2026, joining a grid of established teams with rich histories – some more complex than others. From Ferrari’s celebrated roots to the many faces of Mercedes, we delve into the origins of all 11…

Tom Symonds

Reporting from Heathrow Airport

Image source, PA Media

Image source, PA MediaJeff and Rebecca Moses, from Manchester

I’m at…

Five years ago, The Shore introduced PC players to a nightmare…

Sanju Samson said time away from his phone and social media, along with self-reflection, helped him return to form as he scored an unbeaten 97 to guide India into the semifinals of the T20 World Cup 2026.India defeated West Indies by five…

Artist Lisha Bai’s textiles are studies in depth and dimensionality, built around one simple device: the window. Bai’s two-dimensional, cut-and-stitched works resemble theater sets — small domestic interiors that open onto flattened yet…

BEAR BITES

• California wraps up the regular season on the road this week, looking for a winning finish to ACC action.

• The Golden Bears (20-9, 8-8 ACC) get their second look at Georgia Tech this season, visiting the Yellow…

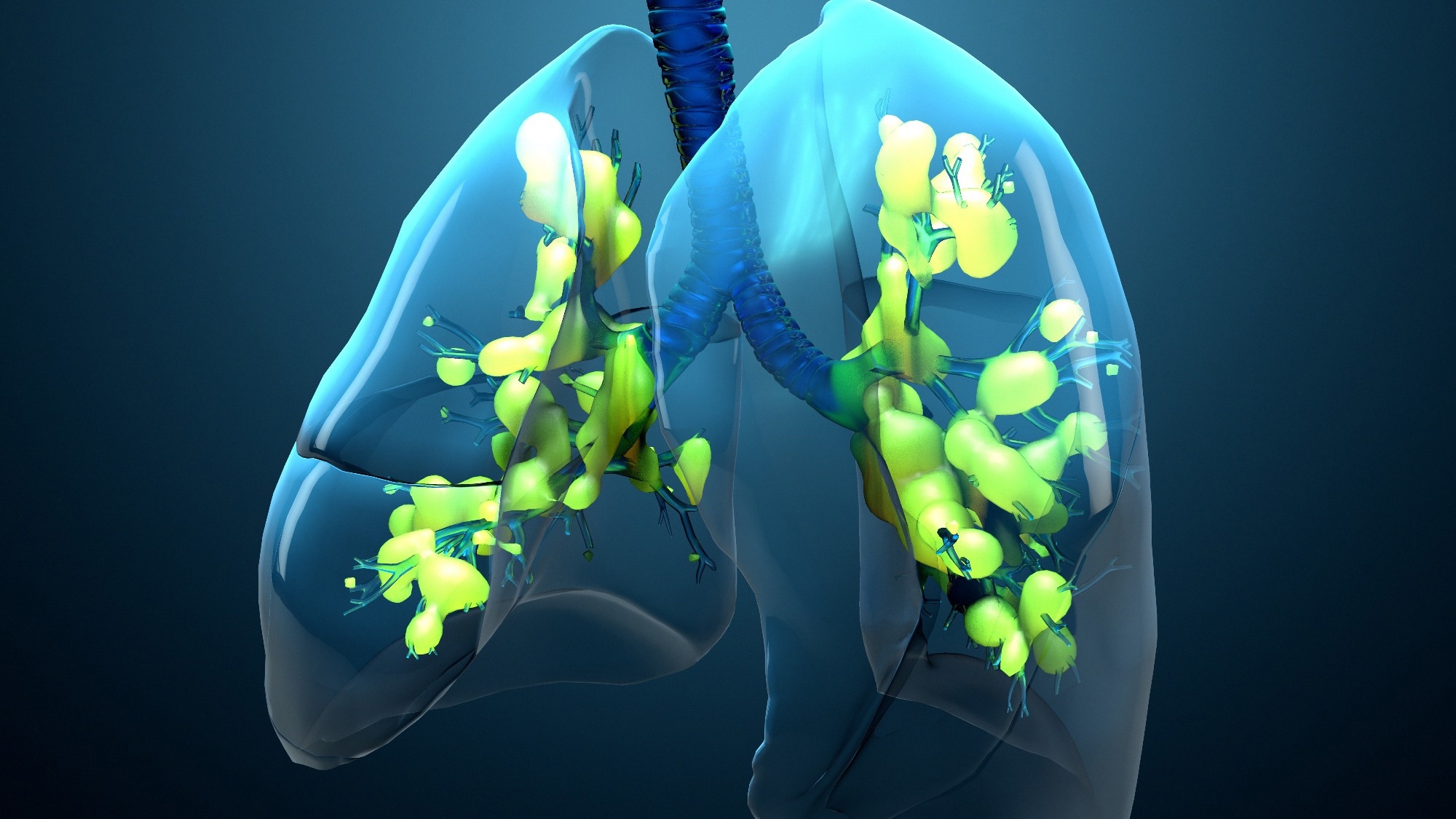

Four years after ICU admission, mortality remains strikingly high in ventilated COVID-19 ARDS patients, and many survivors continue to struggle with fatigue, insomnia, functional decline, and reduced quality of life.

Study: Four…