PA

PAAs Bradford ends its UK City of Culture tenure, it is estimated the year-long celebration cost around £51m and generated audiences of three million people.

Continue Reading

DFT investigation of boron- and zinc-doped C24 fullerenes as efficient nanosensors for molly detection

Linden-Carmichael, A. N., Stamates, A. L., Sheehan, B. E. & Lau-Barraco, C. Molly users versus nonusers in a sample of college alcohol drinkers: differences in substance-related harms and sensation seeking. Subst. Abus. 37(3), 474–479 (2016).

Continue Reading

Immunisation decision-making and barriers to vaccine uptake among children under-5 in limited-resource settings

World Health Organization (WHO). Assessment report of the Global Vaccine Action Plan. Strategic Advisory Group of Experts on Immunization. Retrieved (1 Mar 2022). http://www.who.int/immunization/web_2017_sage_gvap_assessment_report_en.pdf (2017).

Continue Reading

Nottinghamshire hospice issues appeal over unsuitable donations

Alison Walters, who manages Beaumond House’s Balderton branch, said the charity is “extremely lucky” to get so many items brought in, with a bumper amount of toys, games and shoes being donated this week.

“We get donations all day, every day – a…

Continue Reading

Reevaluating streamflow declines across the middle East and central Asia with insights from change point detection

Green, T. R., Taniguchi, M. & Kooi, H. Potential impacts of climate change and human activity on subsurface water resources. Vadose Zone J. 6, 531–532 (2007).

Ryberg, K. R., Hodgkins, G. A. &…

Continue Reading

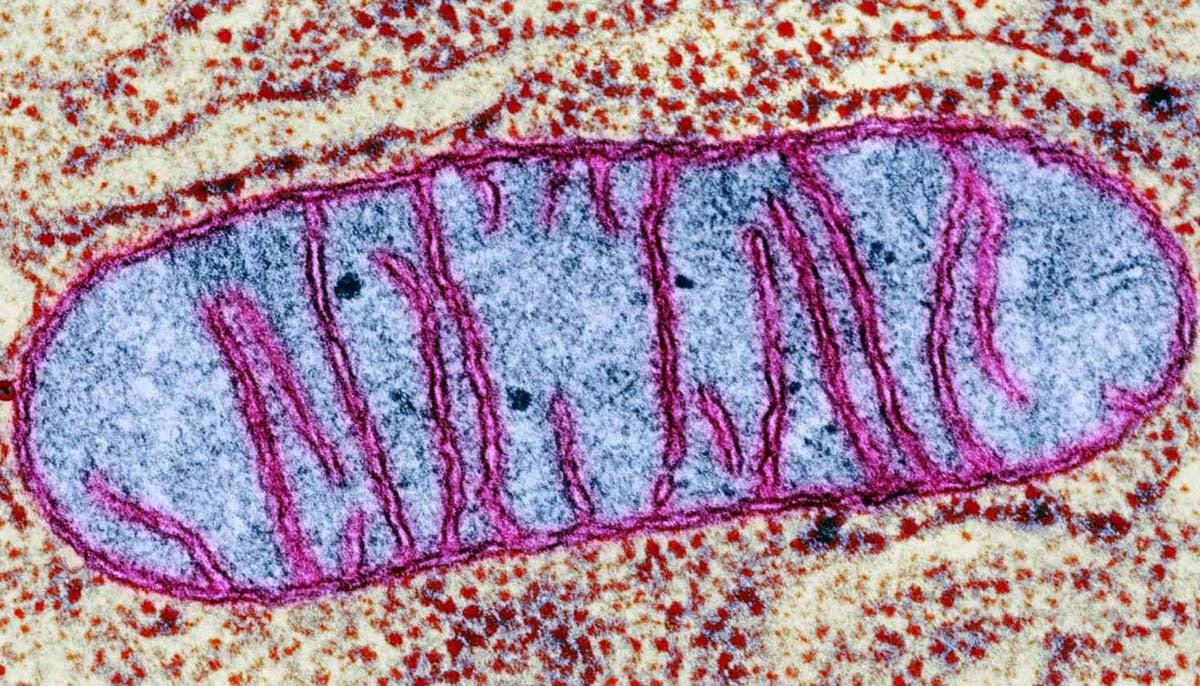

Poor mitochondria function linked to anxiety, depression

Stress definitely leads to anxiety just like isolation makes way for…

Continue Reading

Arcadis wins construction phase services for BPCP

Arcadis continues partnership with Battery Park City Authority as construction begins on landmark $1.7 billion resiliency effort in Lower Manhattan.

Arcadis (EURONEXT: ARCAD) – Arcadis, the world’s leading company in delivering data-driven sustainable design, engineering, and consultancy solutions for natural and built assets, is proud to announce that it has been awarded the construction phase services contract for the Battery Park City Resiliency Project (BPCR), New York City’s first large-scale Progressive Design-Build project. The award marks the transition from planning and design into full-scale construction of one of the nation’s most ambitious climate resiliency efforts.

Commissioned by the Battery Park City Authority (BPCA), the BPCR will safeguard Lower Manhattan’s waterfront and surrounding communities from sea level rise, storm surge, and heavy rainfall while enhancing public spaces and access along the Hudson River. The project, valued at approximately $1.7 billion, represents a critical investment in New York City’s long-term climate resilience and infrastructure renewal.

Led by the Turner Construction Company–SPC Construction Co. LLC joint venture, in collaboration with Arcadis, Bjarke Ingels Group (BIG), and SCAPE Landscape Architecture, the team will deliver an integrated coastal flood risk management system extending from First Place north to North Moore Street and then east to Greenwich Street. The project includes approximately 1.5 miles of flood walls and deployable barriers, as well as drainage improvements including a new pump station and rain gardens, and new green and public open spaces.

Alan Brookes, CEO, Arcadis said: “Arcadis is honored to continue our partnership with the Battery Park City Authority, Turner SPC, and all project partners as we move from design to delivery. This next phase brings our shared vision for a more resilient, equitable, and sustainable Battery Park City to life. Together, we are setting a new model for climate-resilient infrastructure in dense, urban environments.”

Arcadis has served as the lead design and engineering consultant since the project’s inception. As construction begins, Arcadis will continue its leadership role by providing engineering oversight, design compliance, and technical support to ensure an integrated system approach.

Additionally, the BPCR will deliver multiple layers of protection by integrating flood barriers, drainage systems, and raised landscapes within a continuous system designed to withstand sea level rise. It will also improve waterfront access, increase green space, and promote biodiversity through extensive native plantings and habitat restoration. The design team worked closely with stakeholders, agencies, and the community to develop a design that is resilient, adaptable, and fits with Battery Park City’s goals for sustainability, public spaces, and accessibility.

Charlie Whitney, Vice President, Turner Construction Company said: “The Turner Construction/SPC Joint Venture received exceptional resiliency design expertise from Arcadis to reach this critical milestone. We look forward to continuing our partnership as we embark on construction of the North/West Battery Park City Resiliency Project for the Battery Park City Authority.”

As the third major resiliency initiative undertaken by BPCA since Superstorm Sandy, the BPCR builds upon the success of the South Battery Park City Resiliency Project and the Ball Fields & Community Center Project—both key components of Lower Manhattan’s comprehensive coastal protection network

Raju Mann, President and CEO, Battery Park City Authority said: “Battery Park City’s progressive approach to resiliency infrastructure demonstrates what’s possible when collaboration, transparency, and innovation converge. We’re proud to partner with Arcadis, Turner SPC, and our design partners, to make Lower Manhattan a global model of urban resilience.”

Continue Reading

Can eating full-fat cheese protect your brain? New study says it might – Euronews.com

- Can eating full-fat cheese protect your brain? New study says it might Euronews.com

- Does high-fat dairy prevent dementia? Not so fast, experts say CNN

- Great News: Cheese May Be Good for Your Brain AOL.com

- Cautious signal: Study finds surprising…

Continue Reading

New building for children’s charity moving to Frensham home

According to Waverley Borough Council planning documents the new building will allow Change of Scene to support seven children at one time.

Ms Robinson says the charity currently works with 34 children overall, supporting three or four at a time.

Continue Reading

‘I had to plunge the knife into the canvas’: Edita Schubert wielded her scalpel like other artists wield a brush | Art and design

Edita Schubert lived a double life. For more than three decades, the late Croatian artist worked at the Institute of Anatomy at the University of Zagreb’s medical faculty, meticulously drawing dissected human bodies for surgical textbooks. In…