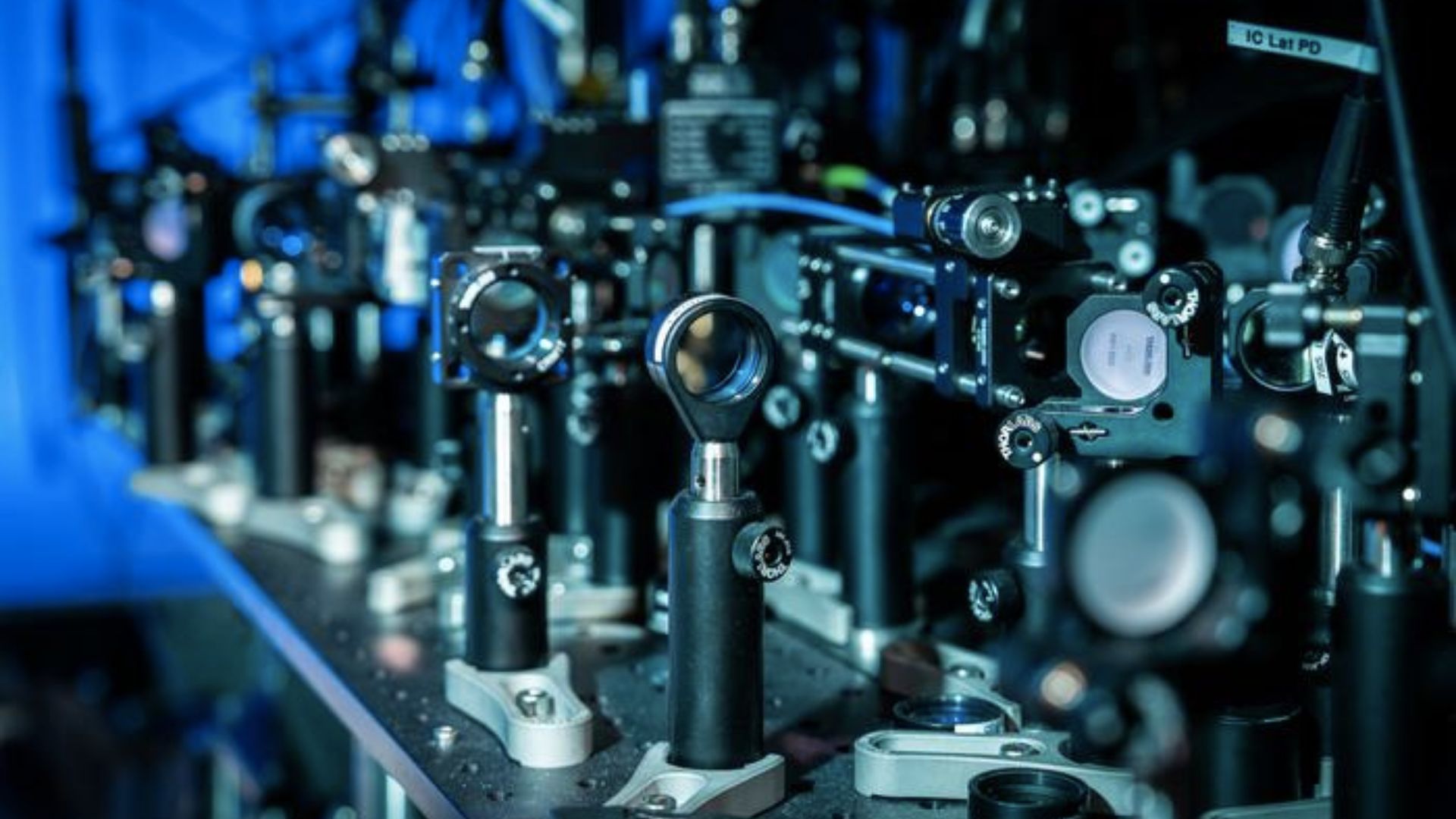

Scientists in the United States have developed a new type of “optical cavity” that can efficiently collect single photons, the fundamental particle of light, from single atoms. These atoms act as the building blocks of a quantum computer by…

A new investigation claims that the Apple and Google app stores hosted dozens of so-called “nudify” AI apps, despite such apps violating the companies’ rules.

The Transparency Project…