The Israeli military announced Monday that it has recovered the remains of the final deceased hostage in Gaza, marking the first time since 2014 that there are no Israeli hostages in the enclave.

…

The Israeli military announced Monday that it has recovered the remains of the final deceased hostage in Gaza, marking the first time since 2014 that there are no Israeli hostages in the enclave.

…

A private aircraft carrying eight people crashed on takeoff on Sunday night at Maine’s Bangor international airport, the Federal Aviation Administration (FAA) said – as that region and much of the country grappled with a huge winter storm.

The…

King Charles, as Commander-in-Chief of…

Fondazione Milano Cortina 2026 and GL events Italia formalise their collaboration with the signing of a partnership that confirms the group as Official Temporary Infrastructure Partner of Milano Cortina 2026.

GL events will be responsible for the…

Team GB confirmed its full 53-strong squad selected to compete at the Olympic Winter Games Milano Cortina 2026 on Monday (26 January).

Competing across 19 days of competition, the squad contains a plethora of medal prospects.

Jennifer Dodds will…

The European Commission has launched an investigation into Elon Musk’s X over concerns its AI tool Grok was used to create sexualised images of real people.

It follows a similar announcement in January from the UK watchdog Ofcom.

If the site is…

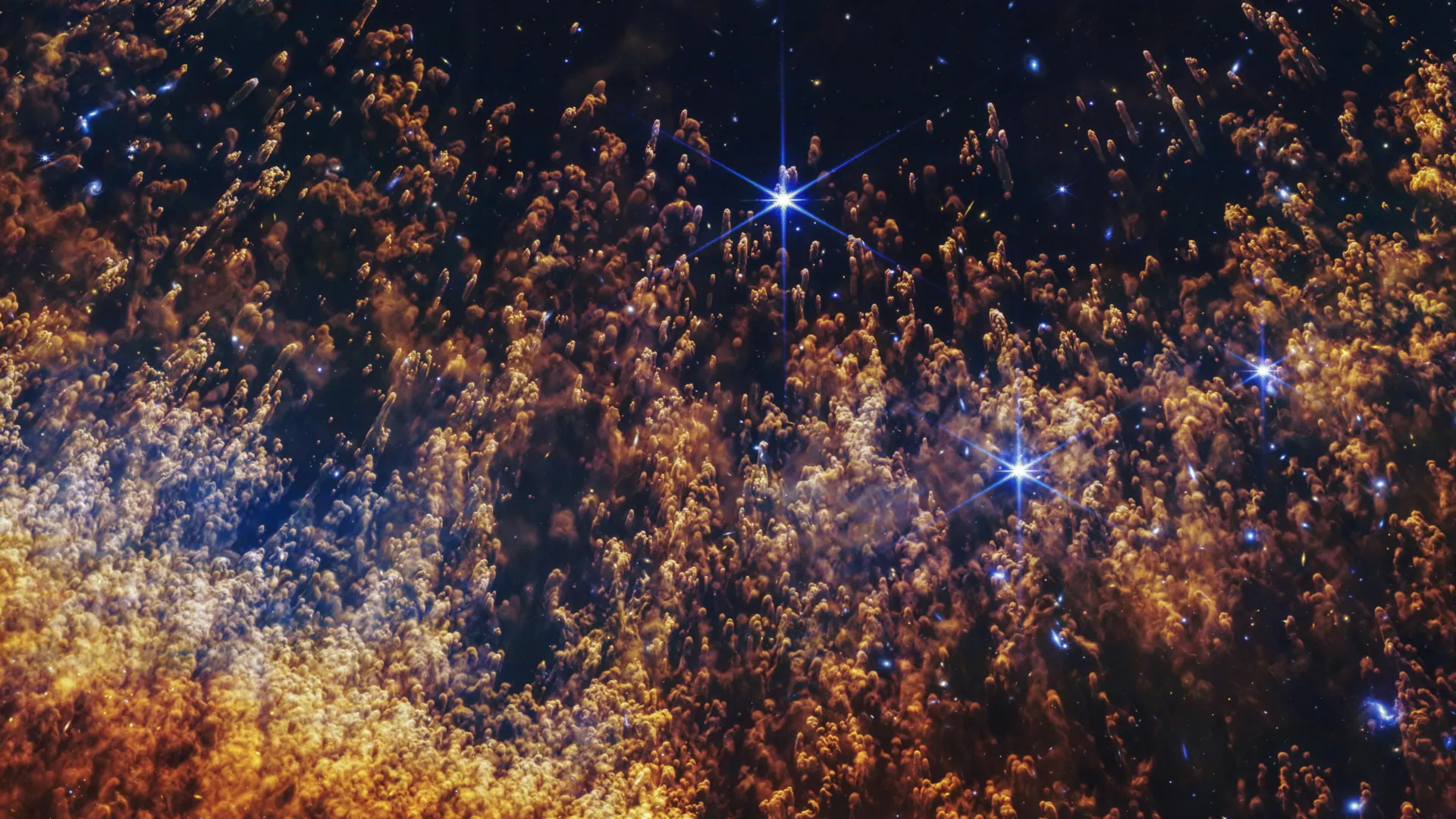

First observed in the early 1800s, the Helix Nebula has become one of the most recognizable planetary nebulas in the sky thanks to its bold, ring-like appearance. As one of the closest planetary nebulas to Earth, it offers astronomers a rare…

Twitch is an exciting platform, but hasn’t always been the easiest for labels to work with, given the licensing complexities. However, UMG’s latest initiative sees it leaning into Twitch more heavily.

It’s called ‘Universal…

The Sundance film festival, which is currently under way in Park City, Utah, saw a mass protest against the two fatal shootings in Minneapolis, Minnesota on Sunday, along with high-profile interventions from major film industry figures.

Actor…