The rift between British power couple Victoria and David Beckham and their son Brooklyn Beckham seems to be growing greater every day, with Brooklyn alleging on Instagram that his famous parents tried “endlessly to ruin” his…

Author: admin

-

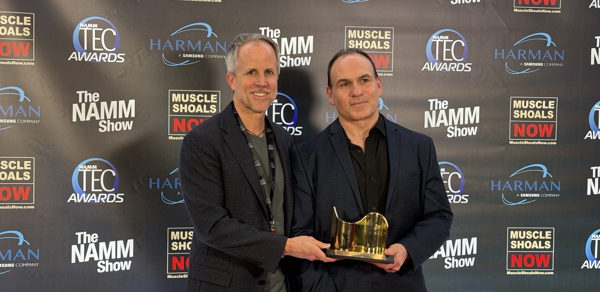

Sennheiser MD 421 Kompakt Awarded 41st Annual NAMM TEC Award for Technical Achievement

Anaheim, California, Jan 23, 2025 — Audio specialist Sennheiser today announced that the MD 421 Kompakt, a compact version of the legendary MD 421 dynamic microphone, has received the 41st Annual NAMM TEC Award for Outstanding Technical Achievement. Selected by a panel of industry professionals and a broader vote of pro audio peers, the award recognizes the MD 421 Kompakt’s ability to deliver iconic large-diaphragm performance in a modernized, multipurpose form factor.

The MD 421 Kompakt introduces a streamlined approach to miking, retaining the legendary capsule and sonic DNA of the MD 421-II while significantly reducing the physical footprint. By eliminating the traditional bass roll-off switch — a function now standard in modern mixing desks and DAWs — Sennheiser has created a highly versatile tool optimized for high-density stages and tight studio setups, such as toms, guitar cabs, and horns.

The microphone features a cardioid pick-up pattern and remarkable dynamic range, engineered to handle exceptionally high sound pressure levels in demanding environments. Beyond its sonic performance, the MD 421 Kompakt features an entirely redesigned, integrated mounting clip that addresses long-standing user feedback, providing a fail-safe mounting solution for performers and technicians. This technical recognition at the 41st TEC Awards highlights the microphone’s utility in modern live production and recording applications.

“The MD 421 is a true audio icon, and with the MD 421 Kompakt we continue its legacy while solving real-world challenges for today’s stages and studios,” said Jimmy Landry, Global Category Market Manager, MI at Sennheiser. “Being recognized by the TEC Awards at NAMM celebrates both our heritage and our commitment to exceptional sound.”

The TEC Awards recognize technical innovations in recordings, live performances, and multimedia. Now in its 41st year, the program honors the products and individuals that contribute to the advancement of audio technology.

NAMM TEC Award for Sennheiser MD 421 Kompakt.docx

DOCX – 10 Mb

Download

NAMM TEC Award for Sennheiser MD 421 Kompakt.pdf

PDF – 350 Kb

Download

Continue Reading

-

Europa League tactical analysis: Yusuf leads the way for Ferencváros – UEFA.com

- Europa League tactical analysis: Yusuf leads the way for Ferencváros UEFA.com

- Ferencváros vs Panathinaikos: UEFA Europa League stats & head-to-head BBC

- Ferencváros Good for a Point Against Panathinaikos Hungarian Conservative

- 18 goal…

Continue Reading

-

White Dwarf Magnetism Links Red Giant Fields, Constraining Fossil Field Strength

Scientists are revisiting the long-standing ‘fossil field’ theory to explain the origin of strong magnetic fields in white dwarf stars, a puzzle that has intrigued astronomers for decades. Lukas Einramhof, Lisa Bugnet, and Leila Magdalena…

Continue Reading

-

ANIAC, in partnership with UNREC, strengthens chemical security and combats illegal trafficking.

Lomé, 6 November 2025: The National Authority for the Prohibition of Chemical Weapons (ANIAC-TOGO), in collaboration with the United Nations Regional Centre for Peace and Disarmament in Africa (UNREC), held a strategic capacity-building…

Continue Reading

-

UN rights chief decries US treatment of migrants, as deaths in ICE custody rise – UN News

- UN rights chief decries US treatment of migrants, as deaths in ICE custody rise UN News

- UN human rights chief urges US to uphold international law in immigration crackdown Reuters

- USA migrant crackdown: UN Human Rights Chief decries…

Continue Reading

-

Severe storms and rain-triggered disasters kill 14 across Afghanistan

KABUL: At least 14 people have died in Afghanistan as severe storms, rain-triggered landslides, and heavy snow battered the country, officials said, with further risks reported on Thursday.

In Kandahar, strong winds and heavy rainfall on…

Continue Reading

-

iPhone 18 Pro tipped to feature much smaller Dynamic Island

Apple’s upcoming iPhone 18 Pro and iPhone 18 Pro Max are expected to launch later this year with display upgrades and a redesigned Dynamic Island. A new leak has now revealed the precise dimensions of the smaller cutout planned for the Pro…

Continue Reading

-

Erika’s Victreebel, Mega Audino ex, and More from Mega Evolution—Ascended Heroes

We’ve unveiled a variety of Mega Evolution Pokémon ex, Trainer’s Pokémon, and even the upcoming Mega attack rares in our first and second previews, but there’s still plenty more to see in Mega…

Continue Reading

-

9 killed as avalanche hits house in K-P’s Lower Chitral

Pakistan Army recovers and transfers bodies of victims killed in Damel avalanche in Lower Chitral. Photo: Express

At least nine people were killed and…

Continue Reading