The Milwaukee Bucks (8-5, 5th in Eastern Conference) host the Los Angeles Lakers (9-4, 4th in Western Conference) Saturday, 8 ET at Fiserv Forum. Both the Bucks and the Lakers are playing on the second leg of a back-to-back set. Here are three…

Author: admin

-

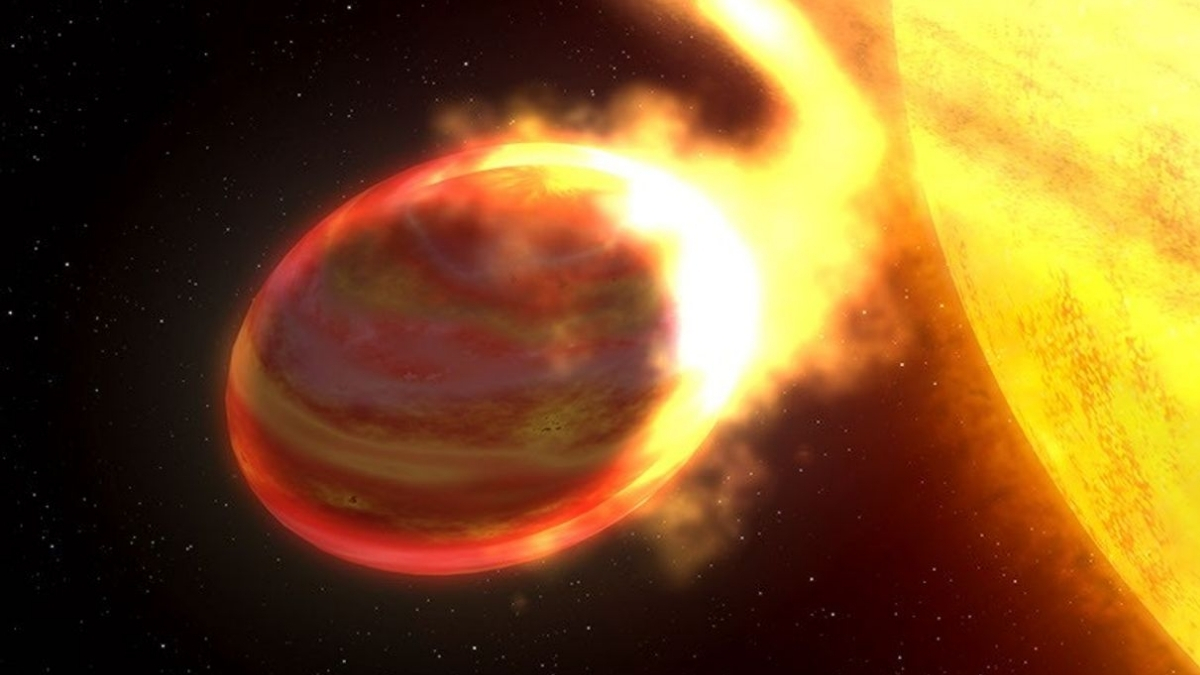

Giant Stars Are Eating Planets, And We Finally Know Why : ScienceAlert

As stars age, they expand. That’s bad news for planets orbiting close to their stars, according to a new study published in the Monthly Notices of the Royal Astronomical Society this month.

The study suggests that planets closest to their…

Continue Reading

-

Blue Islands: Airline suspends operations, cancelling all flights | World News

Airline Blue Islands has suspended trading, cancelling all flights.

Just a day ahead of Friday’s announcement, the company had shared an advert, recruiting for roles including pilots, engineers and head of cabin crew.

Confirming the closure on its website, it wrote: ” We regret to inform you that Blue Islands has suspended trading effective on 14 November 2025. All future flights operated by Blue Islands have been cancelled.”

The company warned those with tickets to fly not to travel to the airport unless they had made alternative travel arrangements.

It told customers: “We deeply regret the inconvenience that this will bring to your travel plans”.

The Channel Islands-based regional airline had bases in Jersey and Guernsey, and flew to Southampton, Bristol, East Midlands, Exeter, Dublin, Newcastle and Norwich, and also to Paris and Bruges.

It had employed about 100 people.

Blue Islands advised disappointed travellers who had booked directly with the airline to contact their bank or credit card provider, or their travel agent or holiday company if booked through a third party.

Rescue fares and medical help

Several airlines stepped in to help stranded customers.

Blue Islands’ codeshare partner Aurigny scheduled 10 additional services between Guernsey and Southampton and eight additional services between Guernsey and Jersey between Saturday and Wednesday.

While Glasgow-based regional airline Loganair introduced special rescue fares for affected passengers on selected routes from Sunday.

With the airline offering a vital service for patients needing hospital treatment in the UK, Health and Care Jersey (HCJ) said it would be contacting patients with upcoming UK clinical appointments, or those who had already travelled to the UK for treatment.

Airline closure should be a ‘wake-up call’

During the Covid pandemic, Blue Islands borrowed £8.5m from the government of Jersey to help secure and maintain vital lifeline services.

A Jersey audit office report showed £7m was still owed last summer.

Formed initially in 1999 as Le Cocq’s Air Link to supply perishable goods to the Channel Island of Alderney from Bournemouth using Britten Norman Islanders, the company took its first passengers in 2002.

Trading under the name Rockhopper from 2003, it rebranded in 2006 as Blue Islands. Ten years later the company became a Flybe franchise partner, restoring its name again in 2020 when Flybe closed.

Commenting on Blue Islands’ demise, Guernsey Hospitality Association president and director Alan Sillett wrote on social media: “Tonight’s news should be a real wake-up call. Guernsey’s air links model is likely to go from an 85% monopoly to a 100% monopoly.

“This shows our lack of resilience. We need major airlines to enter the market. Regional airlines are very fragile unless they have a bailout option.”

A spokesperson for Blue Islands said: “After 26 years of serving the Channel Islands, we deeply regret that Blue Islands has this evening suspended its operations.

“After very constructive dialogue with the government of Jersey in recent months, including what we understood to have been ongoing assessments of the future options, we were informed this afternoon that they are unable to provide further support.

“This has meant that we now need to suspend flying immediately whilst we consider the options available and how we can help our customers, staff and stakeholders.”

Earlier this week, Sky News presenter Jonathan Samuels wrote about the dramatic fall in domestic UK flights, with the figure more than halving over the past two decades.

Continue Reading

-

Digital transformation powers upgrade of manufacturing enterprises in northeast China-Xinhua

Staff members work at a factory of a subsidiary of China First Heavy Industries (CFHI) in Qiqihar, northeast China’s Heilongjiang Province, April 28, 2024. (Xinhua/Xie Jianfei) SHENYANG, Nov. 15 (Xinhua) — Digital transformation is accelerating among small and medium-sized enterprises in northeast China’s industrial base, aided by supportive technical service system and thriving industrial ecosystem.

In Wafangdian City, a major production base for bearings in northeast China’s Liaoning Province, local manufacturers are exploring digital transformation. At Jingu bearing company, where production once depended entirely on the experience of veteran workers, operations are now guided by precise data metrics.

“Digital transformation has elevated our production capacity and efficiency to a new level,” said Zuo Tongming, owner of the company.

Nearby, at another manufacturer, all product inspection data is stored and updated in real time, with comprehensive reports available on demand for analysis.

“We’ve built a fully automated digital system that streamlines the entire process from order to delivery,” said Zhou Jianhong, head of the company’s information department. “It intelligently breaks down production processes and schedules equipment, allowing workers to manage required materials more efficiently. For precision tasks, they can readily access technical drawings on their phones.”

He added that this digital transformation has increased production efficiency by 20 percent and cut operational costs by 15 percent.

For a long time, the high sunk costs of digitalization — often running into millions of yuan — had been a major hurdle for many entrepreneurs.

“I lay awake at night calculating the return on investment,” admitted one local business owner, acknowledging that the financial strain and unpredictable payback periods left many companies feeling hesitant.

A supportive ecosystem developed by local authorities is helping to boost confidence in digital adoption. In addition to financial subsidies, the government has leveraged advanced industrial Internet platforms and tailored services for the local bearing cluster, offering end-to-end support from diagnosis to system deployment.

Liaoning Province has built a comprehensive digital infrastructure system, supported by a foundation of 143,000 5G base stations that ensure full coverage in all cities and key industrial parks. The core of this infrastructure also features a blockchain network and two intelligent computing centers in Shenyang City and Dalian City, providing the critical data backbone for advanced applications.

Such infrastructure development facilitates platforms that connect manufacturers with supply and demand partners. For example, at the Shenyang service center of the national digital supply chain platform for equipment manufacturing, a small components factory uploaded a 3D model and was swiftly matched with a large manufacturer located just 20 kilometers away.

“It’s like an online shopping application for industry. Smart algorithms optimize the matching of manufacturing resources,” said Li Chunwei, an operator of the center. Hundreds of local firms have successfully used the platform, shortening design cycles by 30 percent and saving customer acquisition costs by 40 percent.

Breakthroughs in artificial intelligence (AI) are adding another layer of sophistication. Building on advances in domestic models like DeepSeek, Liaoning is now fostering industry-specific AI applications. For instance, researchers at the Dalian Institute of Chemical Physics recently launched a large model dedicated to the chemical industry. This model is capable of simulating complex molecular reactions, significantly reducing R&D time and optimizing production to conserve energy.

“Comprehensive industrial system and rich application scenarios provide an ideal foundation for developing such specialized models,” said Pan Hong at digital economy research institute of Liaoning University.

Looking ahead, the momentum is set to accelerate across the northeast China. In Heilongjiang Province, the digital foundation is already solidifying. As of the first quarter of 2025, 51.1 percent of industrial enterprises in the province have achieved comprehensive digitization of their key business processes.

According to the plan of Jilin Province for accelerating equipment upgrading in the industrial sector, the province aims to support 1,000 demonstration projects in smart manufacturing and digital transformation by 2027, cultivating 150 digital transformation service providers, establishing 120 provincial-level smart manufacturing demonstration factories and 3 leading industrial internet platforms.

From factory floors to AI models, manufacturers across northeast China are scripting a robust story of revitalization powered by digital transformation. This tech-driven upgrade goes beyond a mere efficiency boost, serving as the key to unlocking a new chapter of innovation. ■

Continue Reading

-

Pick up the Fire TV Stick 4K Max for only $35

Amazon Black Friday deals almost always include discounts on Fire TV devices and Fire TV sets. This year is no different, and some of the best discounts bring Fire TV streaming dongles down to near record-low prices. Case in point: the Fire TV…

Continue Reading

-

Visual Studio 2026 First Look: Evolution, Not Revolution

I’ve never entirely understood the Microsoft roadmap. I certainly enjoyed using Visual Studio 2022 (VS 2022) for C# and .NET development, but when it was dropped for Mac users (replaced with VS Code for the Mac), I assumed we would soon…

Continue Reading

-

Just a moment…

Just a moment… This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

Continue Reading

-

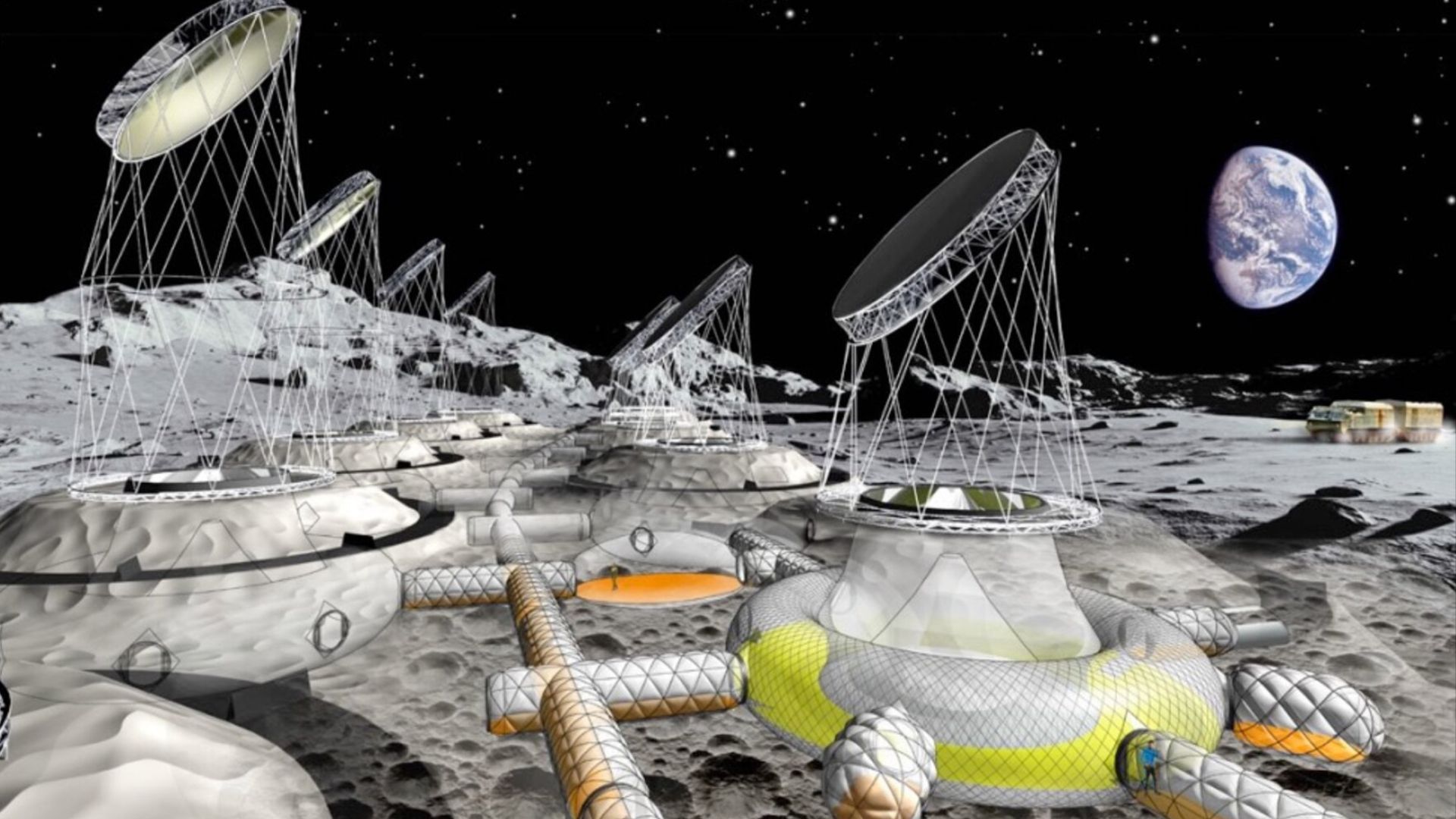

How spacefaring nations could avoid conflict on the moon

This article was originally published at The Conversation. The publication contributed the article to Space.com’s Expert Voices: Op-Ed & Insights.

In the 1960s, Frank Sinatra’s song Fly Me to the Moon became closely associated with the Apollo…

Continue Reading

-

Camilla Faces ‘Very, ‘Very Serious’ & ‘Brutal’ News Amid Reports ‘Dying’ Charles ‘Knows It’s the End’

The British royal family hasn’t exactly had the easiest few months. Or past years, if we’re being honest. From King Charles’ cancer diagnosis to the fact that Kate Middleton fought the disease, the health news has already been bad. And then…

Continue Reading

-

Framework’s franken-laptop is back with big chip upgrades and familiar frustrations

Framework did it again. It promised modular, upgradeable, and user-repairable laptops where other manufacturers dare not venture or have outright failed. And it’s delivered.

The 2025 version of the Framework Laptop 16 comes with not only new AMD…

Continue Reading