Victor Wembanyama and the San Antonio Spurs face the Houston Rockets to open tonight’s doubleheader on NBC and Peacock.

What we know about Tuesday’s games:

- Welcome to AWS NBA Rivals Week 2026, featuring 11 nationally-televised games airing…

Victor Wembanyama and the San Antonio Spurs face the Houston Rockets to open tonight’s doubleheader on NBC and Peacock.

A large biobank study reveals that subtle imbalances between inflammatory lipids and steroids in the blood can identify people with asthma who are most likely to suffer future exacerbations, outperforming traditional clinical…

Cobalt has listed its Microsoft Teams integration on Microsoft Marketplace, giving customers another route to deploy the company’s penetration testing collaboration tools inside Teams.

The integration sits within the Cobalt Offensive…

HOUSTON — Rockets center Steven Adams will be out indefinitely due to a sprained left ankle, coach…

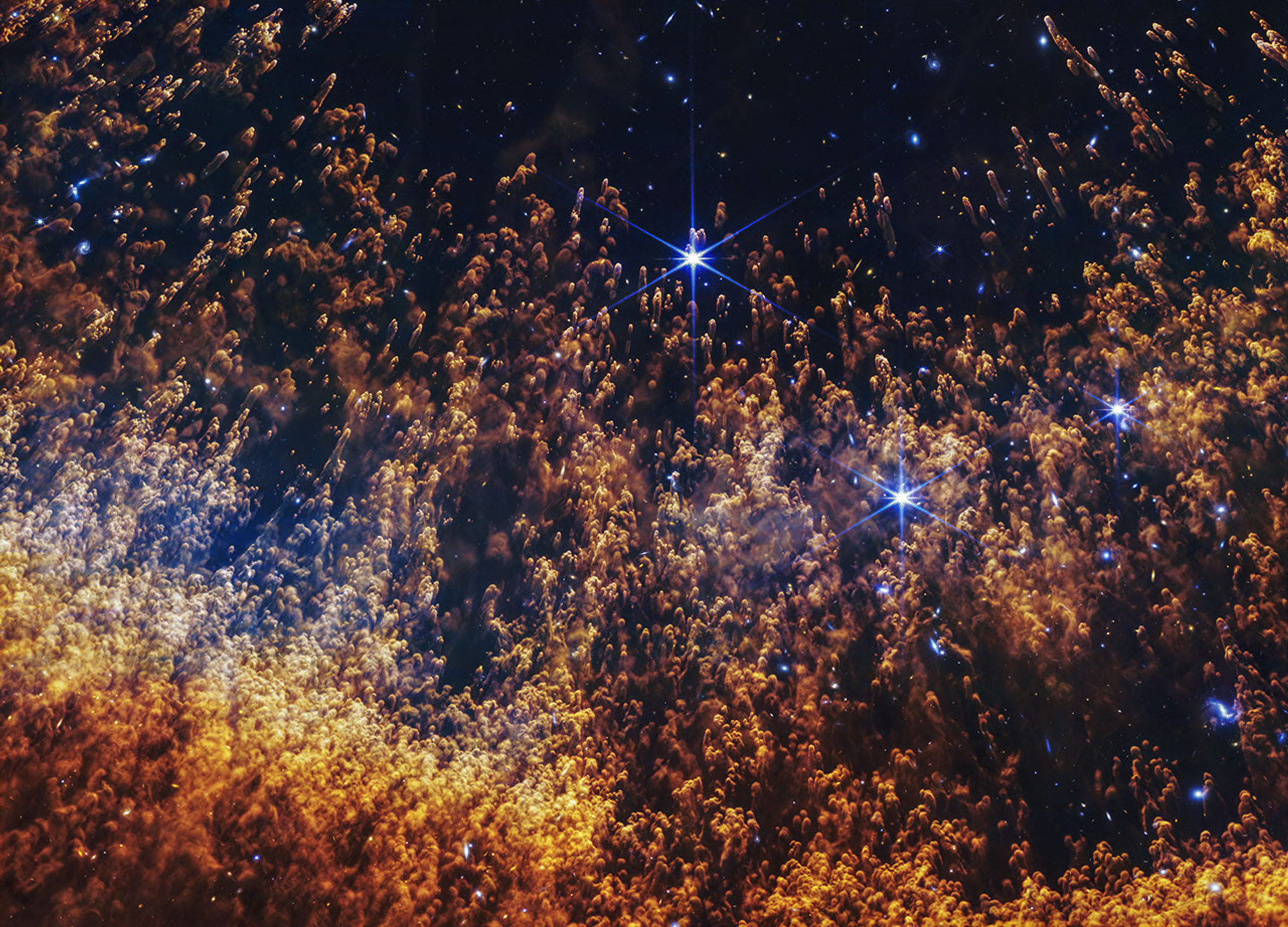

The Helix Nebula is one of the most well-known and commonly photographed planetary nebulae because it resembles the “Eye of Sauron.” It is also one of the closest bright nebulae to…

NEW DELHI: Bangladesh captain Litton Das raised fresh questions over his team’s participation in the upcoming T20 World Cup after Rangpur Riders were knocked out of the Bangladesh Premier League (BPL) on Tuesday.Litton was speaking after…

PARIS (AP) — Valentino Garavani’s death cast a long shadow over the opening day of Paris Fashion Week menswear Tuesday, with front-row guests and industry figures mourning the passing of one of the last towering names of 20th-century couture…

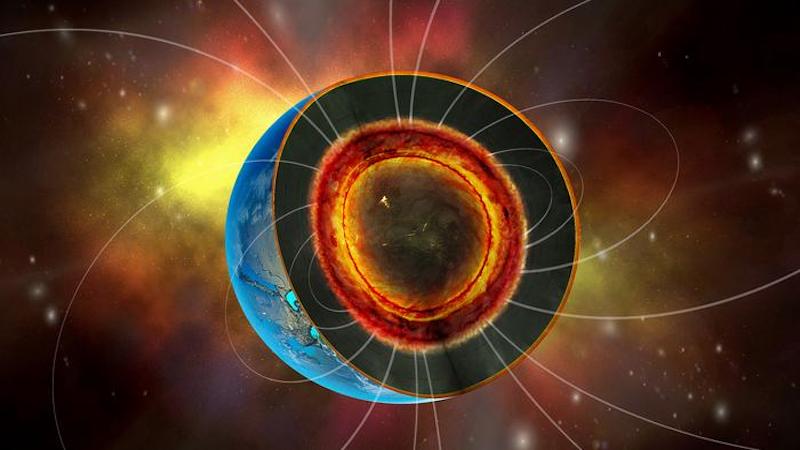

Deep beneath the surface of distant exoplanets known as super-earths, oceans of molten rock may be doing something extraordinary: powering magnetic fields strong enough to shield entire planets from dangerous cosmic radiation and other…

The Western Force is excited to

confirm the addition of Argentine hooker Leonel Oviedo to the 2026 Swyftx Super

Rugby Pacific squad on an injury cover contract.

Oviedo arrived in Perth last week and has already

commenced training with his new…