From alternate to qualifier, Valentin Vacherot is now the champion of the 2025 Shanghai Masters.

The Monegasque came from a set down to become the first tennis player from Monaco to win an ATP title, even more extraordinarily against his cousin,…

From alternate to qualifier, Valentin Vacherot is now the champion of the 2025 Shanghai Masters.

The Monegasque came from a set down to become the first tennis player from Monaco to win an ATP title, even more extraordinarily against his cousin,…

Formula 1 begins a run of races across the Americas this week, aptly kicking-off at the Circuit of the Americas.

A visit to COTA is always popular with drivers, teams and fans alike, and most of the time, there’s not been the need to pack…

Officials in the Trump administration are reportedly weighing the possibility of selling portions of the federal government’s $1.6tn student loan portfolio to private investors, which experts say could carry risks for both taxpayers and borrowers – potentially reshaping the student loan landscape in unpredictable ways.

Senior officials at the education and treasury departments have been engaged in internal conversations about offloading select, high-performing segments of the government’s student debt holdings, according to a Politico report this week. These loans are part of the larger portfolio owed by roughly 45 million borrowers nationwide.

Administration officials have also reportedly reached out to figures in the financial industry, including potential buyers, to discuss the idea. The deliberations, which began earlier this year, initially included “department of government efficiency” (Doge) officials stationed at the education department but are now being guided primarily by senior political appointees.

It’s unclear how far the administration will take the idea, or which parts of the $1.6tn portfolio could be put on the market.

Daniel Zibel, vice-president and chief counsel at the National Student Legal Defense Network, described the proposed loan sale as a “complex and unprecedented” idea, essentially the reverse of the 2008 financial crisis, when the government bought privately held loans to stabilize the market.

“The system for student debt is incredibly complicated, and for the administration to do this in a way that lives up to the protections that exist in the law for student loan borrowers makes it even more complicated,” Zibel said.

Selling them off now, he said, would shift repayment and management responsibilities to private entities, raising questions about enforcement, oversight, and the continuity of borrower protections. It could also eliminate the government’s power to cancel the loan.

“If you’re talking about unilateral cancellation, like what president Biden had been talking about, the department would certainly lose all authority to tell a private company that they had to cancel a debt,” he said.

The sale proposal aligns with the administration’s broader goal of reducing the federal footprint in the student loan system and encouraging more private-sector involvement. It could also explain why the Trump administration was so eager to roll back the loan forgiveness offered by the Biden administration.

“Now we know why President Trump and Secretary [Linda] McMahon are hell bent on squeezing every last dollar out of families with student debt,” Mike Pierce, executive director of Protect Borrowers, said in a statement. “Once again, we see that across the Trump Administration, when Wall Street’s demands run against the financial needs of working people, the banks get what they want.”

Michele Zampini, associate vice-president of federal policy at the Institute for College Access and Success, says the plan is likely linked to the Trump administration’s broader ideological aim of shrinking or dismantling the education department.

“This is all part of that same conversation, because the department manages this huge, billion plus dollar loan portfolio,” Zampini said. “You can’t really wind down the department while still having responsibility for this type of loan portfolio. It’s driven by their desire to wind down the department more broadly. This is the roadblock in their way in many senses.”

Any attempt to sell off federal student loans would raise major legal and logistical questions. Borrowers could face uncertainty about whether current consumer protections, often more favorable than those offered in the private market, would remain intact. It’s also unclear whether the government would continue to guarantee the loans.

Zampini adds that the move would put borrower protections at particular risk “because there’s really no precedent for this”.

“There is no indication that there is, first of all, interest from the private market. And if there is interest, their interest would likely be to squeeze as much profit from the repayment as they could,” she said. “And so the interest of a private purchaser and a private investor would very likely not be to provide borrowers with any type of generous benefits or relief programs.”

This is not the first time the idea has surfaced. During Trump’s first term, the education department hired consulting firms to evaluate the student loan portfolio and estimate its potential sale value. That analysis revealed the loans were worth substantially less than government accountants had assumed, and the plan was shelved as the Covid-19 pandemic upended the economy.

Now, with Trump back in office, the administration appears to be reviving the concept as part of a broader rethink of the student loan system. Officials are reportedly exploring whether to transfer management of the loan portfolio, or segments of it, from the education department to the treasury department, an idea seemingly consistent with Trump’s stated desire to close the education department altogether.

“I don’t think this is driven by an interest in helping borrowers,” Zampini said. “Certainly, I don’t think it’s driven by an interest in improving the program. And I also don’t think it’s driven by an actual interest in saving taxpayers money. I think it’s driven mostly by a political interest.”

The potential sale is only one part of a sweeping effort to overhaul the student loan system. The administration has already rolled back nearly all Biden-era policies that offered loan forgiveness or expanded repayment options. It has also resumed collecting defaulted loans for the first time since March 2020, when the pandemic prompted a nationwide pause.

Still, it’s not completely clear how feasible these plans are under the current legal system.

“The law does specifically allow the secretary of education to work with the treasury department to sell loans,” Zibel said. “But it very clearly says that the secretary has to determine that it is in the best interest of the United States to do so, but also that there will not result in any cost to the federal government.”

The concerns are not just that current borrowers might be at risk of losing their protections, but that a student loan market controlled by private entities would increase the barriers to attend college.

“The federal student loan program is unique because the loans are not originated with the goal of making a profit on them,” Zampini said. “They are essentially an access tool to enable people to go to college who wouldn’t necessarily be able to access that same credit in the private market.

“All of those factors make them a lot less likely to generate a return for an investor. And so it’s hard to see how someone looking to make a return on these loans, on this portfolio, would do anything but increase as much as they can the amount of payment and decrease the relief programs and the flexibilities that the federal government offers.”

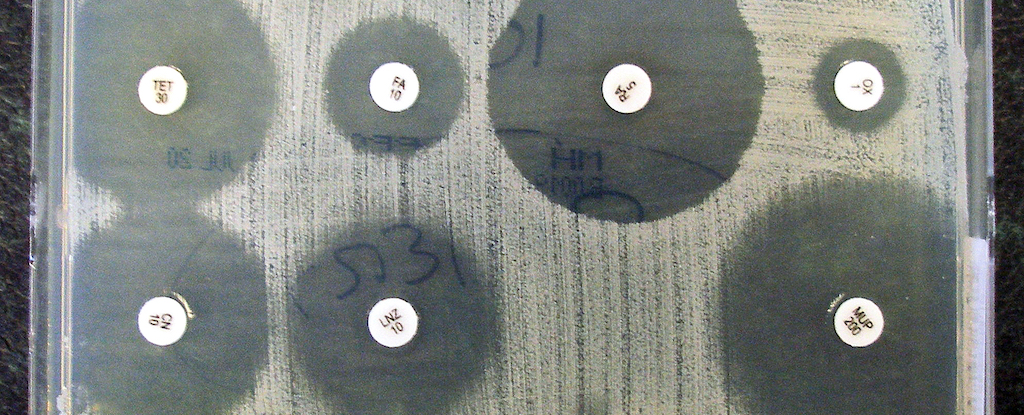

Humanity’s war against drug-resistant microbes is not going very well.

Antibiotic resistance has rapidly become one of our species’ leading causes of death, claiming an estimated 5 million lives globally in 2019. That already exceeds the…

SAN FRANCISCO, CALIFORNIA – NOVEMBER 06: OpenAI CEO Sam Altman speaks during the OpenAI DevDay event on November 06, 2023 in San Francisco, California. Altman delivered the keynote address at the first-ever Open AI DevDay conference.(Photo by Justin Sullivan/Getty Images)

Getty Images

Here are five things in tech that happened this week and how they affect your business. Did you miss them?

Announced on Monday at its developer conference, OpenAI now lets you use apps directly inside ChatGPT, making conversations more interactive and personalized. To enrich the user experience, you can now interact with apps like Booking.com, Spotify, Figma, Coursera, Zillow, and Canva directly within ChatGPT. For example – users can say things like “Figma, turn this sketch into a diagram” or “Coursera, teach me machine learning” to activate apps. Some apps can display videos pinned to the top of the chat window and respond to user input. According to OpenAI, the system is built using Model Context Protocol (MCP), enabling apps to connect their data sources and render interactive UIs inside ChatGPT. OpenAI says users must collect minimal data and be clear about permissions. (Source: TechCrunch)

Here’s the goal: companies use ChatGPT as their main portal. You’re using applications inside this portal. You’re integrating your ERP, CRM, HR and other applications inside this portal. You’re bringing in both inside and outside data in this portal. You’re using the portal to create videos, images and other content. None of this is out of the box. But the tools are available to start this journey. Some business platforms may choose to build themselves inside ChatGPT’s portal. Or you may need to hire a developer to do the work. Other AI Assistants – Gemini, Copilot, Claude, etc. – are doing the same thing. You’ll be asked, as a business owner to get in bed with one of them, for better or worse.

Microsoft Teams is introducing a new pop-out window feature for channels (previously available only for chats). This means users can open channel conversations in a separate window, enabling better multitasking and visibility across multiple conversations. (Source: TechRadar)

Currently, according to the report, Teams supports pop-out windows for 1:1 chats, letting you open a conversation in its own window. But channels (group/team conversations) did not have that pop-out ability until now. Microsoft says it expects the feature to be rolling out soon – possible next month – to desktop clients. By the end of the year, the company says that Teams will be able to update work locations through automatic recognition of WiFi networks. The update is part of a larger push to enhance coordination and productivity in hybrid work settings.

Perplexity’s CEO Aravind Srinivas says their new Comet AI browser could significantly boost productivity and add trillions to the U.S. GDP. Describing Comet as a “true personal assistant” that allows users to complete more tasks in the same amount of time, Srinivas said it could save individuals up to $10,000 per year in productivity value. (Source: CNBC)

Not sure where the $10K annual savings comes from. Regardless, I’ve downloaded the Comet AI browser and have been using it over the past week or so. It’s as good as Chrome, which has been my go-to browser before. With most browsers like Chrome you have to navigate to your AI Assistant or go into “AI Mode” for a full interactive experience. This comes out of the box with Comet. I’m not seeing huge productivity savings yet, but that’s likely due to my inexperience with the product.

AI tools like ChatGPT are reshaping how employees file workplace complaints – often making them sound more legally sophisticated than they are. Employees are submitting complaints that resemble legal documents, quoting laws and citing statutory violations. These complaints often appear to be written by lawyers but are likely generated by AI tools like ChatGPT. (Source: JD Supra)

Firstly, good for the employees. If they’ve got a beef and need an AI Assistant’s help to make a good argument, that go for it. But please: check your facts. According to the authors, employers may feel alarmed by the formal tone and legal references, but many claims misapply employment law, lacking key elements like protected classifications (e.g., race, gender) that are necessary for legal liability. As well, AI-generated complaints may confuse workplace disputes with legally actionable claims. Experts suggest employers should calmly assess the substance of a complaint before reacting to the legal-sounding language – and look for tell-tale signs of an AI-generated complaint such as overly formal phrasing.

Small Business Technology News #5 – Talkdesk Survey: AI Is Growing At Small Businesses But There’s No Plans To Reduce Headcount

Customer service platform Talkdesk released their survey on how small businesses are integrating AI with their customer service. Among the findings: 51 percent have already integrated AI into customer service operations to elevate customer service and, despite AI’s usage, 9 out of 10 those respondents plan to keep or grow their human service teams. (Source: Yahoo Finance)

Talkdesk (a client of my company) has released a new customer service platform specifically geared towards small businesses called Talkdesk Express. There’s lots of great information in this new survey on how businesses are using customer service platforms – and AI – to help them provide a better experience and increase productivity.

Each week I round up five small business technology news stories and explain why they’re important for your business. If you have any interesting stories, please post to my X account @genemarks

Like many women designers, Victoria approaches her work in a way that’s uniquely personal and subjective. “I’ve always had to make the best of what I’ve got,” she tells me. “I’ve never been a six-foot-tall, skinny model [she is five feet…

Zinn Cycles’ B.I.G. 32er is one of the first production full-suspension mountain bikes to be fitted with 32in wheels; a diameter starting to gather momentum in the industry.

Specifically, however, the B.I.G. is designed for riders 193cm tall and…

PlayStation Plus users have been recommended this free game available on the service’s Game Catalog, and we’d recommend checking it out.

If you want a game that imbues the cute aesthetics of Animal Crossing with the action-oriented gameplay of…

Stay informed with free updates

Simply sign up to the US economy myFT Digest — delivered directly to your inbox.

The continuing US government shutdown has stopped official data releases, which will leave investors without the September inflation data that had been scheduled for publication on Wednesday.

Economists polled by Bloomberg had expected the consumer price index from the Bureau of Labor Statistics to show an increase in inflationary pressures. Instead, the BLS said on Friday that it planned to release its data on October 24.

The CPI release, while more than a week late, will still come in time for the Federal Reserve’s rate-setters, which next meet on October 28-29, to factor it into their policy decision. At their last meeting, they signalled a greater focus on the risks from a slowing labour market than from rising inflation. The “dot plot”, the Fed’s survey of its own members’ forecasts, suggests that policymakers expect inflation to be running at 3 per cent by year-end, slightly above the current rate.

The absence of inflation data could keep investors from making big moves in markets. In place of the BLS data, many have resorted to a slew of private data providers alongside survey data from the Fed, such as its “beige book”, for insights into the US economy.

Still, President Donald Trump’s Truth Social post on Friday promising new tariffs on China led to a drop in stocks and a jump in volatility, suggesting that if the risks are high enough, some investors may jump, with or without the economic data to hand. Kate Duguid

Investors will scrutinise UK labour market data on Tuesday and GDP figures on Thursday for insights into underlying inflation pressures and the health of the economy.

Economists polled by Reuters expect annual wage growth (excluding bonuses) for the three months to August to edge down to 4.7 per cent, from 4.8 per cent in the three months to July. They expect the unemployment rate to be unchanged at 4.7 per cent.

Bank of England policymakers are concerned that wage growth is running too hot for their 2 per cent inflation target, particularly given the UK’s weak productivity record.

While the labour market figures remain uncertain because of poor survey response rates in recent years, analysts will focus on whether recent declines in employment are enough to cool wage growth. A sharp slowdown in wages and a deterioration in hiring could reinforce expectations of interest rate cuts in 2026.

Markets are pricing that the BoE will make one or two quarter-percentage-point cuts next year.

As for the GDP data, economists expect month-on-month growth in August of 0.1 per cent, up from zero growth in July, taking the three-month-on-three-month rate — now the Office for National Statistics’ preferred measure — to 0.3 per cent, up from 0.2 per cent previously.

Ellie Henderson, economist at Investec, also forecasts marginally stronger growth in August but said tax increases expected in the November Budget would have an impact on activity in the autumn.

“Various surveys suggest the prospect of fiscal tightening is already prompting households and firms to delay spending and investment,” she said. “Speculation around the scale of adjustment needed is likely to grow in the run-up to [the Budget on November 26], acting as a further drag on output.” Valentina Romei

Chinese exports are expected to jump again when Beijing reports trade figures for September on Monday, as the outward flow of goods continues to swell despite the Trump administration’s tariffs.

Economists expect Beijing to report a year-on-year rise of 7.1 per cent in exports during the month, up from 4.4 per cent growth in September. With imports seen rising at a 1.5 per cent pace (up slightly from 1.3 per cent), China’s monthly trade surplus is expected to come in at a hefty $100bn.

The persistently strong figures have defied many economists’ expectations that China’s export machine would slow as Trump’s tariffs took effect — especially since the weakening dollar has sent the renminbi up 2.4 per cent against the greenback this year.

However, a growing chorus of analysts has pointed out that, on a trade-weighted basis, the renminbi is depreciating. It has fallen 8.6 per cent this year against the euro, for example, making exports to Europe more competitive.

China’s trade surplus with the Eurozone is growing rapidly. For the first eight months of the year, exports to the continent grew 5.4 per cent, while imports fell 9.9 per cent. China’s shipments of steel and textiles, for example, have surged, adding to trade tensions.

Jacqueline Rong, chief China economist at BNP Paribas, said China’s resilient exports to non-US markets were down to more than rerouting of trade with the US. The robust growth of its exports to Europe, she said, has been “driven mostly by China’s gain in market share . . . rather than trans-shipments.” William Sandlund