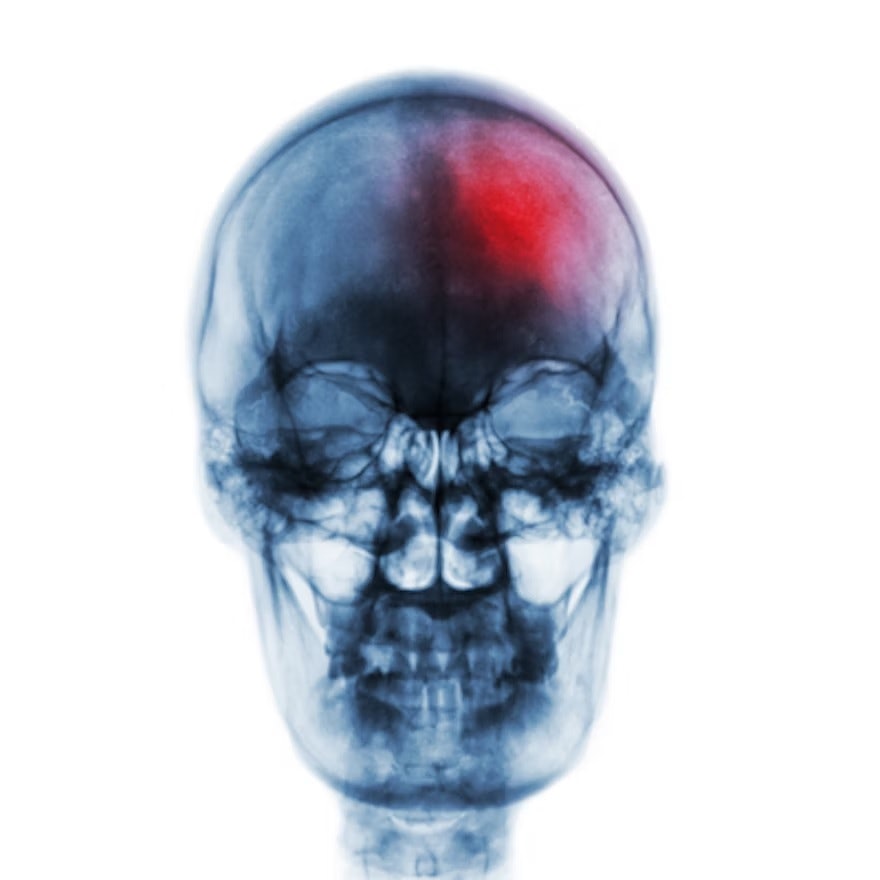

Endovascular thrombectomy (EVT) improves functional outcomes and reduces mortality compared to medical management in stroke patients over 90 years old, researchers have reported.

The finding is from a comparison between the approaches among 149…

Endovascular thrombectomy (EVT) improves functional outcomes and reduces mortality compared to medical management in stroke patients over 90 years old, researchers have reported.

The finding is from a comparison between the approaches among 149…

TORONTO, ON [Oct 27, 2025] – Wealthsimple, Canada’s leading financial innovator, today announced it has signed an equity round of up to CAD $750 million at a post-money valuation of CAD $10 billion. The round, which includes both a $550-million primary offering and a secondary offering up to $200 million, is co-led by Dragoneer Investment Group and GIC, and signals deep conviction from world-renowned investors in Wealthsimple’s role as the future of financial services in Canada. Other investors include new investor Canada Pension Plan Investment Board (CPP Investments), and existing investors Power Corporation of Canada, IGM Financial Inc., ICONIQ, Greylock and Meritech.

Since 2014, Wealthsimple has consistently set the pace for innovation in Canadian finance and reimagined how Canadians build wealth. The company broke down barriers to the markets for a new generation of investors with its managed and self-directed investing platforms and led the charge on many investing firsts for the country, including commission-free trading, regulated crypto trading and 24/5 trading. It has also redesigned everyday banking, with features such as bank draft delivery and automatic paycheque allocation, and a competitive chequing account with no monthly, foreign exchange or ATM withdrawal fees. What began as a simple investing app has become a trusted financial platform that millions of Canadians use to grow and manage their money, whether they’re just starting out, or managing complex portfolios.

The equity round comes after an explosive few years for Wealthsimple and the company continues to scale from a position of strength. Wealthsimple shared that it was profitable in 2024 and the company continues to be profitable in 2025. The company reached $50 billion in assets under administration in 2024, and in one year has doubled it to $100 billion in assets. The company’s latest capital raise will accelerate its roadmap across investing, banking and credit, support strategic opportunities to expand its platform, and deepen the value it delivers to Canadians.

“This raise reflects deep confidence from new and returning investors in our mission and our role as a defining Canadian company,” said Michael Katchen, CEO and co-founder, Wealthsimple. “We were intentional in choosing partners committed to the long-term future of Wealthsimple. These are well-respected, global leaders with a proven track record scaling category leaders, and who believe in our vision for the future of financial services.”

Guided by its mission to help everyone achieve financial freedom, Wealthsimple offers an expansive suite of smart, low-cost financial tools that empower Canadians to build wealth in whatever way works for them. The platform brings together self-directed investing, managed portfolios, cryptocurrency, banking services, tax filing, and advisor services into one simple, integrated experience. The company is also responsible for building Canada’s most-read financial newsletter, TLDR, educating four million weekly subscribers on money and market news.

This year, the company launched a waitlist for its first credit card, surpassing 300,000 Canadians in the first six months. The company also launched Wealthsimple Presents, a bi-annual, live product showcase featuring its latest financial innovations. Nearly 350,000 Canadians registered to attend the 2025 livestream events.

“Few companies have achieved what Wealthsimple has in the last few years,” said Christian Jensen, Partner at Dragoneer Investment Group. “The Wealthsimple team has built an expansive financial platform that millions of Canadians trust. They’re not just participating in Canada’s financial services industry; they’re redefining it. Wealthsimple’s product velocity, customer obsession, and category leadership remind us of some of the most enduring global companies and we’re thrilled to be partnering with them in this next phase of growth.”

Dragoneer is focused on investing in leading growth businesses and recently led OpenAI’s $8.3 billion raise in August 2025 as its largest contributor. The firm previously participated in Wealthsimple’s 2021 funding raise.

“We look for companies that will transform industries for decades to come, and Wealthsimple is one of them,” said Choo Yong Cheen, Chief Investment Officer, Private Equity, GIC. “Their track record of innovation, from investing to trading to banking, combined with deep trust from Canadians, positions them to build a defining, generational company in Canadian financial services.”

GIC is a leading global investment firm delivering long-term, sustainable returns across diverse market landscapes. GIC is one of two new investors this raise, alongside CPP Investments.

“Wealthsimple has built a strong foundation as a trusted financial platform in Canada, combining innovation with disciplined growth,” said Afsaneh Lebel, Managing Director, Head of Funds, CPP Investments. “Alongside our partner Dragoneer, we’ve seen the company’s innovative approach to making financial products more accessible to Canadians, consistent with our strategy to back technology-driven businesses that deliver lasting value for CPP contributors and beneficiaries.”

Meritech and Greylock co-led Wealthsimple’s raise in May 2021 alongside best-in-class investors DST Global, Sagard, ICONIQ, Dragoneer, TCV and iNovia, among others. This raise builds on Wealthsimple’s 2021 financing round — one of the largest in Canadian history at that time — and marks the next chapter in its mission to transform financial services.

Cigarette butts may pose a risk to the health of smokers and nonsmokers alike by acting as genetic pools of microbial antibiotic resistance, researchers report.

With estimated annual…

We’re only a few weeks away from Black Friday, but plenty of retailers are already offering major discounts on big-ticket items such as large TVs from one of our favorite brands, LG. In fact, right now we’ve seen a discount of $1,703 on a 77-inch…

“You shaped all of our lives,” Drake told the dancehall star from a balcony stage

Vybz Kartel’s first concert in Toronto had a special guest — and performance. During the dancehall musician’s show at Scotiabank…

If you purchase an independently reviewed product or service through a link on our website, WWD may receive an affiliate commission.

Shop Kendall Jenner’s Therabody Routine

Kendall Jenner can now…

Colin Farrell starred as Oswald “Oz” Cobb in The Penguin, the spinoff series based on Matt Reeves’ The Batman film.

Although the HBO and DC Studios series was envisioned as a limited series, following its critical acclaim,…