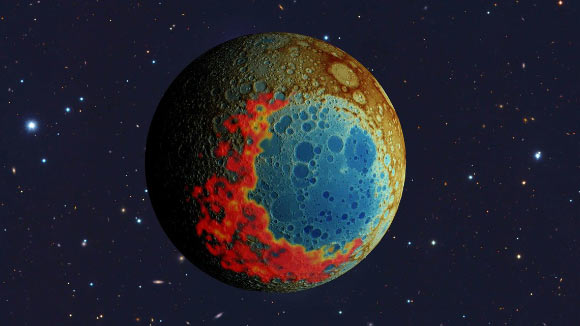

Roughly 4.3 billion years ago, when our Solar System was still in its infancy, a giant asteroid slammed into the far side of the Moon, blasting an enormous crater referred to as the South Pole-Aitken basin. This impact feature is the largest…

Blog

-

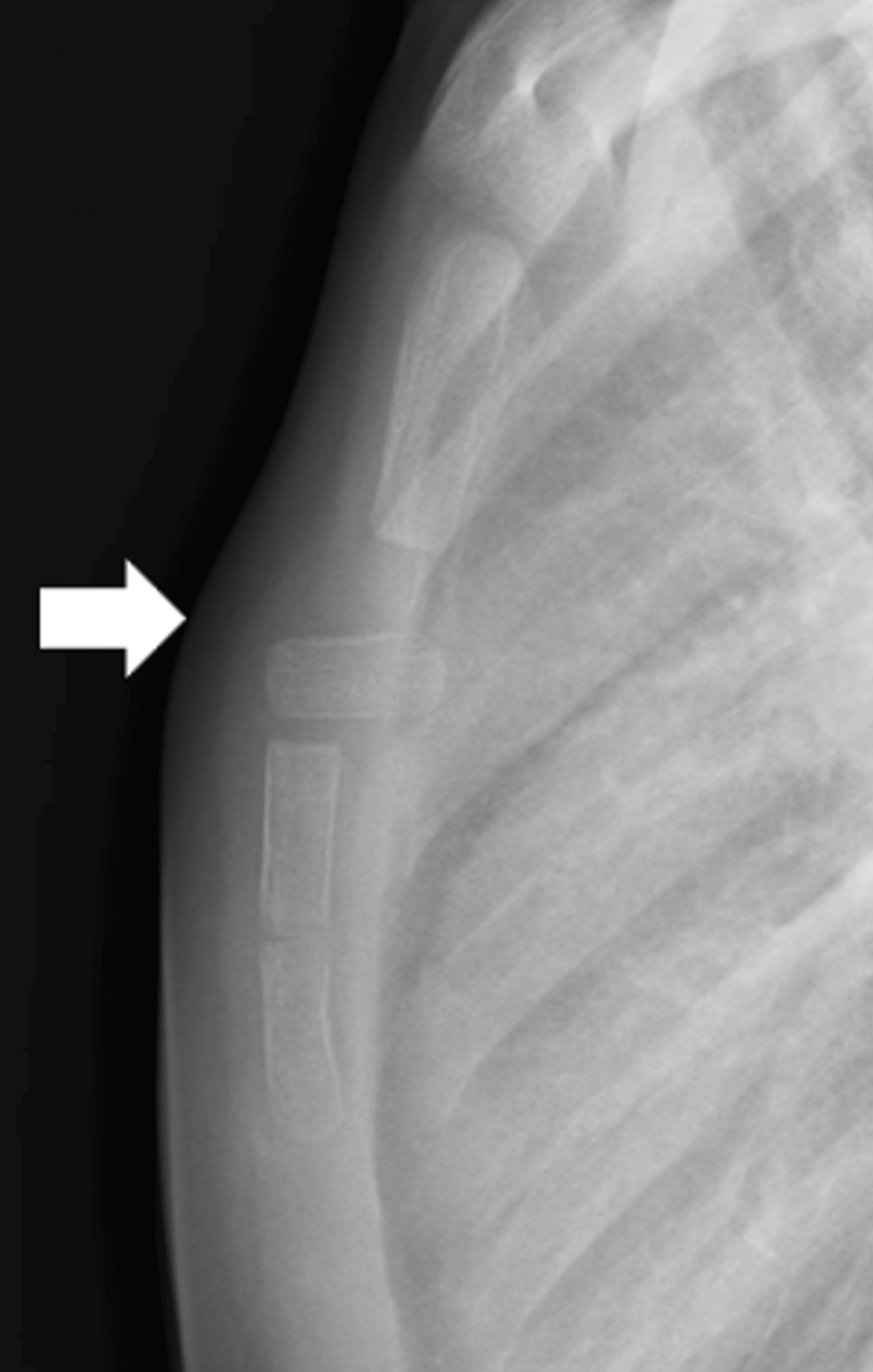

A New Concept to Support Brain Recovery in

LONDON, Oct. 10, 2025 (GLOBE NEWSWIRE) — Concern over the long-term effects of head injuries in rugby and American football has inspired a new approach to athlete care. Oralift Neuro, an emerging concept at the initiation stage, explores how…

Continue Reading

-

Week Ahead Economic Preview: Week of 13 October 2025

The following is an extract from S&P Global Market

Intelligence’s latest Week Ahead Economic Preview. For the full

report, please click on the ‘Download Full Report’ link.Download Full Report

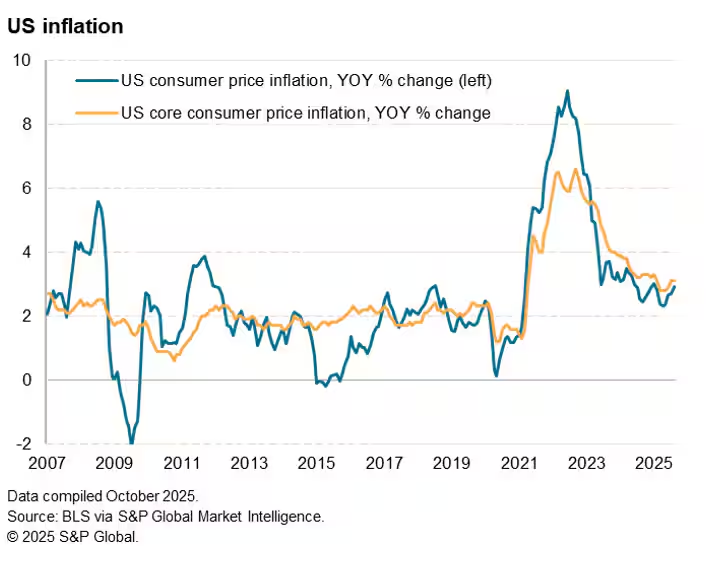

US shutdown prompts more data worries as policy clues are

soughtClues as to the path of US interest rates will hopefully be

provided from updated inflation numbers and economic activity data,

but a prolonged government shutdown would mean a lack of key US

data releases, engendering more uncertainty in the markets and

heightened growth worries. US tariff impact will, however, be

monitored via industrial production numbers for the US as well as

trade numbers out of mainland China and the eurozone. In the UK,

labour market and GDP come under scrutiny.At the time of writing, an ongoing federal government shutdown

is set to affect US data releases in the coming week, including

consumer and producer price inflation numbers, as well as retail

sales data. The markets are expecting consumer prices to have risen

0.3% after a 0.4% rise in August, but for core inflation to hold

steady at 0.3%. Producer prices are meanwhile anticipated to have

risen 0.3% after a surprise 0.1% drop in August. Weakening price

trends will add to the odds of a further FOMC rate cut, but the

case for lower rates will also likely hinge on the activity data.

Fed-compiled industrial production data could therefore prove the

US data highlight of the week, alongside New York and Philly Fed

surveys.Trade and inflation data are meanwhile issued for mainland

China, as are industrial production and trade data for the

eurozone. The data will be scoured for clues as to the impact of US

tariffs, though to also see whether domestic factors such as

increased fiscal spending may be offsetting some of the dampening

impact of the levies.GDP data for August and the latest official labour market data

will be digested by UK economy watchers keen to gauge fiscal

implications ahead of November’s Budget. Prior data showed the

economy flatlining in July and ongoing steep job losses, the latter

largely blamed on last year’s Budget.

Recent PMI survey data have also disappointed, likewise

signalling a stagnating economy and falling employment. More weak

data could tip the scales further toward rate cuts by the Bank of

England. The Bank held rates steady at 4.0% at its last meeting,

but two of the nine policymakers voted to cut rates due to growth

concerns.S&P Global will also be publishing the Investment Manager

Index (IMI) survey, revealing how institutional US equity investor

sentiment trends have changed in October.

Last month’s survey showed heightened risk aversion amid

worries over valuations and the political environment.If released, US inflation numbers will be watched for signs

of tariff levies being passed through to end consumers. So far, the

inflation numbers have not risen as much as many analysts had

feared, but headline inflation was up to 2.9% in August with core

at 3.1%, and it remains early days in terms of the degree to which

the import levied might be expected to impact high street

prices.Key diary events

Monday 13 Oct

Americas

Canada Market Holiday

– Brazil Business Confidence (Oct)EMEA

– Germany Current Account (Aug)APAC

Japan, Thailand Market Holiday

– China (Mainland) Trade (Sep)

– India Inflation (Sep)Tuesday 14 Oct

S&P Global Investment Manager Index* (Oct)

Americas

– Canada Building Permits (Aug)EMEA

– UK BRC Retail Sales Monitor (Sep)

– Germany Inflation (Sep, final)

– UK Labour Market Report (Aug)

– France IEA Oil Market Report

– Eurozone ZEW Economic Sentiment (Oct)

– Germany ZEW Economic Sentiment (Oct)APAC

– Singapore GDP (Q3, adv)

– Australia NAB Business Confidence (Sep)

– Australia RBA Meeting Minutes (Oct)

– India WPI (Sep)

– China (Mainland) New Yuan Loans, M2, Loan Growth (Sep)Wednesday 15 Oct

Americas

– Brazil Retail Sales (Aug)

– Canada Manufacturing Sales (Aug, final)

– US Inflation (Sep)

– US NY Empire State Manufacturing Index (Oct)EMEA

– Germany Wholesale Prices (Sep)

– France Inflation (Sep, final)

– Spain Inflation (Sep, final)

– Eurozone Industrial Production (Aug)APAC

– China (Mainland) Inflation (Sep)

– Japan Industrial Production (Aug, final)

– India Unemployment (Sep)

– India Trade (Sep)Thursday 16 Oct

Americas

– Canada Housing Starts (Sep)

– US PPI (Sep)

– US Retail Sales (Sep)

– US Initial Jobless Claims

– US Philadelphia Fed Manufacturing Index (Oct)

– US Business Inventories (Aug)

– US NAHB Housing Market Index (Oct)EMEA

– UK monthly GDP, incl. Manufacturing, Services and Construction

Output (Aug)

– Italy Inflation (Sep, final)

– Eurozone Balance of Trade (Aug)

– Italy Balance of Trade (Aug)APAC

– Japan Machinery Orders (Aug)

– Australia Employment Change (Sep)Friday 17 Oct

Americas

– US Building Permits (Sep, prelim)

– US Housing Starts (Sep)

– US Industrial Production (Sep)

– US Capacity Utilization (Sep)EMEA

– Eurozone Inflation (Sep, final)APAC

– South Korea Export and Import Prices (Sep)

– South Korea Unemployment Rate (Sep)

– Singapore Non-Oil Domestic Exports (Sep)

– Malaysia Balance of Trade (Sep)

– Malaysia GDP (Q3, prelim)* Access press releases of indices produced by S&P Global

and relevant sponsors

here.Download Full Report

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers’ Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Continue Reading

-

Climate Solutions Already Exist – Here’s How to Speed Up Adoption

By Dr. Hao Xu, Head of Climate Innovation, Tencent

We already have the technologies to fight climate change – so why aren’t we deploying them faster?

That was the question I explored in my TED Countdown Talk. As Head of Climate Innovation at Tencent and an environmental engineer by training, I believe the biggest barrier to decarbonization isn’t the lack of technology – it’s how we work together.

The good news? There’s a way forward. Many scalable climate solutions are available today. From bacteria that turn CO₂ into fuel, to cooling materials that help save glaciers, we can make real impact now. The key is accelerating them by uniting science, engineering, and business to turn bold ideas into real-world solutions that help decarbonize the planet.

Catalyzing emerging low-carbon technology

“I’m more optimistic than ever that we have the answer to accelerating climate innovation, and it’s simple.”

Dr. Hao Xu, Head of Climate Innovation, Tencent

Although Tencent is not a major emitter, we are deeply committed to sustainability and tackling climate change. We have pledged to achieve carbon neutrality in our operations and supply chain by 2030 and are leveraging our capabilities to fulfil our mission of creating tech for good.

Beyond improving data center efficiency and sourcing renewable energy, we’re focused on how to catalyze the next generation of climate technology. That’s why we launched our CarbonX program in partnership with industry, investors and innovators. Three years in, I’m more optimistic than ever, because we think the right answer is not so complicated.

Through CarbonX, we’ve learned that successful climate tech acceleration happens when four key areas work in harmony.

1. Scientific innovation: saving decades of climate tech R&D

Let’s start with the science, which is in advanced stages. We can capture solar energy, store it using cutting-edge chemistry, and convert CO₂ into valuable products – shaving decades off development.

Take Gasgene, a startup we work with through CarbonX. Using CRISPR – a gene editing tool – to reprogram clostridium bacteria, they’ve essentially taught these microorganisms to “eat” carbon dioxide and produce butanol instead. Butanol is found in clothing, paint, water bottles, toys and the like. With engineered clostridium, we can make these everyday products from captured carbon instead of fossil fuels.

2. Engineering expertise: scaling the science from lab to real world

Next is engineering, which acts as the bridge from lab to production, bringing scientific ideas to life at scale.

Imagine building a facility to produces 20,000 tons of butanol a year from captured CO₂. Engineers must decide: what size reactors are needed? Can we use standard equipment, or must systems be customized? How do we optimize for cost, safety and energy?

Think of it like LEGO – you use existing blocks wherever possible to build something new quickly and efficiently.

Feynman Dynamics, another CarbonX innovator, faced this challenge. Their goal: produce sustainable aviation fuel by combining captured CO₂ with green hydrogen. Their breakthrough? A catalyst that blends these ingredients at the molecular level, like a smoothie machine. Inspired by pharmaceutical chemistry, they created a reactor that delivers consistent, scalable performance, cutting waste and boosting efficiency.

3. Business knowhow: turning innovation into industry

However, even the best-engineered solution can fail without a viable business model. Markets, costs and customer demand drive adoption and innovations must make commercial sense.

Yuanchu, a startup that captures CO₂ and turns it into calcium carbonate – used in paper, makeup, and toothpaste – found a smart market fit. Instead of mining limestone, they repurpose steel and industrial by-products, cutting both emissions and costs.

Another example is Moguang, which developed cutting-edge radiative cooling material that reflects over 90 percent of sunlight. It cools objects naturally without using electricity. We piloted this technology on the endangered Dagu Glacier in southwestern China. After three years, melting slowed by 80 percent.

Today, that same material is used in hundreds of thousands of smartphone screens and sports cameras. From glaciers to gadgets, climate tech innovation is full of possibilities.

4. Integration: solving the bottlenecks

So, what’s holding us back? It’s not invention, it’s isolation.

Scientists focus on discovery. Engineers optimize performance. Businesses look at balance sheets. But rarely do they work together from day one.

To accelerate climate solutions, however, these disciplines must collaborate from the start. That means:

- Scientists asking: how much energy does it take to capture one ton of CO₂?

- Engineers asking: can this be deployed at industrial levels?

- Business leaders asking: when can we make this cost effective?

These aren’t easy conversations. But such cross-disciplinary tensions are essential to speed up progress and get us closer to decarbonization.

We’ve already seen this model succeed. With Gasgene, we helped form a clean chemical consortium, linking startups, chemical companies, and consumer brands to make carbon-based products a reality. That alignment enabled pilot deployment and scaling.

To recap, we don’t need to wait for new inventions. We need to work faster, and work together. That’s how we can accelerate the transition to a low-carbon world!

Continue Reading

-

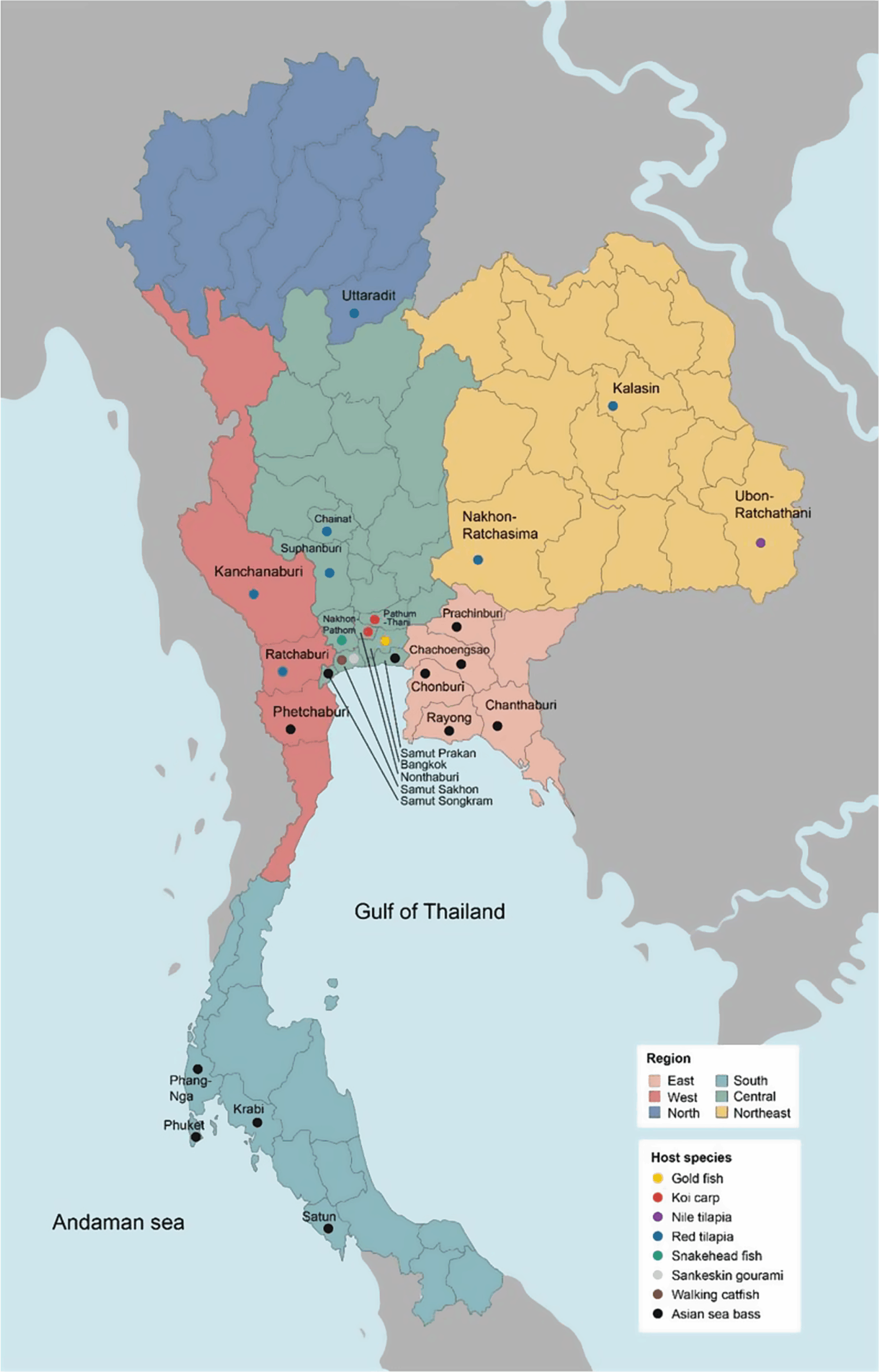

Diversity and antimicrobial resistance among bacterial isolates from finfish aquaculture in Thailand | BMC Veterinary Research

SEAFDEC. The Southeast Asian state of fisheries and aquaculture 2022. Southeast Asian Fisheries Development Center; 2022.

Suyamud B, Chen Y, Quyen DTT, Dong Z, Zhao C, Hu J. Antimicrobial resistance in aquaculture: occurrence and strategies in…

Continue Reading

-

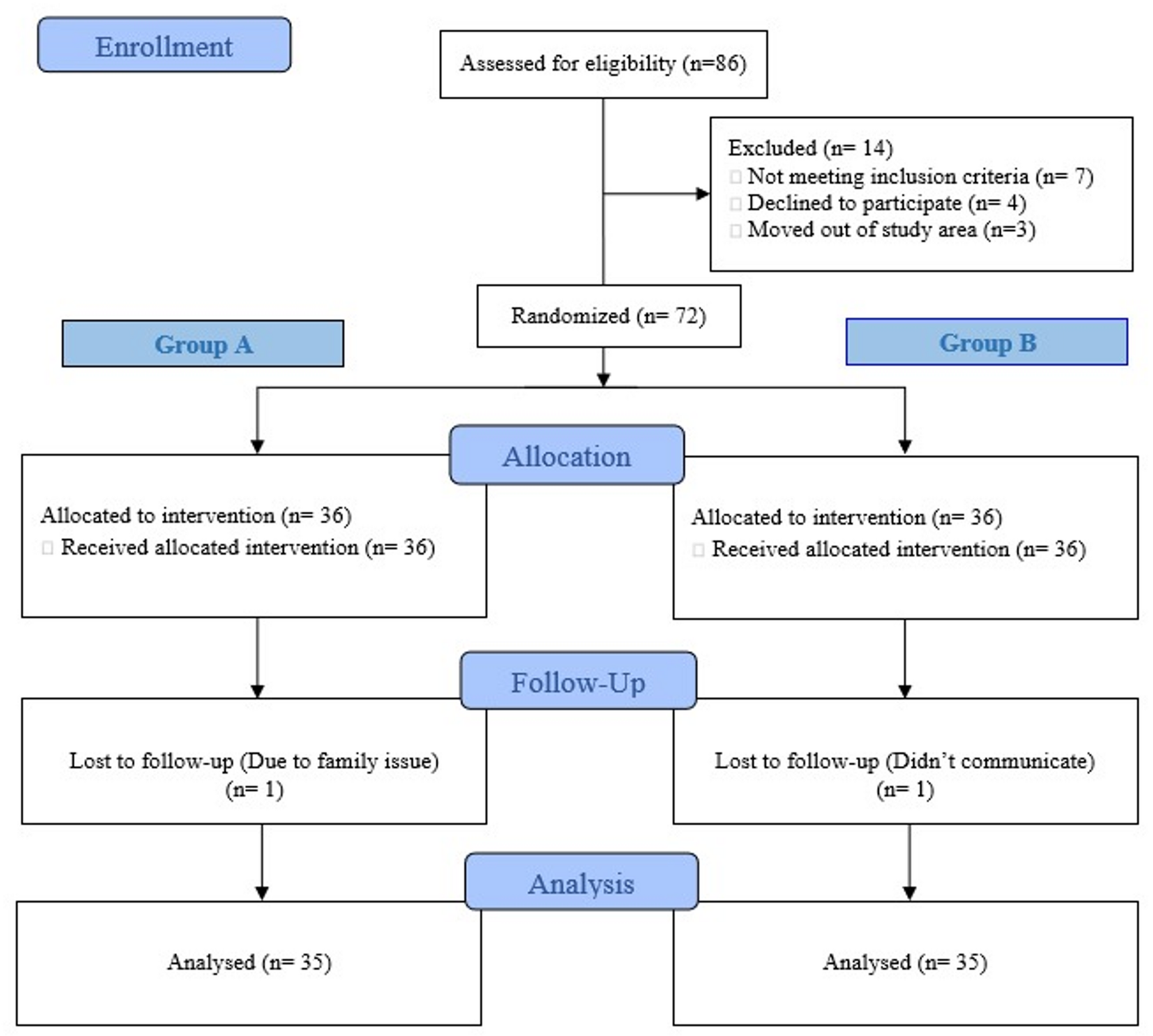

Efficacy of physiotherapy with occupational and speech therapy for improving physical & behavioral status among children with autism spectrum disorder (ASD): an assessor blinded randomized clinical trial | BMC Pediatrics

Lord C, Elsabbagh M, Baird G, Veenstra-Vanderweele J. Autism spectrum disorder. Lancet. 2018;392(10146):508–20. https://doi.org/10.1016/s0140-6736(18)31129-2.

Google Scholar

…Continue Reading

-

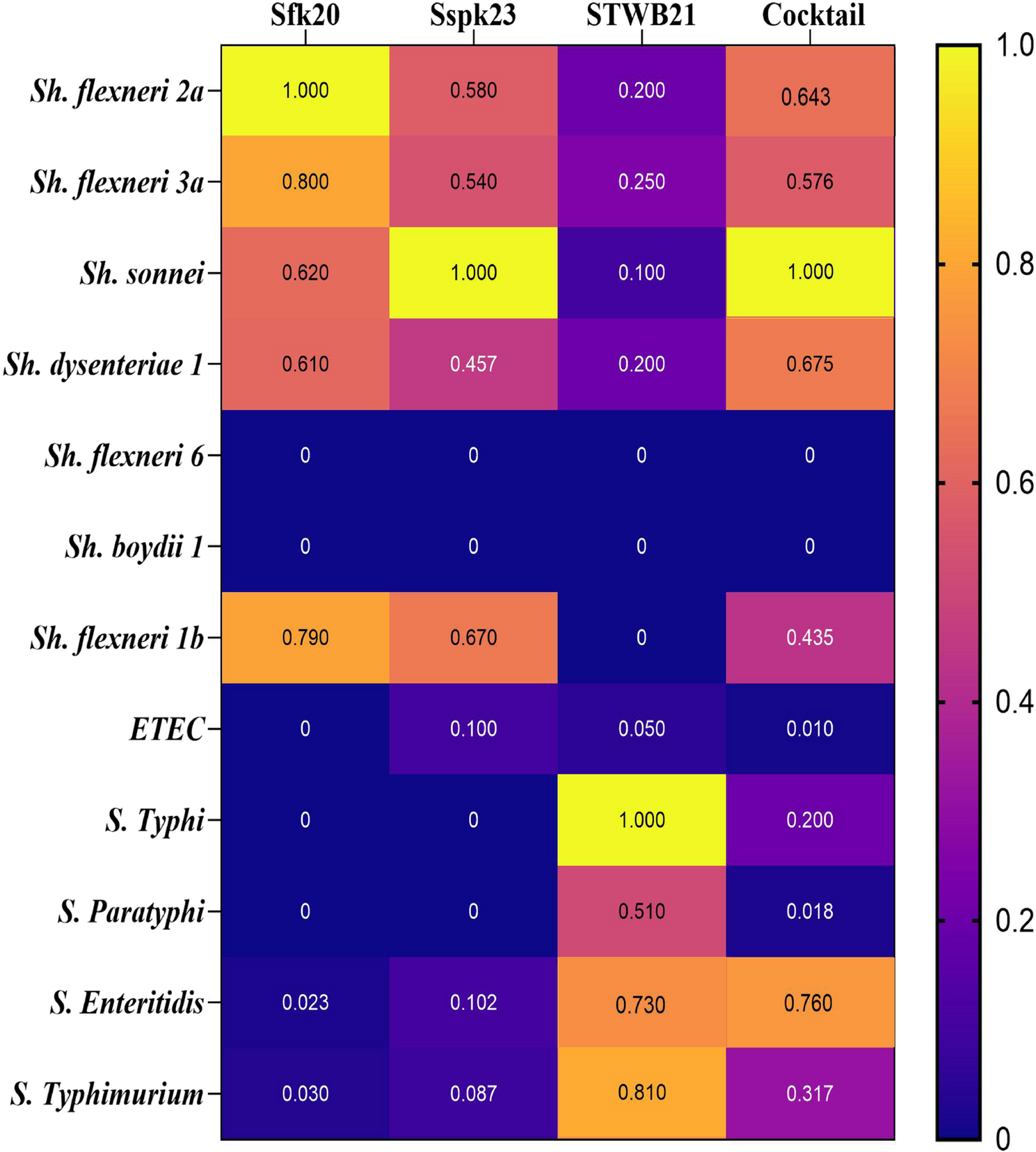

Utilizing the effectiveness of phage cocktail to combat Shigella and Salmonella infections and their polymicrobial biofilm control activity | BMC Microbiology

Bacterial strains

Salmonella and Shigella strains utilized in this study were obtained from the Strain Repository at ICMR-National Institute for Research in Bacterial Infections (ICMR-NIRBI), Kolkata. Strains were kept at −80 °C in Brain Heart…

Continue Reading

-

Opposition ruckus derails Senate sitting – Dawn

- Opposition ruckus derails Senate sitting Dawn

- PTI senators ask deputy chairman to step down The Express Tribune

- Uproar in Senate as PTI MPs demand acting chairman’s resignation The News International

- This Week in Parliament The Zimbabwean

- Lack…

Continue Reading