CDF reiterated the army’s zero-tolerance policy towards threats to national security

Field Marshal Asim Munir at Lahore Garrison observes specialised field training exercise Photo: ISPR

CDF reiterated the army’s zero-tolerance policy towards threats to national security

Field Marshal Asim Munir at Lahore Garrison observes specialised field training exercise Photo: ISPR

Last Updated: 2026.01.08

FAST RETAILING CO., LTD.

(211KB)

to Japanese page

to Chinese page

Fiscal 2026 First-quarter Performance Highlights

■Consolidated results: Fast Retailing reports record performance on significantly increased revenue and profit

■UNIQLO Japan: Reports considerable revenue and profit gains

■UNIQLO International: Significant increases in both revenue and profit

■GU: Slight increase in revenue, large increase in profit

■Global Brands: Revenue and profit both contract

■FY2026 consolidated estimates: Consolidated estimates revised up

Fiscal 2026 1Q Performance in Focus

■UNIQLO Japan: Reports considerable revenue and profit gains

UNIQLO Japan reported considerably higher revenue and profit in the first quarter of fiscal 2026, with revenue totaling 299.0 billion yen (+12.2% year on year) and business profit totaling 62.4 billion yen (+20.2%). First-quarter same-store sales (including e-commerce) expanded by an impressive 11.0%. This expansion was driven by strong sales throughout the quarter of Fall products such as sweatpants/shirts and jeans, buoyant sales of HEATTECH innerwear, PUFFTECH, and other Winter items once the weather turned cold in October, and strong Thank You Festival sales. The gross profit margin contracted by 0.5 point due to a rise in cost of sales caused by a weakening in yen exchange rates on the forward contracts we use for procurement purposes. The selling, general and administrative expense ratio improved by 1.9 points as strong sales reduced personnel and store rent cost ratios.

■UNIQLO International: Significant increases in both revenue and profit

UNIQLO International reported significant increases in both revenue and profit in the first quarter of fiscal 2026, with revenue rising to 603.8 billion yen (+20.3%) and business profit expanding to 117.3 billion yen (+38.0%). This strong performance was underpinned by our ability to develop products that captured customer demand as well as successful marketing strategies. UNIQLO brand recognition and customer trust is also expanding worldwide thanks to the continued strong opening of high-quality stores, centered around flagship stores. The business profit margin improved by 2.4 points as a result of improving gross profit margins and selling, general and administrative expense ratios in all regions.

Breaking down the UNIQLO International performance into individual regions and markets, the Mainland China market reported a rise in revenue and double-digit year-on-year profit growth. Several factors contributed to that increase in revenue, including the onset of cold weather from the latter part of October, marketing that successfully conveyed the value of UNIQLO products, and an increase in new customers attracted by our launch of a collaborative business with JD.com. The Hong Kong market reported revenue and profit gains following strong sales of Fall/Winter ranges. The Taiwan market reported a rise in first-quarter revenue and a contraction in first-quarter profit. However, if we exclude the impact of higher royalty expenses, profit from that market increased year-on-year.

UNIQLO South Korea achieved double-digit growth in both revenue and profit in the first quarter, as a result of marketing efforts that proactively conveyed the value of UNIQLO products and our corporate stance. UNIQLO operations in Southeast Asia, India, and Australia reported double-digit growth in both revenue and profit. Contributing factors included strong sales of HEATTECH, PUFFTECH, and other core Winter ranges after we strategically expanded inventory of those items to satisfy travel demand. Strong sales of new Fall ranges also contributed to the buoyant sales performance.

Meanwhile, UNIQLO North America and UNIQLO Europe both generated double-digit growth in first-quarter revenue and profit. UNIQLO’s visibility and customer base continue to expand thanks to hugely successful new store openings and enhanced efforts to promote the value of UNIQLO products. In Europe, the extremely successful opening of new stores in new cities, from Glasgow and Birmingham in the UK to Frankfurt and Munich in Germany, kept UNIQLO firmly in the news throughout the quarter. The reopening of the UNIQLO Meir flagship store in Belgium, which was relocated to a magnificent heritage building, also attracted significant attention.

■GU: Slight increase in revenue, large increase in profit

GU reported a slight increase in revenue and a large expansion in profits in the first quarter of fiscal 2026, with revenue rising to 91.3 billion yen (+0.8%) and business profit reaching 11.4 billion yen (+20.0%). While soft sheer T-shirts, warm casual innerwear, and sweatpants/shirts sold well, first-quarter GU same-store sales contracted slightly year-on-year after sales struggled to gain momentum due to a lack of products that encapsulated mass fashion trends. On the profit front, the gross profit margin improved by 2.0 points, resulting in a significant increase in profits. This improvement owed to more accurate volume planning, and consequently fewer product shortages and better discounting rates, which was a result of our efforts to narrow GU product offerings and concentrate inventory and marketing on strong-selling items.

■Global Brands: Revenue and profit both contract

Global Brands reported a decline in revenue and profit in the first quarter of fiscal 2026, with revenue declining to 33.0 billion yen (−7.6%) and business profit contracting to 1.7 billion yen (−14.8%). Though operating profit for the segment increased to 1.8 billion yen (+1.0%), this is the result of a simple comparison with the previous year when we recorded several hundred million yen in impairment losses and other costs associated with the restructuring of Comptoir des Cotonniers business. No such losses were recorded in the first quarter of fiscal 2026. Looking at individual labels within the Global Brands segment, Theory reported a decline in revenue and profit in the first quarter, primarily due to a decline in revenue and profit from Theory USA in the face of lackluster sales. Meanwhile, our PLST business performed strongly, reporting higher revenue and profit in the first quarter thanks to enhanced styling suggestions and product marketing, which helped boost sales of coats, knitwear, and shirts. Finally, our combined Comptoir des Cotonniers and Princesse tam.tam business reported a decline in revenue following store closures as part of overall restructuring efforts. These store closures have, however, helped improve cost structure efficiency, resulting in an improvement in the selling, general and administrative expense ratio and – by extension – a contraction in overall losses.

■FY2026 consolidated estimates: Consolidated estimates revised up

In fiscal 2026, the Fast Retailing Group expects to achieve a record performance from consolidated revenue of 3.8000 trillion yen (+11.7%), business profit of 650.0 billion yen (+17.9%), operating profit of 650.0 billion yen (+15.2%), and profit attributable to owners of the Parent of 450.0 billion yen (+3.9%). Compared to our initial estimates announced in October 2025, these new forecasts include an upward revision of 50.0 billion yen for revenue and 40.0 billion yen for both business and operating profit. These revisions incorporate not only the significantly stronger-than-expected first-quarter performance, but also the subsequent slowdown primarily in UNIQLO sales in the Japan and the Mainland China market caused by the persistently warm weather in December. We have not changed our initial earnings forecasts for the second half of fiscal 2026.

In addition to the above revisions, we have also revised up our full-year estimate for profit attributable to owners of the Parent by 15.0 billion yen, to reflect revisions to anticipated net finance income. Meanwhile, we have increased our expected annual dividend per share for fiscal 2026 by 20 yen, to 540 yen, which comprises interim and year-end dividends of 270 yen each. That would represent an increase in the full-year dividend of 40 yen per share, compared to the previous year.

In terms of individual business segments, we forecast double-digit sales and profit growth for UNIQLO International as a whole in the first and second half of fiscal 2026, and the full fiscal year. Within that segment, the Greater China markets are expected to report year-on-year increases in revenue and profit in both the first and second half of the year, and for fiscal 2026 as a whole. The full-year business profit margin is forecast to improve. UNIQLO operations in South Korea, the Southeast Asia, India and Australia region, North America, and Europe are all expected to continue to perform strongly and generate double-digit revenue and profit growth in the first half, second half, and full business year. At UNIQLO Japan, second-quarter revenue is expected to remain flat year-on-year and business profit to contract following the slowdown in demand and drop in sales in December caused by persistently warm weather. However, we do expect UNIQLO Japan will achieve year-on-year increases in both revenue and profit for the first half as a whole, while in the second half, we expect a slight increase in revenue and steady business profit. For the full business year, we expect UNIQLO Japan to report increased revenue and profit. Meanwhile, GU is expected to report higher revenue and slight profit growth in the first half, with higher revenue and profit in the second half and for fiscal 2026 as a whole. Finally, we anticipate Global Brands will generate a slight increase in revenue and profit for fiscal 2026 as a whole.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.

![]() Top of page

Top of page

January is globally observed as Cervical Cancer Awareness Month, a timely reminder of how preventable this disease can be with the right combination of vaccination and regular screening. Cervical cancer develops slowly and is most commonly caused…

Is it her sharp gaze or the fact that, even as a director at AstraZeneca, she likes to pore over lab data? Speaking to Jennifer Kingston, one gets the sense that not much escapes her attention – except, as it turns out, the email in her…

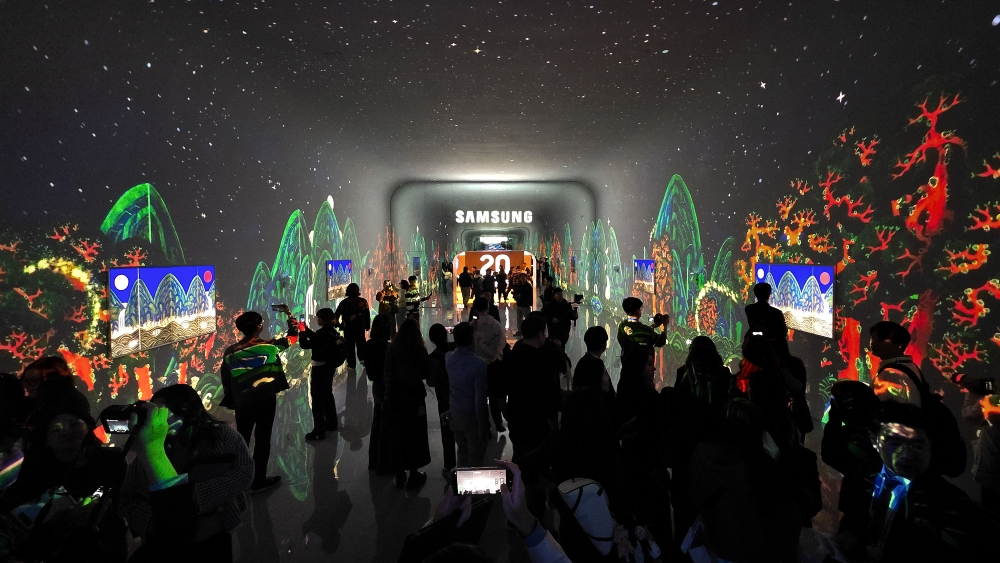

Visitors from around the world enter the exhibition.

The First Look 2026 by Samsung Electronics unveiled a forward-looking vision for AI under the theme “Your Companion to AI Living.” Held…

Tue 06/1/2026

Minister News

H.H. Sheikh Abdullah bin Zayed Al Nahyan, Deputy…

Pakistan and China have agreed to strengthen security and law-enforcement cooperation, including the establishment of a special protection unit in Islamabad to ensure the safety of Chinese citizens. The consensus was reached during a…

The world No 1 expects to skip events again this year and face likely sanctions rather than put her health at risk.

Published On 8 Jan 2026

World number one Aryna Sabalenka has accused…