Softball | January 6

DeKALB, Ill.—The Northern Illinois University softball team will hold…

Softball | January 6

DeKALB, Ill.—The Northern Illinois University softball team will hold…

Orange plans to use the proceeds for general corporate purposes, which may include the repayment of certain outstanding indebtedness of MasOrange to be assumed in connection with Orange’s acquisition of the remaining 50% of MasOrange.

With a weighted average coupon of 4.72% for an average maturity of 9 years, this first US dollars issuance since 2016 allows Orange to benefit from diversification in its pool of credit investors.

CAUTION: NOT FOR DISTRIBUTION IN CANADA, AUSTRALIA OR JAPAN

This press release may not be published, distributed or transmitted in Canada, Australia or Japan. This release does not constitute an offer of securities for sale or a solicitation of an offer to purchase these securities in the United States, Australia, Canada, Japan or any other jurisdiction in which such offer or solicitation is unlawful. The securities may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons, absent registration or an exemption from registration under the U.S. Securities Act of 1933, as amended (the “Securities Act”). There will be no public offering of the securities in the United States. The securities have not been, and will not be, registered under the Securities Act. The securities referred to herein may not be offered or sold in Australia, Canada or Japan or to, or for the account or benefit of, any national, resident or citizen of Australia, Canada or Japan subject to certain exceptions.

The company has not authorized any offer of the securities to retail investors (as such term is defined in the regulation) in any member state of the European Economic Area. No action has been undertaken or will be undertaken to make an offer of the securities to retail investors requiring publication of a prospectus in any EEA Member State. As a result, the securities may only be offered in EEA Member States (i) to any legal entity that is a qualified investor as defined in the Prospectus Regulation (EU) No 2017/1129, as amended or (ii) in any other circumstances falling within Article 1(4) of the Prospectus Regulation.

This press release is an advertisement and not a prospectus within the meaning of the Prospectus Regulation and does not constitute an offer to acquire securities. No Prospectus Regulation compliant prospectus has been or will be published.

In the United Kingdom, this release may only be distributed to, and is only directed at, persons who are “qualified investors” within the meaning of Article 2 of Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018, as amended, and who are also (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”), or (ii) persons falling within Article 49(2)(a) to (d) of the Order (high net worth companies, unincorporated associations, etc.) (all such persons referred to in (i) and (ii) above are together being referred to as “Relevant Persons”). This release is directed only at Relevant Persons and must not be acted on or relied on by persons who are not Relevant Persons. Any investment or investment activity in securities of the Company is available only to Relevant Persons and will be engaged in only with Relevant Persons.

LOS ANGELES — Actor Mickey Rourke says he’s not asking fans for financial help on GoFundMe to avoid eviction.

In a video posted on Instagram, the actor addresses the online fundraiser, saying it’s left him “confused” and “frustrated.”

“That’s not…

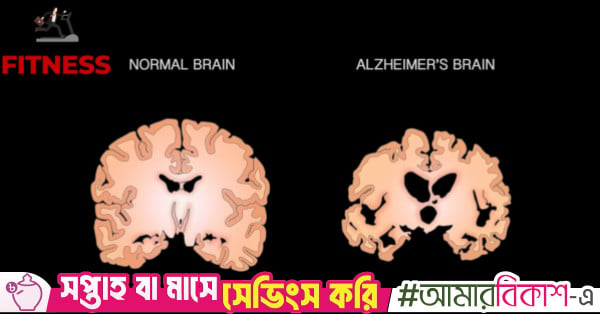

Alzheimer’s disease and dementia don’t suddenly appear in old age – they are often the result of decades of small, everyday habits quietly adding up over time.

The choices you make today around food, sleep, movement, and inflammation can…

Chronic Wasting Disease (CWD) has been reported in a hunter-harvested white-tailed buck in Concordia Parish, the Louisiana Department of Wildlife and Fisheries (LDWF) said. The buck was harvested on Richard K. Yancey Wildlife Management…

One of Creighton’s two fourth year seniors, Lockett appeared in each of the…

The UK and France have signed a declaration of intent on deploying troops in Ukraine if a peace deal is made with Russia, UK Prime Minister Sir Keir Starmer has announced.

After talks with Ukraine’s allies in Paris, he said the UK and France would…