These analyses revealed less brain-wide availability of a specific kind of glutamate receptor, known as metabotropic glutamate receptor 5 (mGlu5) in autistic participants. The findings support the idea that an imbalance of excitatory and…

Author: admin

-

Russia patents space station with artificial gravity as ISS era ends

While the International Space Station (ISS) prepares for a watery grave in 2030, Russia is looking up — and spinning.

The Russian state rocket company, Energia, has officially secured a patent for a giant, rotating space architect,…

Continue Reading

-

Accenture to Acquire Cabel Industry, Strengthening its Financial Services Capabilities in Italy

The acquisition will enhance the managed services portfolio of Accenture Financial Advanced Solutions & Technology (AFAST), the company’s technology center of excellence dedicated to financial services in Italy. By integrating Cabel Industry’s capabilities—along with its approx. 200 highly-skilled professionals—AFAST will be better positioned to deliver advanced IT solutions for the banking and insurance sectors, including in credit management, and accelerate technology adoption among mid-market institutions, helping them build more scalable and competitive business models.

“Core banking and credit management services are undergoing a profound transformation driven by new demands for modernization, scalability and productivity,” said Teodoro Lio, market unit lead for Accenture in Italy . “ Integrating Cabel Industry into Accenture significantly strengthens our core banking proposition. Their specialized platform and industry expertise enable us to accelerate the delivery of flexible, industrialized solutions aligned with the evolving technology priorities of Italian banks.”

“Combining Cabel Industry’s capabilities with Accenture’s existing AFAST assets will create important synergies for our clients and lead to a stronger platform for innovation and efficiency,” said Massimiliano Colangelo, Financial Services lead for Accenture in Italy and Greece. “We can further support financial institutions in their IT reinvention journeys—from core banking modernization to managed services—reinforcing our role as a trusted partner in the region.”

“Innovation in banking increasingly depends on economies of scale and Accenture’s strong expertise and global network will ensure continuity of service for our clients while providing the best opportunity for our people to expand their skillsets,” said Andrea Pettinelli, CEO of the Fibonacci Group and Chairman of Cabel Industry. “We believe that the integration of Cabel Industry’s unique capabilities into AFAST, including around credit management, will enable us to develop new technology solutions and deliver even more value to clients.”

Since 2023, Accenture has completed seven strategic acquisitions in Italy, including IQT (Engineering Managed Services), Ammagamma (AI), Intellera Consulting (Public Administration), Fibermind (5G and fiber networks), Customer Management IT and SirfinPA (Justice and Security), and SIPAL’s Integrated Product Support business (Aerospace and Defense).

Terms of the transaction were not disclosed. Completion of the acquisition is subject to customary closing conditions.

Forward-Looking Statements

Except for the historical information and discussions contained herein, statements in this news release may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “should,” “likely,” “anticipates,” “aspires,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “positioned,” “outlook,” “goal,” “target” and similar expressions are used to identify these forward-looking statements. These statements are not guarantees of future performance nor promises that goals or targets will be met, and involve a number of risks, uncertainties and other factors that are difficult to predict and could cause actual results to differ materially from those expressed or implied. These risks include, without limitation, risks that: Accenture and Cabel Industry will not be able to close the transaction in the time period anticipated, or at all, which is dependent on the parties’ ability to satisfy certain closing conditions; the transaction might not achieve the anticipated benefits for Accenture; Accenture’s results of operations have been, and may in the future be, adversely affected by volatile, negative or uncertain economic and geopolitical conditions and the effects of these conditions on the company’s clients’ businesses and levels of business activity; Accenture’s business depends on generating and maintaining client demand for the company’s solutions and services including through the adaptation and expansion of its solutions and services in response to ongoing changes in technology and offerings, and a significant reduction in such demand or an inability to respond to the evolving technological environment could materially affect the company’s results of operations; risks and uncertainties related to the development and use of AI, including advanced AI, could harm the company’s business, damage its reputation or give rise to legal or regulatory action; if Accenture is unable to match people and their skills with client demand around the world and attract and retain professionals with strong leadership skills, the company’s business, the utilization rate of the company’s professionals and the company’s results of operations may be materially adversely affected; Accenture faces legal, reputational and financial risks from any failure to protect client and/or company data from security incidents or cyberattacks; the markets in which Accenture operates are highly competitive, and Accenture might not be able to compete effectively; if Accenture does not successfully manage and develop its relationships with its ecosystem partners or fails to anticipate and establish new alliances in new technologies, the company’s results of operations could be adversely affected; Accenture’s ability to attract and retain business and employees may depend on its reputation in the marketplace; Accenture’s profitability could materially suffer due to pricing pressure, if the company is unable to remain competitive, if its cost-management strategies are unsuccessful or if it experiences delivery inefficiencies or fail to satisfy certain agreed-upon targets or specific service levels; changes in Accenture’s level of taxes, as well as audits, investigations and tax proceedings, or changes in tax laws or in their interpretation or enforcement, could have a material adverse effect on the company’s effective tax rate, results of operations, cash flows and financial condition; Accenture’s results of operations could be materially adversely affected by fluctuations in foreign currency exchange rates; Accenture’s debt obligations could adversely affect its business and financial condition; as a result of Accenture’s geographically diverse operations and strategy to continue to grow in key markets around the world, the company is more susceptible to certain risks; if Accenture is unable to manage the organizational challenges associated with its size, the company might be unable to achieve its business objectives; Accenture might not be successful at acquiring, investing in or integrating businesses, entering into joint ventures or divesting businesses; Accenture’s business could be materially adversely affected if the company incurs legal liability; Accenture’s work with government clients exposes the company to additional risks inherent in the government contracting environment; Accenture’s global operations expose the company to numerous and sometimes conflicting legal and regulatory requirements; if Accenture is unable to protect or enforce its intellectual property rights or if Accenture’s solutions or services infringe upon the intellectual property rights of others or the company loses its ability to utilize the intellectual property of others, its business could be adversely affected; Accenture may be subject to criticism and negative publicity related to its incorporation in Ireland; as well as the risks, uncertainties and other factors discussed under the “Risk Factors” heading in Accenture plc’s most recent Annual Report on Form 10-K and other documents filed with or furnished to the Securities and Exchange Commission. Statements in this news release speak only as of the date they were made, and Accenture undertakes no duty to update any forward-looking statements made in this news release or to conform such statements to actual results or changes in Accenture’s expectations.About Accenture

Accenture is a leading solutions and services company that helps the world’s leading enterprises reinvent by building their digital core and unleashing the power of AI to create value at speed across the enterprise, bringing together the talent of our approximately 784,000 people, our proprietary assets and platforms, and deep ecosystem relationships. Our strategy is to be the reinvention partner of choice for our clients and to be the most client-focused, AI-enabled, great place to work in the world. Through our Reinvention Services we bring together our capabilities across strategy, consulting, technology, operations, Song and Industry X with our deep industry expertise to create and deliver solutions and services for our clients. Our purpose is to deliver on the promise of technology and human ingenuity, and we measure our success by the 360° value we create for all our stakeholders. Visit us at accenture.com.# # #

Contacts:

Alberto Morici

Accenture

+39 340 2255389

[email protected]Armando Barone

Accenture

+39 348 5608969

[email protected]Michael McGinn

Accenture

+1 312 693 5707

[email protected]Copyright © 2025 Accenture. All rights reserved. Accenture and its logo are registered trademarks of Accenture.

Continue Reading

-

Gout and kidney disease – Kidney Research UK

An episode of gout is usually treated with non-steroidal anti-inflammatory (NSAID) medicines, for example naproxen. However, because these medicines can cause kidney damage if taken often, they tend not to be used for people with

Continue Reading

-

Airway TSLP Asthma Linked to Severe Lung Changes

AN INSIGHTFUL study has revealed that a subset of patients with asthma has elevated levels of thymic stromal lymphopoietin (TSLP) in the airways, a finding associated with severe disease, type 2 inflammation, mucus plugging, and airway…

Continue Reading

-

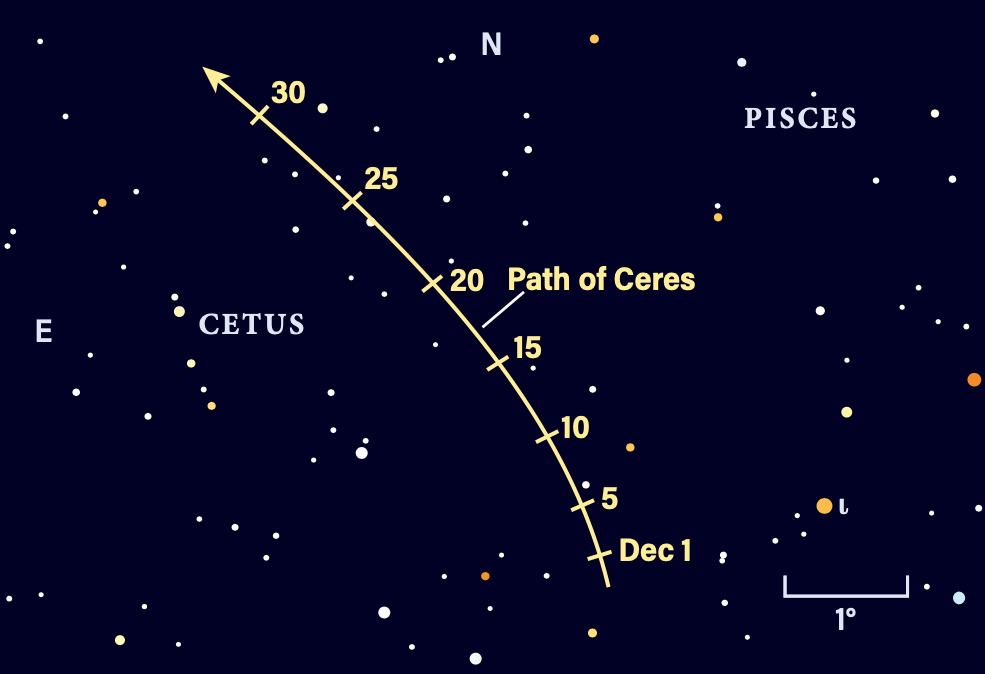

Ceres makes us see double

Dwarf planet Ceres passes close to a background star in Cetus tonight, creating a temporary, one-night-only “double star.”

Ceres remains…

Continue Reading

-

Titanfall 2 Players Honor Creator Vince Zampella With a Heartbreaking Gun Salute

The news of the passing of Vince Zampella, co-founder of Infinity Ward, creator of Respawn Entertainment, and head of Battlefield Studios, came as a shock to the entire gaming community. Millions of gamers took to social media, paying…

Continue Reading

-

PANTHERS SIGN FORWARD JOHNNY CURRAN

Wed 24 Dec 2025 – 09:00AM

🎟 CLICK HERE TO BUY TICKETS FOR PANTHERS HOME GAMES 🎟

Nottingham Panthers have signed Great Britain international and experienced Elite League forward Johnny Curran on an initial five-week contract.

The…

Continue Reading

-

Romance, mysteries dominate list of Hamilton’s most borrowed library books in 2025

Listen to this article

Estimated 4 minutes

The audio version of this article is generated by AI-based technology. Mispronunciations can occur. We are working with our partners to continually review and improve the results.

When it comes to Hamilton…

Continue Reading

-

Song Sung Blue review – Neil Diamond tribute act gets sweet treat of movie thanks to Jackman and Hudson | Film

Here is a startlingly strange, undeniably entertaining true-life story from the heartland of American showbusiness; a lovable crowdpleaser whose feelgood flavour won’t prepare you for the way the plot repeatedly and savagely twists like an…

Continue Reading