In Kurram district, patriarchy, broken healthcare leave women like Gul Rukh fighting for survival

35-year-old Gul Rukh Bibi still remembers the silence…

In Kurram district, patriarchy, broken healthcare leave women like Gul Rukh fighting for survival

35-year-old Gul Rukh Bibi still remembers the silence…

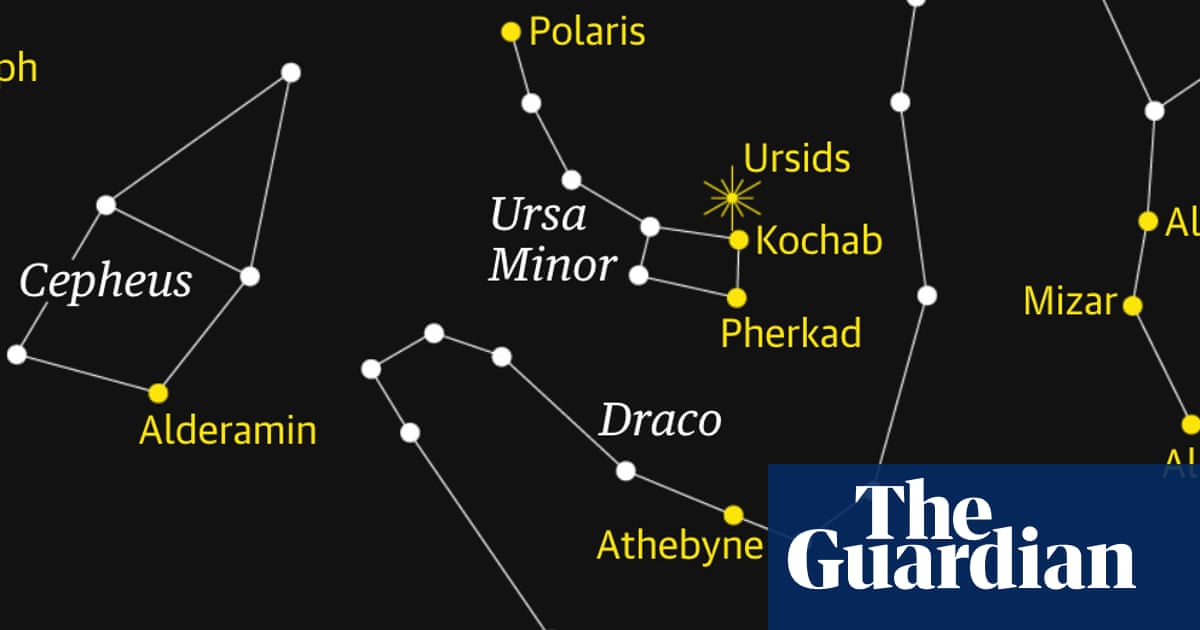

If the Geminids whetted your appetite for meteor showers, then you are in luck. This week it is the turn of the Ursids. Admittedly, they are nowhere near as plentiful as the Geminids, producing a maximum of just 10 meteors an hour, but there is a…

Mon 22 Dec 2025 – 06:00AM

🎟 CLICK HERE TO BUY TICKETS FOR PANTHERS HOME GAMES 🎟

Nottingham Panthers will go into Christmas at the top of the table as the battle intensifies in the Elite League.

There’s a three-way tie on 34 points…

Crosby has a total of 1,925 points (716 goals, 1,209 assists) in the regular season and Stanley Cup Playoffs, the most in Penguins history ahead of Lemieux (1,895 points; 766 goals, 1,129 assists). He is seventh all-time, trailing Gretzky…

When Shimano finally brought back Di2 to mountain biking this summer, this time in wireless form, it was a long awaited and arguably long-overdue release for the Japanese component manufacturer. It wasn’t exactly what was expected, though. It…

Good afternoon.

New details about the police case against the alleged Bondi terrorists have been released, including details of an alleged video manifesto linked to the Islamic State and the undetonated explosives – including a “tennis ball…

A research team in Brazil has found strong evidence that the Joseph’s Coat plant (Alternanthera littoralis) is both safe and effective at reducing inflammation, easing pain, and protecting against arthritis. The study was carried out by…

An Alberta animal welfare agency says a dog that tested positive for highly pathogenic avian influenza has died.

The Alberta Society for the Prevention of Cruelty to Animals says in a Saturday social media post that this is the second…

Tata Elxsi is proud to be honoured with the LG Strategic Partner Award 2025, marking our second consecutive year of recognition.

This award celebrates our outstanding contribution to the LG Information Display business and…