- 410 Million Year Old Fossil Of Prototaxites Defies Classification astrobiology.com

- Scientists Intrigued by Unfamiliar Life Form Futurism

- This Mysterious 407-Million-Year-Old Fossil May Represent a Previously Unknown Branch of Life Smithsonian…

Author: admin

-

410 Million Year Old Fossil Of Prototaxites Defies Classification – astrobiology.com

-

Pakistan-UAE trade conference, business networking event held – Business Recorder

- Pakistan-UAE trade conference, business networking event held Business Recorder

- Pakistan Marks Record Gulfood Presence with 142 Companies The Daily CPEC

- Pakistan showcases agro-food strength at Gulf Food 2026 in Dubai gulfnews.com

- Oman…

Continue Reading

-

What causes chronic pain? A new study identifies a key culprit | CU Boulder Today

A neural circuit hidden in an understudied region of the brain plays a critical role in turning temporary pain into pain that can last months or years, according to new University of Colorado Boulder research.

The animal study, published in the…

Continue Reading

-

Iran closes airspace, announces live-fire drills over Strait of Hormuz amid US tensions

An Iranian missile is launched during a military exercise in an undisclosed location in Iran, August 20, 2025. — Reuters - Iran issues Notam for closure of airspace over Hormuz Strait.

- Iran to launch drills for…

Continue Reading

-

Trump seeks ‘honorable’ probe, signals de-escalation after Minnesota killing

United States President Donald Trump on Tuesday said he wants “a very honorable and honest investigation” into the killing of Alex Pretti by federal agents in Minneapolis.

The latest comments by the US President signify a turnaround on the… Continue Reading

-

NBA Rising Stars

Standout rookies Cooper Flagg and Kon Knueppel were the top two picks in the 2026 Castrol Rising Stars draft.

• NBA All-Star 2026: Complete coverage

The 2026 Castrol Rising Stars were drafted to three teams Tuesday with Dallas Mavericks rookie…

Continue Reading

-

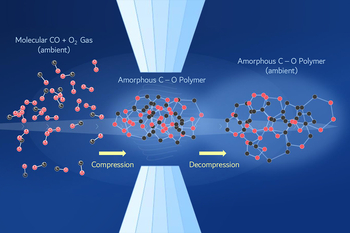

From Fleeting to Stable: Scientists Uncover Recipe for New Carbon Dioxide-Based Energetic Materials

Newswise — When materials are compressed, their atoms are forced into unusual arrangements that do not normally exist under everyday conditions. These configurations are often fleeting: when the pressure is…

Continue Reading

-

How modern lifestyles reprogram the gut microbiome and shape disease risk

From jet lag and poor sleep to exercise and chronic stress, this review unpacks how everyday lifestyle factors can disrupt gut microbial rhythms and why these changes may matter for metabolism, immunity, and long-term disease risk.

Rare Cosmic Lineup Gives Hubble Close Look at 3I/ATLAS

On January 22, 2026, the NASA/ESA Hubble Space Telescope observed the interstellar comet 3I/ATLAS nearly perfectly aligned with the Sun-Earth axis, revealing unprecedented jet structures and an extended anti-tail.

This image of the…

Continue Reading

The limited effects of regulating greenwashing: Evidence from Europe’s Sustainable Finance Disclosure Regulation

Over the past decade, sustainable and ESG investing has grown rapidly. This expansion has been accompanied by increasing concerns about greenwashing: the practice of overstating the environmental or social benefits of financial products. The concern is that sustainable investments might have little impact, or sometimes even a negative impact (Kölbel et al. 2020, Hartzmark and Shue 2023, Berk and Van Binsbergen 2025). In response, European regulators have sought to improve transparency and accountability through disclosure-based regulation.

One of the most ambitious such efforts is the EU’s Sustainable Finance Disclosure Regulation (SFDR). Introduced in March 2021, the SFDR requires mutual funds to classify themselves into three categories: Article 6 funds with no sustainability focus, Article 8 funds that promote environmental or social characteristics, and Article 9 funds that pursue a sustainable investment objective. The goal was to help investors distinguish genuinely sustainable products from those relying mainly on marketing claims.

In a recent paper (Allcott et al. 2026), we study whether the SFDR achieved these aims. Did the regulation affect investor behaviour? Did it lead funds to become more sustainable? And if not, why?

What would need to happen for SFDR to matter?

For sustainability disclosure to affect the real economy, several steps must occur. First, funds classified as ‘greener’ must actually hold different assets. Second, disclosures must provide investors with new or clearer information. Third, investors must respond by reallocating capital. Only then can changes in asset prices potentially influence firms’ real-world behaviour. Our analysis focuses on all three steps.

Fund classifications broadly aligned with sustainability measures

Using monthly European mutual fund data from Morningstar, we first examine how funds classified themselves when the SFDR came into force. At introduction, roughly 7% of funds were classified as Article 9, 57% as Article 8, and the remaining 35% as Article 6.

These classifications broadly align with existing sustainability metrics. Article 9 funds have higher sustainability ratings and lower carbon emissions than Article 8 funds, which in turn score better than Article 6 funds. This suggests that the SFDR did not generate arbitrary classifications; rather, it largely reflected pre-existing differences across funds.

No effect on fund flows

We then study whether investors responded to the new disclosures. Using a difference-in-differences design around the March 2021 introduction of the SFDR, we test whether flows into Article 8 and Article 9 funds changed relative to Article 6 funds.

The result is striking: we find no meaningful effect of the SFDR on mutual fund flows. This holds across a wide range of specifications, subsamples, and weighting schemes. Investors did not reallocate capital toward funds newly labelled as sustainable.

We also examine later reclassifications, most notably in late 2022, when many funds downgraded themselves from Article 9 to Article 8 in anticipation of stricter supervisory guidance. Again, we find little response in investor flows.

Little change in portfolio sustainability

If the SFDR worked through fund behaviour rather than investor demand, we might expect changes in portfolio composition. We therefore examine commonly used sustainability indicators, including portfolio-weighted carbon emissions, Refinitiv environmental scores, and Morningstar carbon risk measures.

Across all specifications, the estimated effects are either statistically insignificant or economically very small. Any gradual improvements in sustainability appear to reflect broader market trends rather than a discrete impact of SFDR itself.

Why was the impact so limited?

A natural interpretation might be that investors simply do not care about sustainability. However, our data strongly reject this explanation. Funds marketed as ESG or sustainable consistently receive higher inflows than conventional funds, both before and after SFDR, consistent with earlier evidence that investors value sustainability characteristics (Riedl and Smeets 2017, Hartzmark and Sussman 2019, Baker et al. 2022, Heeb et al. 2023, Bonnefon et al. 2025).

Instead, our findings point to two related explanations. First, the SFDR disclosures provided little new information. Long before the regulation, investors already appeared to know which funds were ‘light green’ and ‘dark green’, based on fund names, mandates, and prior marketing. Indeed, before the SFDR took effect, 86% of eventual Article 9 funds already had explicit sustainability mandates, compared to virtually none of the Article 6 funds. The regulation largely codified existing perceptions rather than correcting them.

Second, the disclosures were difficult to understand. In practice, many funds simply display their Article 6, 8, or 9 status on websites or factsheets, with minimal explanation of what these categories actually mean. Both investors and regulators have expressed concern that the distinctions are opaque, echoing broader critiques of complex ESG disclosure frameworks.

Evidence from a survey and experiment

To distinguish between investor indifference and disclosure design, we complement our fund-level analysis with a survey and an experiment among European investors.

In the survey, many respondents report confusion about the meaning of Article 6, 8, and 9 classifications. In the experiment, participants construct portfolios from a set of mutual funds under different information conditions.

When investors are shown only the standard SFDR classifications, portfolio choices barely change. However, when we pair the same classifications with clear and intuitive explanations of what each category implies, investor behaviour shifts substantially toward more sustainable funds. This suggests that investors care about sustainability, but struggle to translate the existing SFDR disclosures into meaningful decisions.

Implications for SFDR 2.0

Our findings are directly relevant for the ongoing reform of the regulation. The European Commission’s proposed SFDR 2.0 explicitly acknowledges that the original framework was overly complex and confusing for retail investors.

The proposed reform replaces Articles 8 and 9 with three clearer product categories: “ESG Basics”, “Transition”, and “Sustainable”. This change closely aligns with our experimental evidence, which shows that intuitive and well-defined categories can significantly increase the effectiveness of sustainability disclosures.

At the same time, important challenges remain. Much will depend on the forthcoming Level 2 rules, which will specify thresholds, exclusions, indicators, and reporting templates. There is also a risk that complexity re-emerges through implementation, even if the headline categories appear simpler.

Conclusion

Disclosure-based regulation is often seen as a low-cost way to address greenwashing. Our evidence suggests that disclosure can work, but only if it delivers genuinely new and understandable information.

The experience of SFDR 1.0 shows that complex labels, even when well intentioned, may have little effect on investor behaviour if they merely formalise what investors already believe or are too difficult to interpret. Designing disclosures that investors can easily understand is therefore not a cosmetic detail, but central to regulatory effectiveness.

As policymakers finalise the next generation of sustainable finance rules, the key lesson is simple: transparency helps only when people can actually use it.

References

Allcott, H, M Egan, P Smeets and H Yang (2026), “The Effects of Regulating Greenwashing: Evidence from Europe’s SFDR”, NBER Working Paper.

Baker, M, M Egan and S Sarkar (2022), “How Do Investors Value ESG?”, NBER Working Paper.

Berk, J and J H Van Binsbergen (2025), “The impact of impact investing”, Journal of Financial Economics 164.

Bonnefon, J-F, A Landier, P R Sastry, and D Thesmar (2025), “The Moral Preferences of Investors: Experimental Evidence”, The Journal of Financial Economics 163.

Hartzmark, S and A Sussman (2019), “Do Investors Value Sustainability? A Natural Experiment Examining Ranking and Fund Flows”, The Journal of Finance 74(6): 2789-2837.

Hartzmark, S and K Shue (2023), “Counterproductive Impact Investing: The Impact Elasticity of Brown and Green Firms”, working paper.

Heeb, F, J Kölbel, F Paetzold and S Zeisberger (2023), “Do Investors Care about Impact?”, Review of Financial Studies 36(5): 1737-1787.

Kölbel, J, F Heeb, F Paetzold and T Busch (2020), “Can Sustainable Investing Save the World?”, Organization & Environment 33(4).

Riedl, A and P Smeets (2017), “Why Do Investors Hold Socially Responsible Mutual Funds?”, Journal of Finance 72(6): 2505-2550.

Continue Reading