The next monthly webinar of the International Testing Agency (ITA) on 10 December will be targeting athletes trying to qualify for the upcoming Milano Cortina 2026 Olympic Winter Games, as well as their support personnel.

What are the…

The next monthly webinar of the International Testing Agency (ITA) on 10 December will be targeting athletes trying to qualify for the upcoming Milano Cortina 2026 Olympic Winter Games, as well as their support personnel.

What are the…

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

They grow up so fast. Anthropic, a maker of artificial intelligence models and rival to OpenAI, has hired lawyers ahead of an initial public offering that could value it at $350bn next year. By that point the company would have reached the not-at-all-grand age of five.

That makes it a pretty good example of AI companies’ turbocharged growth. As a comparison, Google went public six years after its founding, achieving a valuation of about $23bn. Facebook took eight years to spring into public markets with roughly a $100bn price tag. The geriatric Microsoft waited 11 years and debuted in 1986 at around $800mn.

Behind the hype, at least, is a business. Anthropic’s main product is its chatbot Claude. That generates revenue, if not yet profit: Anthropic has projected that it could make $70bn in sales by 2028, The Information has reported. That would put its mooted valuation at five times that sum. Meta went public in 2012 at, with hindsight, a multiple of six times its three-year-hence sales; China’s Alibaba at seven times and Palantir at 10.

When investors do get the chance to buy stock in Anthropic directly, joining existing backers Amazon, Google, Microsoft and Nvidia, they will be benchmarking it particularly closely with OpenAI, the maker of ChatGPT, whose latest valuation of $500bn is also five times 2028 projections.

Who wins the bake-off depends on what flavours an investor prefers. Anthropic seems more popular with companies, with a 32 per cent share of the “enterprise” market as of the end of July, according to Menlo Ventures — which it should be noted is an Anthropic investor. That’s helpful, because businesses are more likely to pay up for AI than consumers.

Anthropic is also a more narrow business. It builds models, and that’s about it. OpenAI, meanwhile, is investing in data centres, pocket-sized devices, other companies’ shares and its own web browser. Some might call that sprawl; a venture capitalist might be more likely to call it “full stack”. Seen that way, Anthropic might more resemble a Palantir or a Salesforce, where OpenAI has shades of Google parent Alphabet or Microsoft.

Perhaps the toughest thing to value is what Anthropic might see as its greatest asset: its principles. The company was founded to be a safer alternative to OpenAI, building bots that are “helpful, honest and harmless”. Indeed, the Center for AI Safety deems Anthropic’s products the least likely among major models to “overtly lie” or furnish answers to “hazardous expert-level virology queries”.

Whether investors will pay a premium for that — or instead demand a discount — remains to be seen. In the meantime, much can happen. By the time it goes public, if it does, AI may have taken another leap forward, or tripped on its own hype. It’s therefore worth thinking about how Anthropic might justify a $350bn valuation — while also being prepared to tear those assumptions up and start again.

john.foley@ft.com

South Africa completed the joint-highest chase in the history of one-day internationals in India as they passed a target of 359 to win by four wickets in Naya Raipur.

Aiden Markram hit 110 from the top of the order, while Matthew Breetzke and…

South Africa completed the joint-highest chase in the history of one-day internationals in India as they passed a target of 359 to win by four wickets in Naya Raipur.

Aiden Markram hit 110 from the top of the order, while Matthew Breetzke and…

2025 has been a year of firsts for Laura Mueller and Esteban Ocon. It’s Laura’s first season as a race engineer, Esteban’s first season with Haas, and it’s their first time working with each other.

So, how are they finding it? What do…

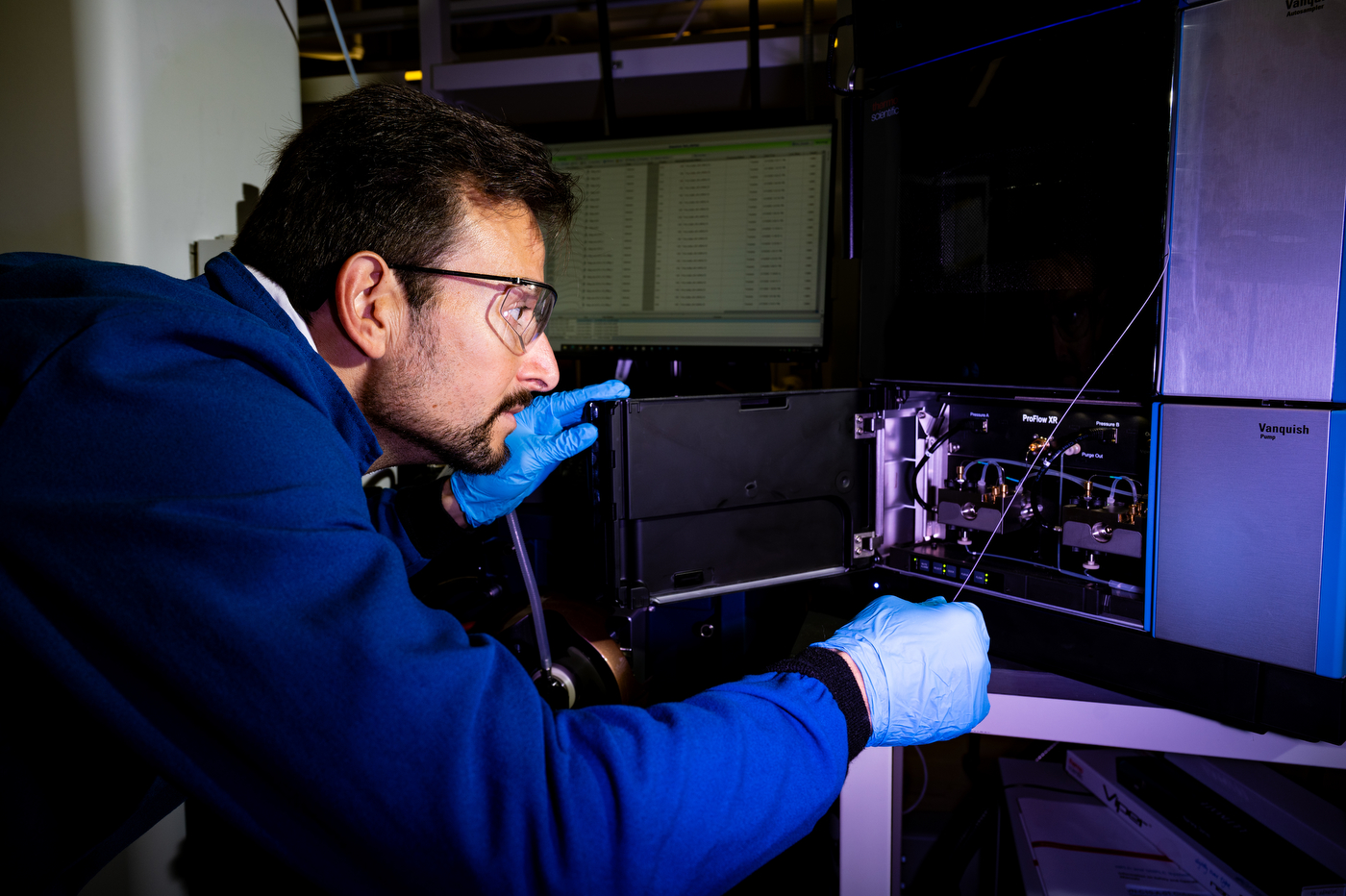

Mammal embryos show differences between individual cells from the very first division — a finding that could transform stem cell therapy, Northeastern University researchers have discovered.

Individual cells are distinct from one…

A deal to combine Paramount and Warner Bros. Discovery would create a media behemoth.

And that behemoth could be partially owned by the governments of Saudi Arabia, Qatar, and Abu Dhabi.

So says Variety, reporting that…

For Honor’s newest season, called Conquest, is out tomorrow, rounding out Year 9 content with themes of dominion, dynasty, and control. Players can expect a new converted map for Dominion, a themed Battle Pass, an Ice Brawlers and Zhanhu’s…

Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

Bond investors have told the US Treasury they are concerned about Kevin Hassett’s potential appointment as Federal Reserve chair, worrying he will cut interest rates aggressively to please President Donald Trump.

The Treasury department solicited feedback on Hassett and other candidates in one-on-one conversations with executives at major Wall Street banks, asset management giants and other big players in the US debt market, according to several people familiar with the conversations.

The discussions took place in November, before Treasury secretary Scott Bessent held his second round of interviews with candidates to replace Jay Powell as Fed chair when his term expires in May 2026, these people said.

A White House spokesperson said “the president will continue to nominate the most qualified individuals to the federal government, and until an announcement is made by him, any discussion about potential nominations is pointless speculation”.

The Treasury declined to comment.

Hassett, the White House’s top economic official, has emerged as a frontrunner for the position in recent weeks, as Trump and Bessent have whittled down the list of potential candidates from 11 initial contenders.

Trump on Tuesday said he planned to name his pick for Fed chair “early” next year, and signalled Hassett was a “potential” contender. The US dollar briefly slipped on the president’s mention of Hassett.

The doubts about Hassett reflect a broader anxiety on Wall Street about the transition at the Fed’s helm as Trump prepares to nominate a new leader of the central bank. Some senior bond market participants would have preferred other candidates such as BlackRock’s Rick Rieder and Fed governor Christopher Waller who were seen as more independent from Trump than Hassett.

Several of the market participants the Treasury contacted said they were worried about Hassett’s alignment with Trump, who has insisted rates should be cut sharply and has called Powell a “stubborn mule” for the central bank’s decision to only modestly lower borrowing costs this year.

The bankers and investors were worried that Hassett could agitate for indiscriminate rate cuts even if inflation continues to run above the Fed’s 2 per cent target, according to three people familiar with the conversations.

“No one wants to get Truss-ed,” said one market participant, referring to the shock in the UK bond market in 2022 triggered by the then-prime minister Liz Truss’s plans for unfunded tax cuts.

The prospect of a dovish Fed chair was viewed as particularly worrisome to the big bond managers in the event that inflation in the US rises next year. The Fed’s preferred inflation gauge registered 2.7 per cent in August.

The combination of loose monetary policy and higher inflation could ignite a sell-off in long-term Treasuries, said one market participant.

Some market participants were also unconvinced Hassett would be able to win round a divided Fed board and corral consensus on rate decisions, the people added.

Among the array of participants in those conversations were members of the group of Wall Street bond titans who make up the Treasury Borrowing Advisory Committee, which counsels Bessent on market and issuance questions, according to two people familiar with the matter.

When Hassett, a career economist whose work has focused on tax policy, met with TBAC earlier this year, he spent little time talking about markets, instead pitching White House priorities, including a discussion about Mexican drug cartels, these people said.

A Washington insider, Hassett served as a senior economic adviser on the presidential campaigns of John McCain, George W Bush and Mitt Romney, before joining the White House during Trump’s first term as chair of the Council of Economic Advisers.

He also worked at the conservative think-tank the American Enterprise Institute — and at the Fed, where staffers who worked with him remember him as ambitious.

Robert Tetlow, a senior policy adviser who recently left the Fed, said Hassett struck him as “smart, eloquent and self-assured”.

However, concerns abound that his closeness to a president who has spent the past year attacking the US central bank will threaten the institution’s independence.

“Kevin Hassett is more than capable of doing the job of Fed chair, it’s just a question of who shows up,” said Claudia Sahm, a former Fed economist who is now chief economist at New Century Advisors. “Is it the Kevin Hassett who is the active participant in the Trump administration? Or Kevin Hassett the independent economist?”

John Stopford, head of managed income at asset manager Ninety One, added: “I think the market sees him as a Trump stooge which erodes the Fed’s credibility at the margin.”

Additional reporting by Ian Smith in London