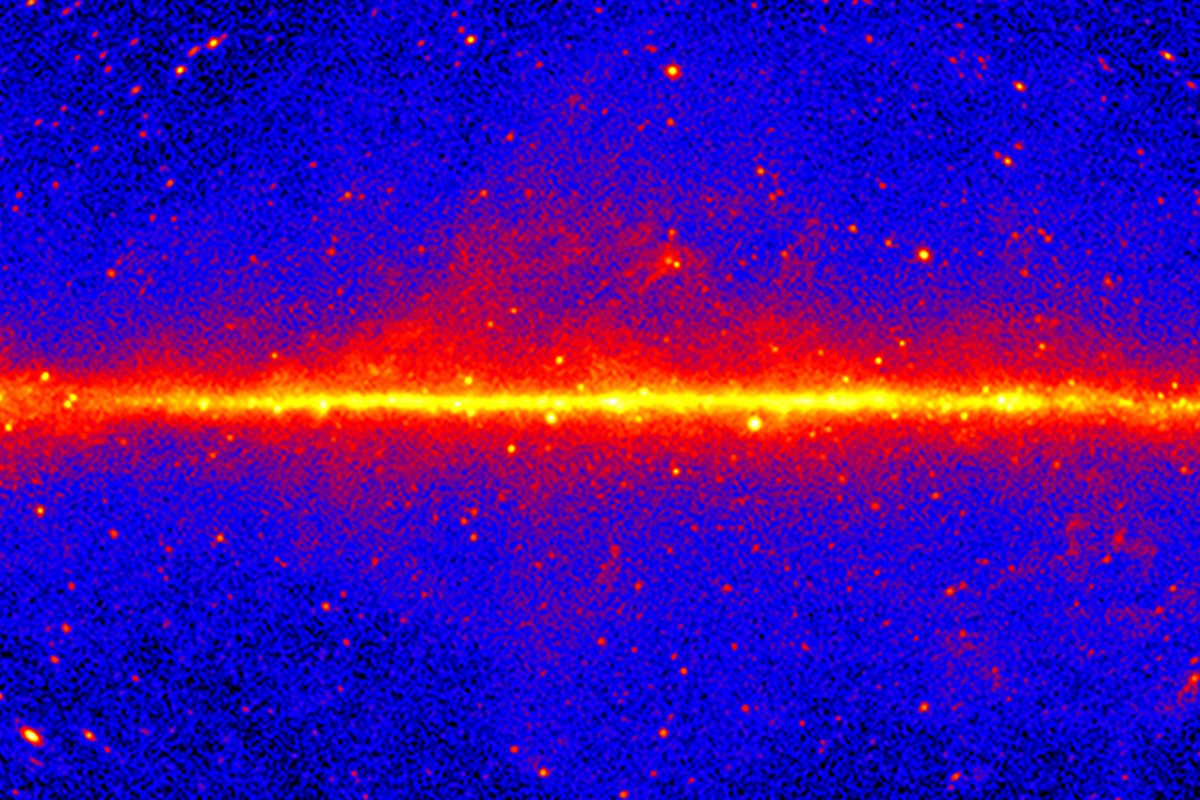

A scientist using a powerful NASA space telescope says he may have finally detected dark matter.

Dark matter is thought to make up about 27% of all the matter in the Universe, and it acts as a sort of gravitational ‘glue’ holding whole galaxies…

A scientist using a powerful NASA space telescope says he may have finally detected dark matter.

Dark matter is thought to make up about 27% of all the matter in the Universe, and it acts as a sort of gravitational ‘glue’ holding whole galaxies…

Sky-watchers across the globe were treated to a supermoon this week, appearing brighter and larger in the evening sky.

A supermoon occurs when the moon reaches its perigee in orbit, meaning it is at its closest point to the Earth.

This is a…

Amy HolmesBedfordshire Political Reporter

Kimberley Piper/BBC

Kimberley Piper/BBCThe East West Rail (EWR) project “desperately needs to win back public trust”, a borough’s mayor said.

The billion-pound rail line aims to connect Cambridge and Oxford, via Bedford, Milton Keynes and Bicester.

Tom Wootton, the Conservative mayor of Bedford, said EWR’s latest plans “did not have a rationale” for needing to demolish more homes in the borough, after some properties were announced as being at risk of being knocked down in August.

Natalie Wheble, EWR’s external affairs director, said: “We recognise that it takes time to build trust” and the company “remained committed to our intention of improving our communication with those impacted by our plans”.

EWR held a third non-statutory consultation on its plans to develop the project at the start of this year and received more than 6,200 responses, which it said has helped to make 80 design changes to proposals.

The revisions included building a new station at Stewartby to serve the proposed Universal Studios theme park, the redevelopment of Bedford Station, reducing the number of stations on the Marston Vale Line and building a new station at Tempsford.

Alex Pope/BBC

Alex Pope/BBCWootton said he was studying the latest update to EWR’s plans, which were published this month, with officers from Bedford Borough Council and reaffirmed their continued support for the project “in principle”.

He added that “everyone at East West Rail desperately needed to show they were being honest and transparent”.

In August it was announced that more homes could be demolished on Ashburnham Road, along with a GP surgery and the Dom Polski community venue, to make way for the project.

Wootton said he was waiting for an explanation from EWR on why the demolition would need to take place and claimed the council had been promised a technical note more than two months ago.

Wootton said: “When EWR held a public meeting earlier this month, they failed to share simple information beforehand with the council.”

He added that EWR “needed to keep us in the loop if we are to support our residents”.

Ms Wheble said: “Bedford sits at the heart of the East West Rail route, and continued dialogue with the council, residents and local organisations is essential.”

She added the company would “keep listening, working collaboratively and improving the way we engage as the project moves forward”.

The United States Women’s National Team (USWNT) earned their third straight victory in an international football friendly on Friday (28 November), besting Italy 3-0 in Orlando, Florida.

The five-time Olympic champions looked confident and…

A bestselling children’s author said he only realised how much his home county had inspired his writing after organising an exhibition about his work.

With more than three million copies of his stories sold, Kes Gray is well known for books such…

Belgian scientists from VIB and Ghent University (UGent), together with Danish collaborators, have uncovered compelling evidence that early-infancy infection with respiratory syncytial virus (RSV) significantly increases the risk of…

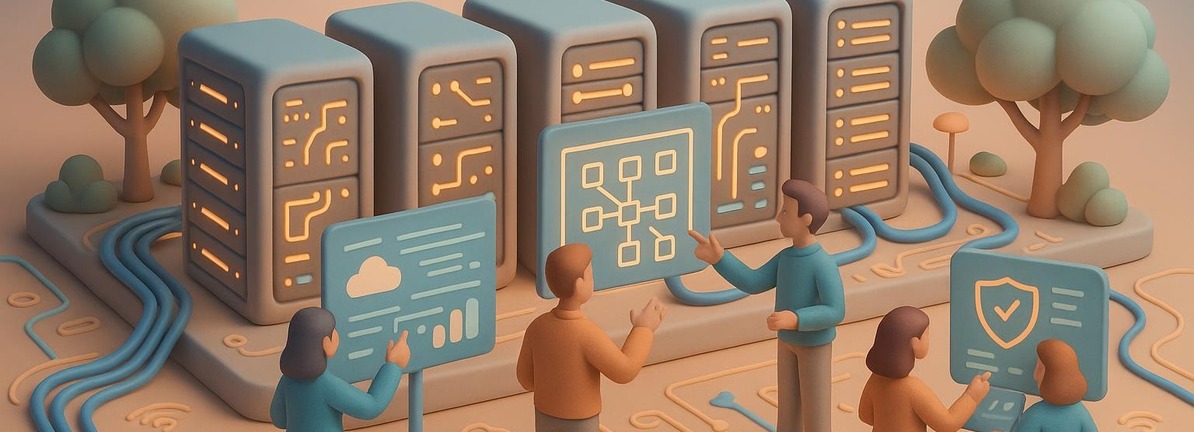

Curious whether Digital Realty Trust is trading at a bargain or an inflated price? Let’s dive into what the numbers and recent events might reveal about its true value.

The stock has seen notable moves recently, rising 1.9% over the past week, but still down 4.2% for the month and 15.8% over the last year. These shifts hint at changing investor sentiment regarding both growth prospects and risk.

Recent headlines covering major partnerships and continued investment in global data center expansion have dominated the news. These developments highlight the company’s positioning in a fast-evolving tech landscape, help explain the stock’s volatile performance, and are generating ongoing debate about what could come next.

On our valuation checks, Digital Realty Trust scores a 3 out of 6, suggesting there’s more to the story beneath the surface metrics. We’ll walk through traditional valuation methods in a moment, but stick around for an even more insightful way to evaluate the stock before making any moves.

Digital Realty Trust delivered -15.8% returns over the last year. See how this stacks up to the rest of the Specialized REITs industry.

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those amounts back to today’s dollars. For Digital Realty Trust, this model uses adjusted funds from operations to forecast the company’s free cash flow performance over time.

Currently, Digital Realty Trust generates annual free cash flow of $2.02 billion. Analyst consensus projects steady growth, with free cash flows expected to reach nearly $3.70 billion by 2029. After five years, further growth assumptions are extrapolated based on historical trends and sector outlook. All cash flow projections are measured in US dollars.

Based on this analysis, the DCF model produces an estimated intrinsic value of $236.26 per share. Compared to the current market price, this suggests that Digital Realty Trust is undervalued by about 32.2 percent according to these assumptions.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Digital Realty Trust is undervalued by 32.2%. Track this in your watchlist or portfolio, or discover 920 more undervalued stocks based on cash flows.

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Digital Realty Trust.

The price-to-earnings (PE) ratio is one of the most widely used metrics for assessing the value of profitable companies like Digital Realty Trust. Since the company generates consistent earnings, the PE ratio helps investors quickly compare its share price relative to recent profits and spot any potential discrepancies in valuation.