- France’s Macron unveils voluntary military service amid ‘accelerating threats’ Reuters

- France brings back limited military service with 3,000 volunteers next year BBC

- Education Ministry to support late Astro Awani journalist’s children Newswav

Author: admin

-

France's Macron unveils voluntary military service amid 'accelerating threats' – Reuters

-

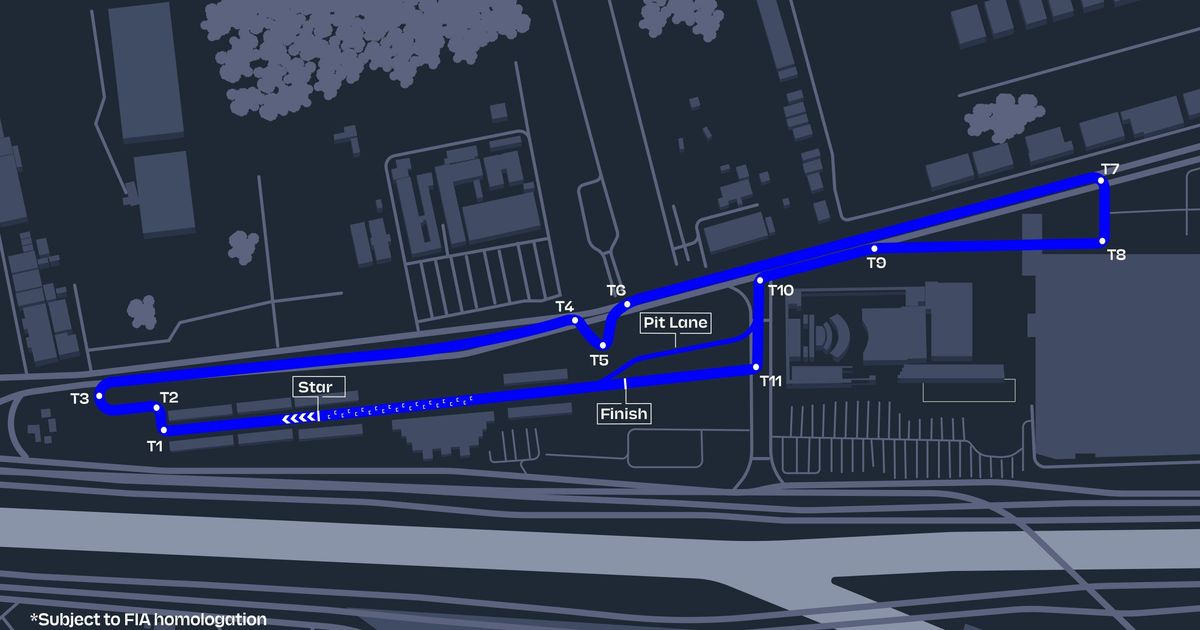

What does the São Paulo E-Prix circuit look like?

Feature by Katy Fairman

The first race of the 2025/26 ABB FIA Formula E season is almost upon us, as the championship kicks off Season 12 with a visit to Brazil. The 2025 São Paulo E-Prix promises to be…

Continue Reading

-

Poll: Camera of the Year 2025 – Have Your Say!

A dedicated article featuring CineD’s “Camera of the Year 2025” will follow soon, but before diving into it, we’d like to ask for YOUR opinion.

2025 was a very busy year for most camera manufacturers, and we can conclude that with the…

Continue Reading

-

Transform your Mac with Microsoft apps for less than $9 each – SFGATE

- Transform your Mac with Microsoft apps for less than $9 each SFGATE

- Microsoft Goes Wild for Black Friday, Windows 11 Pro Drops 94% Like They Forgot the Price Tag Kotaku

- Lifetime Access to Microsoft’s Latest Office Software is 40% Off for Black…

Continue Reading

-

wartime cliches overwhelm this extraordinary true account

What does the familiar film tagline “based on a true story” really mean? Leaving aside questions of historical fidelity versus poetic license, what does an audience get from the assurance that a given story “truly happened”?

At…

Continue Reading

-

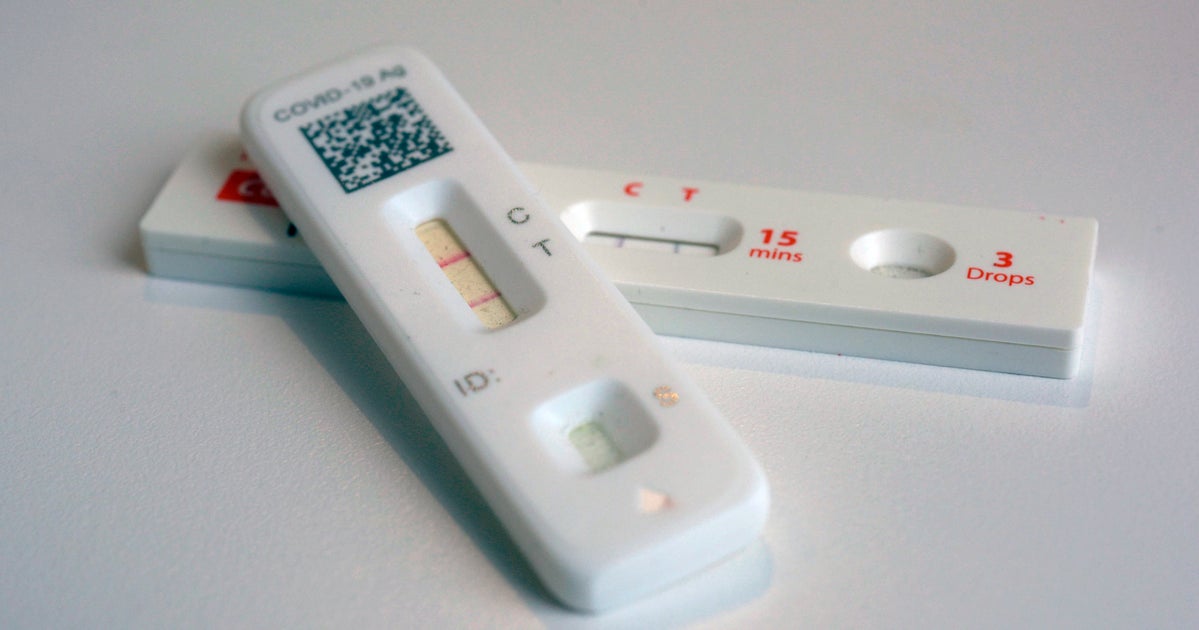

Bird Flu Could Mutate Into Pandemic Worse Than COVID, Warns Leading French Scientist

PARIS, Nov 27 (Reuters) – The bird flu virus that has been spreading among wild birds, poultry and mammals could lead to a pandemic worse than COVID-19 if it mutates to transmit between humans, the head of France’s Institut Pasteur respiratory…

Continue Reading

-

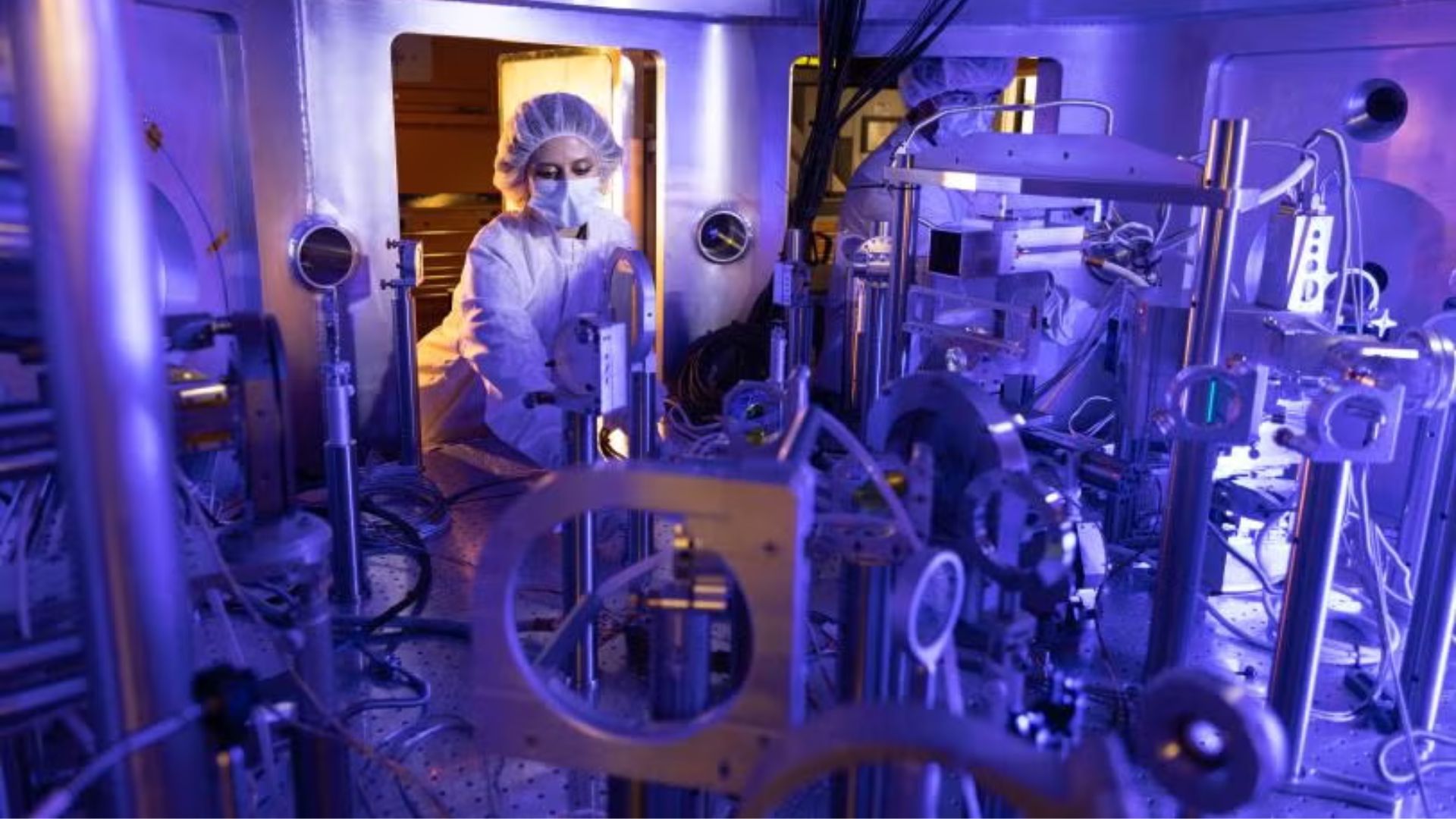

US lab reveals secrets to nuclear fusion fuel target survival

Work performed at the Department of Energy’s SLAC National Accelerator Laboratory has unlocked new data on the design of fusion fuel targets, a fundamental part of the future of inertial fusion energy (IFE).

The research, published in…

Continue Reading

-

FPL Scout: Fantasy Premier League Gameweek 13 hints, tips and advice | Brentford FC

Brentford have teamed up with Fantasy Football Scout to help bring you hints, tips and advice during the 2025/26 Fantasy Premier League (FPL) season.

Scout will be using their expertise to provide info, advice and Gameweek tips which may prove…

Continue Reading

-

ICC Confirms Broadcast and Digital Rights Partners in Pakistan Till 2027

The International Cricket Council (ICC) has confirmed that Pakistan Television Corporation (PTVC) and Myco will hold the broadcast and digital rights for all ICC events in Pakistan until 2027.

Under the new agreement, PTVC, in collaboration with…

Continue Reading

-

You’re gonna need a bigger boat: the 20 best films set on water – ranked! | Film

20. Deep Rising (1998)

Stephen Sommers’ sci-fi horror pulp follows a bunch of scene-stealing character actors playing mercenaries hired to destroy the cruise ship Argonautica for insurance purposes. But a giant mutant octopus has got there…

Continue Reading