Lando Norris has admitted that despite the frustrating double disqualification for McLaren in Las Vegas, nothing has changed within himself or the team as he continues to target his maiden Drivers’ Championship crown.

The Standings leader and his…

Lando Norris has admitted that despite the frustrating double disqualification for McLaren in Las Vegas, nothing has changed within himself or the team as he continues to target his maiden Drivers’ Championship crown.

The Standings leader and his…

Two Russian cosmonauts and one American astronaut floated through a hatch into the International Space Station on Thursday, beginning an eight-month stay after arriving on a Russian spacecraft that launched from the Baikonur Cosmodrome in…

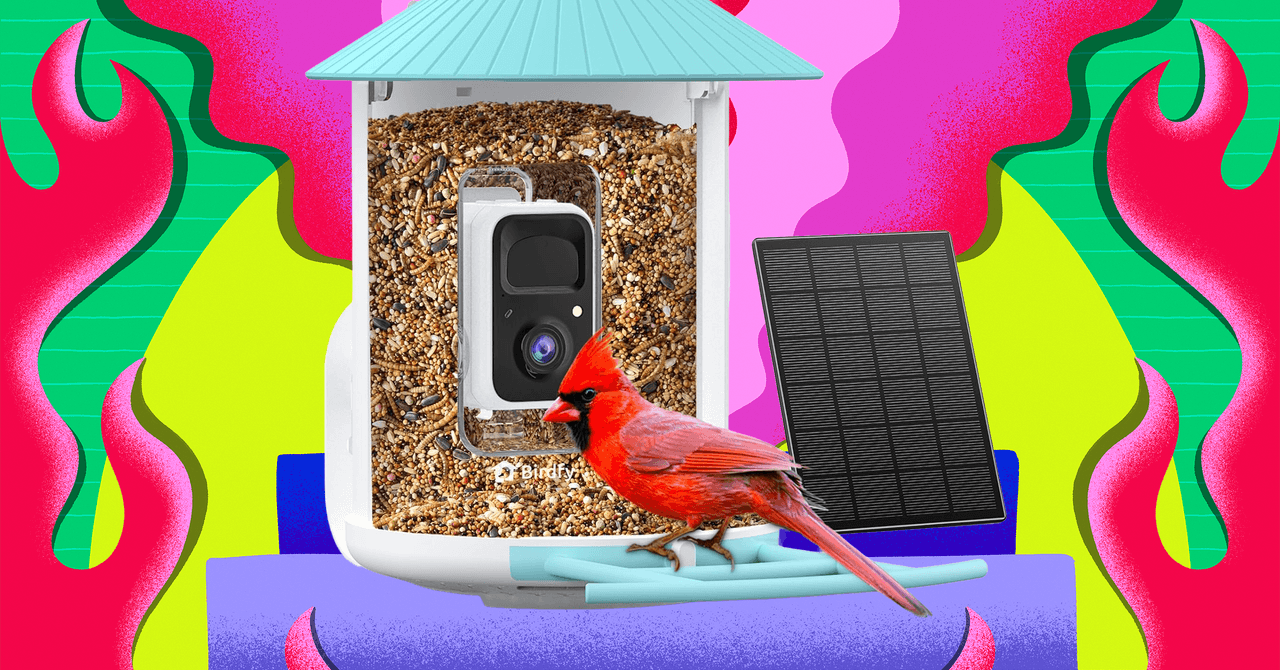

After spending the past year testing 25 smart bird feeders from 10 different brands, many have impressed me, but none so frequently and consistently as Birdfy’s. It was the first brand on the market to introduce AI bird identification, as well as…

We absolutely love this Walmart HQinX Astronaut Star Projector, and not just because it’s down to $12 in Walmart’s Black Friday sale. These astronaut star projectors come in many varieties, but someone has decided this particular interstellar…

The 2025 National Dog Show, hosted by the Kennel Club of Philadelphia, will feature 201 breeds competing in a traditional event that has been held since 1933 and will air on Thanksgiving Day.

The event, founded in 1879, features only purebred dogs…

Google Maps’ Gemini-powered navigation is officially rolling out more broadly, marking the next step in the overhaul Google first teased earlier this month. When Mashable first…

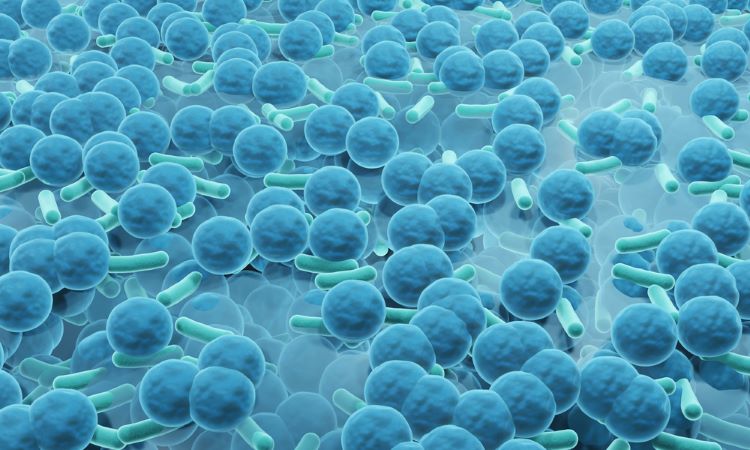

The proposed mechanical antibacterial approach offers a new way to use metal-organic frameworks, a Nobel Prize-winning material.

An innovative, mechanical technique has shown promise for eliminating biofilms without requiring antibiotics or toxic…

About 1,800 miles (2,900 kilometers) below our feet, two enormous patches of strange rock sit above Earth’s core. New computer models now tie these deep structures to slow chemical leaks between the core and mantle that may have helped Earth…