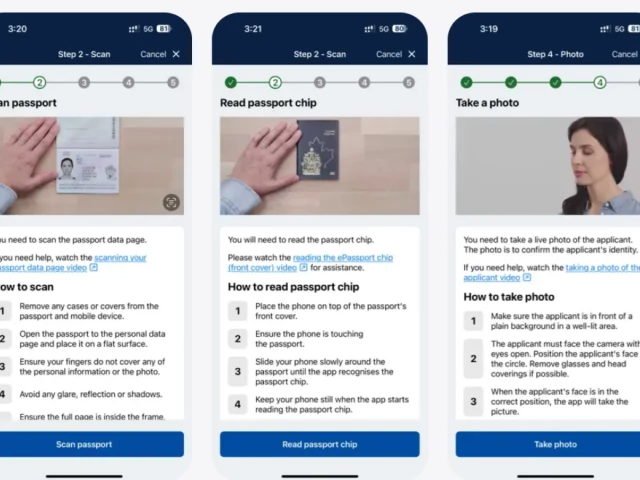

Eligible Pakistanis can submit passport details and facial biometrics via Australia’s free Immi App

Australian High Commissioner, Timothy Kane said this app is a major step forward in making the Australian visa process easier and more…

Eligible Pakistanis can submit passport details and facial biometrics via Australia’s free Immi App

Australian High Commissioner, Timothy Kane said this app is a major step forward in making the Australian visa process easier and more…

Can your technology triumph in the ocean?

Ask SEA-Stack.

True to its name, this one-of-a-kind, free, open-source tool combines (or stacks) multiple wave energy modeling capabilities into one user-friendly package.

With SEA-Stack, wave energy companies—or any developers working on water-based tech, like ships, underwater drones, or even space shuttle crew modules—will be able to quickly vet new technology designs and potentially save significant time and money. Those savings could help accelerate technology development and enable wave energy devices to fulfill their promise: to deliver reliable energy to populated coastal cities, rural and remote communities, or even offshore data centers and military bases.

“Wave energy has a lot of great prospects right now,” said Salman Husain, a mechanical engineer at NREL who is helping develop the next-generation SEA-Stack tool. “Computers are getting smaller. Advanced manufacturing has become a lot more affordable. You can do wireless communication to monitor devices that have been deployed.”

And, Husain added, “with these rapid tools, we just might crack it.” (“It” being wave energy.)

SEA-Stack is rapid—thanks to high-performance computing, it is about 10 to 100 times faster than its predecessors. The tool is also flexible, capable of running everything from simple but fast simulations (essential to quickly assess new design ideas) to complex analyses that account for tricky physics. With help from machine learning, it can also ingest the latest wave energy data—or data from nearly any floating tech.

In short, SEA-Stack will be a Swiss Army knife for wave energy developers (and beyond).

Wave energy devices—which produce electricity from the consistent, predictable energy flowing in ocean waves—could help the United States build an even more secure and resilient power system. But these early-stage energy technologies are not yet affordable or competitive enough to achieve commercial success, in large part because they come with complex engineering challenges. Devices must survive decades in a turbulent, powerful environment: the ocean.

And the ocean is not a cooperative research partner.

If developers toss an unvetted prototype into potentially destructive waves, they risk losing significant time and money (plus investors) if their device quickly fails, breaks, or does not produce as much energy as expected. Instead, companies need a virtual testing platform that can accurately replicate the ocean, so they can assess different device designs with far less risk, time, or cost. Although such tools exist, they all have major limitations.

SEA-Stack is designed to overcome those limitations.

“SEA-Stack enables researchers to design and optimize technologies while considering all relevant physics,” said Michael Lawson, who leads the NREL marine energy team. “That’s just not possible using the existing tools.”

Existing tools cannot simulate certain features, like flexible device shells, collisions, or autonomous control systems, which allow a device to react automatically to its changing environment. Developers also cannot mix and match different codes to explore broader design possibilities. The SEA-Stack team is building in both capabilities.

Plus, existing coding tools are typically siloed. A developer could use one to subject a design idea to a simplified ocean. Such low-fidelity models are handy because they are fast. But once the developer has a winning design, they often cannot use the same tool to put it through a high-fidelity model—one that is not as fast but accounts for the complex physics that affect how waves of different sizes and speeds interact with various wave energy devices.

“In reality, waves are more like poly-pyramids moving all over the place,” Husain said.

SEA-Stack has the poly-pyramids. And it has simplified waves, thanks to its predecessor and partner, WEC-Sim.

“Historically, NREL has played a leading role in developing these simulation tools,” said David Ogden, a research engineer who helped develop the SEA-Stack code.

That was true with WEC-Sim, the Wave Energy Converter SIMulator, another wave simulation tool, which won a prestigious R&D 100 Award in 2022. Researchers at NASA and Lockheed Martin depended on WEC-Sim to help a spaceflight crew land their module safely in the ocean.

Husain, who specializes in numerical modeling, is learning from WEC-Sim’s successes and limitations to build SEA-Stack. WEC-Sim “has a lot of tools inside of it, but the moment you step outside of that ecosystem, you’re out in the open on your own,” Husain said.

WEC-Sim also mostly operates in a two-dimensional space, which cannot fully replicate all wave dynamics.

SEA-Stack does not jettison WEC-Sim’s bounty; instead, it simply expands its reach, stacking WEC-Sim with three additional code layers:

“We want to have as much data as possible before ‘getting the metal wet,’ as they say,” Ogden said. That includes data on numerous design iterations and fluid simulation methods, which help “build up that confidence that the thing is going to perform well and survive or ‘survive and thrive.’”

With SEA-Stack, a developer can rapidly test their initial design ideas and then easily transition to more rigorous testing. As a bonus, the higher-fidelity models double-check the lower-fidelity results. If the low-fidelity model erred, it can learn and refine itself. With help from machine learning, the entire SEA-Stack package can learn from broader ocean-based industries and their expertise.

“We’re part of the larger community of marine systems, such as floating platforms, ships, and marine robots, like autonomous underwater vehicles, or AUVs,” Husain said. “This would help us innovate and design novel applications, like wave-powered AUVs.”

That means wave energy developers benefit and so do companies that build any kind of floating technology.

With SEA-Stack, Ogden said, “we’ll be able to do much more innovative design exploration and make sure the devices that are being built have the best possible chance of performing well.”

Learn more about NREL’s research in marine energy and SEA-Stack. Then subscribe to The Current, NREL’s water power newsletter, to stay up to date on the latest research.

Inter-Services Public Relations (ISPR) Director General Lieutenant General Ahmed Sharif Chaudhry said on Tuesday that Pakistan did not carry out an attack on Afghanistan and always makes a formal announcement when…

A new pre-print paper suggests that our latest interstellar visitor, comet 3I/ATLAS, may be headed for one final close encounter before it departs our Solar System in 2026. The paper, which focuses on dynamical simulations of the object, also…

Alpine had high hopes of picking up a point or two in Las Vegas, such was the pace Pierre Gasly had shown throughout the weekend at a track he tends to go well at. But despite starting in the top 10, the Frenchman’s chances of scoring were over…

While TikTok’s algorithm caters to each user’s obsession of the moment, it feels nearly impossible to be on the app without seeing at least one video about Crave and HBO Max’s new gay hockey romance series, Heated Rivalry.

The…

Women with persistent thyroid hormone imbalance across pregnancy may be at an increased risk of having children with autism, according to a new study published in The Journal of Clinical Endocrinology & Metabolism.

Maternal…