After the Shore Hawks scored the first four points of the game,…

Author: admin

-

Four In Double Figures Helps Women’s Basketball Take Down UMES, 81-62

NASSAU – The Princeton Women’s Basketball Team used four players in double figures to drop the Maryland Eastern Shore Hawks, 81-62, at the Imperial Arena on Sunday afternoon. -

Mamdani reiterates Trump is a ‘fascist’ just days after cordial meeting | Donald Trump

Zohran Mamdani has reiterated his view that Donald Trump is a “fascist” and a “despot” just days after the pair had a surprisingly cordial meeting at the White House.

Speaking to NBC’s Meet the Press on Sunday, the New York City…

Continue Reading

-

Amasia Nabs ‘Complete Idiot’s Guide’ Franchise Rights

After 32 years of teaching readers to DIY, The Complete Idiot’s Guide is primed for a multimedia franchise.

Amasia Entertainment has secured franchise rights to the reference books from from Penguin Random House and DK’s…

Continue Reading

-

Hitting 100 Million RMB in One Night — What Chicjoc Got Right

China’s Double 11 shopping period this year once again proved the scale of the country’s consumer market: online retail sales reached nearly 2.4 trillion yuan, or $337.69 billion, marking double-digit, year-over-year growth. While major platforms kept sales reports intentionally low-key, several breakout brands delivered performance that cut through the noise.

Among them was Chicjoc. Its “Super Fashion Launch 2.0,” a global livestream co-created with Taobao Clothing, ran for 30 continuous hours and generated more than 100 million yuan in sales — a milestone that has quickly become part of Double 11 lore.

More from WWD

The achievement offered a counterargument to recent pessimism about China’s consumer sentiment. The market is indeed more complex and volatile than before, but enthusiasm for quality products remains robust and the country’s purchasing potential is far from exhausted. The real challenge for brands today is navigating the shift from “scale dividends” to “innovation dividends” — and capturing the momentum of this era.

Since 2023, WWD China has been tracking the rise of a cohort of high-quality domestic brands. Chicjoc, one of the most internationally ambitious among them, came onto our radar in 2024. Over the past year it has rapidly expanded in global markets: its first U.S. boutique opening, a European debut in Paris, appearances at international fashion weeks, collaborations with overseas designers, and now a landmark livestream that has become a case study across the industry.

Lynn Fu, chief executive officer of WWD China, attributes the brand’s breakthrough to its alignment with market timing, its global supply-and-retail footprint, and its investment in digital and operational capabilities. All of this, she noted, is rooted in a distinctly Chinese approach — one that prioritizes product excellence, brand credibility and a long-term moat of core competitiveness.

Chicjoc’s livestream strategy has evolved into a hybrid runway-show-meets-content-studio format that targets global audiences with day-to-night styling and cinematic storytelling. The format not only expands its consumer reach but also strengthens the brand’s identity.

The foundation for this year’s performance was laid in 2023. That season, Chicjoc introduced film-grade visuals, multi-camera transitions, and scenes recreating the intimacy of a designer atelier. Models showcased new collections while designers offered commentary on fabrics and craftsmanship — a format that underscored the brand’s “intellectual wardrobe” philosophy.

The livestream generated 60 million yuan in sales, with fall-winter pieces averaging 6,000 yuan per unit. One item surpassed 10 million yuan in sales, three exceeded 5 million yuan, and 12 crossed the 1 million mark. It was an early indicator that runway-caliber livestreams would become a new competitive frontier on platforms like Taobao Clothing and Douyin.

For Double 11 this year, Chicjoc and Taobao Clothing upgraded the concept. The 2.0 version preserved the high-fashion visual language while layering in richer storytelling and deeper interaction. Founder Wei Yujing appeared alongside industry figures such as designers Bonnetje and Freya Dalsjø, formerly of Maison Margiela and Balenciaga. Together with brand ambassadors, they wove discussions of creative philosophy, craftsmanship and aesthetics into the show.

Bonnetje cofounders Anna Myntekær (left) and Yoko Maja Hansen (right).

Segments ranged from international supermodel presentations to extensions of the brand’s Milan Fashion Week showcase, with invited guests sharing interpretations of “time” as a narrative theme. The result was a dialogue between fashion, culture and storytelling that heightened engagement and further cemented Chicjoc’s brand equity.

When international designers travel thousands of miles to appear on a Chinese livestream, the visual contrast of Eastern and Western aesthetics is striking. But behind the scenes is Chicjoc’s larger ambition: to help shape a new global fashion map.

In August 2024, the brand joined Taobao Clothing’s worldwide free-shipping initiative. Three months later, it opened its first U.S. boutique. Today it operates more than 40 retail locations globally. The combination of Taobao’s cross-border logistics and the brand’s overseas stores creates a frictionless “see now, buy now, receive now” loop for global consumers.

Ahead of this year’s Milan Fashion Week, Chicjoc deepened its collaboration with a rising Copenhagen-based design duo through the WWD Select design incubation platform. During its Double 11 livestream, this partnership evolved from resource sharing to value creation. Founder-designer conversations explored the intersections of minimalism, sustainability and modern wardrobe design — signaling a shift toward globally resonant aesthetics.

What gives Chicjoc the confidence to compete on an international stage? The brand’s strategy rests on three pillars: an expanding global retail network, an omnichannel understanding of consumer behavior, and the ability to create bestselling “super products” through an agile supply chain. The company, founded as a Taobao shop in 2013 and formalized as an e-commerce brand in 2015, combines digital-native instincts with disciplined product focus.

The Chinese consumer landscape has also reshaped the brand’s trajectory. A new generation of shoppers has moved past firm loyalty to foreign luxury labels and beyond the race to chase the lowest price. They prioritize aesthetics, quality and “worth” — a value system that increasingly aligns with global standards of sustainable and rational consumption.

This consumer environment offers three advantages:

• A high-speed innovation lab, where robust supply chains turn global ideas into real products rapidly.

• A value resonance zone, where demand for quality and aesthetics matches global conversations around sustainable fashion.

• A creative ecosystem, where China’s manufacturing capabilities and market depth attract global talent and collaboration.Given this backdrop, Chicjoc’s 100 million yuan, 30-hour global livestream success is less a coincidence than a reflection of structural transformation. China’s fashion market has entered the era of “value innovation,” where brands win not by discounting but by storytelling, technology, global integration and emotional connection.

As marketers increasingly move away from traffic-driven or discount-driven strategies, the essence of Double 11 is shifting. Shopping festivals are no longer battles of price cuts; they are stages for brand identity, creativity and cross-border cultural exchange.

Chicjoc, positioned as a rising force in the women’s fashion market, has opted out of price wars and instead leaned into an international narrative — one that fuses Chinese design intelligence with global aesthetics.

As China’s fashion industry transitions from “scale dividends” to “innovation dividends,” the rules of the game are being rewritten. Chicjoc’s performance marks not just a brand success, but a signal of how China’s fashion leaders will compete — and collaborate — on the world stage in the years ahead.

Editor’s Note: China Insight is a monthly column from WWD’s sister publication WWD China looking at trends in that all-important market.

Best of WWD

Sign up for WWD’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Continue Reading

-

West Virginia Heads to Baha Mar Hoop Pink Flamingo Championship

MORGANTOWN, W.Va. – The No. 23-ranked West Virginia University women’s basketball team is headed to Nassau, The Bahamas for two games as part of the Baha Mar Pink Flamingo Championship. The event runs from Nov. 24-26 with the Mountaineers…Continue Reading

-

Donald Glover shares health update: Stroke and heart condition

Donald Glover performs onstage at Tyler, The Creator’s Camp Flog Gnaw Carnival 2025 Day 1 held at Dodger Stadium on November 22, 2025 in Los Angeles, California. (Photo by Katie Flores/Billboard via Getty Images)

Donald Glover, who…

Continue Reading

-

Ohio State Beats Michigan State on Senior Day

COLUMBUS, Ohio – The Ohio State women’s volleyball team (6-20, 3-15 B1G) defeated Michigan State (18-10, 8-10 B1G) in four sets (25-15, 24-26, 28-26, 25-18) in Sunday afternoon’s senior day match inside the Covelli Center.

Ohio State used a…Continue Reading

-

French scientists probe mRNA’s potential to fight cancer

Inside a lab in the French city of Orleans, scientists are testing out the limits of molecules in our body called messenger RNA — best known for being used in COVID-19 vaccines — in the hopes of finding a breakthrough treatment for a…

Continue Reading

-

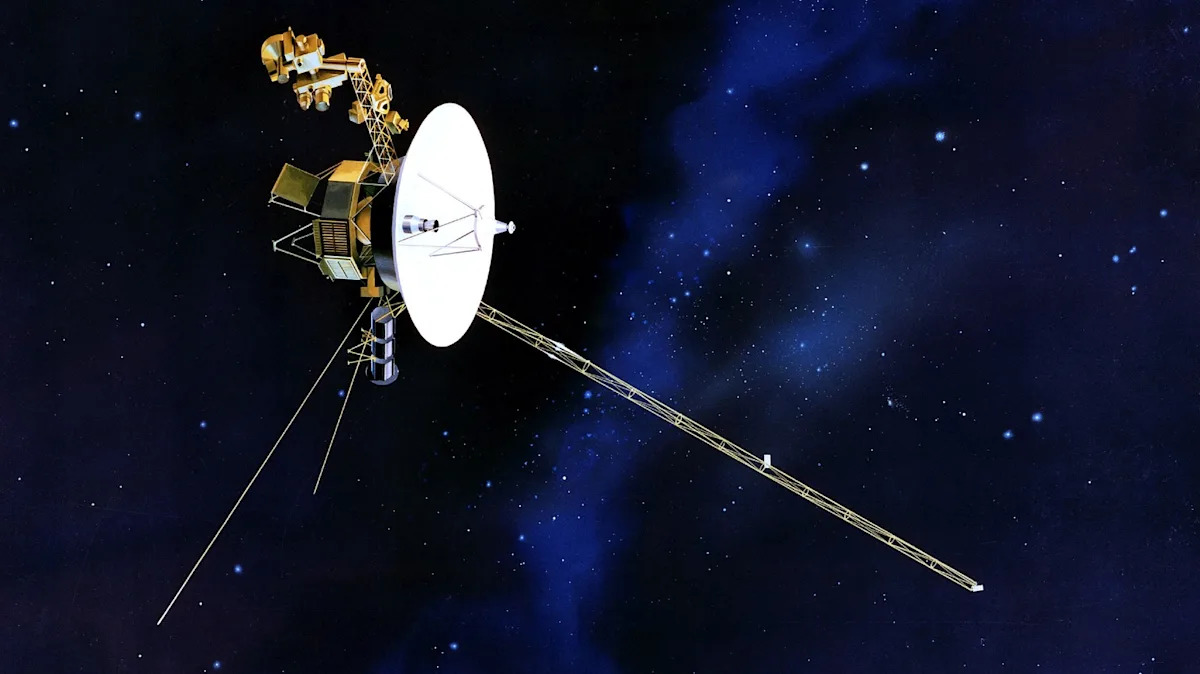

At The Edge Of Our Solar System, NASA’s Voyager 1 Found A ‘Wall Of Fire’

Nothing manmade has reached further from Earth than the Voyager series of spacecraft. Hurtling away from the sun at 38,000 miles an hour, the duo have now traveled over 12 billion miles, with Voyager 1 set to be a light-day from Earth by the end…

Continue Reading

-

‘Said it in past, say it today’: Zohran Mamdani stands by calling Donald Trump a fascist

New York’s mayor-elect Zohran Mamdani on Sunday made it clear he has not walked back his long-held view that US President Donald Trump is a “fascist”, even after the two struck an unexpectedly cordial tone during their first meeting at…

Continue Reading