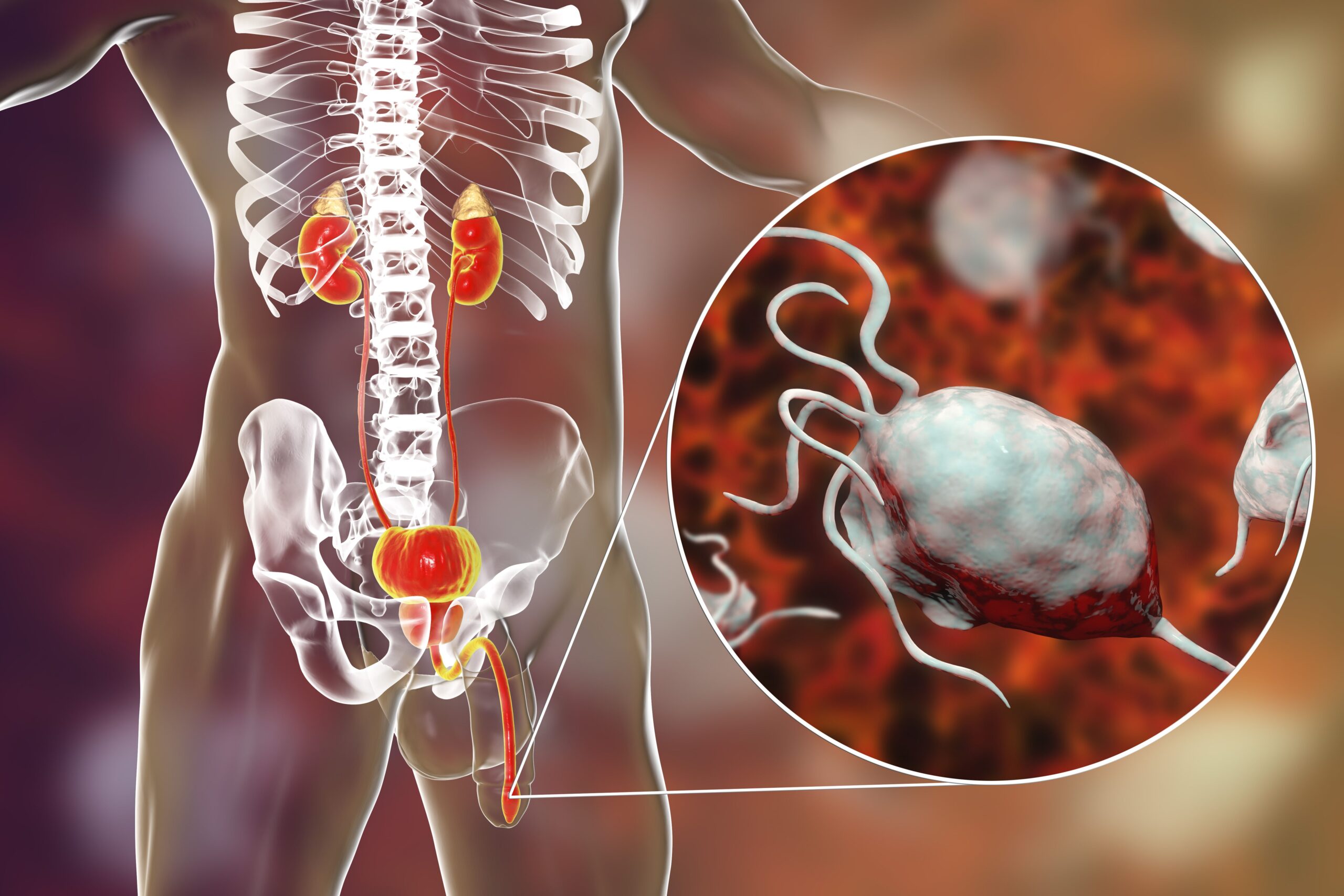

Combining darolutamide (Nubeqa) with androgen deprivation therapy (ADT) showed improvements in efficacy vs placebo plus ADT among patients with metastatic hormone-sensitive prostate cancer (HSPC) who were 75 years or older, according to subgroup findings from the phase 3 ARASENS trial (NCT02799602) published in European Urology Oncology.1

Among patients who were 75 years or older, the median overall survival (OS) was not reached (NR; 95% CI, 45.4-NR) in the darolutamide arm vs 42.0 months (95% CI, 33.8-48.9) in the placebo arm (HR, 0.61; 95% CI, 0.41-0.91). In each respective arm, the median time to metastatic castration-resistant prostate cancer (CRPC) was NR (95% CI, 36.0-NR) vs 19.4 months (95% CI, 14.0-24.8; HR, 0.42; 95% CI, 0.28-0.64), and the median time to initiation of subsequent antineoplastic treatment was NR (95% CI, NR-NR) vs 24.9 months (95% CI, 20.0-34.0; HR, 0.35; 95% CI, 0.22-0.54).

In a population of patients who were younger than 75, data showed a median OS that was NR (95% CI, NR-NR) with the darolutamide regimen and NR (95% CI, 45.0-NR) with the placebo combination (HR, 0.70; 95% CI, 0.58-0.84). Additionally, the median time to CRPC was NR (95% CI, NR-NR) vs 17.3 months (95% CI, 16.4-19.5) in each arm (HR, 0.35; 95% CI, 0.30-0.43). Investigators also noted a median time to initiation of subsequent antineoplastic therapy of NR (95% CI, NR-NR) vs 25.3 months (95% CI, 22.4-29.5) with each regimen (HR, 0.40; 95% CI, 0.34-0.48).

“In patients aged [75 or older] in the ARASENS trial, darolutamide demonstrated improved efficacy vs placebo and favorable safety, consistent with the findings in patients aged [younger than 75],” lead study author Joan Carles Galceran, MD, PhD, a medical oncologist in the Department of Oncology at Hospital Universitari Vall d’Hebron in Barcelona, Spain, wrote with coauthors in the publication.1 “Thus, darolutamide and ADT with docetaxel can be considered a standard of care for patients with [metastatic] HSPC regardless of age.”

In the international phase 3 ARASENS trial, patients were randomly assigned to receive darolutamide at 600 mg orally twice daily or matched placebo plus ADT and docetaxel. As part of this subgroup analysis, investigators assessed outcomes in patients who were younger than 75 (n = 1086) or 75 years and older (n = 219).

The trial’s primary end point was OS. Secondary end points included treatment-emergent adverse effects (TEAEs), time to CRPC, time to pain progression, time to initiation of subsequent antineoplastic therapy, and time to worsening of disease-related physical symptoms.2

Patients 18 years and older with cytologically or histologically confirmed adenocarcinoma of the prostate and metastatic disease were eligible for enrollment on the trial. Additional eligibility criteria included having an ECOG performance status of 0 or 1 and adequate bone marrow, liver, and renal function.

Investigators noted similar baseline disease and demographic features across the darolutamide and placebo arms in both age subgroups, although ongoing comorbidities were more frequent in patients who were 75 years or older. The most frequent prior and ongoing comorbidity types in patients who were younger than 75 or 75 and older, respectively, included vascular (55% vs 67%), musculoskeletal or connective tissue (42% vs 42%), and metabolism or nutrition (35% vs 43%).

Among patients 75 years and older in the darolutamide and placebo arms, 99% and 99% from each group had any-grade TEAEs, the most common of which included neutropenia (43% vs 46%), fatigue (33% vs 36%), and peripheral edema (30% vs 35%). Grade 3/4 TEAEs occurred in 74% vs 70% of each arm, with the most common including neutropenia (40% vs 41%) and febrile neutropenia (14% vs 9.7%).

Among those who were younger than 75, 99.6% in the darolutamide arm and 99.0% of the placebo arm had TEAEs of any grade; the most common types of toxicity in each arm included alopecia (43% vs 42%), neutropenia (38% vs 37%), and fatigue (33% vs 32%). Grade 3/4 TEAEs were reported in 65% and 62% of each arm, with the most common toxicities including neutropenia (33% vs 33%) and febrile neutropenia (6.6% vs 6.9%).

References

- Carles J, Tombal B, Hussain M, et al. Age-related efficacy and safety of darolutamide plus androgen-deprivation therapy and docetaxel in patients with metastatic hormone-sensitive prostate cancer: a subgroup analysis of the phase 3 ARASENS trial. Eur Urol Oncol. 2025l4:S2588-9311(25)00255-X. doi:10.1016/j.euo.2025.10.001

- Darolutamide in addition to standard androgen deprivation therapy and docetaxel in metastatic hormone-sensitive prostate cancer (ARASENS). ClinicalTrials.gov. Updated April 16, 2024. Accessed November 20, 2025. https://tinyurl.com/3f5h3a7k