The Centers for Disease Control and Prevention alarmed doctors with a change to its website that they say raises unfounded…

Author: admin

-

NASA’s Quesst Mission Marks X-59’s Historic First Flight

NASA’s X-59 quiet supersonic research aircraft took off for its historic first flight on Oct. 28 at 11:14 a.m. EDT from Lockheed Martin Skunk Works in Palmdale, California. The one-of-a-kind aircraft flew for 67 minutes before landing and taxiing to NASA’s Armstrong Flight Research Center in Edwards, California.

NASA test pilot Nils Larson flew the X-59 up to an altitude of about 12,000 feet and an approximate top speed of 230 mph, precisely as planned. The plane’s landing gear remained down during the entire flight, a common practice for experimental aircraft flying for the first time.

Now that the X-59’s first flight is in the books, the team is focused on preparing for a series of test flights where the aircraft will operate at higher altitudes and supersonic speeds. This test flight phase of NASA’s Quesst mission will ensure the X-59 meets performance and safety expectations.

Through the Quesst mission, NASA aims to usher in a new age of quiet supersonic flight, achieved through the unique design and technology of the X-59 in future supersonic transport aircraft.

Continue Reading

-

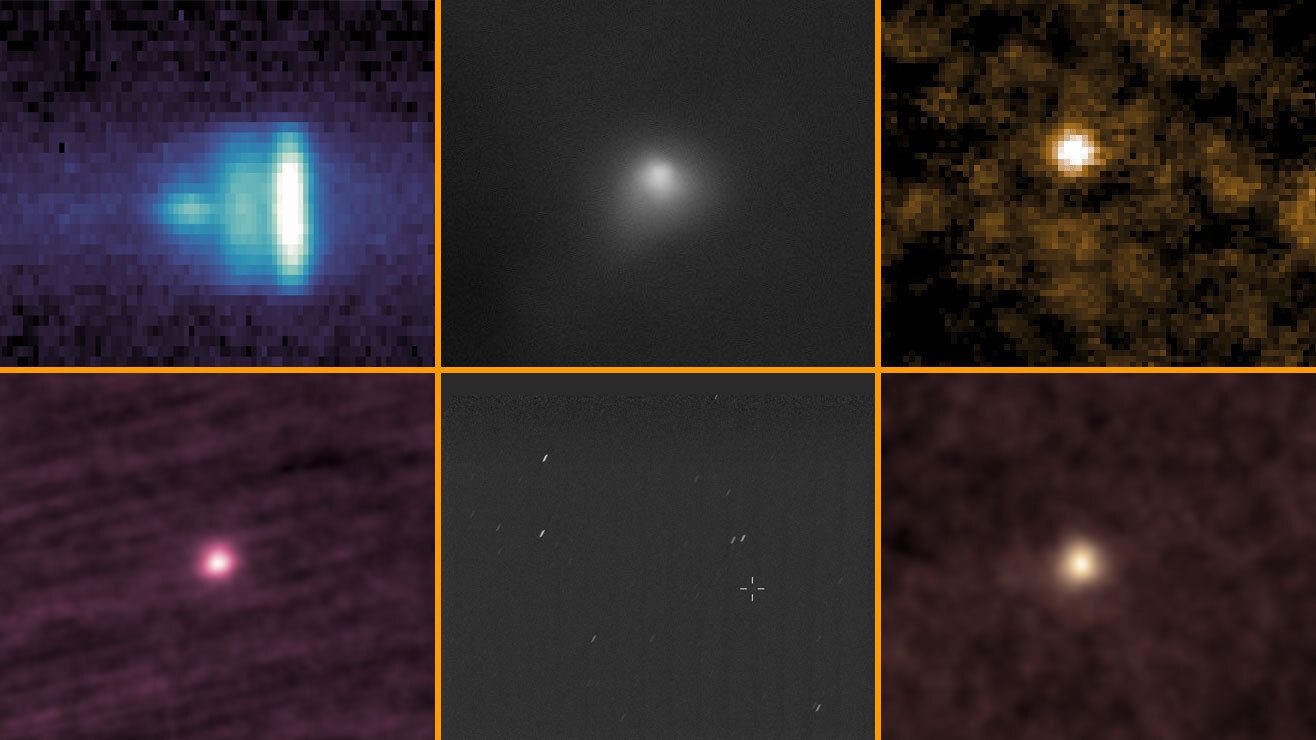

Comet 3I/ATLAS gallery: See NASA’s long-awaited images of interstellar visitor

NASA has released a treasure trove of comet 3I/ATLAS images, giving us some of the closest views yet of the interstellar visitor.

The U.S. government shutdown, which ran from Oct. 1 to Nov. 12, delayed the release of the highly anticipated…

Continue Reading

-

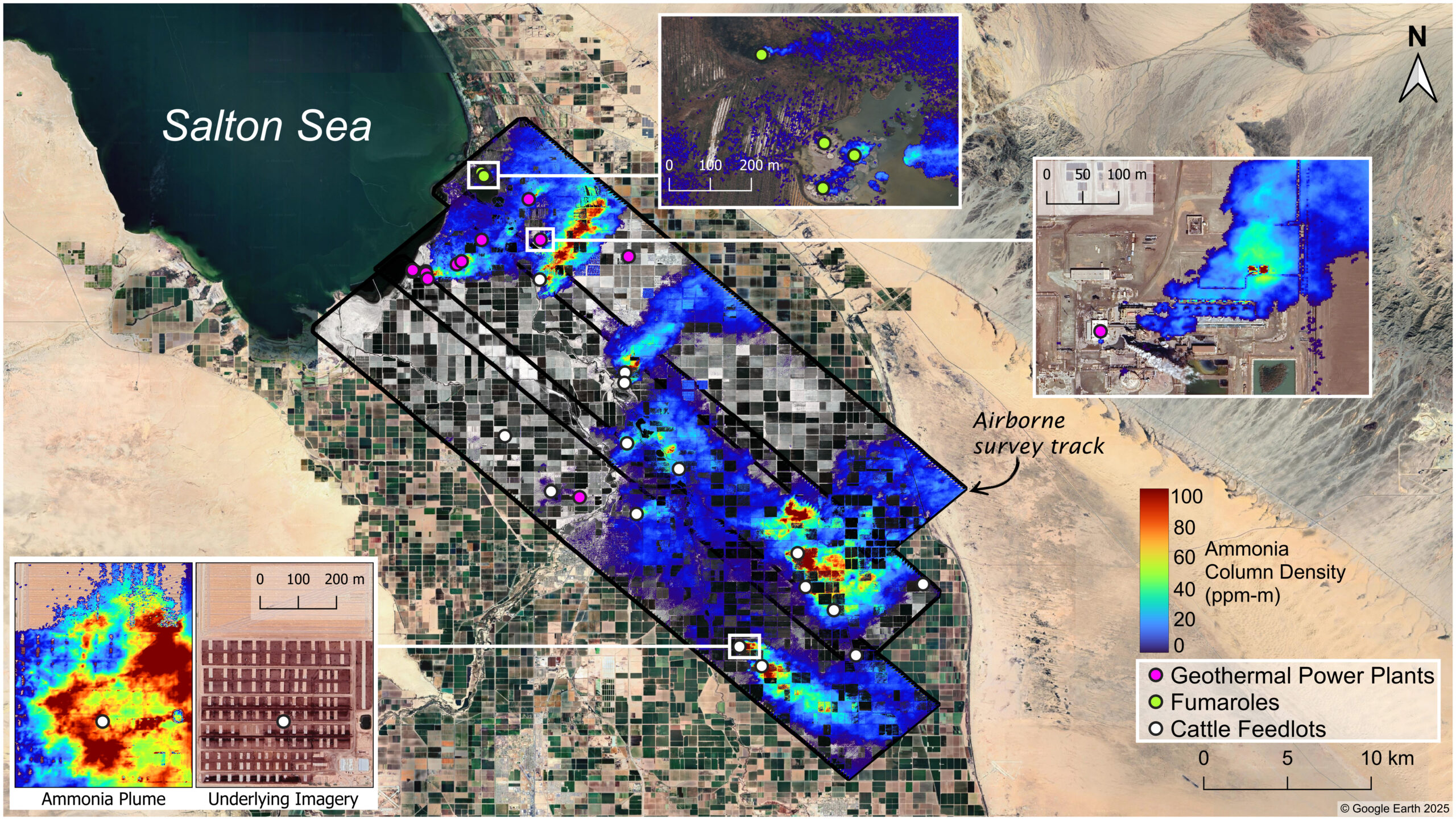

NASA, Aerospace Corporation Study Sharpens Focus on Ammonia Emissions

The pungent gas contributes to fine airborne particulate pollution, which endangers human health when inhaled and absorbed in the bloodstream.

A recent study led by scientists at NASA’s Jet Propulsion Laboratory in Southern California and…

Continue Reading

-

Corrections to A.9 User-Centered Applications with Large Earth Foundation Models

A.9 User-Centered Applications with Large Earth Foundation Models (EA FM) supports development of decision-support tools based on Prithvi-Earth Observation (EO) and Prithvi-Weather and Climate (WxC), large Earth foundation models developed…

Continue Reading

-

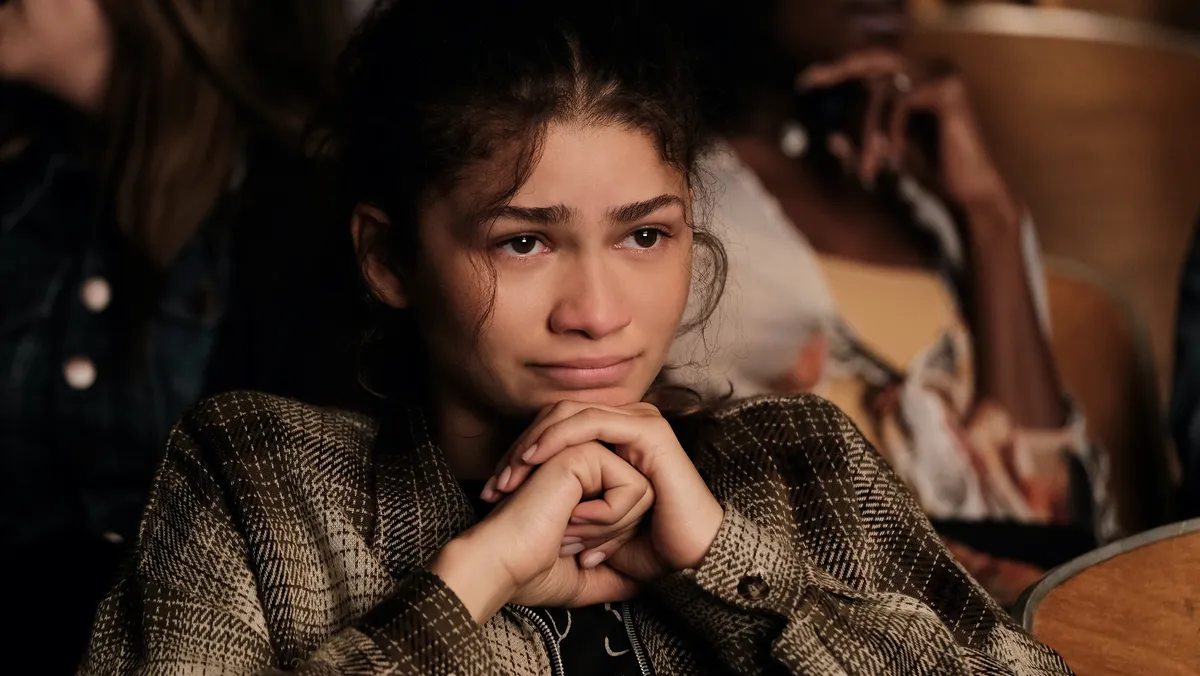

HBO boss previews ‘Euphoria’ and ‘White Lotus,’ shuns generative AI

NEW YORK− HBO wants to remind you that it’s the best of the best. Still.

The premium cable network, and its sister streamer HBO Max, announced their major new and upcoming TV shows on Nov. 20 at a ritzy New York event led by chairman and CEO…

Continue Reading

-

UK to Allow High-Earners New, Faster Visa Path to Residency – Bloomberg.com

- UK to Allow High-Earners New, Faster Visa Path to Residency Bloomberg.com

- Want to Immigrate to the UK? The Government Says You Must Earn It. The New York Times

- Some migrants to face 20-year wait for settled status BBC

- Biggest overhaul of legal…

Continue Reading

-

Tennis, Davis Cup Final 8 2025: Spain come back to eliminate Czechia and reach semi-finals

Comeback kings Spain have struck again to reach the semi-finals of the 2025 Davis Cup Final 8.

The six-time champions of the men’s World Cup of tennis staged a superb comeback in Bologna, Italy, where they defeated fourth seed Czechia 2-1 on…

Continue Reading

-

Scientists put moss on the outside of the International Space Station for 9 months — then kept it growing back on Earth

Moss spores have survived a prolonged trip to space, scientists reveal. The spores spent nine months on the outside of the International Space Station (ISS) before returning to our planet, and over 80% of the spores were still able to reproduce…

Continue Reading

-

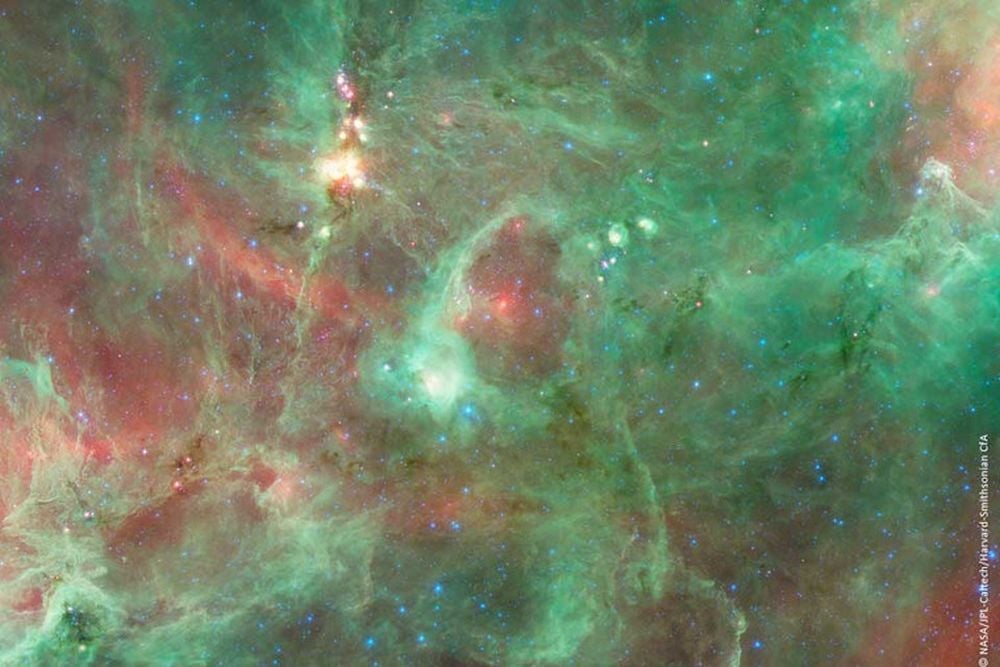

A Star Blew A “Diamond Ring” Bubble In Space

The Cygnus X star-forming region is about 4,600 light-years away. It contains a huge number of massive protostars, and one of the most massive star-forming molecular clouds known. With all of this activity, it’s not surprising that it…

Continue Reading