MPFI Scientists have discovered how two brain areas work together like an hourglass to flexibly control movement timing.

Key Findings

- The Brain’s Hourglass: The motor cortex and striatum work together like an hourglass to measure time for…

MPFI Scientists have discovered how two brain areas work together like an hourglass to flexibly control movement timing.

Key Findings

Commissioner Atkins outlined four principal categories:

1. Digital Commodities

Assets whose value is tied to the operation of a functional, decentralized protocol, rather than to managerial promises or the issuer’s ongoing efforts. The Commissioner stated that “essential managerial efforts” require “explicit and unambiguous representations,” signaling that the absence of such representations may support treatment as a non-security.

2. Digital Collectibles

Tokens “designed to be collected,” including digital art, media, and similar items (aka NFTs). Where purchasers are not relying on managerial or entrepreneurial efforts for financial return, such assets are not viewed as securities.

3. Digital Tools

Tokens providing practical functionality, such as access rights, credentials, identity features, or membership. Where the token operates as an instrument of use rather than an investment, securities regulation would not apply.1

4. Tokenized Securities

Tokens representing traditional securities or financial instruments (e.g., equity interests, debt claims, or revenue-sharing rights). These remain subject to the federal securities laws in full.

Commissioner Atkins noted that a token’s classification may change over time as a network matures or decentralizes, and that the analysis remains fact-specific.

While non-binding, the Commissioner’s remarks offer several important signals for market participants active in digital assets:

1. Regulatory Perimeter May Become More Objective

A structured taxonomy could create greater predictability regarding which digital-asset activities require registration or fall within existing regulatory frameworks. This would represent a shift away from the historical reliance on case-by-case enforcement.

2. Substance Over Form Will Remain Central

The SEC is likely to continue evaluating tokens based on their actual mechanics and market behavior. Marketing statements, rights embedded in code, managerial involvement, and network architecture will remain central to determining whether an asset is a security.

3. Asset Classification May Evolve

The Commissioner expressly acknowledged the possibility that a token initially offered as part of a securities transaction could, under appropriate conditions, cease to be treated as a security once the operative network is sufficiently functional and decentralized.

4. Enforcement Will Continue in Parallel

Nothing in the Commissioner’s remarks suggests a reduction in enforcement activity pending rulemaking. Activities involving tokenized securities, unregistered platforms, misleading promotional practices, or inadequate custody arrangements will remain a regulatory focus.

Commissioner Atkins’s remarks under Project Crypto offer an early and non-binding indication of how the SEC may seek to organize the digital asset market through a functional taxonomy. Although the ultimate regulatory framework will depend on forthcoming rulemaking and the composition of the Commission, the concepts outlined in the November 12 speech provide meaningful insight into the SEC’s current analytical direction.

Market participants should use this opportunity to evaluate their digital asset activities, anticipate potential regulatory classifications, and prepare for the possibility of formal SEC proposals that may incorporate elements of this taxonomy.

1 It is worth noting that in September 2025, the SEC’s Division of Corporation Finance issued a no-action letter to DoubleZero Technologies, Inc., stating that it would not recommend enforcement action if the company sold its 2Z token without registration under the Securities Act. The staff’s position was based on the token’s strictly functional role within the DoubleZero network, used to reward user-provided infrastructure services, and on the company’s representations that the token would not be marketed or positioned as an investment.

NEW YORK, NY — November 19, 2025: Warner Music Group (Nasdaq: WMG) and Stability AI today announced a collaborative effort to advance the use of responsible AI in music creation, combining WMG’s long-standing advocacy for principled…

A long-standing barrier in optoelectronics has been addressed by researchers at the University of Cambridge’s Cavendish Laboratory.

They have invented a molecular “back door” to power materials previously considered useless for modern…

The emergence of cancer drug resistance remains one of the most pressing problems in cancer care and there is a critical need to devise approaches to mitigate it. However, the molecular mechanisms driving treatment resistance are poorly understood, hindering efforts to devise new treatment strategies which prevent resistance. Now, researchers at the University of California San Diego have found a paradoxical new way in which cancer cells survive and regrow after targeted therapy: by hijacking an enzyme that is typically only switched on during cell death.

“This flips our understanding of cancer cell death on its head,” said senior author Matthew J. Hangauer, Ph.D., assistant professor of dermatology at UC San Diego School of Medicine and Moores Cancer Center member. “Cancer cells which survive initial drug treatment experience sublethal cell death signaling which, instead of killing the cell, actually helps the cancer regrow. If we block this death signaling within these surviving cells, we can potentially stop tumors from relapsing during therapy.”

About one in six deaths worldwide are caused by cancer. Many of these deaths are ultimately attributable to acquired resistance following an initially positive treatment response. Cancer typically develops resistance to treatment through mutations over months to years, similar to how bacteria can evolve resistance to antibiotics over time. These mutations are difficult to treat with limited available drug combinations. However, the newly-discovered mechanism focuses on the earliest stages of resistance, which do not rely on genetic mutations, making it an attractive new target for future treatments.

“Most research on resistance focuses on genetic mutations,” said first author August F. Williams, Ph.D., a postdoctoral fellow in the Hangauer lab at UC San Diego. “Our work shows that non‑genetic regrowth mechanisms can come into play much earlier, and they may be targetable with drugs. This approach could help patients stay in remission longer and reduce the risk of recurrence.”

In the new study, the researchers found:

The study was published in Nature Cell Biology and funded, in part, by grants from the Department of Defense, the National Institutes of Health and the American Cancer Society. Hangauer is a cofounder, consultant and research funding recipient of BridgeBio subsidiary Ferro Therapeutics.

NASA’s James Webb Space Telescope has delivered a first of its kind: a crisp mid-infrared image of a system of four serpentine spirals of dust, one expanding beyond the next in precisely the same pattern. (The fourth is almost…

Researchers at IFW Dresden and the Cluster of Excellence ct.qmat announced on November 19 that they had identified a new form of superconductivity in the crystalline material PtBi₂. This form displayed a topological behavior and an…

Computers are extremely good with numbers, but they haven’t gotten many human mathematicians fired. Until recently, they could barely hold their own in high school-level math…

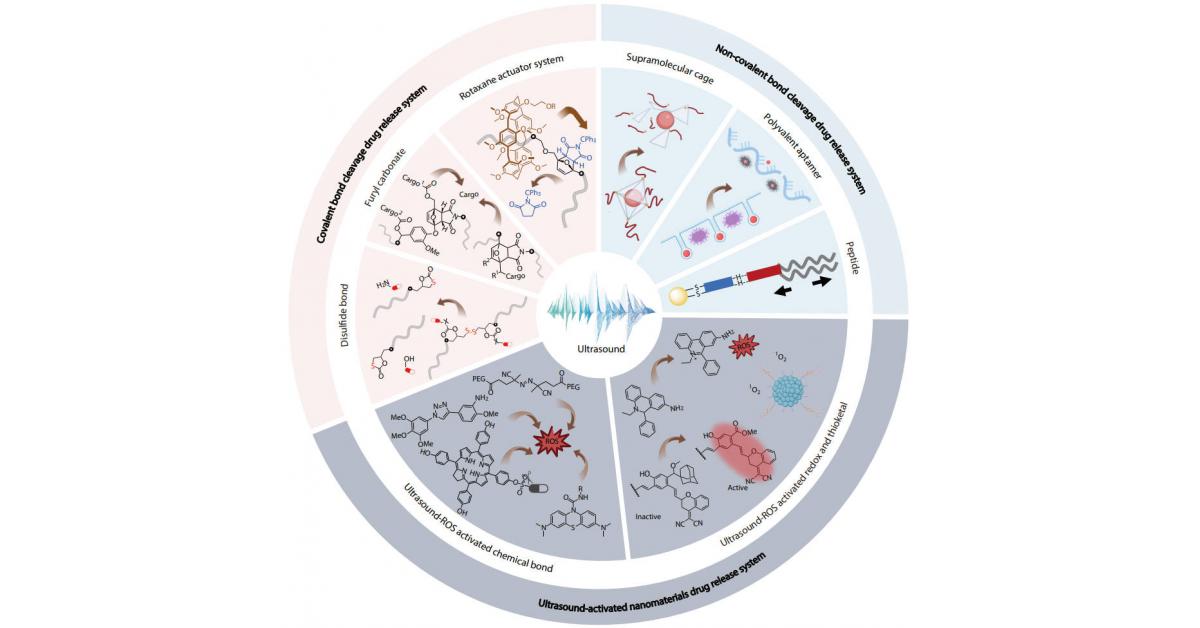

Schematic diagram of ultrasound-induced drug activation systems.

GA, UNITED STATES, November 19, 2025 /EINPresswire.com/ — Ultrasound offers a non-invasive and deeply penetrative means of controlling drug activation with high spatial and…

England Men U19s will face Pakistan, Scotland and hosts Zimbabwe in the group stages of the 2026 ICC U19 World Cup, set to take place in January and February.

Hosted by Zimbabwe and Namibia, the tournament features four groups of…