- At Baku talks, Pakistan, China push Digital Silk Road as next phase of economic corridor Arab News

- Pakistan, China reaffirm resolve for stronger security ties Daily Times

- Chinese Ambassador Jian Zedongc called on Interior Minister Mohsin Naqvi,…

Author: admin

-

At Baku talks, Pakistan, China push Digital Silk Road as next phase of economic corridor – Arab News

-

South Africa’s Sensational Win Over India

New Delhi: Members of the cricket fraternity have reacted to South Africa’s remarkable 30-run win over India at Kolkata’s Eden Gardens, calling it a “sensational and crazy victory” for the Proteas.

The two sides reached a result on just…

Continue Reading

-

ESA works to make CubeSats Zero Debris

Enabling & Support 17/11/2025

10 views

0 likesESA’s Zero Debris Approach aims to have ‘net zero pollution’ for objects in space by 2030. The recent CleanCube campaign, funded by the Preparation…

Continue Reading

-

Bangladesh's ousted PM Hasina sentenced to death for students crackdown – Reuters

- Bangladesh’s ousted PM Hasina sentenced to death for students crackdown Reuters

- Ex-Bangladesh leader Sheikh Hasina sentenced to death over brutal protests crackdown BBC

- Live: Bangladesh’s Hasina sentenced to death for crimes against humanity

Continue Reading

-

Continental Debuts at Metstrade 2025 with skai Artificial Leather for Marine Hospitality

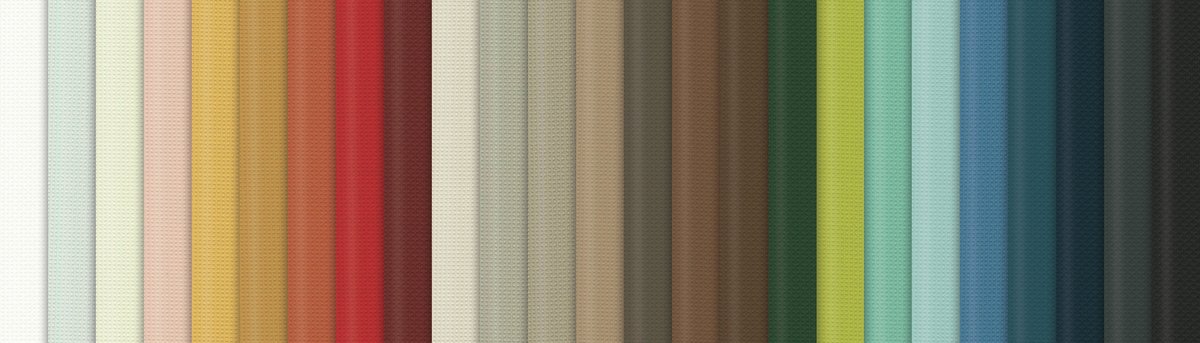

Continental will also highlight upholstery fabrics featuring staynu surface technology, which provides exceptional dirt resistance and ease of cleaning. Two key products in this category are skai Toronto EN, with a fine leather grain, and skai Tovega EN, featuring a microporous texture. Both materials are designed for indoor environments such as public spaces and hospitality areas, offering durability, resistance to disinfectants and a wide range of colors for versatile design options.

Commitment to more sustainable surfaces: skai Evida and Evida Fiber

As part of its sustainable product strategy, Continental will present skai Evida and skai Evida Fiber, two bio-based artificial leathers intended for indoor use. skai Evida consists of up to 80 percent renewable raw materials, while skai Evida Fiber reaches 90 percent, combining a natural look with durability and easy maintenance. Both products are vegan, phthalate-free and manufactured using CO2-neutral electricity.

Visitors to Metstrade are invited to explore the full range of skai materials at RAI Amsterdam, booth 11.404, and learn more about Continental’s commitment to quality, innovation and compliance in marine hospitality design.

Continue Reading

-

Indian police confirm 45 pilgrims dead in Saudi bus crash

Indian police said on Monday that…

Continue Reading

-

Non-invasive Skin Imaging Reveals Histologic Features

A CROSS-MODAL skin imaging system may soon transform how dermatologists diagnose skin diseases, offering near-histologic accuracy without the need for a biopsy. In this study, researchers evaluated whether this non-invasive imaging method…

Continue Reading

-

Feed nutrient distribution affects broiler performance

Photo: Koos Groenewold Broilers being feed in houses through long distribution lines can be affected by inconstant feed quality, affecting bird growth and health.

Researchers at Penn State University, United States, carried out a study of how…

Continue Reading

-

Access Denied

Access Denied

You don’t have permission to access “http://www.business-standard.com/technology/tech-news/samsung-galaxy-buds-4-pro-may-debut-with-galaxy-s26-series-what-to-expect-125111700729_1.html” on this server.

Reference…

Continue Reading