- Gilani visits late Senator Irfan-ul-Haq Siddiqui’s residence to offer condolences RADIO PAKISTAN

- PML-N senator Irfan Siddiqui moved to ICU, family denies ventilator claims The Express Tribune

- Senator Siddiqui admitted to ICU due to respiratory…

Author: admin

-

Gilani visits late Senator Irfan-ul-Haq Siddiqui’s residence to offer condolences – RADIO PAKISTAN

-

Rory McIlroy loses playoff to Matt Fitzpatrick, wins Euro title

DUBAI, United Arab Emirates — Rory McIlroy holed an eagle putt on No. 18 to force a playoff but lost out to Matt Fitzpatrick, who won the World Tour Championship for a third time on a chaotic final day of the 2025 golf…

Continue Reading

-

Analysts Are Updating Their WildBrain Ltd. (TSE:WILD) Estimates After Its First-Quarter Results

WildBrain Ltd. (TSE:WILD) last week reported its latest quarterly results, which makes it a good time for investors to dive in and see if the business is performing in line with expectations. Revenues were in line with expectations, at CA$126m, while statutory losses ballooned to CA$0.15 per share. Earnings are an important time for investors, as they can track a company’s performance, look at what the analysts are forecasting for next year, and see if there’s been a change in sentiment towards the company. Readers will be glad to know we’ve aggregated the latest statutory forecasts to see whether the analysts have changed their mind on WildBrain after the latest results.

We’ve found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

TSX:WILD Earnings and Revenue Growth November 16th 2025 Taking into account the latest results, the consensus forecast from WildBrain’s four analysts is for revenues of CA$570.7m in 2026. This reflects a reasonable 6.1% improvement in revenue compared to the last 12 months. WildBrain is also expected to turn profitable, with statutory earnings of CA$0.023 per share. Before this latest report, the consensus had been expecting revenues of CA$564.9m and CA$0.01 per share in losses. While there’s been no material change to the revenue estimates, there’s been a pretty clear upgrade to earnings estimates, with the analysts expecting a per-share profit compared to previous expectations of a loss. So it seems like the latest results have led to a significant increase in sentiment for WildBrain.

View our latest analysis for WildBrain

There’s been no major changes to the consensus price target of CA$2.34, suggesting that the improved earnings per share outlook is not enough to have a long-term positive impact on the stock’s valuation. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic WildBrain analyst has a price target of CA$3.00 per share, while the most pessimistic values it at CA$1.60. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await WildBrain shareholders.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It’s clear from the latest estimates that WildBrain’s rate of growth is expected to accelerate meaningfully, with the forecast 8.2% annualised revenue growth to the end of 2026 noticeably faster than its historical growth of 2.6% p.a. over the past five years. Other similar companies in the industry (with analyst coverage) are also forecast to grow their revenue at 9.9% per year. Factoring in the forecast acceleration in revenue, it’s pretty clear that WildBrain is expected to grow at about the same rate as the wider industry.

Continue Reading

-

Global Ship Lease, Inc. (NYSE:GSL) Looks Interesting, And It’s About To Pay A Dividend

Global Ship Lease, Inc. (NYSE:GSL) is about to trade ex-dividend in the next 4 days. The ex-dividend date occurs one day before the record date, which is the day on which shareholders need to be on the company’s books in order to receive a dividend. The ex-dividend date is important as the process of settlement involves a full business day. So if you miss that date, you would not show up on the company’s books on the record date. Meaning, you will need to purchase Global Ship Lease’s shares before the 21st of November to receive the dividend, which will be paid on the 4th of December.

The company’s next dividend payment will be US$0.625 per share, on the back of last year when the company paid a total of US$2.50 to shareholders. Based on the last year’s worth of payments, Global Ship Lease stock has a trailing yield of around 7.2% on the current share price of US$34.51. We love seeing companies pay a dividend, but it’s also important to be sure that laying the golden eggs isn’t going to kill our golden goose! So we need to investigate whether Global Ship Lease can afford its dividend, and if the dividend could grow.

Trump has pledged to “unleash” American oil and gas and these 15 US stocks have developments that are poised to benefit.

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Global Ship Lease has a low and conservative payout ratio of just 19% of its income after tax. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Over the last year it paid out 56% of its free cash flow as dividends, within the usual range for most companies.

It’s encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don’t drop precipitously.

Check out our latest analysis for Global Ship Lease

Click here to see the company’s payout ratio, plus analyst estimates of its future dividends.

NYSE:GSL Historic Dividend November 16th 2025 Businesses with strong growth prospects usually make the best dividend payers, because it’s easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That’s why it’s comforting to see Global Ship Lease’s earnings have been skyrocketing, up 50% per annum for the past five years.

Continue Reading

-

IDFA Chief On Decision To Ban Israeli State-Backed Orgs From Festival

In her welcoming letter to IDFA guests, the festival’s new artistic director Isabel Arrate Fernandez writes, “In these uncertain times we need the voices of filmmakers and artists more than ever.”

As if responding to that call, some…

Continue Reading

-

Why are biologic drugs expensive? Will Trump’s plans make them cheaper? | Donald Trump News

Lowering the prices of prescription drugs has been high on United States President Donald Trump’s agenda since he took office in January. He has taken a number of steps, including striking deals with pharmaceutical companies, to lower the costs of prescription drugs.

Trump has also directed the Food and Drug Administration (FDA) to streamline its regulation process to boost cheaper copycat drugs, such as generic and biosimilar drugs.

Recommended Stories

list of 3 itemsend of list

Biosimilars are highly similar versions of biologics, a group of drugs produced through biological processes. One of the most widely used biologic drugs is insulin, which is used to treat diabetes.

Biologics, which make up just 5 percent of prescriptions, account for more than half of the total expenditures on medicines in the US, according to the health data analysis company IQVIA.

The Trump administration said it hopes to make these medications more affordable, partly by increasing access to biosimilars.

So what are biologics and biosimilars, and will the administration’s proposals help drive down their costs?

What are biologics?

Biologics is short for biological medications or products. It’s a broad category of products that include vaccines, blood and blood components, gene therapy and tissues. They are a class of complex drugs produced through biological processes or from living organisms, such as proteins and genes. They treat cancer, autoimmune diseases and other rare disorders.

Biologics are typically administered by injection or through an intravenous infusion, said Alex Keeton, executive director of the Biosimilars Council at the Association for Accessible Medicines, an industry group that advocates on behalf of biosimilar manufacturers.

The FDA approval process for these products is rigorous and typically takes 10 to 15 years, said Brian Chen, a University of South Carolina health law and economics expert. Speedier timelines are possible in extraordinary circumstances: Federal agencies worked with vaccine manufacturers and scientists to expedite COVID-19 vaccines, for example.

What are biosimilars?

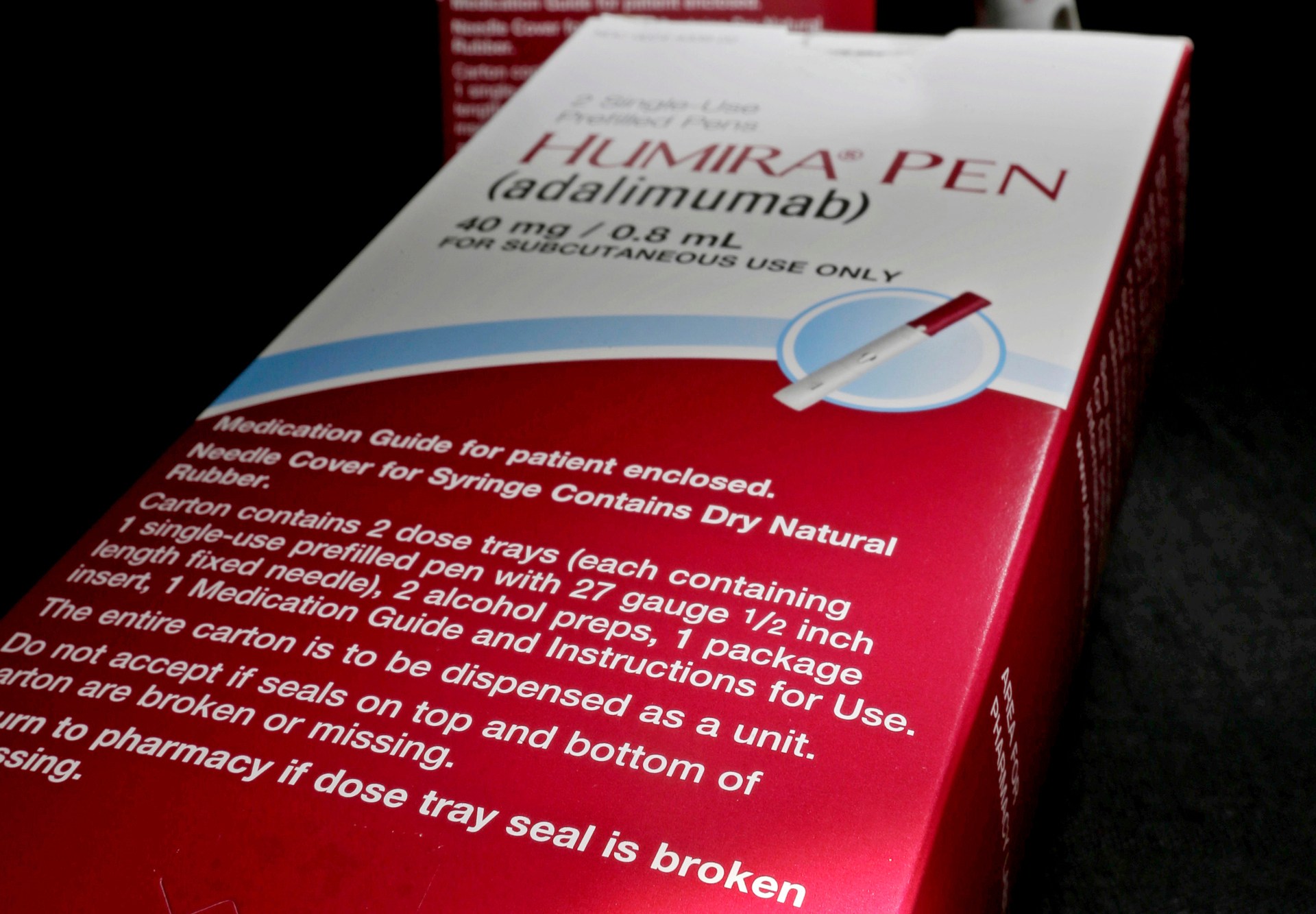

As the name suggests, these medications are similar to the original biologics approved by the FDA. Biosimilars are developed and sold after the original biologic has lost its patent exclusivity, Keeton said. Biosimilars for Humira, a drug used by people with rheumatoid arthritis, include Cyltezo, Amjevita and Idacio.

“They still work the same way clinically, but they’re not exactly the same,” Keeton said.

That’s because, unlike with generic versions of brand name drugs, it’s impossible to make exact copies of biologics. Biologics have complicated production processes and their components are derived from live organisms.

“Biologics are like strands of flexible, cooked spaghetti folded in very specific ways, making exact replication nearly impossible,” Chen said.

The FDA evaluates proposed biosimilar products against the original biologic to determine whether the product is extremely similar and has no meaningful clinical differences. It is expected to have the same benefits and risks as the original biologic. To be approved, biosimilar manufacturers must show patients using their products don’t have new or worsening side effects compared with patients using the original biologic.

FDA approval for biosimilars often takes five to six years, Keeton said.

Biosimilars increase market competition, incentivising brand name drug manufacturers to lower their prices.

How much do biologics and biosimilars usually cost?

They’re pricey, and exact costs vary.

One 2018 study found that biologics and biosimilars can cost a US patient $10,000 to $30,000 each year on average.

Humira is more. It was listed at $6,922 for a month’s supply in early November. The Humira biosimilar Cyltezo advertises for 5 percent off Humira’s cost. The makers of Cyltezo also offer a non-brand name option for people who pay cash at pharmacies while using the GoodRx app at a price of $550.

The actual amount insured patients pay also depends on their plan and their insurer’s negotiated rates.

Biosimilar prices typically run 15 percent to 35 percent lower than their brand name biologic counterparts, one 2024 study found. The FDA found biologics produce a more dramatic cost savings of 50 percent on average.

Why are these medications so expensive?

Biologics and biosimilars are difficult to develop and produce, which adds to their expense.

Making a standard over-the-counter medication such as aspirin requires five ingredients. Making insulin, a biologic, requires genetic modifications to living organisms.

These complex manufacturing procedures and proprietary information make it difficult for competitors to create alternatives.

To put this in perspective, there were 226 marketed biologics in the US as of July, and the FDA had approved 76 biosimilars such as insulin. When it comes to non-biologic medications, the FDA has approved more than 32,000 generic drugs. That’s more than the number of approved brand name drugs.

Can biosimilars be used in place of the original, FDA-approved biologics?

Yes. All biosimilars must meet FDA requirements and must be highly similar and have no clinically meaningful differences from their existing FDA-approved biologic counterpart.

So how does the Trump administration hope to change the FDA approval process for biosimilars?

Under its draft guidance, the administration proposed reducing some of the tests required as part of the FDA process used to prove a biosimilar drug is as safe and effective as its biologic counterpart.

Currently, a manufacturer requesting a biosimilar licence has to provide clinical study data proving its product’s similarity. The FDA’s new proposal would no longer require drug developers to conduct these comparative clinical trials.

Manufacturers would still be required to test proposed biosimilars. Other data – including comparative analysis, immune response data and human study data showing how the drug moves through the body – could sufficiently demonstrate the drug’s similarity to an existing biologic, the FDA said.

Why does the FDA want to change the biosimilar approval process?

Ultimately, the agency said it aims to incentivise drug manufacturers to quickly develop biosimilars by eliminating redundant, costly and time-consuming clinical studies, Keeton said.

Saving that time might increase the number of biosimilar alternatives.

It would almost certainly lower the front-end development costs for drugmakers, Chen said.

Will that change lower the costs of these medications for patients who need them?

Regulatory changes alone may not significantly drive down prices for many Americans.

Several non-brand name options need to be available to produce significant price drops, according to a US Department of Health and Human Services report.

But prices could remain the same even with more options.

A 2024 study in the JAMA Health Forum, a health policy journal, found that annual out-of-pocket costs either increased or remained stable for most biologics even after biosimilars were available. Patients who used biosimilars didn’t pay less than those who used the original biologics.

That’s at least partly because biologic manufacturers often offer substantial rebates to pharmacy benefit managers, companies that work with insurers, employers and others to manage prescription drug plan benefits. In exchange, insurers give the name brand biologics preferred or exclusive placement on their lists of insurance-covered drugs, Chen said. Rebate walls ultimately prevent the sale of cheaper biosimilars, he said.

Are there any other obstacles to getting more biosimilars on the market?

Yes, another key hurdle remains: Name brand biologic manufacturers often hold many patents and file lawsuits blocking approved biosimilars from being commercially marketed.

A 2018 study conducted by Chen found that of 12 FDA-approved biosimilar products, five were commercially available as of October 2018. Six others were unavailable because of patent disputes.

PolitiFact researcher Caryn Baird contributed to this report.

Continue Reading

-

‘A legendary artist’: Amitabh Bachchan mourns Kamini Kaushal’s demise

Bollywood megastar Amitabh Bachchan penned a note on his social media as he remembered late actor Kamini Kaushal, calling her a “legendary artist” and an “icon” who contributed immensely to Hindi cinema.

Kaushal died at her Mumbai…

Continue Reading

-

Four Indian boxers secure medals with opening day victories

Minakshi Hooda, Preeti Pawar, Ankush Phangal and Narender Berwal powered India to a flawless start on the opening day of the World Boxing Cup Finals 2025 as all four secured medals with dominant wins in Greater Noida on Sunday.

With the…

Continue Reading

-

We will respond to those who impose war on us in the same way we did in May: COAS – Dawn

- We will respond to those who impose war on us in the same way we did in May: COAS Dawn

- The Field Marshal’s nation The Hindu

- Field Marshal Munir vows strong response to any future aggression Geo News

- How Asim Munir is taking Pakistan Army to…

Continue Reading

-

Dermatologists criticise ‘dystopian’ skincare products aimed at children | Skincare

Dermatologists have criticised an actor’s new skincare brand, calling it “dystopian” for creating face masks for four-year-olds, warning that the beauty industry is now expanding its reach from teenagers to toddlers.

It comes as a growing…

Continue Reading