…

Author: admin

-

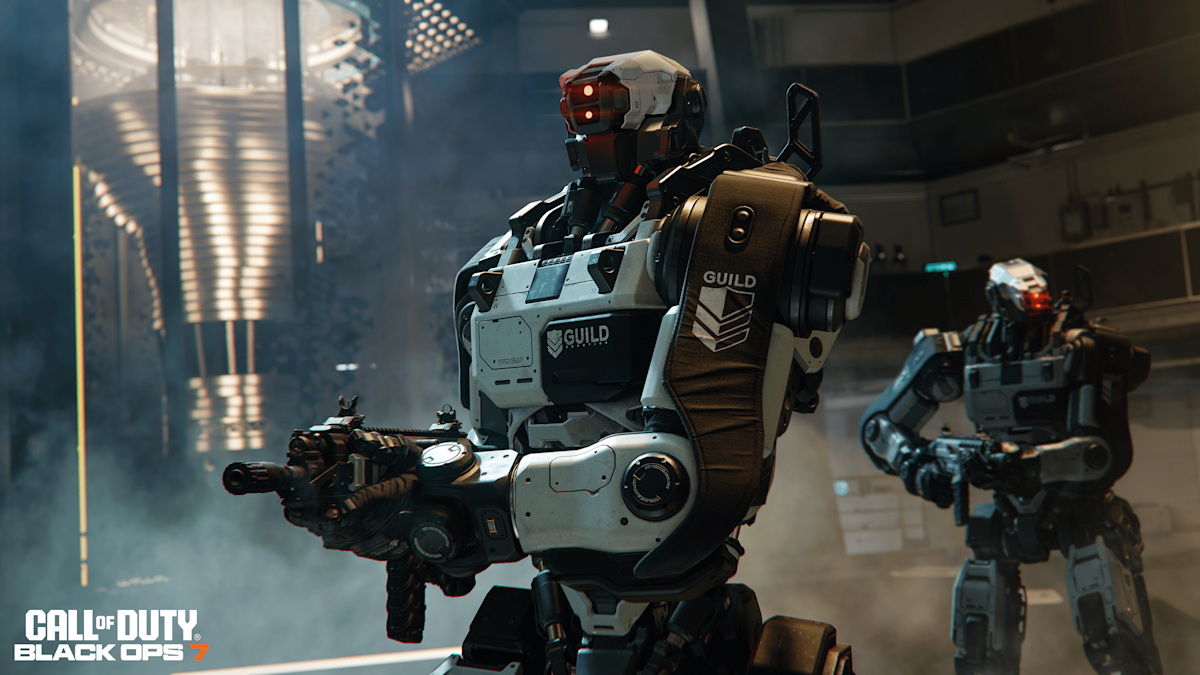

Black Ops 7 appears to feature AI-generated art assets

By all appearances, Call of Duty: Black Ops 7 features a not insignificant amount of AI-generated art, Kotaku reports. The game’s over 680 Calling Cards — collectible backgrounds earned through in-game achievements or purchases — appear to be…

Continue Reading

-

Lots to Watch in the November Auctions This Year

Even in a market defined by caution and recalibration, the November marquee sales in New York still generate their own gravitational field. Trophy works have become rarer, and bidders more selective, but when the top…

Continue Reading

-

Trains cancelled on branch line due to flooding

Flooding has closed part of the railway line in Cornwall, Great Western Railway (GWR) has confirmed.

Train services running between Liskeard and Looe have been cancelled and disruption is expected until the end of the day, the firm said.

It said Network Rail was monitoring water levels and inspections would need to be carried out before the line was reopened.

GWR said it was sorry for the disruption and added it had requested replacement transport options between Liskeard and Looe – and would give details once they had been confirmed.

Continue Reading

-

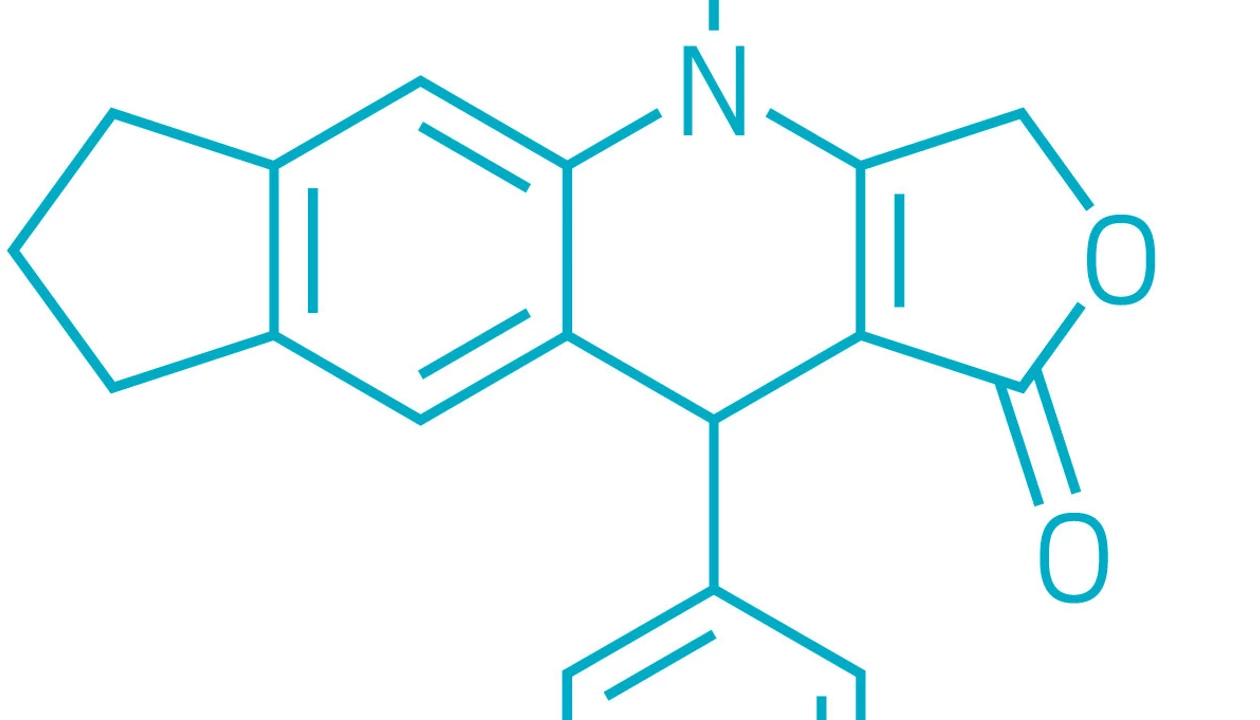

Carbon Capture Materials Research Report 2025-2030, Profiles of Key Players – Ecolab, BASF, DOW, Mitsubishi, Solvay, Air Products and Chemicals, Tosoh, Honeywell International, and Zeochem – ResearchAndMarkets.com – Business Wire

- Carbon Capture Materials Research Report 2025-2030, Profiles of Key Players – Ecolab, BASF, DOW, Mitsubishi, Solvay, Air Products and Chemicals, Tosoh, Honeywell International, and Zeochem – ResearchAndMarkets.com Business Wire

- What is carbon capture and storage (CCS)? Here’s what you need to know Nordea

- Business school teaching case study: can direct carbon capture overcome cost barriers? Financial Times

- E&E News: The scientists who popularized carbon capture have a warning about it POLITICO Pro

- Nordea Bank : What is carbon capture and storage (CCS)? Here’s what you need to know MarketScreener

Continue Reading

-

Scientists pull ancient RNA from a woolly mammoth’s body

It was 2012 when Love Dalén, a paleogeneticist at Stockholm University, first laid eyes upon a special specimen on a lab table in eastern Siberia.

“Our Russian collaborators said, ‘Come here into this…

Continue Reading

-

Tiger Global slashes Meta stake by 63%

NEW YORK, Nov 14 (Reuters) – Tiger Global Management, the hedge fund founded and led by Chase Coleman, slashed its stake in Facebook parent Meta Platforms (META.O) during the third quarter, according to a filing released on Friday.During the quarter ended September 30, Tiger Global reduced its holdings in Meta by 62.6% to 2.8 million of the company’s shares, valuing the stake at about $2.1 billion. The firm also dissolved its positions in some other high-profile names including drugmakers Eli Lilly (LLY.N), Novo Nordisk (NOVOb.CO) and cybersecurity firm CrowdStrike (CRWD.O).Sign up here.

Tiger Global, which is an offshoot of famed investor Julian Robertson’s firm and is part of a cohort of stock-picking funds popularly known as Tiger Cubs, took new positions in streaming giant Netflix (NFLX.O) and buy-now-pay-later firm Klarna (KLAR.N).Tiger Global ended the first half of 2025 up roughly 4.5%, trailing most of its top multi-strategy fund peers.

Reporting by Anirban Sen in New York; Editing by Matthew Lewis

Our Standards: The Thomson Reuters Trust Principles.

Continue Reading

-

New Dutch farm detects bird flu in outbreak wave-Xinhua

THE HAGUE, Nov. 14 (Xinhua) — Bird flu has been detected at a small-scale poultry farm in Assendelft, a village in the province of North Holland, the Dutch government said on Friday, the latest in a series of outbreaks affecting the country…

Continue Reading

-

Evaluating Digi International After 8.4% Weekly Jump on New IoT Partnerships

-

Thinking about whether Digi International could be a hidden gem or overpriced stock? You are not alone, especially if you are curious about what really makes a tech company worth its current price.

-

In just the past week, Digi International’s stock jumped 8.4%, adding to a 31.5% gain year to date and an impressive 127.7% surge over the past five years.

-

Much of this momentum has been fueled by recent headlines around Digi’s new product launches and key partnerships in the Internet of Things space. These developments have given investors plenty to think about regarding Digi’s growth prospects and overall risk profile.

-

Despite this buzz, Digi International scores only 2 out of 6 on our valuation checks for undervalued companies. This suggests there is room for debate on how attractive it is today. We will break down the main valuation approaches, and at the end, reveal an even better way to put these numbers in context.

Digi International scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. In essence, it answers the question of what all of Digi International’s expected future profits are worth right now.

Digi International’s current Free Cash Flow is $105.8 million. According to analysts, Free Cash Flow is expected to grow steadily, reaching around $107.6 million by the end of fiscal 2027. Moving further, projections using modest growth rates suggest Free Cash Flow could grow to $151.3 million by 2035. It is important to note that only the first few years are based on analyst estimates, with long-term figures extrapolated by Simply Wall St.

Based on the 2 Stage Free Cash Flow to Equity model, this steady cash generation gives Digi International an intrinsic value of $59.21 per share. With the stock currently trading about 34.9% below this fair value estimate, the DCF model points to the shares being significantly undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Digi International is undervalued by 34.9%. Track this in your watchlist or portfolio, or discover 876 more undervalued stocks based on cash flows.

DGII Discounted Cash Flow as at Nov 2025 Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Digi International.

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Digi International because it directly links the market’s expectations to a company’s bottom-line earnings. Investors often look to the PE ratio as a quick gauge of whether a stock seems reasonably priced in the context of its profitability.

Continue Reading

-