Offering an insight into how hard Sesko is working behind the scenes in order to change the narrative surrounding his big-money move, Amorim said: “I’m relaxed, [but] he’s not relaxed. I understand how things are in football and he’s going to…

Author: admin

-

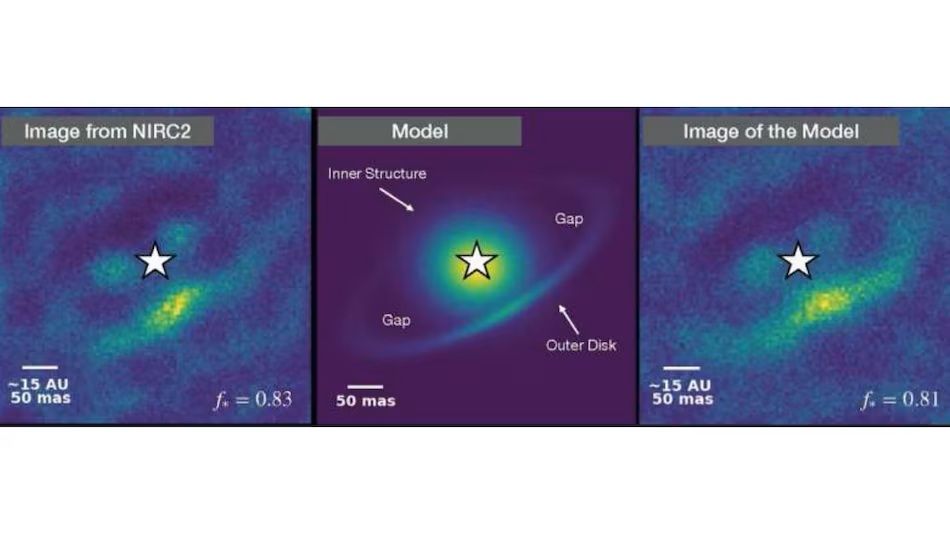

Astronomers spot signs of a new infant planet forming inside a cosmic “planet-making factory” just 400 light-years away

Astronomers capture detailed infrared images of HD 34282’s planet-forming disk

It may be hard to picture a planet as a newborn in a nursery, but astronomers have just observed one of the factories where these celestial objects are formed. The…

Continue Reading

-

Frankenstein 2025 Ending Explained: Is Victor Frankenstein Alive?

Frankenstein 2025 is here, and it introduced us to Oscar Isaac’s Victor Frankenstein. The genius scientist had the capability to conquer the world with his knowledge. However, his pride made him do all the wrong things. He created a…

Continue Reading

-

Methane-cutting cow feed trials on Arla dairy farms end

A major UK trial of a controversial feed additive designed to reduce emissions of planet-warming methane gas by dairy cows has ended.

Arla Foods, owner of the UK’s largest dairy co-operative, is now reviewing the results of the tests on 30 farms before any decision on future use is made.

The launch of the Bovaer supplement trial last year saw concerns raised over food safety, as well as misinformation and conspiracy theories posted online, with videos on social media showing people flushing milk down the toilet in protest.

Bovaer is now the focus of an investigation in Denmark after farmers raised fresh concerns but manufacturer DSM-Firmenich said the additive was “proven, effective and safe”.

The company spokesman added that it had been “successfully used for over three years by thousands of farmers in over 25 countries.”

But he said: “We are aware that in recent days, some farmers have raised concerns about cow health.

“We are actively engaging with the relevant organizations to ensure that all these concerns are fully investigated and properly addressed.

“In previously reported cases, Bovaer was not identified as a contributing factor to the health concerns raised.”

Methane is one of the most potent greenhouse gases and, although it does not hang around in the atmosphere as long as carbon dioxide, it is 28 times stronger over a 100-year period.

It is claimed Bovaer – a brand name for the additive 3-Nitrooxypropanol – could reduce cow methane emissions by between 30-45%, and help farmers be more environmentally-friendly. It works by suppressing the enzymes in a cow’s stomach that create the gas.

The supplement, which is added in small quantities to cow feed, has been approved for use by UK regulators and the UK government has said milk from cows given Bovaer is safe to drink.

A Food Standards Agency safety assessment in 2023 concluded there were no safety concerns when Bovaer is used at the approved dose.

But it is not clear whether the additive will be more widely used in the UK, with a spokeswoman for Arla saying the findings of its trial were “currently being reviewed”.

The National Farmers’ Union (NFU) said “animal welfare must continue to be our highest priority” with any new product.

Paul Tompkins, who oversees the NFU Dairy Board, said: “Following reports of investigations in Denmark into the use of methane suppresants, we will continue to monitor the situation for any developments to ensure the impact of any product is known.”

In Denmark, it is mandatory to use methane-reducing animal feed as part of the government’s plan to reduce the environmental impact from agriculture.

About 1,400 out of 2,000 dairy farms in Denmark are currently using Bovaer.

Jannik Elmegaard, of the Danish Food and Veterinary Administration, told the BBC they were “very aware that some herd owners have reported animals showing signs of illness after being fed with Bovaer” but it was “unclear how many cows were affected”.

He added that they were “closely monitoring” the situation and collecting data so that they could determine the cause of the illnesses but emphasised that Bovaer had “undergone a long and thorough approval process”.

Denmark’s Aarhus University has conducted several studies on the feed additive as part of its research into reducing methane emissions from cows and gives advice to the Danish authorities.

Professor Charlotte Lauridsen, from the university’s Department of Animal and Veterinary Sciences, said of the concerns raised: “The pattern of disease now being described in the media – with fever, diarrhoea and, in some cases, dead cows – has never been observed in our extensive studies.”

But she added that the reports were being taken seriously and researchers were now collecting samples from herds where problems had been reported.

A spokesperson for Bovaer manufacturer DSM-firmenich said the company was “aware that in recent days, some farmers have raised concerns about cow health”.

“We are actively engaging with the relevant organisations to ensure that all these concerns are fully investigated and properly addressed,” he explained.

“In previously reported cases, Bovaer was not identified as a contributing factor to the health concerns raised.”

He added that animal welfare was the company’s “highest priority” and that “Bovaer is a proven, effective and safe solution that has been successfully used for over three years by thousands of farmers in over 25 countries.”

Continue Reading

-

Two more bird flu cases confirmed at Norfolk poultry sites

Two more cases of bird flu have been confirmed at large commercial poultry premises in Norfolk.

The Department for Environment, Food and Rural Affairs (Defra) said the H5N1 virus was confirmed near Attleborough and at another site near Feltwell…

Continue Reading

-

Know where to watch WBBL 11 on live streaming and telecast in India

Fresh off her Women’s ODI World Cup heroics for India, Jemimah Rodrigues will be in action at the Women’s Big Bash League 2025-26 cricket tournament, which starts from Sunday.

The WBBL is the premier franchise-based T20 cricket tournament for…

Continue Reading

-

KKR & Co.: Consistent Performance Despite Credit Fears (Rating Upgrade) – Seeking Alpha

- KKR & Co.: Consistent Performance Despite Credit Fears (Rating Upgrade) Seeking Alpha

- KKR Defied Private-Equity Fundraising Slump in the Third Quarter The Wall Street Journal

- KKR’s profit beats forecast on credit-led inflows, one-off charge weighs Reuters

- KKR & Co. (KKR) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates Yahoo Finance

- Dow Jones Top Financial Services Headlines at 11 AM ET: KKR Revenue, Profit Rise on Growth in Insurance Business 富途牛牛

Continue Reading

-

Prince William wraps Brazil tour with Amazon Indigenous leaders

Prince William wraps Brazil tour with Amazon Indigenous leaders – Daily Times

…Continue Reading

-

Punjab CM approves launch of IT Internship Program – RADIO PAKISTAN

- Punjab CM approves launch of IT Internship Program RADIO PAKISTAN

- Punjab Opens Applications for School Teacher Jobs ProPakistani

- Punjab Launches Paid IT Internship Program for Young Graduates TechJuice

- Punjab approves recruitment of…

Continue Reading

-

Microsoft’s lack of quality control is out of control • The Register

OPINION I have a habit of ironically referring to Microsoft’s various self-induced whoopsies as examples of the company’s “legendary approach to quality control.” While the robustness of Windows NT in decades past might qualify as “legendary”,…

Continue Reading