- CapitaLand Is Said to Mull Merging Non-China Assets With Mapletree Bloomberg.com

- Singapore’s Top Real-Estate Asset Managers Mull Merger That Could Create $150 Billion Entity The Wall Street Journal

- WSJ report triggers re-look at CLI and Mapletree Investments’ REIT combinations The Edge Singapore

- CapitaLand Investment declines to comment on rumoured merger with Mapletree The Independent Singapore News

- CapitaLand Investment (SGX:9CI) News Today Nov 5: Speculation on Mapletree Merger Meyka

Author: admin

-

CapitaLand Is Said to Mull Merging Non-China Assets With Mapletree – Bloomberg.com

-

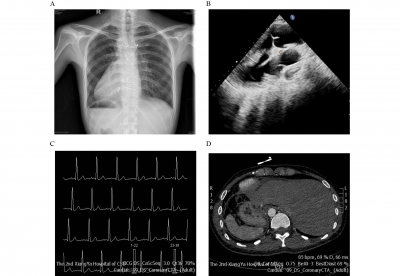

Identification of a novel MYO1D variant associated with laterality defects, congenital heart diseases, and sperm defects in humans

Researchers from the Second Xiangya Hospital of Central South University, et al. have conducted a paper entitled “Identification of a novel MYO1D variant associated with laterality defects, congenital heart…

Continue Reading

-

Zohran Mamdani and London’s Muslim mayor, Sadiq Khan, have much in common, but also key differences

LONDON — He’s the left-leaning Muslim mayor of the country’s biggest city, and U.S. President Donald Trump is one of his biggest critics.

London’s Sadiq Khan has a lot in common with New York Mayor-elect Zohran Mamdani — but also many…

Continue Reading

-

May 9 riots case: Faisalabad ATC sends SIC chief Hamid Raza to jail to serve 10-year sentence – Dawn

- May 9 riots case: Faisalabad ATC sends SIC chief Hamid Raza to jail to serve 10-year sentence Dawn

- SIC chief Sahibzada Hamid Raza arrested Business Recorder

- SIC chief Hamid Raza ‘surrenders’ to police in May 9 case The Express Tribune

- Chairman…

Continue Reading

-

Largest study of its kind explores sexual dysfunction in women at midlife – Monash University

- Largest study of its kind explores sexual dysfunction in women at midlife Monash University

- Navigating Female Sexuality in Midlife Requires Provider Nuance and Patient Advocacy Managed Healthcare Executive

- Almost half of women experience poor…

Continue Reading

-

Kyrgios hoping to turn the page on knee injury after sudden improvement

Nick Kyrgios says he has a new lease on life on court after being amazed at sudden improvement in his long-term knee injury and the Australian hinted at a Grand Slam comeback at Melbourne Park if he makes it through a series of exhibition…

Continue Reading

-

Pakistan, UK agree to fast-track trade mechanism, expand economic partnership – Arab News

- Pakistan, UK agree to fast-track trade mechanism, expand economic partnership Arab News

- Iqbal pushes UK to activate trade groups The Express Tribune

- Ahsan Iqbal, UK minister discuss ways to deepen economic cooperation Business Recorder

- Pakistan,…

Continue Reading

-

SIC chief Hamid Raza sent to jail following arrest in May 9 conviction

FAISALABAD (Dunya News) – Sunni Ittehad Council Chairman Sahibzada Hamid Raza was presented before the anti-terrorism court after his arrest and subsequently sent to jail.

The Faisalabad ATC ordered his transfer…

Continue Reading

-

Adobe deepens AI strategy with hybrid models & agentic tools

Adobe is doubling down on its vision to lead the integration of artificial intelligence (AI) across creative workflows. This time with a strong focus on both proprietary and 3rd party models, according to Alexandru Costin, Vice President…

Continue Reading