This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

Author: admin

-

Just a moment…

Just a moment… -

Oprah Sheds Light on Gray Divorce

Every week, Oprah sets an intention exclusively for Oprah Daily Insiders, with reflections on topics like letting go, forgiveness, coming into your own, and more.

Hello Insiders,

I learned something recently that I found interesting enough to…

Continue Reading

-

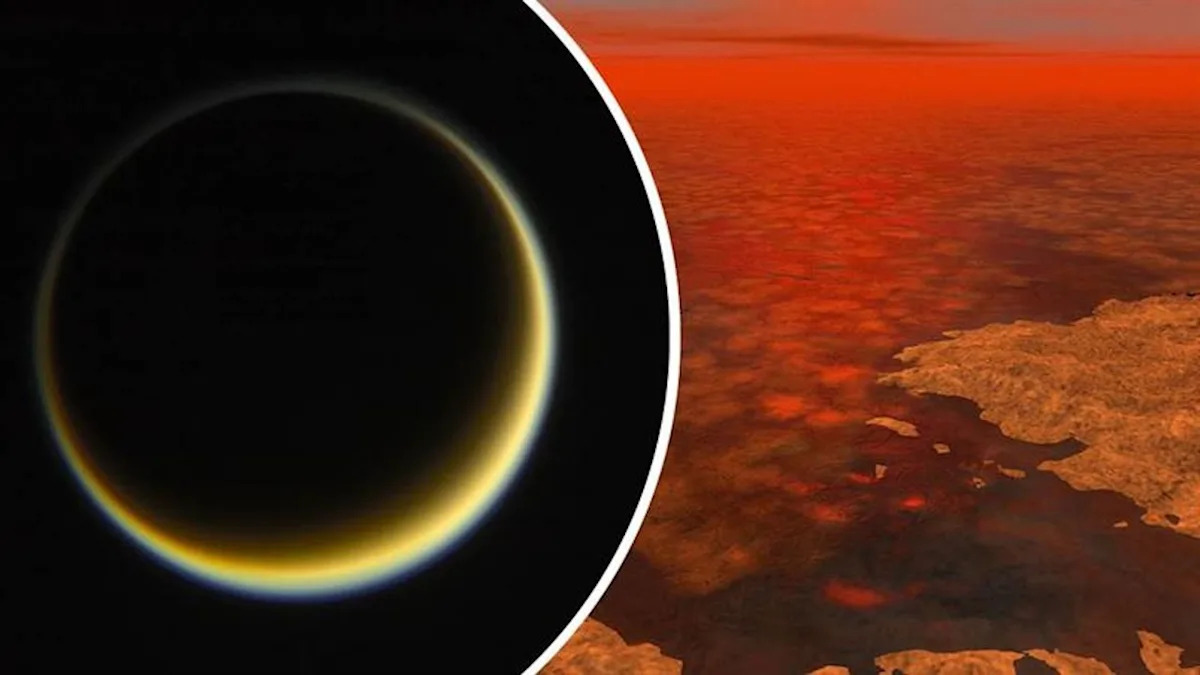

On Saturn’s largest moon, water and oil would mix — opening the door to exotic chemistry in our solar system

When you buy through links on our articles, Future and its syndication partners may earn a commission.

Researchers have discovered that molecules on Saturn’s moon Titan may be breaking a fundamental rule of chemistry that governs which…

Continue Reading

-

Ukraine’s energy sector again target of overnight Russian strikes

By Euronews with AP

Published on

•Updated

Continue Reading

-

Israel threatens to step up attacks against Hezbollah in Lebanon | Israel

Israel has threatened to step up its attacks against Hezbollah in southern Lebanon, a day after the Lebanese health ministry reported that four people had been killed in an Israeli airstrike.

Despite the November 2024 ceasefire, Israel maintains…

Continue Reading

-

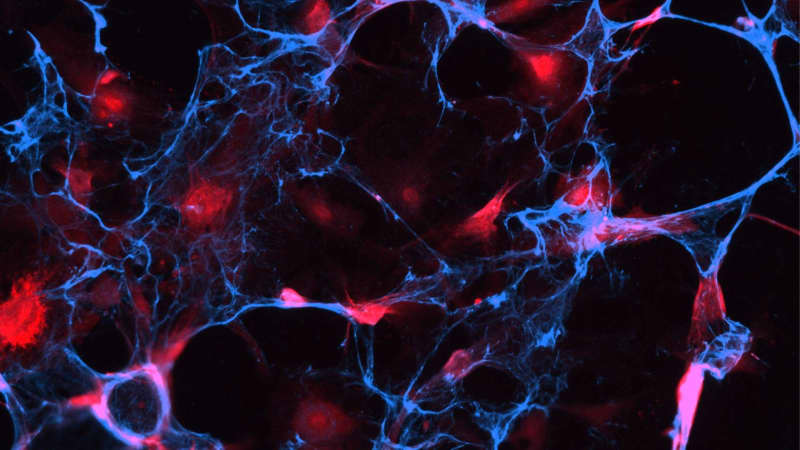

New DNA tool detects ‘zombie cells’ linked to Alzheimer’s and arthritis

At times, aging doesn’t become evident in wrinkles or in gray hair, it occurs deep inside your body, in cells that have ceased to divide but are still alive. These “zombie cells,” or senescent cells for short, lie in wait within tissues,…

Continue Reading

-

Just a moment…

Just a moment… This request seems a bit unusual, so we need to confirm that you’re human. Please press and hold the button until it turns completely green. Thank you for your cooperation!

Continue Reading

-

AI browsers are here, and they’re already being hacked

Kevin Collier | NBC News

AI-infused web browsers are here and they’re one of the hottest products in Silicon Valley. But there’s a catch: Experts and the developers of the products warn that the…

Continue Reading

-

Israel urges Lebanon to disarm Hezbollah under ceasefire terms – Reuters

- Israel urges Lebanon to disarm Hezbollah under ceasefire terms Reuters

- Israeli air strike kills four in Lebanon, straining fragile ceasefire Al Jazeera

- Katz warns Hezbollah over “playing with fire” – Shafaq News شفق نيوز

- IDF confirms…

Continue Reading