- WESFX, WEFCX, WEIFX Investors Have Opportunity to Lead Wildermuth Fund Securities Fraud Lawsuit with the Schall Law Firm Business Wire

- DEADLINE ALERT: Faruqi & Faruqi, LLP Investigates Claims on Behalf of Investors of … Bluefield Daily Telegraph

- Shuttered Wildermuth Fund, Auditor Withum Sued Over Valuations Bloomberg Law News

- WESFX; WEFCX; WEIFX INVESTOR ALERT: Bronstein, Gewirtz & Grossman LLC Announces that Wildermuth Fund Investors with Substantial Losses Have Opportunity to Lead Class Action Lawsuit Morningstar

- Wildermuth Fund Securities Lawsuit Investigation Claim Depot

Author: admin

-

WESFX, WEFCX, WEIFX Investors Have Opportunity to Lead Wildermuth Fund Securities Fraud Lawsuit with the Schall Law Firm – Business Wire

-

YouTube denies AI was involved with odd removals of tech tutorials

Those users could become loyal to Microsoft, White said. And eventually, some users may even “get tired of bypassing the Microsoft account requirements, or Microsoft will add a new feature that they’ll happily get the…

Continue Reading

-

UN calls for Western Sahara talks based on Morocco's autonomy plan – Reuters

- UN calls for Western Sahara talks based on Morocco’s autonomy plan Reuters

- Rabat (TNS) The King of Morocco Mohammed VI Delivers Speech to His Faithful People tns.world

- Eight Decades of Injustice: Why Africa Deserves a Permanent Voice at the…

Continue Reading

-

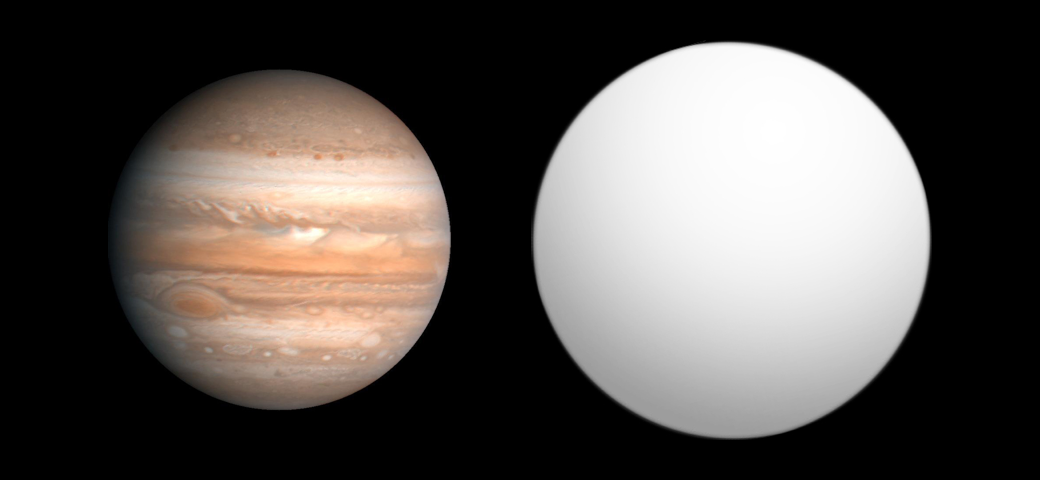

Mapping Alien Worlds in 3D

For decades, astronomers have studied Jupiter’s Great Red Spot and swirling cloud bands through increasingly powerful telescopes, building a detailed understanding of our giant neighbor’s dynamic atmosphere. Now, for the first time,…

Continue Reading

-

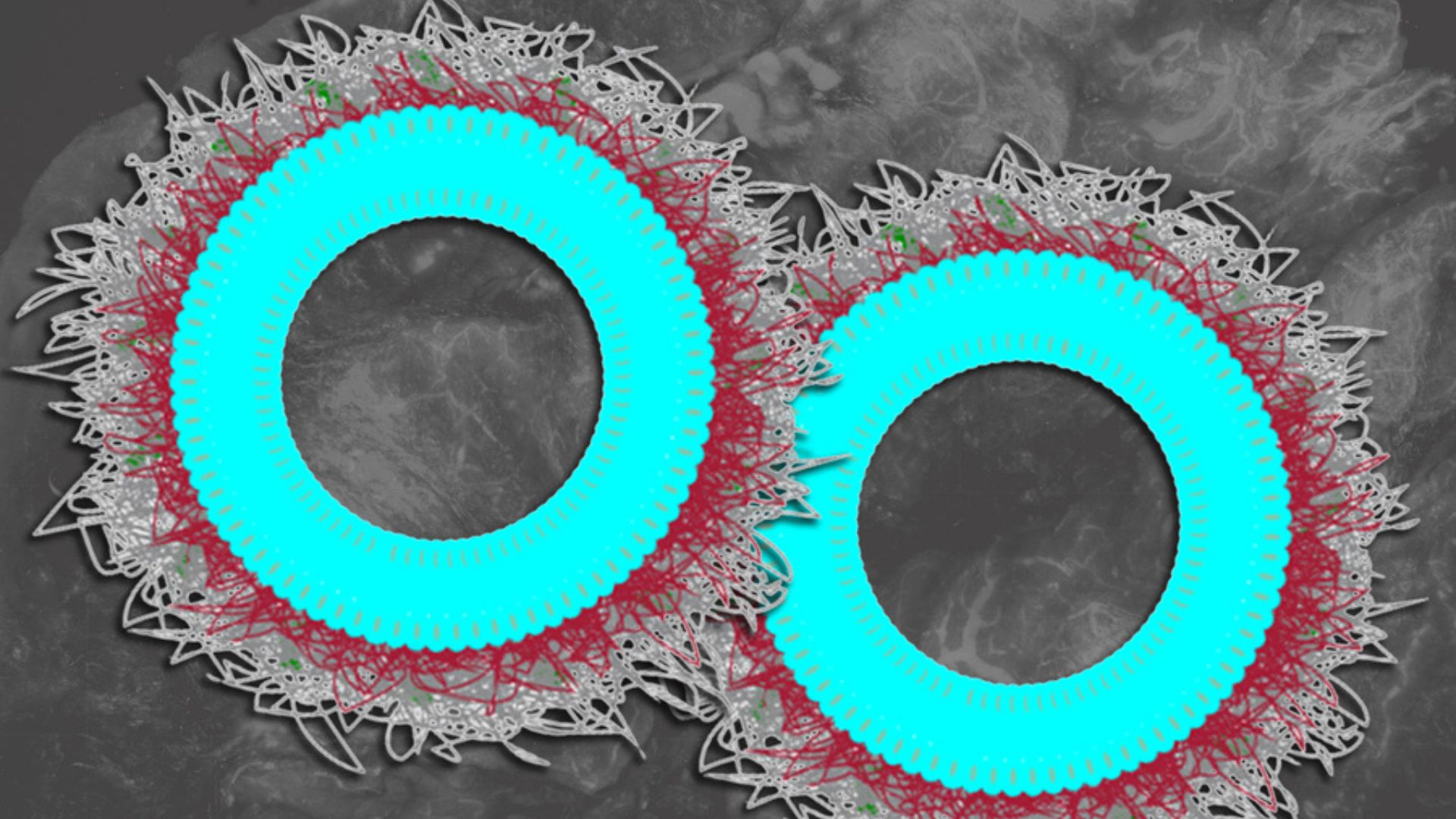

Targeted nanoparticles show 80% success in treating ovarian cancer

MIT scientists have designed nanoparticles that could make cancer immunotherapy work better against ovarian tumors, one of the most treatment-resistant cancers.

The new system delivers an immune-activating molecule called IL-12 directly to…

Continue Reading

-

Assessing Valuation After Strong Year-to-Date Share Price Surge

AngloGold Ashanti (NYSE:AU) stock has seen interesting movement lately, particularly with a $68 close and noticeable performance over the past month and 3 months. Investors may be reviewing its recent returns to assess next steps.

See our latest analysis for AngloGold Ashanti.

AngloGold Ashanti’s momentum has attracted attention, with its share price up 179% year-to-date. The miner has delivered a remarkable 159% total shareholder return over the past year. After surging in recent quarters, short-term momentum appears to be cooling. However, long-term shareholders are still sitting on impressive gains.

If AngloGold’s run has you wondering what other fast-moving opportunities are out there, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares still sitting well below analyst targets, AngloGold’s current valuation raises the question: is the recent rally just the start, or is the company’s future growth already reflected in its price?

AngloGold Ashanti’s fair value is now pegged at $70.50, slightly above its last closing price of $68. This gap has fueled fresh debate over whether the stock’s rally still leaves room for further upside.

Ongoing optimization of asset portfolio toward lower-risk jurisdictions, combined with disciplined cost control (notably, stable cash cost and AISC in real terms despite sectoral inflation) is improving production stability and supporting structurally stronger net margins. Organic production growth from brownfield projects (Obuasi ramp-up, Cuiabá, Siguiri, Geita, and upcoming Nevada developments) is set to increase output volumes and extend mine life, driving future revenue and earnings growth over the next decade.

Read the complete narrative.

Want to know what’s really powering this valuation? This narrative hinges on big operational shifts and ambitious growth targets that could rewrite the company’s trajectory. If you’re curious which forecasted leaps and pivotal performance drivers the analysts believe will justify a higher price, you’ll want to see the full breakdown.

Result: Fair Value of $70.50 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, rising costs and delays in new project approvals could affect AngloGold Ashanti’s outlook if these headwinds intensify in the coming quarters.

Find out about the key risks to this AngloGold Ashanti narrative.

If you see the story differently or want to dig into the numbers on your own terms, you can craft your own perspective in just a few minutes, so why not Do it your way

Continue Reading

-

Saudi Arabia tightens Umrah visa rules

Umrah pilgrims coming to Saudi Arabia will now be able to stay in the kingdom for three months. PHOTO: AFP/FILE

Saudi Arabia’s Ministry of Hajj and…

Continue Reading

-

Prince William leaves Andrew scandal behind for trip to Brazil – Reuters

- Prince William leaves Andrew scandal behind for trip to Brazil Reuters

- Earthshot Prize awards take a trip down memory lane Geo TV

- Our oceans – responsible for feeding billions, regulating our climate, and producing the air we breath – are in…

Continue Reading

-

Scientists craft biochar from wood waste that rivals steel in strength

Wood, long admired for its natural beauty and strength, has now inspired a carbon material tough enough to rival steel.

Researchers at the University of Toronto have discovered that biochar derived from wood can achieve hardness levels…

Continue Reading

-

J.P. Morgan Finds Women Are Driving Their Own Financial Success — Not Waiting To Inherit It

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

A growing number of women are actively shaping their own financial futures by investing and building wealth on their own terms, according to J.P. Morgan Wealth Management’s latest investor study. These women are taking control of their financial journeys in ways that go beyond the old narrative of waiting to inherit wealth.

The study found that though many older women are already benefitting from the Great Wealth Transfer, younger women aren’t waiting on their share to build wealth on their own. The survey of 1,000 investors with a minimum of $25,000 in investable assets found that of those women who are expecting to receive an inheritance, 93% said they aren’t depending on that money to reach their financial goals. And 69 % of those with a financial plan said they were on track to meet their 2025 resolutions.

Don’t Miss:

Nearly three-fourths of the J.P. Morgan survey said having money gives them security, and 64% of Gen Z and millennial women said it gives them freedom and choices. That sense of control often comes from having a clear plan. The survey found that those who take the time to create a clear investment strategy are nearly three times more likely to feel confident about hitting their goals.

If you’re just getting started on your financial journey, here are a few steps that can help you reach your money goals:

-

Automate your investing. Consistency beats perfection when it comes to building wealth. Set up recurring deposits so you’re consistently putting money to work and won’t have to rely on willpower to remember to save or invest each month.

-

Diversify your portfolio. Never put all your eggs in one basket. Mix different types of assets, like stocks, bonds and index funds, to spread out risk.

Trending: From Moxy Hotels to $12B in Real Estate — The Firm Behind NYC’s Trendiest Properties Is Letting Individual Investors In.

-

Keep learning. The more you know, the more confident you’ll feel about your money. Follow finance newsletters like the Morning Brew or podcasts like The Ramsey Show to stay educated.

-

Check in on your goals. Your financial goals will evolve as your life does. Revisit your plan at least once a year and adjust it as your life changes.

-

Build an emergency fund. Before you start investing, make sure you have a safety net to fall back on. Aim to save at least three to six months’ worth of expenses in an easily accessible account.

Continue Reading

-