- White House restricts reporters’ access to press office Dawn

- White House restricts media access in the West Wing Editor and Publisher

- Trump Administration Places Restrictions On Reporter Access To West Wing’s “Upper Press” Area imdb.com

Author: admin

-

White House restricts reporters’ access to press office – Dawn

-

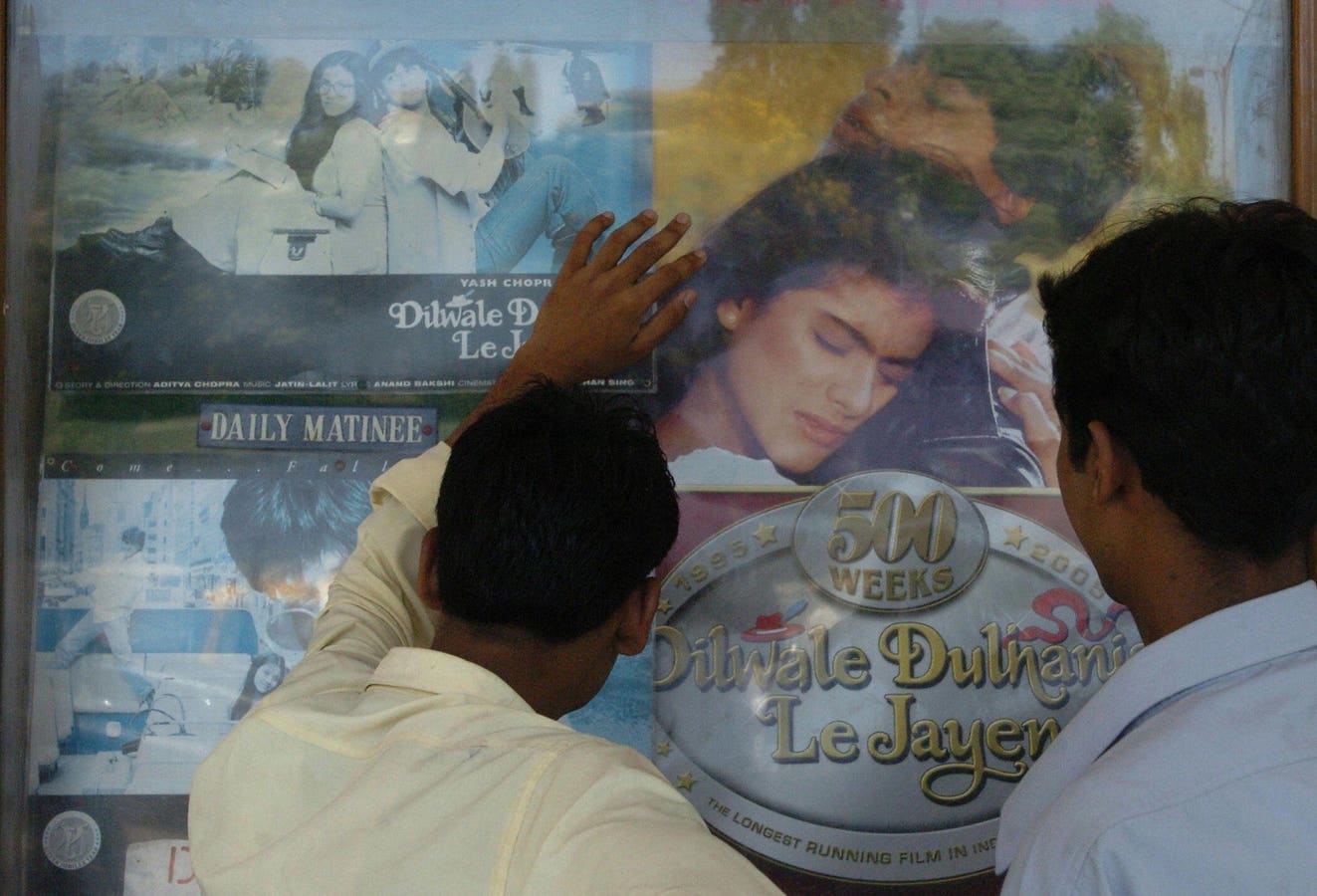

How One Of India’s Most Enduring Films Explains Its Rise

Movie buffs look at posters and pictures from the popular Hindi film “Dilwale Dulhania Le Jayenge.”

INDRANIL MUKHERJEE/AFP via Getty Images

Barack Obama and Donald Trump agree on virtually nothing. Yet both found common ground in an unexpected…

Continue Reading

-

Macau Gaming Revenue Beats Estimate on Post-Golden Week Boost – Bloomberg.com

- Macau Gaming Revenue Beats Estimate on Post-Golden Week Boost Bloomberg.com

- Macau GGR rebounds to MOP$24.1 billion in October, setting another post-COVID record IAG – Inside Asian Gaming

- October gaming revenue jumps 15.9 pct to MOP 24.1 bln, hitting six‑year high Macau Business

- Citi Lifts MO Oct GGR Forecast to MOP23.5B AASTOCKS.com

- Macau October GGR tops $3B, breaking record since pandemic Asia Gaming Brief

Continue Reading

-

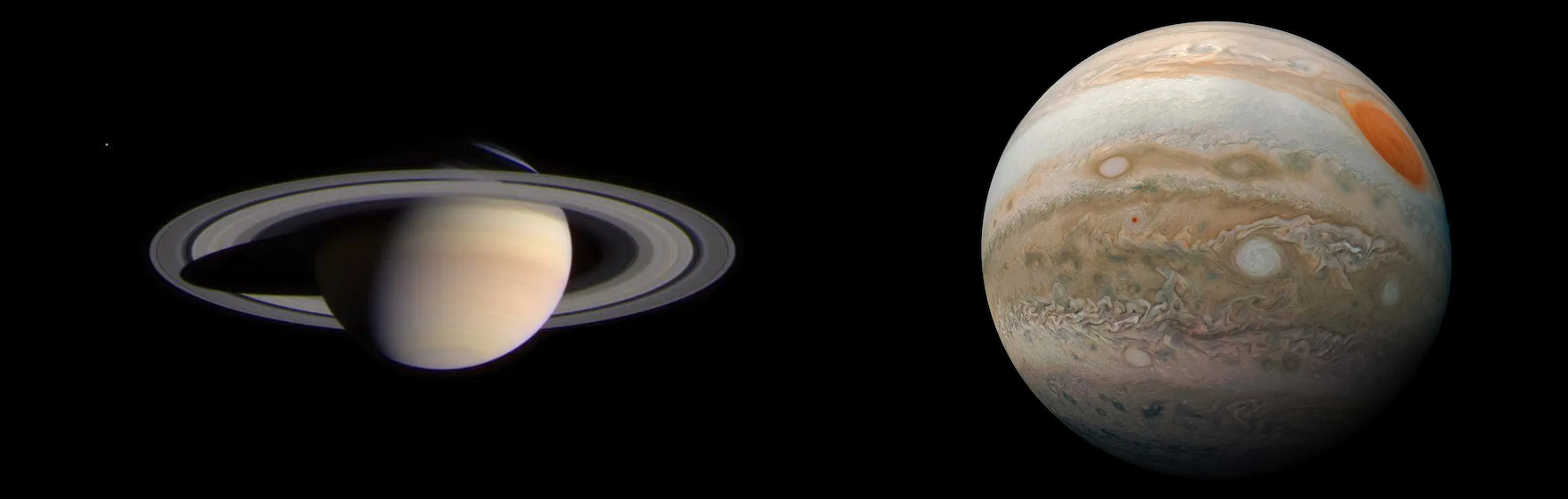

What’s in the Southern Hemisphere sky this month?

Gas giants Saturn (left) and Jupiter are some of the planetary highlight’s in this month’s sky. Credit: NASA/JPL/Space Science Institute (Saturn); Enhanced image by Kevin M. Gill (CC-BY) based on images provided…

Continue Reading

-

Samsung and Nvidia are building an AI megafactory powered by 50,000 GPUs — here’s what it means for the future of chips

Samsung has announced plans to establish a next-generation artificial intelligence (AI) “megafactory” in partnership with US chipmaker Nvidia. The initiative, revealed on Friday and reported by Focus Taiwan, aims to integrate AI throughout Samsung’s entire semiconductor production ecosystem.

According to Samsung, the platform will operate on more than 50,000 Nvidia GPUs and serve as an “intelligent manufacturing platform” capable of analysing, predicting, and optimising chip production in real time.

“The Samsung AI Factory goes beyond traditional automation,” a company official said. “It connects and interprets immense data generated across chip design, production and equipment operations.”

What do Samsung and Nvidia offer currently?

The megafactory marks the latest chapter in a 25-year partnership between Samsung and Nvidia. Their collaboration began when Samsung supplied DRAM chips for Nvidia’s first-generation graphics cards and has since expanded to include foundry and memory technology.

Current joint efforts include the development of HBM4, Nvidia’s next-generation high-bandwidth memory, built using Samsung’s sixth-generation 10nm-class DRAM and 4nm logic base die. Samsung said it will continue to advance its portfolio of HBM, GDDR and SOCAMM solutions alongside foundry services to “drive innovation and scalability across the global AI value chain.”

How the process of chipmaking will be enhanced?

At the heart of the new AI factory will be Nvidia’s Omniverse and Cuda-X platforms, which will enable Samsung to create digital twins of entire chip fabs. These virtual models simulate real-world factory conditions, allowing engineers to test new processes, predict maintenance needs and fine-tune operations without interrupting physical production.

Samsung will also use Nvidia’s cuLitho software to speed up computational lithography, a key step in chipmaking that determines circuit precision. The company expects up to a 20-fold increase in performance, enabling faster design iterations and higher chip yields.

Also Read | After Nvidia’s $5 trillion milestone, Huang races ahead of ex-Microsoft CEOSmarter robots to process real-time data

Beyond chip design and lithography, Samsung plans to apply Nvidia’s AI capabilities to robotics and automation. The company is deploying RTX Pro 6000 Blackwell Server Edition GPUs to enhance humanoid robot performance and Jetson Thor modules to power real-time AI reasoning and execution in its smart robotic systems.

The collaboration will also extend into AI-enhanced mobile networks. Through joint development of AI-RAN technology, Samsung and Nvidia aim to enable edge devices, such as drones and industrial robots, to process real-time data locally using GPU acceleration, reducing latency and enhancing operational efficiency.

“This AI-powered mobile network will play a crucial role as a neural network essential in the widespread adoption of physical AI,” Samsung said.

Also Read | Nvidia stock is still a buy. Why $5 trillion isn’t the top.Expanding across global facilities

Samsung plans to roll out the AI factory infrastructure across its semiconductor plants worldwide, including the upcoming chip facility in Taylor, Texas. The move underlines the company’s ambition to lead across all semiconductor categories: memory, logic, foundry and advanced packaging.

Already, Samsung’s proprietary AI models power over 400 million consumer devices. Through its new Megatron framework, the company intends to embed similar capabilities into its manufacturing systems — enabling intelligent summarisation, multilingual interaction, and advanced reasoning across production lines.

Beyond chip design and lithography, Samsung plans to apply Nvidia’s AI capabilities to robotics and automation. “This is a critical milestone in our journey to lead the global shift toward AI-driven manufacturing,” the Samsung official added.

Key Takeaways

- The AI megafactory will utilize over 50,000 Nvidia GPUs for real-time analysis and optimization.

- Nvidia’s platforms will allow for the creation of digital twins to simulate production processes.

- Samsung aims to enhance both chip production and AI capabilities in mobile networks through this collaboration.

Continue Reading

-

Mega-brewers keep investors’ coffers topped up

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Pick your poison: beer or cigarettes? Weak share prices are pushing cash yields on the biggest brewers closer to those of sin-bin stalwart, Big Tobacco. For investors with the bottle for a sector that seems to be sliding into pariah territory, that could spell opportunity.

Recent news has contributed to investors’ sour mood. Shares in AB InBev, the world’s largest brewer and maker of Budweiser and Stella Artois beers, fell on Thursday despite an unexpectedly generous $6bn two-year share buyback. Numbers two and three, Heineken and Carlsberg, recently reported falls in quantity sold, and stuck with already-watered down profit forecasts.

Over the past year, only shares in Carlsberg are in the black — and then, only barely. Its heftier rivals are each down roughly a tenth. Volumes have become a key metric for investors as brewers try to offset mature western markets with growth in less developed countries and in newer categories such as alcohol-free beer.

But key growth spots have gone flat, with Brazil hurt by bad weather and economic uncertainty — a factor in China too, which also this year banned alcohol from official events. Consumption in Vietnam, a market prized for its large, young population, has been slow to recover from the impact of a strict 2020 drink-driving law.

Mega-brewers’ relegation from the premium to the bargain shelves has been a long process. From trading on at least 20 times expected earnings in 2020, the three brewers now trade on between 12 and 14 times 2026 forecasts. Investors appear to fear that consumption will flag under the influence of public health groups and a more alcohol-conscious younger generation.

Investors gloomily peering into their half-empty glasses could choose to see things differently. Granted, neither Big Beer’s top nor bottom line have been effervescent of late. But managers have used a mix of price rises and cost cuts to boost free cash flow. AB Inbev, whose annual cash generation after investments is 9 per cent of its market capitalisation, is not far short of the 12 per cent yielded by tobacco stocks — a sector that has handsomely rewarded investors prepared to accept its sinful status.

Big Beer, for all its doubters, isn’t Big Tobacco. It still has growth potential if key markets steady. In the meantime, cash is a good consolation.

jennifer.hughes@ft.com

Continue Reading

-

Why Fiber Is the Secret Weapon for Balanced Blood Sugar

- Despite fiber’s many benefits, around 95% of adults fall short of the daily fiber recommendations.

- Eating fiber helps support blood sugar by slowing sugar absorption, feeding beneficial bacteria and supporting steady release of energy.

- Aim to…

Continue Reading

-

Boots sued for alleged copycat neck pillow

Stay informed with free updates

Simply sign up to the Retail & Consumer industry myFT Digest — delivered directly to your inbox.

Boots is being sued by a travel accessories company that claims travel pillows sold by the UK retailer imitate its “particularly ergonomic” design and breach its intellectual property rights.

Travel Blue has launched a lawsuit against Boots at the High Court in London, demanding the beauty and health retailer stop infringing its design. It has called for unquantified damages and wants Boots to destroy or hand over unsold pillows.

U-shaped pillows have existed since at least the 1920s, when Elizabeth Millson of New York patented one in the US for use in baths.

Together with noise-cancelling headphones, the modern version has become a fixture of long-haul economy class flights. The neck-supporting products offer a degree of comfort — and the promise of sleep — to passengers confronted with limited leg room and barely reclining seats.

Travel Blue’s lawsuit, which was filed in September, recognises that all travel pillows need to “fit around a person’s neck, to provide support for that person’s neck whilst travelling and to be transportable”.

However, the legal claim states that specific elements of some pillows sold by Boots mean they infringe on a design that Travel Blue has registered with the UK’s Intellectual Property Office.

Nicholas Caddick KC, representing the UK accessories company, said in court papers that Travel Blue’s design had “significant features” that created an “overall impression of a particularly ergonomic and comfortable travel pillow with flowing rather than rigid lines”.

He set out a range of similarities between Travel Blue’s design and Boots’, including legs that had “a bulbous appearance accentuating the support” to the sides of the user’s head.

Caddick continued: “When viewed from the rear, an undulating top profile with a concave centre section flanked by raised lateral support points, once again, giving the appearance of enhanced support for the wearer’s head and neck”.

A Boots spokesperson said “We don’t believe the claim has any merit and will be strongly defending our position.” According to court records the company has retained law firm Browne Jacobson to defend it in the case. Defence documents have yet to be filed with the court.

Boots operates stores in several UK airports among about 1,800 stores, selling travel essentials and health and beauty products.

The chain, formerly part of US-listed Walgreens Boots Alliance, became a standalone entity this year after private equity group Sycamore Partners took WBA private and split off the international health and beauty retailer and drug wholesaling business as The Boots Group.

Travel Blue, founded in 1987, is a family-owned business and sells its products through a wide range of airport duty free outlets as well as luggage and bag shops and department stores around the world, as well as online.

Continue Reading

-

Broadband operator saddled with £1bn debt pile tries to find buyer

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Gigaclear, a heavily indebted UK broadband provider, has launched a sale process as investors and creditors including NatWest, Lloyds and the National Wealth Fund try to resolve a £1bn debt pile.

Potential buyers received teaser documents earlier this week, according to three people familiar with the matter. The process comes as Gigaclear’s creditors seek a solution to their investment, which soured after an expected equity injection from Equitix failed to fully materialise in 2023.

Other options include writing down debt, a debt-for-equity swap or a further cash injection from investors that include main shareholder Infracapital and Railpen, according to a person familiar with the process. They added that Gigaclear’s operations would not be affected regardless of the outcome.

Gigaclear, which is available in more than 500,000 homes and has about 160,000 customers, could fetch between £500mn and £700mn, New Street Research has estimated.

The dozens of small broadband companies or alternative network providers set up to challenge BT’s Openreach and Virgin Media O2 are now grappling with a collective £8bn debt pile, according to estimates from Enders Analysis, as well as fewer customers than hoped.

Gigaclear’s restructuring process may involve the first major writedown of debt in the “altnet” sector, and would come after lenders including NatWest and Lloyds set aside provisions to account for losses in the sector. TMT Finance first reported the restructuring.

Taxpayers stand to take a hit in any writedown as the National Wealth Fund gave a £240mn guarantee as part of a wider £1.5bn debt package in 2023. The fund has committed more than £1bn to altnets, according to a person familiar with the matter.

The fund said it continued “to be supportive of the business in exploring ways to raise capital and deliver a sustainable capital structure for the company in order to grow value”.

Potential buyers for Gigaclear could include the industry’s largest player, CityFibre, according to a person familiar with the matter. Any buyer is likely to want a reduction of the altnet’s debt levels before any deal, they added.

The Financial Times reported earlier this week that Virgin Media O2 was in talks about acquiring the UK’s fourth-largest broadband network, Netomnia, in a potential £2bn deal. CityFibre has also expressed interest in the business.

New Street analyst James Ratzer said the “combination of high build costs and low customer take-up” meant the business was unlikely to have any equity value.

“Trying to sell a business with no equity value when equity backers and creditors both want a share of any proceeds is very challenging to complete,” he added.

Gigaclear said it continued to deliver “strong operational performance” and was “delivering on all key financial metrics”.

“Our existing stakeholders remain supportive of the business, and we continue to work constructively with them to explore a range of options that support the long-term success of Gigaclear and deliver the best outcome for all parties,” it added.

Equitix said it had invested £50mn in Gigaclear in late 2023 that had “unlocked £1bn in senior debt” and was disappointed that the “financial performance of the investment did not meet the targets that Gigaclear set itself”.

Infracapital, Railpen, Lloyds, NatWest and CityFibre declined to comment.

Continue Reading