Author: admin

-

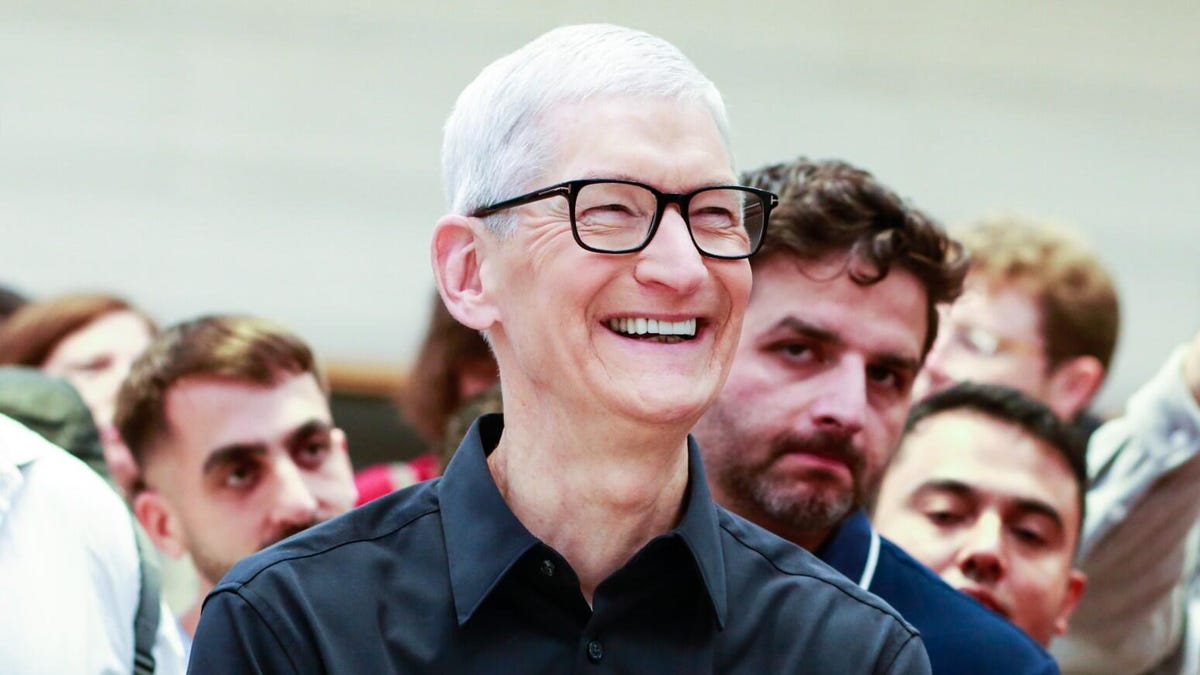

Will Tim Cook Step Down? Apple CEO’s Impending 65th Birthday Sparks Succession Talk

Tim Cook‘s 65th birthday is next week, on Nov. 1. And with the Apple CEO’s special day almost here, talks have been growing as to who could be his successor should he choose to retire. Cook has made no official public mention of stepping down…

Continue Reading

-

Ancient sea animals may have used magnetic particles to navigate

For millions of years, Earth’s magnetic field has helped animals move through their environments. Birds, turtles, and fish are known to use it as an invisible map.

But now, scientists have found clues that ancient marine life may have been doing…

Continue Reading

-

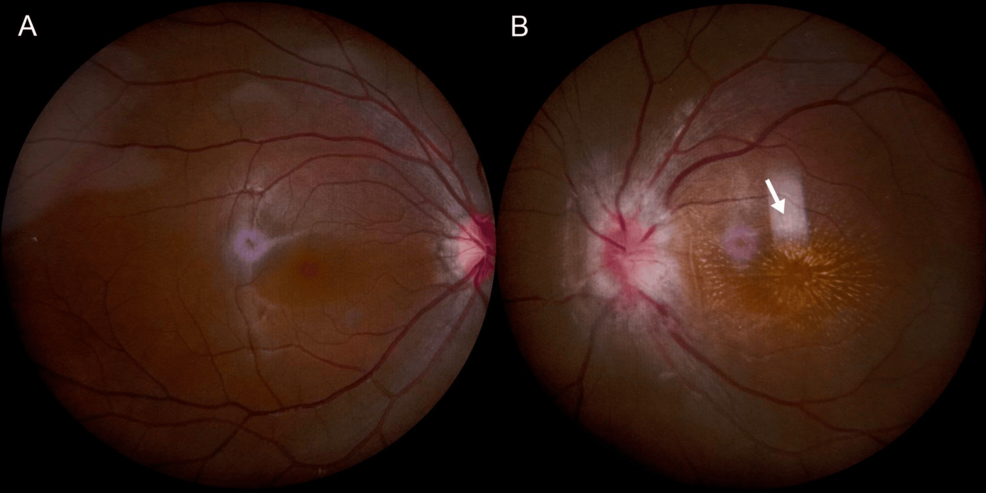

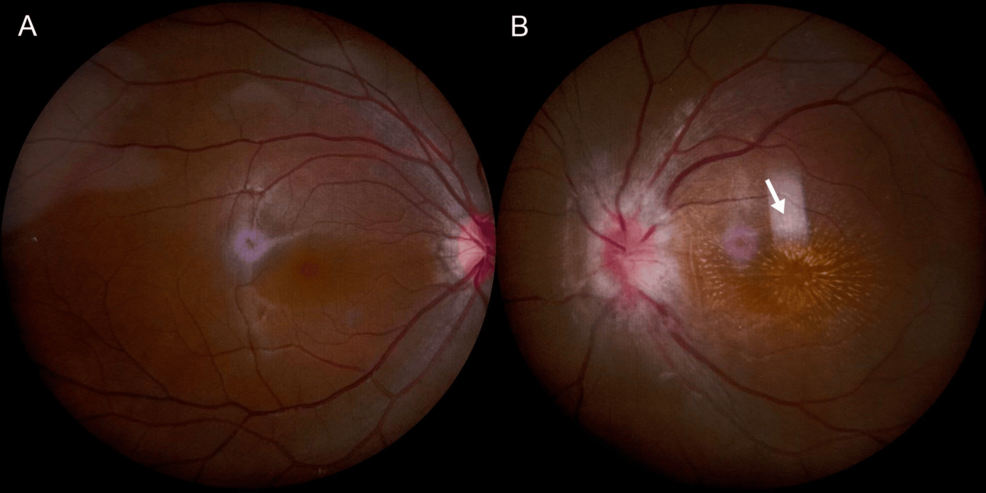

Cholera Epidemic Rapidly Spreading Across The Country

A medical worker takes care of patients at a cholera treatment center in Kinshasa, capital of the Democratic Republic of the Congo, July 10, 2025. The cholera outbreak in the Democratic Republic of the Congo (DRC) has reached an “acute phase,”…

Continue Reading

-

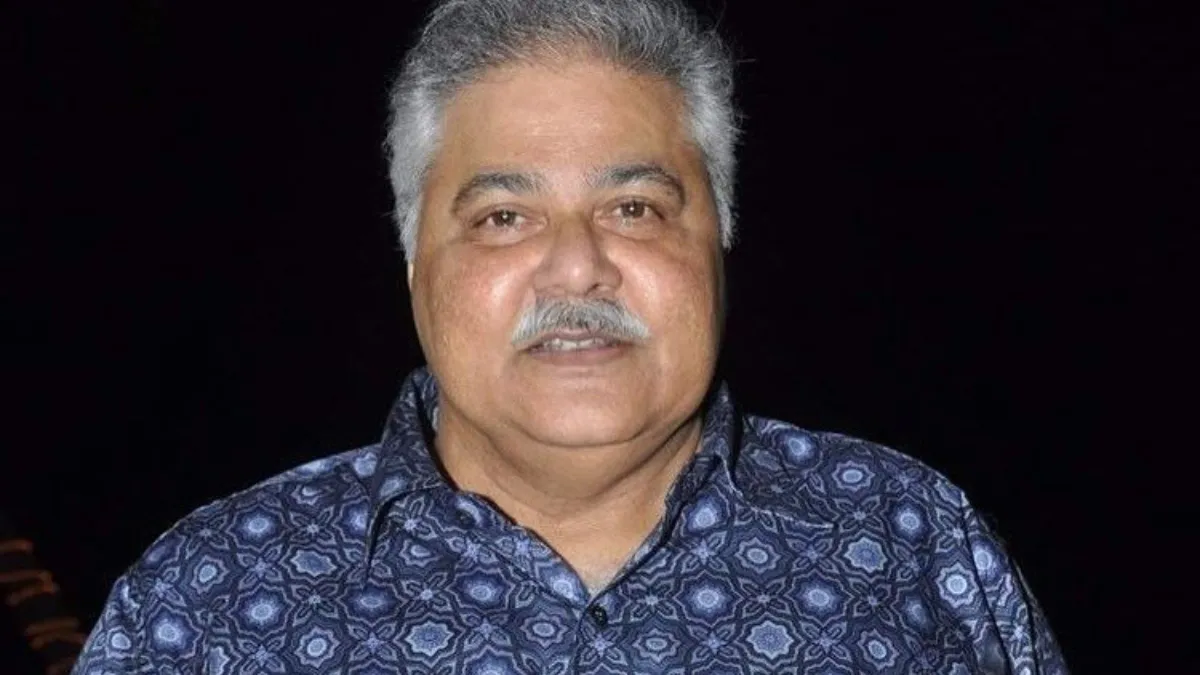

‘Lost Respect For Our Team…’

This year, when there was a huge controversy around the India vs Pakistan Asia Cup match, the late actor Satish Shah called for a boycott. Shah then took to his social media to urge his fans and followers to be true patriots and not watch the…

Continue Reading

-

Rising Polio Cases In Pakistan And Afghanistan Raise Alarm In India

Although the World Health Organization (WHO) certified India as polio-free in March 2014, the resurgence of polio cases in countries such as Pakistan and Afghanistan has raised concern in India.

India Last Reported Polio Case In 2011

Deepak Kapur,…

Continue Reading

-

Access Denied

Access Denied

You don’t have permission to access “http://www.business-standard.com/cricket/news/gill-heaps-praise-on-rohit-virat-for-their-match-winning-knock-in-sydney-125102500679_1.html” on this server.

Reference…

Continue Reading

-

Julia Scheib delivers home victory in giant slalom season opener, Shiffrin ends fourth

The FIS Alpine Ski World Cup season roared into action on Saturday (25 October) in Sölden, Austria, where the women’s giant slalom delivered a fairytale start for the host nation.

A decade of waiting ended on the Rettenbach Glacier as Julia…

Continue Reading