Guillaume Henry fans Diane Kruger and Kelly Rutherford were among the guests that turned out for the Patou show Sunday, while “Wednesday” star Joy Sunday was chatting with Tommy Dorfman front row. They were both enjoying the rainy Parisian…

Author: admin

-

Flight Cancellations Hit Record High As Winter Storm Rages On

As Winter Storm Fern continues to bring icy temperatures and snow across North America from New Mexico to Maine, air travel is taking a record hit.

A total of 11,016 flights have been canceled in the United States as of 4 p.m. ET…

Continue Reading

-

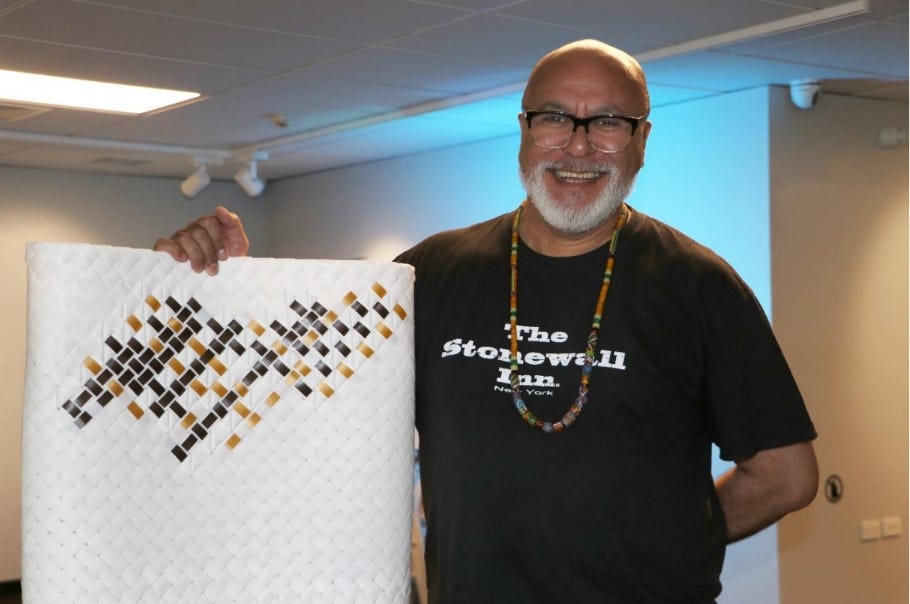

First Pasifika recipient of fellowship explores ancestral pathways

The Southland Art Foundation’s William Hodges Fellow 2025, Te’Okotā’i Paitai, will showcase works created during his residency at He Waka Tuia in Invercargill.

Everyone is on a journey – whether they realise it or not.

For Auckland-based…

Continue Reading

-

Two days of oats can lower cholesterol for weeks

Oats have been sitting quietly on grocery store shelves for decades. They are cheap, familiar, and often ignored.

But a recent study suggests this simple food can do something surprising in a very short amount of time.

Just two days of…

Continue Reading

-

The WhatsApp Wall Breached? A Startup’s Audacious Bid to Force Open Messaging

In the high-stakes world of digital communication, where giants like Meta Platforms Inc. build impenetrable walled gardens around their billion-user messaging apps, a small startup has just fired a provocative shot across the bow….

Continue Reading

-

Real Madrid loanee Endrick nets hat trick in Lyon win

Endrick’s hat trick in a 5-2 win at Metz in Ligue 1 on Sunday showed just how shrewd Lyon was to get him on loan from Real Madrid.

The 19-year old Brazil forward, who is widely touted as a future superstar but had…

Continue Reading

-

Dana White Talks UFC 324, First Event With Paramount+, Referee’s Injury & More – UFC.com

- Dana White Talks UFC 324, First Event With Paramount+, Referee’s Injury & More UFC.com

- Dana White confirms UFC 324 referee suffered never seen before injury as he was carried out of arena Bloody Elbow

- Watch: UFC Referee Suffers Torn ACL During…

Continue Reading

-

Govt okays Rs30b Ramazan relief package

RAWALPINDI:The Punjab provincial government has approved financial…

Continue Reading

-

Did Humans Nearly Go Extinct 900,000 Years Ago? A Biologist Explains

At some point in the deep past, humans may have come frighteningly close to disappearing altogether. Here’s what we know, according to research.

getty

According to genetic evidence published in a 2023 study from Science, our ancestors experienced…

Continue Reading

-

A Look At M/I Homes (MHO) Valuation As Shares Trade Below Popular Fair Value Estimates

Find your next quality investment with Simply Wall St’s easy and powerful screener, trusted by over 7 million individual investors worldwide.

M/I Homes (MHO) is back on investors’ radar after recent share price moves, with the stock closing at $133.45. You might be weighing how this homebuilder’s latest performance fits into your portfolio today.

See our latest analysis for M/I Homes.

That latest move to $133.45 comes after a mixed short term stretch, with a 1 day share price return of 1.69% decline and a 7 day share price return of 2.70% decline, set against a 3 year total shareholder return of 126.53% and 5 year total shareholder return of 170.31%. This combination points to strong longer term momentum despite recent softness.

If M/I Homes has you rethinking where housing fits in your portfolio, this could be a useful moment to compare it with other fast growing stocks with high insider ownership that are catching attention right now.

With annual revenue and net income both showing recent declines, yet the share price sitting below the average analyst target of $157, you have to ask yourself: is M/I Homes undervalued, or is the market already pricing in future growth?

With M/I Homes closing at $133.45 against a most-followed fair value estimate of $157, the current price sits well below that narrative benchmark.

Strong balance sheet fundamentals (record-high equity, substantial cash reserves, low net debt, and aggressive share repurchases) not only provide downside protection but also amplify future earnings per share (EPS) and return on equity as demand and deliveries ramp up.

Read the complete narrative.

Analysts are tying this fair value to a detailed mix of revenue expectations, margin assumptions, and future P/E levels. Curious which input carries the most weight here, and how buybacks factor into the earnings path behind that $157 figure.

Result: Fair Value of $157 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, you still need to factor in the risk that softer new contracts and rising inventory exposure could pressure margins and weaken the case for upside.

Find out about the key risks to this M/I Homes narrative.

While the fair value narrative of $157 suggests upside, the Simply Wall St DCF model lands in a very different place, with an estimate of $38.03 per share. This would make the current $133.45 price look expensive rather than cheap. As an investor, which story do you trust more, the earnings path or the cash flows?

Continue Reading