The request could not be satisfied.

Request blocked.

We can’t connect to the server for this app or website at this time. There might be too much traffic or a configuration error. Try again later, or…

We, the leaders of the Hashemite Kingdom of Jordan (hereinafter Jordan) and the European Union, held our first EU-Jordan Summit in Amman, Jordan on 8 January 2026 and concluded the following:

1. Today’s Summit marks an important milestone in…

Hyundai Motor Group’s integrated AI Robotics value chain

Hyundai Motor Group’s manufacturing facilities are helping to develop reliable robots that are tested and trained internally. Thanks to various capabilities within the Group, we can supply parts, mass-produce robots, and provide one-stop robotics-as-a-Service (RaaS). Working with affiliates like Boston Dynamics, the Group is expanding its mass-production expertise from automotive to robotics, increasing overall value for customers.

Each of HMG’s group affiliates plays a crucial role in development and testing by bringing its own expertise:

– Hyundai Motor Company and Kia provide manufacturing infrastructure, process control and large-scale production data.

– Hyundai Mobis works closely with Boston Dynamics to develop high-performance actuators, standardizing key components and optimizing designs for manufacturability.

– Hyundai Glovis optimizes logistics and supply chain management.

By integrating all these areas of expertise, we can offer ongoing customer support after deployment, including regular software updates, hardware maintenance, repairs, and remote monitoring and control. These services enable us to oversee the process from start to finish, helping to bring AI Robotics solutions to market.

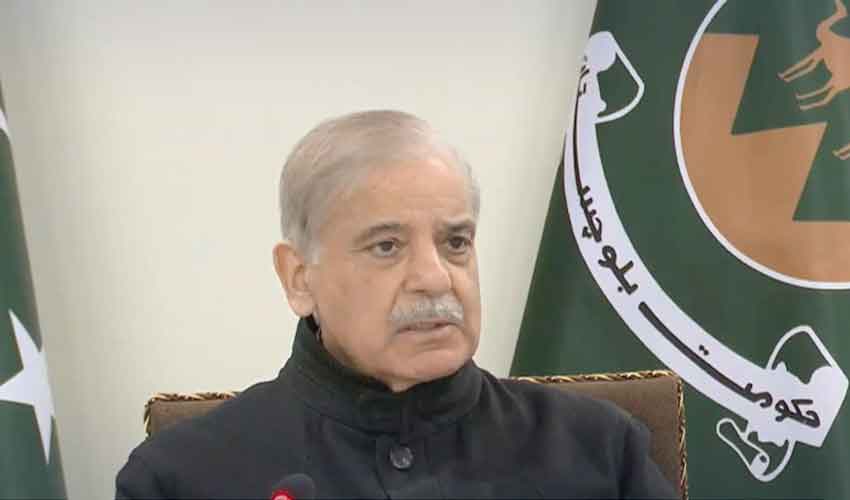

Prime Minister Shehbaz Sharif on Thursday met political leaders in Quetta, reaffirming the federal government’s commitment to defeating terrorism and accelerating development across Balochistan.

Addressing the…

Despite the immense amount of genetic material present in each cell, around three billion base pairs in humans, this material needs to be accurately divided in two and allocated in equal quantities. The centromere,…

Sriram, K. & Insel, P. A. G protein-coupled receptors as targets for approved drugs: how many targets and how many drugs? Mol. Pharmacol. 93, 251–258 (2018).

Arinaminpathy, Y., Khurana, E.,…

The duty would require councils to engage directly with those affected before the kinship local offer is published, strengthening expectations that had previously been set out only in statutory…

Released: 2026-01-08

In October, Canada’s merchandise imports increased 3.4%, while exports were up 2.1%. As a result, Canada’s merchandise trade balance with the world went from a small surplus of $243 million in September to a deficit of $583 million in October.

Consult the “International trade monthly interactive dashboard” to explore the most recent results of Canada’s international trade in an interactive format.

After falling 4.3% in September, total imports rose 3.4% in October. Overall, gains were observed in 8 of the 11 product sections. In real (or volume) terms, total imports were up 2.6% in October.

Imports of electronic and electrical equipment and parts were up 10.2% in October, with all product groups increasing. Imports of computers and computer peripherals (+32.2%) rose the most to reach a record high in October, mainly because of higher imports of processing units from Ireland. Imports of communication, and audio and video equipment (+5.1%) also contributed to the gain, mainly on stronger imports of smartphones from China and the United States.

Following a large decrease of 27.9% in September, imports of metal and non-metallic mineral products were up 9.5% in October. This was largely attributable to an increase in imports of unwrought gold, silver, and platinum group metals, and their alloys (+55.3%). While imports of unwrought gold have been behind the volatility within this product group in 2025, higher imports of unwrought platinum and silver bullion from the United States were behind the growth in October.

Imports of industrial machinery, equipment and parts were up 5.7% in October. Significant contributors to the increase in the month were imports of other general-purpose machinery and equipment (+5.6%), logging, construction, mining and oil and gas field machinery and equipment (+14.7%) and parts of industrial machinery and equipment (+7.1%).

The increase in total imports in October was partly offset by a 7.5% decrease in imports of basic and industrial chemical, plastic and rubber products, which reached their lowest level since July 2023. Imports of basic chemicals (-23.5%) were down the most in October 2025, mainly on lower imports of active pharmaceutical ingredients that are used in the production of medicaments. Imports of lubricants and other petroleum refinery products (-17.6%) also declined in October, mostly because of lower imports of crude oil diluents from the United States.

Following a sharp increase of 6.7% in September, total exports rose 2.1% in October. Despite the overall increase, exports in 6 of the 11 product sections decreased in October. As was the case in September, exports of unwrought gold, silver, and platinum group metals, and their alloys increased the most in October. Excluding exports of this product group, total exports were down 2.5%. Higher prices also contributed to the monthly increase in total exports; in real (or volume) terms, total exports were down 0.4%.

Following a strong increase of 25.0% in September, exports of metal and non-metallic mineral products (+27.3%) rose sharply again in October and reached another record high. Exports of unwrought gold, silver, and platinum group metals, and their alloys—a category largely composed of unwrought gold—led the increase (+47.4%), driven by a rise in gold exports to the United Kingdom. When compared with the same month in 2024, exports of this product group have more than doubled. Higher gold prices have largely been behind this recent growth, but volumes were also up, increasing by nearly 40% in October 2025 on a year-over-year basis.

Exports of motor vehicles and parts rose 4.1% in October with all subcategories posting increases. Higher exports of passenger cars and light trucks (+3.2%) and medium and heavy trucks, buses, and other motor vehicles (+24.7%) contributed the most to the gain in October. For medium and heavy trucks, buses, and other motor vehicles, this increase coincided with the announcement of new import tariffs by the United States, which came into effect on November 1, 2025.

Moderating the increases in October were lower exports of energy products (-8.4%). This was mainly the result of lower exports of crude oil and bitumen (-13.5%), which were down both on lower volumes and prices. The decrease in volumes coincided with refinery shutdowns in the United States in October, while prices declined amid global oversupply.

Following three consecutive monthly declines, imports from the United States increased 5.3% in October. Meanwhile, exports to the United States were down 3.4%, partly because of lower exports of aircraft and unwrought gold. Exports to the United States were down 4.1% in the first 10 months of 2025 compared with the same period in 2024. Canada’s trade surplus with the United States narrowed from $8.4 billion in September to $4.8 billion in October.

Following an increase of 11.8% in September, exports to countries other than the United States rose 15.6% to reach a record high in October. Higher exports to the United Kingdom (gold) and China (crude oil) contributed the most to this growth. Meanwhile, imports from countries other than the United States edged up 0.6% in October. Higher imports from China (smartphones) and Peru (gold) were partially offset by lower imports from Belgium (pharmaceutical products) and Australia (mineral products). Canada’s trade deficit with countries other than the United States narrowed from $8.1 billion in September to $5.4 billion in October. This was the lowest deficit since January 2021.

Imports in September, originally reported at $64.1 billion in the previous release, were revised to $64.0 billion in the current reference month’s release. Exports in September, originally reported at $64.2 billion in the previous release, were revised to $64.3 billion in the current reference month’s release.

In October, monthly service exports decreased 0.4% to $20.1 billion. Meanwhile, imports of services were down 1.2% to $19.6 billion.

When international trade in goods and services are combined, exports rose 1.5% to $85.7 billion in October, while imports increased 2.3% to $85.7 billion. Canada’s total trade balance with the world went from a surplus of $607 million in September to a small deficit of $59 million in October.

As a result of the recent US government shutdown, Statistics Canada has announced new release dates for Canadian International Merchandise Trade statistics, with several months affected.

Statistics for the November 2025 reference month are now scheduled to be published on January 29, 2026.

Tentative dates have been identified for the December 2025 reference month (February 19, 2026) and for the January 2026 reference month (March 12, 2026). These dates remain subject to change. Statistics Canada will communicate any updates to release dates should changes be necessary. Following these releases, it is expected that the publication of monthly international trade statistics will return to the originally planned release schedule.

Information on concepts and methods used for the monthly release of Canada’s international merchandise trade is now available online. Please see “Notes on the monthly release of Canadian international merchandise trade” for more details.

For a detailed overview of the Canadian International Merchandise Trade program, please see “Reference Guide to Canadian International Merchandise Trade Statistics.”

The real-time data table 12-10-0165-01 will be updated on January 19.

Data on Canadian international merchandise trade for November 2025 will be released on January 29, 2026.

The International trade statistics portal is now available on the Statistics Canada website.

The product “International trade monthly interactive dashboard” (71-607-X) is now available. This interactive dashboard is a comprehensive analytical tool that presents monthly changes in Canada’s international merchandise trade data on a balance-of-payments basis, fully supporting the information presented every month in the Daily release.

The product “The International Trade Explorer” (71-607-X) is now available online.

The updated “Canada and the World Statistics Hub” (13-609-X) is available online. This product illustrates the nature and extent of Canada’s economic and financial relationship with the world using interactive charts and tables. It provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, Mexico, China, Japan, Belgium, Italy, the Netherlands and Spain.

The product “Canada’s international trade and investment country fact sheet” (71-607-X) is also available.

The online Canadian International Merchandise Trade Database is no longer available. It has been replaced by the Canadian International Merchandise Trade Web Application (71-607-X), a modern tool that provides trade data users with a number of enhancements.

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).