How are we enjoying the “normal seasonal soft patch” so far? The stock market spent the past week chopping around the range left by the sharp drop the prior Friday, while confronting the ghosts of crises past: regional-bank balance-sheet worries , possible re-escalation of China trade hostilities, a crypto flash correction and a reversal in the most speculative and fundamentally flimsy stocks. The S & P 500 managed a 1.7% weekly gain, almost all of it coming from Monday’s reflex rebound, carving out what now amounts to a five-week trading range bounded by the all-time high above 6,750 and the twice-tested low of 6,550. Entering last week, nearly early everyone lining up behind the consensus bullish argument pointed to the AI-investment bonanza, a Federal Reserve poised to cut rates twice more this year into a still-firm economy and the heaven-bestowed right to a year-end performance-chasing rally. Along with these hard-to-dispute premises would come the standard disclaimer that one should be ready for some October volatility along the way. We’ve now had some of that, though the net effect so far is the mildest of pullbacks, just shy of 3% at the worst from a record high. But last week saw an observable upwelling of anxiety, reflecting a break of the preceding low-volatility climb and some possible pent-up selling from historically elevated equity allocations. Investors all-in The upward march in the indexes has pushed the aggregate equity allocation of Bank of America’s high-net-worth clients up to 64%, just shy of the two-decade high set in late 2021. This suggests less need to top up stock balances, even if they have wanted to, with inflows to equity funds from wealthier households heavy in recent months. Long-short hedge funds, after failing to capture much of the initial surge off the April correction lows, had largely “re-risked” into last week, based on cycle-high gross and net leverage among BofA’s prime-brokerage customers. The tactical fast-money players no doubt backed away in the past week, as they confront the annual fourth-quarter choice either to lock it in or let it ride. Goldman Sachs head of hedge-fund coverage, Tony Pasquariello, says, this cohort last week executed “the largest selling of both US and global equities since April (with a big increase in macro shorts),” adding that “while I believe there’s still plenty of length held by a variety of market actors, the fact is the market did clean up some risk over the past two weeks — and, as we move through October, I believe the technicals will improve.” It’s impossible to prove, but it seems the market has also suffered a bit from a confluence of anniversaries and milestones causing investors to recognize how generous the market has been. The third anniversary of this bull market just passed, with the S & P 500 having compounded at a 24% annual pace over that span, lifting valuations to the upper edge of the post-pandemic range. We also crossed the six-month mark since the April tariff-panic low, pushing a 40% burst from low to high. And in recent weeks the S & P 500 surpassed 6,666 for the first time, registering a ten-bagger since the financial-crisis bottom of 666 set in March 2009. The index crossed that level in each of the past six trading days and closed Friday two points below. First sign of volatility in a while Such nostalgic atmospherics aside, the drop from the record high has likely felt worse than it looks on a chart because it punctuated an unusually long stretch of sleepily rising prices. Before Oct. 10, it had been 48 days since the prior 1% S & P 500 daily decline. That slide also ended the longest-ever streak that saw the index stay above its 20-day moving average. And the index had gone 123 days since the last 3% pullback, one of the dozen longest runs on record, according to 3Fourteen Research founder Warren Pies – and the gain over that period was the best of any such streak at the 123-day mark. Reassuringly, Pies crunched the numbers on what followed past such streaks, and concludes that such calm ascents rarely come at the very end of a bull market. And the subsequent market performance following a busted streak has been a good deal better when the Fed’s next move was a cut rather than a hike. It’s quite possible, even if the recent slippage is not the start of a severe tailspin, that the interruption of the harmoniously rotating, low-drama uptrend let the volatility goblin loose for a while. The Cboe S & P 500 Volatility Index and the futures tied to it saw a much larger jump than one would expect given the relatively mild index setback, the VIX jumping from 16 on Oct. 9 to a high above 28 on Friday before receding below 21. .VIX YTD mountain Cboe Volatility Indes, YTD This promises to put in a nice spike on the chart if the sort that can mean the anxiety attack is waning and a tactical buy-the-dip signal might be flashing. Or perhaps the AI excitement and recent wild momentum stampedes into and out of speculative thematic subsectors means we could be in for a jumpier phase of the bull market. Three weeks ago, when spit-balling about what signs might accompany the acceleration into a more euphoric environment, I noted : “Another feature of markets growing toward an unstable bubbly episode is volatility rising along with stock prices – counter to the broad inverse interplay. The excitable, erratic flows in 1999 drove such a phenomenon, the CBOE Volatility index rarely dropping below 20 as the S & P 500 rallied 20% and the Nasdaq Composite soared 85%.” Too early to declare this is where we are now, but it can’t be dismissed. Credit worries Volatility can also be manifesting the flareup of credit concerns related to losses in a confluence of “one-off” commercial bankruptcies (in part chalked up to alleged fraud), fed into a simmering unease with somewhat loose non-bank lending and opaque structures in the fast-growing private-credit realm. We have had more false alarms than real ones when it comes to selloffs shadowed by credit-contagion fears, but if nothing else the price action in alternative asset managers, regional banks and the investment bank Jefferies Financial have undermined the comfort many investors were taking in historically tight corporate-debt spreads. Hints of a souring credit cycle matter most to equities because they would work against the consensus view that the Fed will be cutting rates a bit more for “the right reasons” into a still-sturdy economy. The same goes for the rhetorical escalation of trade hostilities between the U.S. and China. To remain aggressively bullish now, one must opt for the bright-side interpretation of a few apparent paradoxes. One is that divide between isolated commercial-credit weakness and still-healthy indicators of corporate creditworthiness. Another is the divide between the GDP tracking models showing above-trend growth while all job-market indicators are near stall speed. A third is the tenacious strength in gold , traditionally a risk-off asset that feeds off fears of calamity but recently a globally embraced momentum trade and “universal diversifier” against elevated equities, a surplus of government debt, a less-trustworthy U.S. dollar and cryptocurrencies that move with techno-enthusiasm. @GC.1 YTD mountain Gold, YTD Coming into Friday, traders were unsettled by the recent moves lower in stocks, Treasury yields, the dollar and crude oil – disinflationary, decelerating-growth signals – along with the unceasing buying of gold even at grossly extended prices. In this context, the metal’s $100 slide on Friday from a record above $4,380 an ounce came as a mild relief to equity traders. Whether this triggers a more disorderly unwind in gold remains to be seen, of course, and there’s no telling how stocks might correlate to such a reversal. Do we need a proper scare? Not on the same scale, but some of the more overheated meme-like stocks have been punctured without much apparent disruption to the large-cap core of the market. Quantum-computing playthings IonQ and Rigetti Computing both fell more than 20% in two days after monstrous rallies, and Robinhood shares have lost 15% in six trading days. With any luck, attention can turn next week to more fundamentally grounded matters. Earnings reporting starts to pick up in coming weeks, with year-over-year growth expected to exceed 8% (14.9% for the Magnificent 7 and 6.7% for the rest), according to FactSet. It’s tough for the economy and market to get into all that much trouble with profits and profit forecasts still on the rise, and with a U.S. federal deficit still near 6% of GDP. Last week’s action never broke the bounds of a purely routine consolidation, though it also settled nothing in particular. Scrutinizers of the tape were flagging relatively weak market responses to great Taiwan Semiconductor results and Oracle’s ecstatic growth outlook. There were more 52-week lows than highs on both major exchanges on Friday. The bounce in financial stocks Friday wasn’t all that emphatic; this group has much to prove with the sector barely above its high from late 2024. And is it a bit too trite for the S & P 500 to undergo its first noticeable pullback in six months and have it halt a mere point above the 50-day moving average, as it did at last Tuesday’s low? An ideal scenario for the remainder of the year would have the recent choppiness last a bit longer to qualify as a proper scare, skimming the froth off the speculative stuff and resetting expectations in a way that rebuilds investors’ capacity to be surprised to the upside.

Category: 3. Business

-

Belzutifan Plus Pembrolizumab and Lenvatinib Demonstrates Potential in Advanced Clear Cell RCC

Treatment with belzutifan (Welireg) plus pembrolizumab (Keytruda) and lenvatinib (Lenvima) improved efficacy outcomes compared with multiple other pembrolizumab-based triplet regimens in patients with advanced clear cell renal cell carcinoma (ccRCC), according to findings from substudy 3A of the phase 1/2 KEYMAKER-U03 trial (NCT04626479) presented at the

2025 ESMO Congress .Providing the background for the study, Cristina Suarez Rodriguez, MD, PhD, of Vall d’Hebron University Hospital, Barcelona, Spain, said, “First-line triplet regimens adding novel mechanisms of action to standard doublet therapy may be a promising approach for advanced clear cell renal cell carcinoma…The potent and selective HIF-2α inhibitor belzutifan is a treatment for advanced RCC following prior anti-PD-(L1) and VEGFR-TKI therapy, and may be a highly suitable candidate for novel triplet therapy in the first-line setting.”

For substudy 3A (NCT04626479) of the umbrella phase 1/2 KEYMAKER-U03 trial, investigators sought to evaluate novel pembrolizumab-based regimens as first-line treatment for advanced ccRCC.

“The study employed an adaptive design in which experimental arms were added and/or inactivated on a rolling basis with a continuous enrolling reference arm. Experimental arms each had a safety lead-in phase of 10 patients,” Suarez Rodriguez explained.

Patients with histologically confirmed locally advanced or metastatic ccRCC as measurable by RECIST v1.1, no prior systemic therapy for advanced RCC, and a KPS score of at least 70% were eligible for the study. Following the safety lead-in phase, the study entered the randomized phase. In this phase, patients were randomly assigned to 2:1 to 1 of 5 arms. Arm 1 included coformulated favezelimab/pembrolizumab 800mg/200 mg intravenously every 3 weeks, and lenvatinib 20 mg orally once daily. Arm 2 included coformulated vibostolimab/pembrolizumab 200/200 mg IV every 3 weeks plus belzutifan 120 mg orally once daily. Arm 3 included coformulated quavonlimab/pembrolizumab 25 mg/400 mg IV every 6 weeks plus lenvatinib 20 mg orally once daily. Arm 4 included belzutifan 120 mg orally once daily plus pembrolizumab 400 mg IV every 6 weeks, plus lenvatinib 20 mg orally once daily. A concurrent reference arm included pembrolizumab 400 IV every 6 weeks plus lenvatinib 20 mg orally once daily.

Primary end points were overall responsive rate (ORR) as measured by RECIST v1.1 by blinded independent central review (BICR), as well as safety. Secondary end points included duration of response (DOR) and progression-free survival by RECIST v1.1 by BICR, as well as overall survival (OS).

Suarez Rodriguez reported ORR for the arms as follows:

• Arm 1: At a median follow-up of 39.2 months (range, 28.8-44.6 months), ORR was 62.7% (95% CI: 48.1-75.9).

• Arm 2: At a median follow-up of 16.4 months (range, 11.8-23.4 months), ORR was 42.5% (95% CI: 31.5-54.1).

• Arm 3: At a median follow-up of 22.1 months (range, 13.5-40.6 months), ORR was 71.3% (95% CI: 60.0-80.8).

• Arm 4: At a median follow-up of 23.4 months (range, 14.1-41.0 months), ORR was 77.5% (95% CI: 66.8-86.1).

• Reference arm: At a median follow-up of 21.2 months (range, 11.9-44.4 months), ORR was 80.6% (95% CI: 68.6-89.6).

Complete response was observed in 5 (9.8%), 4 (5.0%), 5 (6.3%), 10 (12.5%), and 4 (6.5%) patients across the respective arms.

In arm 1, DOR and PFS were found to be numerically similar to the reference arm, Suarez Rodriguez reported. The treatment regimen of arm 2 was found to be not superior to the reference arm. For arm 3, median DOR was 25.0 months (range, 2.4-37.1+ months) in arm 3 and 25.6 months (range, 1.4+-27.6 months) in the reference arm.

Arm 4 “showed a median duration of response of 33 months vs 26 months in the reference arm,” Suarez Rodriguez said. Median PFS was 31.8 months (95% CI: 26.3-NR) in arm 4 vs 20.8 months (95% CI: 12.4-29.0) in the reference arm (HR, 0.45, 95% CI: 0.25-0.83). OS was not reached in either arm.

Suarez Rodriguez also discussed safety across the regimens. Arm 1 had the highest incidence of grade 3 or higher adverse events (AEs) (86.9%), followed by arm 3 (73.3%), the reference arm (71.0%), arm 4 (70.0%), and arm 2 (68.9%). Arm 1 had the highest rate of treatment-related AEs (37.7%), followed by arm 3 (34.4%), arm 2 (31.1%), the reference arm (30.6%), and arm 4 (24.4%). Serious treatment-related AEs were highest in arm 1 (36.1%) followed by arm 3 (34.4%), the reference arm (30.6%), arm 2 (27.8%), and arm 4 (22.2%).

“As expected, the most common adverse event observed in the combination arms containing lenvatinib was hypertension. The most common adverse event in the combinations containing belzutifan was anemia,” Suarez Rodriguez said.

“In conclusion, observed efficacy of pembrolizumab plus lenvatinib were confirmatory of prior observations for this combination. Belzutifan/pembrolizumab plus lenvatinib and the anti-CTLA-4 combination had similar overall response rate compared to pembrolizumab/lenvatinib as first-line therapy in patients with previously untreated advanced clear cell renal cell carcinoma. Responses were potentially less favorable in the anti-LAG-3 and anti-TIGIT arms. Belzutifan plus pembrolizumab plus lenvatinib, but not the other investigative arms, may have been associated with a higher proportion of complete response, prolonged duration of response, and prolonged progression-free survival compared to pembrolizumab plus lenvatinib,” Suarez Rodriguez said in her concluding remarks.

Suarez Rodriguez also noted that belzutifan plus pembrolizumab plus lenvatinib and quavonlimab/pembrolizumab plus pembrolizumab are being evaluated in the phase 3 LITESPARK-012 study (NCT047367706).

DISCLOSURES: Suarez Rodriguez noted research funding and medical writing support from Merck Sharp & Dohme (MSD) LLC; research funding from Bristol Myers Squibb, Ipsen, Pfizer, and Roche; advisory board membership with Astellas, AstraZeneca, Bristol Myers Squibb, and MSD; travel accommodations from Bayer, speakers’ bureau membership with AstraZeneca, Astellas, Bristol Myers Squibb, Ipsen, and MSD; an invited speaker for Bristol Myers Squibb and MSD; and expert testimony for Bristol Myers Squibb and MSD.

Reference

1. Suarez Rodriguez C, Rojas CI, Shin SJ, et al. First-line pembrolizumab-based regimens for advanced clear cell renal cell carcinoma: KEYMAKER-U03 substudy 03A. Presented at: European Society for Medical Oncology Congress. October 17-21, 2025. Berlin, Germany. Abstract LBA96. https://s3.eu-central-1.amazonaws.com/m-anage.com.storage.esmo/static/esmo2025_abstracts/LBA96.html.pdf

Continue Reading

-

Lenvatinib/Everolimus Beats Cabozantinib in Phase 2 RCC Study

The combination of lenvatinib (Lenvima) and everolimus (Afinitor) reduced the risk of progression or death by 49% compared with cabozantinib (Cabometyx) for patients with metastatic clear cell renal cell carcinoma (ccRCC) following progression on a PD-1 inhibitor, according to findings from a phase 2 study presented at the

European Society for Medical Oncology Congress 2025 and simultaneously published in the Annals of Oncology.1,2In the multicenter phase 2 study, the median progression-free survival (PFS), which was the primary end point of the study, was 15.7 months with the combination of lenvatinib plus everolimus compared with 10.2 months with cabozantinib (HR, 0.51; 95% CI, 0.29-0.89; P = .02). There were more adverse events (AEs) observed with the combination, but these differences were not deemed statistically significant. Grade 3/4 AEs were experienced by 67.5% of those treated with lenvatinib plus everolimus compared with 50% of those receiving cabozantinib (odds ratio [OR], 2.08; 95% CI, 0.86-5.02).

“Lenvatinib plus everolimus significantly prolonged progression-free survival over cabozantinib,” Andrew W. Hahn, MD, Department of Genitourinary Medical Oncology, Division of Cancer Medicine, The University of Texas MD Anderson Cancer Center, said during a presentation of the results. “As the first head-to-head randomized comparison of contemporary second-line or later treatments after immune checkpoint inhibition, these results are relevant to treatment sequencing and inform oncology practice.”

The study enrolled 86 patients, with 40 receiving the combination and 46 receiving cabozantinib. For the combination arm, lenvatinib was administered at 18 mg per day and everolimus was given at 5 mg per day. Cabozantinib was administered at 60 mg per day. The most common prior treatment was the combination of nivolumab (Opdivo) and ipilimumab (Yervoy), which was received by 70.9% of patients enrolled in the study. This was followed by the combination of pembrolizumab (Keytruda) and axitinib (Inlyta) for 16.3%, adjuvant pembrolizumab for 4.7%, and any other checkpoint inhibitor for 8.1%.

Baseline characteristics were well balanced between the groups with most patients (69.8%) in each group having received 1 prior line of therapy and 30.2% having received 2 prior lines of therapy. Nearly half of patients had received prior VEGF-targeted therapy (45% for the combination arm and 41.3% for the single agent group). The IMDC risk was primarily intermediate in both groups (80% for combination and 73.9% for single agent). The IMDC risk was poor for 7.5% of those in the combination arm and for 8.7% of those in the control arm.

The objective response rate was 52.6% with lenvatinib plus everolimus compared with 38.6% with cabozantinib. Although numerically higher, this rate did not pass the bar for statistical significance (OR, 1.87; 95% CI, 0.75-4.6; P = .17). In addition to responses, stable disease was observed in 39.5% of those receiving the combination and for 54.5% of those in the single-agent arm.

The study was not designed to assess differences in overall survival (OS) and findings for this end point were still immature, Hahn noted. After a median of 20 months of follow-up, there had been 11 events in the combination arm and 13 in the control group. The 1-year OS probability was 87.0% with lenvatinib plus everolimus compared with 84.6% with cabozantinib (HR, 1.05; 95% CI, 0.47-2.38; P = .86).

Serious AEs were experienced by 27.5% of those treated with lenvatinib plus everolimus compared with 19.6% of those in the cabozantinib arm (OR, 1.56; 95% CI, 0.57-4.24). Dose interruptions were necessary for 70% of those in the combination arm compared with 78.3% of those in the cabozantinib group (OR, 0.65; 0.24-1.73). Dose reductions were necessary for 57% and 60.9% of those in the combination and control arm, respectively (OR, 0.80; 95% CI, 0.33-1.93). Treatment discontinuation was more common in the combination group at 20% compared with the single agent at 10.9% (OR, 2.05; 95% CI, 0.61-6.91).

“Of the 8 patients who discontinued treatment with lenvatinib plus everolimus, 5 of those were due to proteinuria,” said Hahn.

The most commonly observed AEs in the study aligned with those historically associated with each agent, Hahn noted. For the combination and single agent arms, respectively, the most common all-grade AEs were diarrhea (70% vs 73.9%), fatigue (72.5% vs 60.9%), proteinuria (65% vs 37%), hypertension (57.5% vs 39.1%), nausea (40% vs 39.1%), palmar-plantar erythrodysesthesia (20% vs 52.2%), vomiting (32.5% vs 34.8%), and oral mucositis (15% vs 43.5%).

“This is a positive phase 2 trial and demonstrates improved PFS and response compared with cabozantinib, but with higher toxicity,” said invited discussant Lisa M. Pickering, consultant medical oncologist at The Royal Marsden, MD, PhD, FRCP. “So, is it positive enough? I think that depends on you and your patient, but I would say that we can and should consider using lenvatinib/everolimus, particularly in patients for whom the priority is response and to who the toxicity rate is acceptable.”

The combination of lenvatinib and everolimus was approved by the FDA in 2016 for the treatment of patients with advanced RCC after a prior anti-angiogenic agent.3 The phase 2 study was completed to assess the combination in a more contemporary treatment setting, Hahn noted.

References

- Hahn AW, Chahoud J, Skelton W, et al. LenCabo: A randomized phase II multicenter trial of lenvatinib plus everolimus (len/eve) versus (vs) cabozantinib (cabo) in patients (pts) with metastatic clear cell RCC (ccRCC) that progressed on PD-1 immune checkpoint inhibition (ICI). Presented at: 2025 ESMO Congress; October 17-21, 2025; Berlin, Germany. Abstract LBA94.

- Hahn AW, Chahoud J, Skelton WP, et al. A multicenter randomized phase II trial of lenvatinib plus everolimus versus cabozantinib in patients with metastatic clear cell RCC that progressed on PD-1 immune checkpoint inhibition (LenCabo). Ann Oncol. 2025. Doi:10.1016/j.annonc.2025.10.009.

- Lenvatinib in combination with Everolimus. FDA. May 16, 2016. Accessed October 18, 2025. https://www.fda.gov/drugs/resources-information-approved-drugs/lenvatinib-combination-everolimus

Continue Reading

-

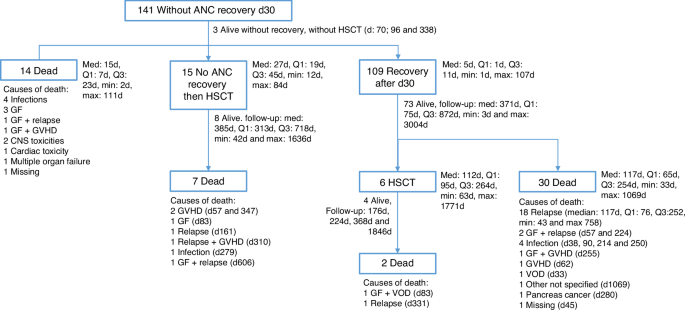

Outcomes of primary graft failure in acute myeloid leukemia patients following unrelated transplantation with post-transplant cyclophosphamide: a study from the ALWP/EBMT

Bolaños-Meade J, Hamadani M, Wu J, Al Malki MM, Martens MJ, Runaas L, et al. Post-transplantation cyclophosphamide-based graft-versus-host disease prophylaxis. N Engl J Med. 2023;388:2338–48.

Google Scholar

Broers AEC, de Jong CN, Bakunina K, Hazenberg MD, van Marwijk Kooy M, et al. Posttransplant cyclophosphamide for prevention of graft-versus-host disease: results of the prospective randomized HOVON-96 trial. Blood Adv. 2022;6:3378–85.

Google Scholar

Battipaglia G, Labopin M, Kröger N, Vitek A, Afanasyev B, Hilgendorf I, et al. Posttransplant cyclophosphamide vs antithymocyte globulin in HLA-mismatched unrelated donor transplantation. Blood. 2019;134:892–9.

Google Scholar

Brissot E, Labopin M, Moiseev I, Cornelissen JJ, Meijer E, Van Gorkom G, et al. Post-transplant cyclophosphamide versus antithymocyte globulin in patients with acute myeloid leukemia in first complete remission undergoing allogeneic stem cell transplantation from 10/10 HLA-matched unrelated donors. J Hematol Oncol. 2020;13:87.

Google Scholar

Nagler A, Labopin M, Swoboda R, Schroeder T, Hamladji RM, Griskevicius L, et al. Post-transplant cyclophosphamide, calcineurin inhibitor, and mycophenolate mofetil compared to anti-thymocyte globulin, calcineurin inhibitor, and methotrexate combinations as graft-versus-host disease prophylaxis after allogeneic stem cell transplantation. Bone Marrow Transpl. 2024;59:1012–21.

Google Scholar

Penack O, Abouqateb M, Peczynski C, Boreland W, Gülbas Z, Gedde-Dahl T, et al. PTCy versus ATG as graft-versus-host disease prophylaxis in mismatched unrelated stem cell transplantation. Blood Cancer J. 2024;14:45.

Google Scholar

Penack O, Abouqateb M, Peczynski C, Boreland W, Kröger N, Stelljes M, et al. ATG or post-transplant cyclophosphamide to prevent GVHD in matched unrelated stem cell transplantation? Leukemia. 2024;38:1156–63

Ngo D, Samuels D, Chen J, Koller PB, Al Malki MM. A clinical review of the different strategies to minimize hemorrhagic cystitis associated with the use of post-transplantation cyclophosphamide in an allogeneic transplant. Transplant Cell Ther. 2022;28:349–54.

Google Scholar

Duléry R, Mohty R, Labopin M, Sestili S, Malard F, Brissot E, et al. Early cardiac toxicity associated with post-transplant cyclophosphamide in allogeneic stem cell transplantation. JACC Cardio Oncol. 2021;3:250–9.

Google Scholar

Rambaldi B, Kim HT, Reynolds C, Chamling Rai S, Arihara Y, et al. Impaired T- and NK-cell reconstitution after haploidentical HCT with posttransplant cyclophosphamide. Blood Adv. 2021;5:352–5364.

Google Scholar

Irene GC, Albert E, Anna BV, Rahinatu A, Silvana N, Silvana S, et al. Patterns of infection and infection-related mortality in patients receiving post-transplant high-dose cyclophosphamide as graft-versus-host-disease prophylaxis: impact of HLA donor matching. Bone Marrow Transpl. 2021;56:818–27.

Google Scholar

Mehta RS, Saliba RM, Chen J, Rondon G, Hammerstrom AE, Alousi A, et al. Post-transplantation cyclophosphamide versus conventional graft-versus-host disease prophylaxis in mismatched unrelated donor haematopoietic cell transplantation. Br J Haematol. 2016;173:444–55.

Google Scholar

Salas MQ, Eikema DJ, Koster L, Maertens J, Passweg J, Finke J, et al. Impact of post-transplant cyclophosphamide (PTCy)-based prophylaxis in matched sibling donor allogeneic haematopoietic cell transplantation for patients with myelodysplastic syndrome: a retrospective study on behalf of the Chronic Malignancies Working Party of the EBMT. Bone Marrow Transpl. 2024;59:479–88.

Google Scholar

Battipaglia G, Labopin M, Hamladji RM, Blaise D, Chevallier P, Brissot E, et al. Post-transplantation cyclophosphamide versus antithymocyte globulin in patients with acute myeloid leukemia undergoing allogeneic stem cell transplantation from HLA-identical sibling donors: a retrospective analysis from the Acute Leukemia Working Party of the European Society for Blood and Marrow Transplantation. Cancer. 2021;127:209–18

Modi D, Kondrat K, Kim S, Deol A, Ayash L, Ratanatharathorn V, et al. Post-transplant cyclophosphamide versus thymoglobulin in HLA-mismatched unrelated donor transplant for acute myelogenous leukemia and myelodysplastic syndrome. Transplant Cell Ther. 2021;27:760–7.

Google Scholar

Nagler A, Ngoya M, Galimard JE, Labopin M, Blau IW, Kröger N, et al. Comparable relapse incidence after unrelated allogeneic stem cell transplantation with post-transplant cyclophosphamide versus conventional anti-graft versus host disease prophylaxis in patients with acute myeloid leukemia: a study on behalf of the Acute Leukemia Working Party of the European Society for Blood and Marrow Transplantation. Am J Hematol. 2024;99:1732–45.

Google Scholar

Kharfan-Dabaja MA, Kumar A, Ayala E, Aljurf M, Nishihori T, Marsh R, et al. Standardizing definitions of hematopoietic recovery, graft rejection, graft failure, poor graft function, and donor chimerism in allogeneic hematopoietic cell transplantation: a Report on behalf of the American Society for Transplantation and Cellular Therapy. Transplant Cell Ther. 2021;27:642–9.

Google Scholar

Olsson R, Remberger M, Schaffer M, Berggren DM, Svahn BM, Mattsson J, et al. Graft failure in the modern era of allogeneic hematopoietic SCT. Bone Marrow Transpl. 2013;48:537–43.

Google Scholar

Chen J, Pang A, Zhao Y, Liu L, Ma R, Wei J, et al. Primary graft failure following allogeneic hematopoietic stem cell transplantation: risk factors, treatment, and outcomes. Hematology. 2022;27:293–9.

Google Scholar

Park JH, Lee JH, Lee JH, Park HS, Choi EJ, Kang YA, et al. Incidence, management, and prognosis of graft failure and autologous reconstitution after allogeneic hematopoietic stem cell transplantation. J Korean Med Sci. 2021;36:e151.

Google Scholar

Davies SM, Kollman C, Anasetti C, Antin JH, Gajewski J, Casper JT, et al. Engraftment and survival after unrelated-donor bone marrow transplantation: a report from the National Marrow Donor Program. Blood. 2000;96:4096–102.

Google Scholar

Rubinstein P, Carrier C, Scaradavou A, Kurtzberg J, Adamson J, Migliaccio AR, et al. Outcomes among 562 recipients of placental-blood transplants from unrelated donors. N Engl J Med. 1998;339:1565–77.

Google Scholar

Chakrabarty JH, Glover J, Schmidt S, Phan M, Bycko M, Duong Q, et al. Incidence and risk factors for graft failure in the modern era of cord blood transplantation. Vox Sang. 2022;117:1405–10.

Google Scholar

Ciurea SO, Cao K, Fernandez-Vina M, Kongtim P, Malki MA, Fuchs E, et al. The European Society for Blood and Marrow Transplantation (EBMT) consensus guidelines for the detection and treatment of donor-specific anti-HLA antibodies (DSA) in haploidentical hematopoietic cell transplantation. Bone Marrow Transpl. 2018;53:521–34.

Google Scholar

Guru Murthy GS, Logan BR, Bo-Subait S, Beitinjaneh A, Devine S, Farhadfar N, et al. Association of ABO mismatch with the outcomes of allogeneic hematopoietic cell transplantation for acute leukemia. Am J Hematol. 2023;98:608–19.

Google Scholar

Cluzeau T, Lambert J, Raus N, Dessaux K, Absi L, Delbos F, et al. Risk factors and outcome of graft failure after HLA-matched and mismatched unrelated donor hematopoietic stem cell transplantation: a study on behalf of SFGM-TC and SFHI. Bone Marrow Transpl. 2016;51:687–91.

Google Scholar

Ferrà C, Sanz J, Díaz-Pérez MA, Morgades M, Gayoso J, Cabrera JR, et al. Outcome of graft failure after allogeneic stem cell transplant: study of 89 patients. Leuk Lymphoma. 2015;56:656–62.

Google Scholar

Aversa F, Tabilio A, Velardi A, Cunningham I, Terenzi A, Falzetti F, et al. Treatment of high-risk acute leukemia with T-cell-depleted stem cells from related donors with one fully mismatched HLA haplotype. N Engl J Med. 1998;339:1186–93.

Google Scholar

Mayumi H, Umesue M, Nomoto K. Cyclophosphamide-induced immunological tolerance: an overview. Immunobiology. 1996;195:129–39.

Google Scholar

Aversa F, Lustig EB, Geva NO, Prezioso L, Bonomini S, Manfra I, et al. Immune tolerance induction by nonmyeloablative haploidentical HSCT combining T-cell depletion and posttransplant cyclophosphamide. Blood Adv. 2017;1:2166–75.

Google Scholar

Hoff FW, Chung SS, Patel PA, Permnath N, Khatib J, Ovcina MT, et al. Post-transplant cyclophosphamide and early mixed donor Chimerism in myeloid malignancies: a single-center experience. Transpl Immunol. 2023;77:101808.

Google Scholar

Marco- Ayala J, Sanz JM, Seguí IG, Balaguer-Rosello A, Montoro J, Guerreiro M, et al. Impact of post-transplantation cyclophosphamide on transfusion requirements in HLA-matched sibling peripheral blood stem cell transplantation. Transplant Cell Ther. 2023;29:313.e1–313.e.

Google Scholar

Luznik L, O’Donnell PV, Symons HJ, Chen AR, Leffell MS, Zahurak M, et al. HLA-haploidentical bone marrow transplantation for hematologic malignancies using nonmyeloablative conditioning and high-dose, post-transplantation cyclophosphamide. Biol Blood Marrow Transpl. 2008;14:641–50.

Google Scholar

Ruggeri A, Labopin M, Angelucci E, Blaise D, Ciceri F, Koc Y, et al. Prognostic factors for neutrophil engraftment after haploidentical cell transplantation with PT-Cy in patients with acute myeloid leukemia in complete remission, on behalf of the ALWP-EBMT. Bone Marrow Transpl. 2021;56:1842–9.

Google Scholar

Bacigalupo A, Ballen K, Rizzo D, Giralt S, Lazarus H, Ho V, et al. Defining the intensity of conditioning regimens: working definitions. Biol Blood Marrow Transpl. 2009;15:1628–33.

Google Scholar

Przepiorka D, Weisdorf D, Martin P, Klingemann HG, Beatty P, Hows J, et al. 1994 consensus conference on acute GVHD grading. Bone Marrow Transpl. 1995;15:825–8.

Shulman HM, Sullivan KM, Weiden PL, McDonald GB, Striker GE, Sale GE, et al. Chronic graft-versus-host syndrome in man. A long-term clinicopathologic study of 20 Seattle patients. Am J Med. 1980;69:204–17.

Google Scholar

Kanate AS, Nagler A, Savani B. Summary of scientific and statistical methods, study endpoints, and definitions for observational and registry-based studies in hematopoietic cell transplantation. Clin Hematol Int. 2019;2:2–4.

Google Scholar

R Core Team. R: a language and environment for statistical computing. R Foundation for Statistical Computing; 2020.https://www.R-project.org/

Nagler A, Labopin M, Swoboda R, Kulagin A, Velardi A, Sanz J, et al. Long-term outcome of second allogeneic hematopoietic stem cell transplantation (HSCT2) for primary graft failure in patients with acute leukemia in remission: A study on behalf of the Acute Leukemia Working Party of the European Society for Blood and Marrow Transplantation. Bone Marrow Transpl. 2023;58:1008–16.

Google Scholar

Schriber J, Agovi MA, Ho V, Ballen KK, Bacigalupo A, Lazarus HM, et al. Second unrelated donor hematopoietic cell transplantation for primary graft failure. Biol Blood Marrow Transpl. 2010;16:1099–106.

Google Scholar

Shouval R, Fein JA, Labopin M, Kröger N, Duarte RF, Bader P, et al. Outcomes of allogeneic haematopoietic stem cell transplantation from HLA-matched and alternative donors: a European Society for Blood and Marrow Transplantation registry retrospective analysis. Lancet Haematol. 2019;6:e573–584.

Google Scholar

Canaani J, Beohou E, Labopin M, Ghavamzadeh A, Beelen D, Hamladji RM, et al. Trends in patient outcome over the past two decades following allogeneic stem cell transplantation for acute myeloid leukaemia: an ALWP/EBMT analysis. J Intern Med. 2019;285:407–18.

Google Scholar

Penack O, Peczynski C, Mohty M, Yakoub-Agha I, Styczynski J, Montoto S, et al. How much has allogeneic stem cell transplant-related mortality improved since the 1980s? A retrospective analysis from the EBMT. Blood Adv. 2020;4:6283–90.

Google Scholar

Schmälter AK, Ngoya M, Galimard JE, Bazarbachi A, Finke J, Kröger N, et al. Continuously improving outcome over time after second allogeneic stem cell transplantation in relapsed acute myeloid leukemia: an EBMT registry analysis of 1540 patients. Blood Cancer J. 2024;14:76.

Google Scholar

Wachsmuth LP, Patterson MT, Eckhaus MA, Venzon DJ, Gress RE, Kanakry CG. Post-transplantation cyclophosphamide prevents graft-versus-host disease by inducing alloreactive T-cell dysfunction and suppression. J Clin Invest. 2019;129:2357–73.

Google Scholar

Kanakry CG, Ganguly S, Zahurak M, Bolaños-Meade J, Thoburn C, Perkins B, et al. Aldehyde dehydrogenase expression drives human regulatory T cell resistance to post-transplantation cyclophosphamide. Sci Transl Med. 2013;5:211ra157.

Google Scholar

McCurdy SR, Radojcic V, Tsai HL, Vulic A, Thompson E, Ivcevic S, et al. Signatures of GVHD and relapse after posttransplant cyclophosphamide revealed by immune profiling and machine learning. Blood. 2022;139:608–23.

Google Scholar

Zhao C, Bartock M, Jia B, Shah N, Claxton DF, Wirk B, et al. Post-transplant cyclophosphamide alters immune signatures and leads to impaired T cell reconstitution in allogeneic hematopoietic stem cell transplant. J Hematol Oncol. 2022;15:64.

Google Scholar

Sawyer J, Elliott T, Orton L, Sowell H, Gatwood K, Shultes K. Prevention and management of acute toxicities from conditioning regimens during hematopoietic stem cell transplantation. Clin Hematol Int. 2024;6:1–10.

Google Scholar

Hickey CL, Zhang MJ, Allbee-Johnson M, Romee R, Majhail NS, Malki MMA, et al. Donor type does not impact late graft failure following reduced-intensity allogeneic hematopoietic cell transplantation with post-transplant cyclophosphamide-based graft-versus-host disease prophylaxis. Transplant Cell Ther. 2025;31:174.e1–12.

Google Scholar

Giammarco S, Raiola AM, Di Grazia C, Bregante S, Gualandi F, Varaldo R, et al. Second haploidentical stem cell transplantation for primary graft failure. Bone Marrow Transpl. 2021;56:1291–6.

Google Scholar

Harada K, Fuji S, Seo S, Kanda J, Ueki T, Kimura F, et al. Comparison of the outcomes after haploidentical and cord blood salvage transplantations for graft failure following allogeneic hematopoietic stem cell transplantation. Bone Marrow Transpl. 2020;55:1784–95.

Google Scholar

Mata JR, Zahurak M, Rosen N, DeZern AE, Jones RJ, Ambinder AJ. Graft failure incidence, risk factors, and outcomes in patients undergoing non-myeloablative allogeneic hematopoietic cell transplantation using post-transplant cyclophosphamide. Transplant Cell Ther. 2024;30:588–96.

Google Scholar

Gooptu M, Romee R, St Martin A, Arora M, Al Malki M, Antin JH, et al. HLA-haploidentical vs matched unrelated donor transplants with posttransplant cyclophosphamide-based prophylaxis. Blood. 2021;138:273–82.

Google Scholar

Continue Reading

-

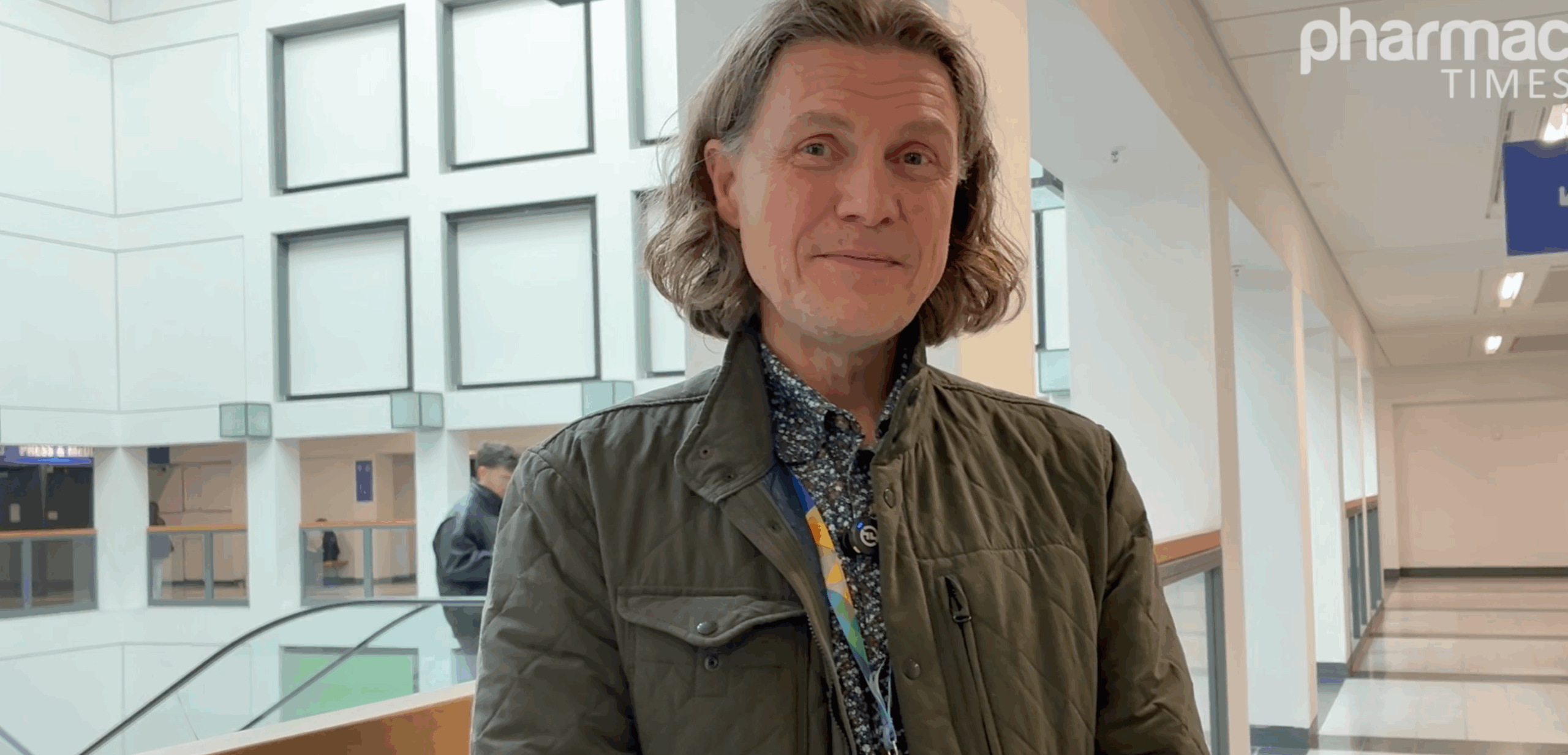

Expert Discusses Early Safety and Tolerability Findings for VMT-α-NET in Neuroendocrine Tumors | ESMO 2025

Q: Could you walk us through the key safety and tolerability findings from the dose-finding cohorts (1 and 2)? Were there any dose-limiting toxicities, and how manageable were they in this patient population?

Thor Halfdanarson, MD: Absolutely. So, in terms of the safety profile, there were relatively few grade 3 toxicities, and overall, the drug is very well tolerated. There were no new safety signals. Obviously, as always, we get concerned about kidney function and bone marrow involvement by the radioligand, but we didn’t really see any of that.

In terms of renal function, creatinine—the indicator of renal function—was stable in patients following treatment. There were no obvious kidney signals. Therefore, for kidney toxicity, same thing with the bone marrow and the blood counts—everything seemed to hold up really nicely.

So, nothing unexpected. As we’ve seen with other alpha particle therapies, there is more hair loss, but typically mild in patients undergoing latitude 12 alpha, VMT alpha NET, and it’s similar with other radioligand therapies testing alpha. There is a little bit of nausea, mostly mild, but in terms of other organ toxicities, not a whole lot.

Q: Do you have data on the pharmacokinetics, tumor uptake, normal organ distribution, and clearance of ^212Pb-VMT-α-NET? How consistent was tumor targeting across patients?

Halfdanarson: We have limited information on that yet. We did collect those data in a subset of the patients enrolled, but we haven’t looked at it in a systematic way yet, so we are not reporting that at ESMO. That’s definitely to be reported later.

What we do know is that a subset of the patients had tumors that did not uniformly light up on somatostatin receptor imaging and were included in the trial because the inclusion criteria didn’t require uniform expression—and they seemed to derive benefit as well. So, in terms of pharmacokinetics and more advanced dosimetry data, that’s yet to come.

Q: Based on the safety and preliminary efficacy, what is the recommended phase 2 dose (or dose expansion dose) you intend to move forward with? What factors drove that decision?

Halfdanarson: We are not yet at a point with the recommended phase 2 dose. We are up to 5 millicurie in the largest expansion cohort, and then there is one cohort above that with 6 millicurie, which I believe has eight patients on it. We have not yet reported in full in terms of efficacy and toxicity. So, I would suspect that it falls somewhere between five and six, depending on what the third and highest dose cohort shows.

Continue Reading

-

While shareholders of XP (NASDAQ:XP) are in the red over the last five years, underlying earnings have actually grown

Generally speaking long term investing is the way to go. But no-one is immune from buying too high. To wit, the XP Inc. (NASDAQ:XP) share price managed to fall 62% over five long years. That is extremely sub-optimal, to say the least. More recently, the share price has dropped a further 17% in a month.

The recent uptick of 4.7% could be a positive sign of things to come, so let’s take a look at historical fundamentals.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10bn in marketcap – there is still time to get in early.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate half decade during which the share price slipped, XP actually saw its earnings per share (EPS) improve by 26% per year. So it doesn’t seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

Because of the sharp contrast between the EPS growth rate and the share price growth, we’re inclined to look to other metrics to understand the changing market sentiment around the stock.

We note that the dividend has remained healthy, so that wouldn’t really explain the share price drop. While it’s not completely obvious why the share price is down, a closer look at the company’s history might help explain it.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

NasdaqGS:XP Earnings and Revenue Growth October 18th 2025 XP is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It’s fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for XP the TSR over the last 5 years was -58%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

Continue Reading

-

5 bubble-resistant tech stocks to guard your portfolio from an AI crash

By Christine Ji and Philip van Doorn

At a time where some companies are seeing declining free cash flow due to AI spending, these five tech stocks are doing the opposite

Investors looking to hedge against an AI downturn should consider looking at a company’s free cash flow yield.

Announcements of deals with OpenAI have sent shares of chip makers Advanced Micro Devices Inc. (AMD) and Broadcom Inc. (AVGO) soaring, while nuclear-energy stock Oklo Inc. (OKLO) has rallied almost 1,000% in the last year – despite having no revenues – on hopes that nuclear power will help meet the energy needs of artificial-intelligence infrastructure.

In a market trading on future potential instead of current fundamentals, many investors are wondering if the AI trade is overheating. And if AI is indeed becoming a bubble, what can you do to protect your portfolio?

There are still ways to play the AI trade in a less speculative way by focusing on a company’s fundamentals. Ted Mortonson, managing director at Baird, has his eyes on one metric: free cash flow, or the money left over after a company spends on its operations and capital assets.

A company’s free-cash-flow yield – or how much free cash flow it generates divided by its total market capitalization – gives investors a way to compare how much cash is returned for every dollar invested in the stock. While massive AI capital expenditures are seeing free cash flows at Big Tech companies trend downward or turn negative, other areas of the market are seeing the opposite effect.

If demand for AI products fails to live up to current expectations, it’ll be hard to avoid a widespread stock-market decline. Market concentration among the “Magnificent Seven” megacap tech stocks has reached record levels, and the AI theme has boosted valuations across all parts of the economy.

Yet companies with growing free cash flows will be better positioned to weather a potential downturn than those without.

Screening for tech stocks with high free-cash-flow yields

To begin this screen, we started with the 70 components of the S&P 500’s SPX information-technology sector XX:SP500.45. What might surprise you about this sector is that it excludes some of the largest tech-oriented companies such as Meta Platforms Inc. (META) and Alphabet Inc. (GOOGL) (GOOG), both of which are in the communications-services sector XX:SP500.50.

To bring those companies in, we added the 45 components of the Nasdaq-100 Technology Sector index XX:NDXT (a subset of the Nasdaq-100 index NDX) to our initial list. After removing duplicates, this left us with 82 stocks.

We screened for estimated free-cash-flow yields based on current share prices and consensus 2026 estimates for free cash flow per share among analysts polled by LSEG. The estimates are adjusted for the calendar year for companies whose fiscal reporting periods don’t match the calendar. Since consensus 2026 FCF estimates weren’t available for 10 of the companies, we were left with 72 stocks.

Some of these companies pay dividends – and since no management team wants to lower dividend payouts because of the dire effect that doing so can have on a stock’s price, we subtracted the dividend yields from the expected FCF yields for estimated 2026 FCF “headroom.” The idea is that the headroom is cash that the companies are free to use to fund expansion, raise dividends, buy back shares or for other corporate purposes that would hopefully benefit shareholders.

Here are the 20 stocks passing the screen with the highest expected 2026 free-cash-flow headroom:

Name Ticker Forward P/E Estimated 2026 FCF headroom Estimated 2026 FCF yield Dividend yield PDD Holdings Inc. PDD 11.4 12.59% 12.59% 0.00% GoDaddy Inc. GDDY 18.4 9.78% 9.78% 0.00% Akamai Technologies Inc. AKAM 10.4 8.48% 8.48% 0.00% ON Semiconductor Corp. ON 18.9 8.02% 8.02% 0.00% Adobe Inc. ADBE 14.1 7.74% 7.74% 0.00% Cognizant Technology Solutions Corp. CTSH 12.0 6.83% 8.72% 1.89% Gartner Inc. IT 18.2 6.82% 6.82% 0.00% First Solar Inc. FSLR 11.0 6.68% 6.68% 0.00% Dell Technologies Inc. DELL 14.0 6.60% 7.99% 1.39% GlobalFoundries Inc. GFS 18.2 6.55% 6.55% 0.00% Gen Digital Inc. GEN 9.7 6.55% 8.44% 1.89% Zebra Technologies Corp. ZBRA 16.8 6.06% 6.06% 0.00% Salesforce Inc. CRM 19.7 5.90% 6.58% 0.68% Qualcomm Inc. QCOM 13.6 5.86% 8.03% 2.17% F5 Inc. FFIV 17.9 5.84% 5.84% 0.00% Skyworks Solutions Inc. SWKS 17.4 5.83% 9.64% 3.81% Western Digital Corp. WDC 17.3 5.32% 5.64% 0.32% NetApp Inc. NTAP 14.7 5.50% 7.24% 1.74% Workday Inc. WDAY 22.3 5.20% 5.20% 0.00% Atlassian Corp. TEAM 31.9 4.87% 4.87% 0.00% Source: LSEG(You might need to scroll the table to see all of the data, or flip to a landscape view, depending on which device you are using. Click on the tickers for more information about each stock.)

Read: Tomi Kilgore’s detailed guide to the information available on the MarketWatch quote page

The table includes forward price-to-earnings ratios, which are current stock prices divided by consensus earnings-per-share estimates among analysts polled by FactSet. Most of the stocks among these 20 trade at low valuations compared with forward P/E ratios of 30.5 for the S&P 500 information-technology sector, 27.9 for the Nasdaq-100 and 23 for the full S&P 500.

Out of these 20 names, analysts are especially bullish on five, in particular: Qualcomm Inc. (QCOM), Western Digital Corp. (WDC), Dell Technologies Inc. (DELL), Atlassian Corp. (TEAM) and Salesforce Inc. (CRM)

Several of these names are hardware companies that have benefited greatly from selling the picks and shovels of the AI trade. Storage and memory businesses such as Qualcomm and Western Digital have seen demand for their products shoot up. Western Digital is one of the largest players in enterprise hard disk drives and is gaining pricing power amid this backdrop, Travis Prentice, chief investment officer of the Informed Momentum Company, recently told MarketWatch. As a result, Western Digital’s free-cash-flow yield inflected positive at the end of 2024 and has increased ever since.

Mortonson likes Qualcomm because of its “fabless” business model, which means that it designs its own chips but outsources the manufacturing. “Semiconductor companies that do not own their fabs produce an enormous amount of free cash flow,” Mortonson told MarketWatch. Additionally, Qualcomm’s products will be critical to powering AI devices at the “edge,” such as next-generation wearables, he added.

Dell is another attractive opportunity for investors looking for free cash flow. Bank of America analyst Wamsi Mohan wrote in a note last month that Dell should be able to grow its free cash flow “meaningfully” as it increases profitability on the AI servers it sells and expands its storage business.

Outside of AI hardware, the software sector also presents opportunities for robust free cash flows. Atlassian, which specializes in collaboration tools for developers, is one example. Miller Jump, vice president of equity research at Truist Securities, anticipates that Atlassian will be able to grow its free cash flow at 13.7% annually.

And Salesforce is another pick for Mortonson and BofA analyst Brad Sills. Although the stock has sold off 26% this year on fears of slow AI adoption, the company showed rising momentum with its Agentforce offering at its recent investor day. Salesforce also announced plans to repurchase $7 billion in shares over the next six months. In a note on Thursday, Sills raised the company’s free-cash-flow targets for the 2026 and 2027 fiscal years to $16.2 billion and $18.5 billion – a 2.5% and 3.7% increase, respectively.

Read: Think AI is a bubble? Here’s how to position your stock portfolio.

-Christine Ji -Philip van Doorn

This content was created by MarketWatch, which is operated by Dow Jones & Co. MarketWatch is published independently from Dow Jones Newswires and The Wall Street Journal.

(END) Dow Jones Newswires

10-18-25 0800ET

Copyright (c) 2025 Dow Jones & Company, Inc.

Continue Reading

-

RNA Sequencing Signatures May Guide Treatment Selection in Advanced ccRCC

RNA sequencing (RNAseq)-defined clusters could effectively be used to select treatment for patients with metastatic clear cell renal cell carcinoma (ccRCC), according to data from the prospective phase 2 OPTIC RCC trial (OPtimal Treatment by Invoking biologic Clusters in Renal Cell Carcinoma) trial (NCT05361720) presented at the

2025 ESMO Congress .1The OPTIC trial sought to validate RNAseq-based clusters that were defined using a machine learning model from data collected in the IMmotion 151 trial (NCT0242082).2 In the trial, those with cluster 1/2, indicating an angiogenic tumor, were treated with cabozantinib (Cabometyx) plus nivolumab (Opdivo) and demonstrated deepened clinical outcomes.

“Selection of patients exhibiting an angiogenic gene expression signature enriches for clinical outcomes to cabozantinib plus nivolumab, including high objective response rate, reduction of tumor burden for all patients, and lack of progressive disease,” Scott, M. Haake, MD, PhD, assistant professor of medicine, Division of Hematology & Oncology at Vanderbilt School of Medicine, said during a presentation of the data.

What were the results of the OPTIC RCC trial?

The study met its primary end point with an objective response rate (ORR) of 76% among patients with cluster 1/2 tumors treated with cabozantinib plus nivolumab. Responses included 2 patients with a complete response (8%), 17 with partial responses (68%), 6 with stable disease (24%), and no patients with progressive disease.

“Of the 6 patients with stable disease, 3 just missed the criteria for objective response, but are very close at 27%, 27%, and 29%,” Haake noted. By RECIST criteria, a partial response is defined as a reduction of 30% or more.

In addition, 100% of tumors demonstrated tumor burden reduction, with a median reduction of 42% (range, 5%-100%).

Median follow-up was 11.1 months (range, 0.9-31.5), and as of the presentation, 17 of 27 patients remained on the study.

Further, the investigators compared gene expression patterns for tumors with the most vs the least tumor shrinkage. Preliminary results demonstrated distinct gene expression patterns in tumors with the most tumor shrinkage, Haake said. “When we look at pathways that include these differentially expressed genes, we see several metabolic pathways are enriched in tumors with the most tumor shrinkage, an increased epithelial transition expression, correlating with decreased tumor shrinkage.”

He noted that time-to-event end points such as PFS and duration of response will require additional follow-up.

How was the OPTIC RCC trial conducted?

In the trial, patients were selected for treatment based on their RNA sequencing-defined cluster. Those with cluster 1/2, defined as angiogenic, received nivolumab/cabozantinib whereas those with cluster 4/5, defined as inflamed, would receive ipilimumab (Yervoy)/nivolumab. “[This allows] us to test the hypothesis that angiogenic tumors can enrich the response to a regimen which contains an anti-angiogenic therapy,” Haake said.

The cluster 4/5 portion of the study remained open for accrual, and findings were not presented for this group. Those with cluster 3/6/7 were excluded from the trial.

Patients were eligible for the OPTIC RCC trial if they had an ECOG performance score (PS) of 0 or 1, metastatic ccRCC without prior systemic therapy in any setting, and available tissue for RNA sequencing or cluster prediction.

ORR served as the primary end point, while secondary end points included progression-free survival (PFS), a depth of response of 80% or more at 6 months, and immune-related adverse events.

Of the 27 patients included in the analysis, patients were a median age of 68 years (range, 52-86), and the majority were male (56%), White (89%), and had an ECOG PS of 0 (70%). Of note, 41% of patients were in the favorable-risk IMDC prognostic group.

There were no patients with sarcomatoid histology, and the sites for metastasis were typical of advanced kidney cancer. “However, we should point out that there was a higher proportion of pancreatic adrenal metastases relative to other frontline studies,” Haake added.

In terms of operational logistics, the investigators improved their speed over the course of the study, optimizing the turnaround for sequencing and data analysis with a consent to cluster assignment from 40 days to 20 days. “The rate-limiting step was typically acquisition of tissue, especially when biopsies or surgical samples were obtained at outside facilities that needed to be shipped to Vanderbilt before submission,” Haake explained.

Where did the OPTIC RCC trial originate?

According to Haake, the origins of the OPTIC RCC trial started with groups of clusters defined in the randomized phase 3 IMotion 151 trial which was designed to evaluate atezolizumab plus bevacizumab vs sunitinib in patients with kidney cancer who were not previously treated.

Of the 7 clusters discovered, grouping similar tumors, cluster 1/2 exhibited a strong angiogenic gene expression signature. “Patients in these 2 clusters had favorable PFS to both the control arm and the experimental arm, possibly because both arms contain the potent anti-angiogenic therapy,” he added.

Meanwhile, cluster 4/5 demonstrated a superior response to the immune checkpoint inhibitor-containing experimental arm.

“[Therefore], the goal [of the OPTIC RCC trial] was to take these tumor clusters or gene expression signatures that retrospectively correlated with drug response and prospectively evaluate their ability to enrich for drug response,” Haake explained. “…We can do this study. We can biopsy metastatic tumors. We can isolate their mRNA, sequence them, assign them clusters and treat them according to those cluster assignments, all within the context of an interventional clinical trial.”

References

- Haake SM, Beckermann K, Barata P, et al. Efficacy of Cabozantinib and Nivolumab in Cluster 1/2 Metastatic Clear Cell Renal Cell Carcinoma: Results from OPTIC RCC, a phase II trial of a novel RNAseq-based biomarker. Presented at: 2025 ESMO Annual Congress; October 17-21, 2025; Berlin, Germany. Abstract 2591O.

- Motzer RJ, Powles T, Atkins MB, et al. Final Overall Survival and Molecular Analysis in IMmotion151, a Phase 3 Trial Comparing Atezolizumab Plus Bevacizumab vs Sunitinib in Patients With Previously Untreated Metastatic Renal Cell Carcinoma. JAMA Oncol. 2021;8(2):1–6. doi:10.1001/jamaoncol.2021.5981.

Continue Reading

-

Assessing Airbnb (ABNB) Valuation as Shares Rebound from Recent Lows

Airbnb (ABNB) shares climbed nearly 2.5% today, reflecting renewed investor interest as the stock continues to recover from its dip over the past 3 months. Recent trading momentum highlights shifting sentiment in the travel platform.

See our latest analysis for Airbnb.

Airbnb’s share price rebound this week follows several choppy months, with the stock still trailing its year-ago levels as shown by a 1-year total shareholder return of -7.7%. However, positive price action lately suggests market sentiment may be turning, as investors start focusing on the company’s long-term growth prospects.

If renewed momentum in travel platforms has you exploring fresh ideas, now is a great time to see what’s happening among fast-growing companies with strong insider backing via our fast growing stocks with high insider ownership.

But with Airbnb’s stock still trading about 10% below analyst price targets and a healthy gap to some estimates of intrinsic value, investors are left pondering whether this is the start of a bargain opportunity or if the market has already accounted for brighter days ahead.

The most widely discussed narrative on Airbnb puts its fair value well above the current share price, highlighting a major disconnect between the stock’s recovery and what long-term believers see as its true growth potential. According to TickerTickle, this valuation is anchored in big bets on the product evolution and future scale outside the US.

They have launched long-term rentals, made over 500 product improvements, and are going all in on AI to make the platform smoother. It is easier now to find the right stay without scrolling for 20 minutes.

Read the complete narrative.

Want to know why this fair value projection stands out? The hook is a turbocharged revenue mix and future margins that would put Airbnb in the top tier of consumer tech names. Only the full narrative reveals which aggressive forecasts are behind these sky-high expectations.

Result: Fair Value of $163.75 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, regulatory pressure in Europe and unresolved tax disputes in the US remain risks that could quickly alter the upside argument for Airbnb investors.

Find out about the key risks to this Airbnb narrative.

Looking from a market ratios perspective, Airbnb trades at a price-to-earnings ratio of 29.4x, which is higher than the US Hospitality industry average of 23.5x, but just below its peer group average of 31x. The fair ratio based on historical patterns comes in at 30.9x, indicating that the stock is actually near where the market could expect it to settle over time. This gap raises the question: are current expectations too high, or is there further room for upside if Airbnb outperforms?

Continue Reading

-

Meet the AI Stock That’s Crushing Nvidia and Palantir in 2025

-

Nvidia and Palantir have climbed in the double and triple digits this year as investors pile into artificial intelligence (AI) leaders.

-

This younger player is active in a new and exciting space that’s offering AI customers exactly what they need.

-

10 stocks we like better than Nebius Group ›

Nvidia (NASDAQ: NVDA) and Palantir Technologies (NASDAQ: PLTR) have been two stocks investors could count on for outsized gains over the past few years — and that continues as they both head for increases of more than 30% and about 130%, respectively, this year. This is thanks to the companies’ strengths in the artificial intelligence (AI) market.

Nvidia designs the world’s most sought-after AI chip, one that fuels the most essential AI tasks. And Palantir helps customers immediately apply AI to their operations and generate game-changing results. These companies already are benefiting from AI, and so are their customers.

In spite of these successes, Nvidia and Palantir haven’t been scoring the biggest gains among AI players in recent months. In fact, one stock in particular has left these two market giants in the dust when it comes to stock performance. Let’s meet the AI stock that’s crushing Nvidia and Palantir in 2025.

I might surprise you when I say this player, in its current form, didn’t even exist about a year and a half ago. It formed when Russian tech company Yandex sold off its Russian businesses last summer and reorganized under a new name with a headquarters in Amsterdam. I’m talking about Nebius Group (NASDAQ: NBIS), a stock that’s jumped more than 300% this year.

Nebius soared into the spotlight, offering something in high demand right now — and likely this demand will continue in the years to come. The company provides neocloud services, meaning it offers compute for AI workloads as well as a selection of managed services for customers.

This is extremely practical, as it means customers don’t have to buy their own high-powered graphics processing units (GPUs) and instead can go to Nebius to rent access to these chips. And it also saves customers time, as they don’t have to wait to ramp up a facility, but instead can take advantage of infrastructure that already exists.

Of course, Nebius competes with cloud giants such as Alphabet‘s Google Cloud and Microsoft Azure — customers can run AI workloads through those services too. But major cloud service providers offer a wide range of services beyond AI, while Nebius has focused on specifically serving the AI customer. This specialization could help it fine-tune its offering to the needs of customers and stand out. On top of this, demand for AI capacity is so strong that there is room for the major cloud providers and up-and-coming neocloud players like Nebius all to generate growth.

Continue Reading

-