Treatment with adjuvant nivolumab (Opdivo) led to a sustained disease-free survival (DFS) advantage compared with placebo in patients with muscle-invasive urothelial carcinoma (MIUC) following radical radical resection, according to 5-year follow-up findings from the phase 3 CheckMate 274 trial (NCT02632409) presented at the 2025 ESMO Congress and published concurrently in Annals of Oncology.

Among all randomly assigned patients, the median DFS was 21.9 months (95% CI, 18.8-36.9) with nivolumab vs 11.0 months (95% CI, 8.3-16.6) with placebo (HR, 0.74; 95% CI, 0.61-0.90). In each respective arm, the DFS rates were 45.1% vs 35.3% at 36 months, 41.2% vs 33.0% at 48 months, and 36.4% vs 30.9% at 60 months. In patients with a PD-L1 expression of 1% or higher, the median DFS was 55.5 months (95% CI, 25.8-66.5) in the nivolumab arm and 8.4 months (95% CI, 5.6-20.0) in the placebo arm (HR, 0.58; 95% CI, 0.42-0.79). The DFS rates in the PD-L1 expression of 1% or higher population were 56.6% vs 33.1% at 36 months, 53.9% vs 32.2% at 48 months, and 46.8% vs 32.2% at 60 months in the experimental and placebo arms, respectively.

Among all randomly assigned patients with muscle-invasive bladder cancer (MIBC), the median DFS was 25.6 months (95% CI, 19.2-42.6) with nivolumab and 9.4 months (95% CI, 7.4-13.7) with placebo (HR, 0.66; 95% CI, 0.53-0.81). The 36-month, 48-month, and 60-month DFS rates were 46.8% vs 32.3%, 42.8% vs 30.2%, and 36.7% vs 28.9%, respectively. Among patients with MIBC and a PD-L1 expression of at least 1%, the median DFS in each arm was 59.4 months (95% CI, 39.5-not evaluable [NE]) and 8.3 months (95% CI, 4.7-16.6); the DFS rates were 60.3% vs 30.7% at 36 months, 57.0% vs 30.7% at 48 months, and 48.3% vs 30.7% at 60 months (HR, 0.50; 95% CI, 0.36-0.72).

In patients with MIBC and prior receipt of cisplatin, the median DFS was 19.6 months (95% CI, 15.6-48.2) with nivolumab compared with 8.3 months (95% CI, 5.6-11.2) using placebo (HR, 0.63; 95% CI, 0.47-0.84). The DFS rates in each arm were 46.8% vs 29.3% at 36 months, 42.6% vs 27.8% at 48 months, and 33.4% vs 26.2% at 60 months. Among those without prior receipt of cisplatin for MIBC, data showed a median DFS of 25.9 months (95% CI, 19.2-55.5) vs 13.7 months (95% CI, 8.2-22.1) in each respective arm (HR, 0.70; 95% CI, 0.52-0.95). The DFS rates in each arm across this population were 46.6% vs 35.6% at 36 months, 42.8% vs 32.9% at 48 months, and 39.8% vs 31.9% at 60 months.

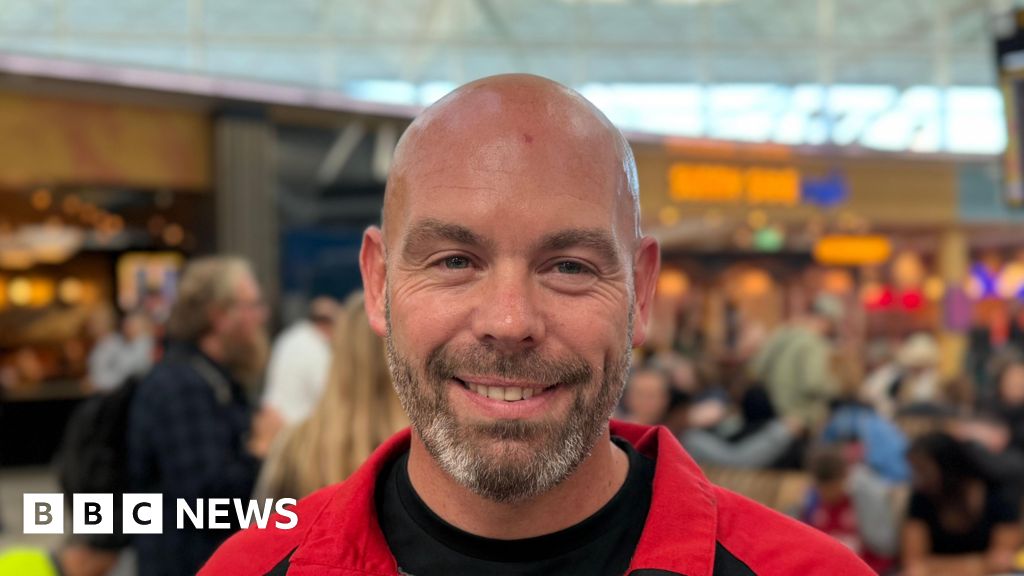

“With 5 years [of] follow-up, adjuvant nivolumab continues to show DFS benefits vs placebo in all [randomly assigned] patients and in patients with tumors PD-L1 [expression] greater than or equal to 1%. The benefits of nivolumab extended to the secondary and exploratory end points,” presenting investigator Matthew Galsky, MD, professor of Medicine (Hematology and Medical Oncology), director of Genitourinary Medical Oncology, co-director of the Center of Excellence for Bladder Cancer, and associate director for Translational Research at The Tisch Cancer Institute, stated in the presentation. “Overall, these results provide additional support for adjuvant nivolumab as a standard treatment for patients with high-risk MIUC after radical surgery.”

In the double-blind, multicenter phase 3 CheckMate 274 trial, 709 patients with high-risk MIUC were randomly assigned 1:1 to receive nivolumab at 240 mg intravenously every 2 weeks (n = 353) or matched placebo (n = 356). Investigators stratified patients by tumor PD-L1 expression status, receipt of prior neoadjuvant cisplatin-containing chemotherapy, and nodal status.

The trial’s primary end point was DFS in all randomly assigned patients and among those with a PD-L1 expression status of at least 1%. Secondary end points included overall survival (OS) and disease-specific survival (DSS). Safety was an exploratory end point.

Interim OS data showed that among all randomly assigned patients, the median OS was 75.0 months (95% CI, 56.7-NE) with nivolumab and 50.1 months (95% CI, 38.0-72.1) with placebo (HR, 0.83; 95% CI, 0.67-1.02). The 36-month, 48-month, and 60-month OS rates in each arm were 65.3% vs 57.7%, 59.5% vs 51.3%, and 54.6% vs 47.1%, respectively. Among those with PD-L1 expression of 1% or higher, the median OS was not reached (NR; 95% CI, 70.0-NE) vs 59.4 months (95% CI, 29.1-NE), with respective rates of 73.8% vs 56.5% at 36 months, 69.6% vs 51.6% at 48 months, and 64.3% vs 49.9% at 60 months (HR, 0.63; 95% CI, 0.44-0.90).

Among all randomly assigned patients with MIBC, interim data showed a median OS of 61.2 months (95% CI, 48.2-NE) with nivolumab and 38.2 months (95% CI, 29.8-50.3) with placebo (HR, 0.73; 95% CI, 0.58-0.91). The OS rates in this population were 63.8% vs 53.1% at 36 months, 56.6% vs 45.9% at 48 months, and 51.3% vs 41.8% at 60 months. Among those with MIBC and PD-L1 expression in at least 1% of tumor cells, the median OS was NR (95% CI, 75.0-NE) vs 38.2 months (95% CI, 27.8-72.1) in the nivolumab and placebo arms, respectively (HR, 0.51; 95% CI, 0.35-0.76). The OS rates were 75.0% vs 53.3% at 36 months, 70.0% vs 47.4% at 48 months, and 64.8% vs 45.3% at 60 months.

In the overall population, the median DSS was NR (95% CI, 91.9-NE) with nivolumab and NR (95% CI, 52.1-NE) with placebo (HR, 0.79; 95% CI, 0.62-1.00). Data showed DSS rates of 71.7% vs 63.1% at 36 months, 66.7% vs 57.5% 48 months, and 63.0% vs 54.1% at 60 months. In patients with PD-L1 expression of 1% or higher, the median DSS in each arm was NR (95% CI, NE-NE) vs 92.1 months (95% CI, 54.4-NE); the DSS rates in each arm were 79.8% vs 64.3% at 36 months, 77.0% vs 59.6% at 48 months, and 74.0% vs 57.6% at 60 months (HR, 0.57; 95% CI, 0.37-0.87).

Among 709 randomly assigned patients, 133 (18.8%) underwent circulating tumor DNA (ctDNA) analysis; of these patients, 54 (40.6%) had evaluable ctDNA. The median DFS was 52.1 months (95% CI, 19.4-NE) in patients with undetectable ctDNA (n = 79) vs 5.0 months (95% CI, 2.8-6.5) among those with detectable ctDNA (n = 54; HR, 0.30; 95% CI, 0.18-0.48). Additionally, the median OS was NR (95% CI, 62.0-NE) and 28.2 months (95% CI, 19.4-36.1) among patients with undetectable and detectable ctDNA, respectively (HR, 0.44; 95% CI, 0.25-0.76).

Among patients with detectable ctDNA, nivolumab conferred improvements in DFS (HR, 0.35; 95% CI, 0.18-0.66) and OS compared with placebo (HR, 0.41; 95% CI, 0.20-0.83). In those with undetectable ctDNA, numerical improvements occurred with nivolumab for DFS (HR, 0.99; 95% CI, 0.51-1.93) and OS (HR, 0.87; 95% CI, 0.41-1.84). Galsky noted that conclusions in exploratory post hoc ctDNA analyses were limited due to a small sample size.

Investigators observed no new safety signals in the latest analysis for CheckMate 274. Any-grade treatment-related adverse effects (TRAEs) occurred in 79% and 56% of the nivolumab and placebo arms, respectively; grade 3 or higher toxicities affected 18% vs 7%. The most common any-grade TRAEs in each arm included pruritus (23% vs 11%), fatigue (17% vs 12%), diarrhea (17% vs 11%), rash (15% vs 6%), and lipase increases (10% vs 6%).

Disclosures: Galsky noted advisory board/consul associations with AbbVie, Alligator Bioscience, Analog Devices, ARS Pharmaceuticals, Asieris Pharmaceuticals, AstraZeneca, Basilea Pharmaceutica, Bicycle Therapeutics, Bristol Myers Squibb, Curis, Daiichi Sankyo, Dragonfly Therapeutics, EMD Serono, Fujifilm, Genentech, Gilead Sciences, GlaxoSmithKline, Janssen, Merck, Numab Therapeutics, Pfizer, Rappta Therapeutics, Seagen, UroGen Pharma, and Veracyte.

Reference

Galsky MD, Gschwend JE, Milowsky MI, et al. Adjuvant nivolumab versus placebo for high-risk muscle-invasive urothelial carcinoma: 5-year efficacy and ctDNA results from CheckMate 274. Ann Oncol. Published online October 17, 2025. doi:10.1016/j.annonc.2025.09.139