Pérez V, Herrero M, Hormaza J. Self-fertility and preferential cross-fertilization in mango (Mangifera indica). Sci Hortic. 2016;213:373–8.

Article

Google Scholar

Jaglan P, Buttar HS, Al-bawareed O, Chibisov S. Potential health benefits of selected fruits: Apples, blueberries, grapes, guavas, mangos, pomegranates, and tomatoes. Functional foods and nutraceuticals in metabolic and non-communicable diseases. Elsevier; 2022. pp. 359–70.

Jahurul M, Zaidul I, Ghafoor K, Al-Juhaimi FY, Nyam K-L, Norulaini N, et al. Mango (Mangifera indica L.) by-products and their valuable components: a review. Food Chem. 2015;183:173–80.

Article

CAS

PubMed

Google Scholar

Mitra S. Mango production in the world–present situation and future prospect. In: XXIX International Horticultural Congress on Horticulture: Sustaining Lives, Livelihoods and Landscapes (IHC2014)2014;IV 1111:287–296.

Zhang D, Chong W, Li X-L. Yield gap and production constraints of mango (Mangifera indica) cropping systems in Tianyang County, China. J Integr Agric. 2019;18(8):1726–36.

Article

CAS

Google Scholar

Liu B, Xin Q, Zhang M, Chen J, Lu Q, Zhou X, Li X, Zhang W, Feng W, Pei H. Research progress on Mango post-harvest ripening physiology and the regulatory technologies. Foods. 2022;12(1):173.

Article

CAS

PubMed

PubMed Central

Google Scholar

Tahir H, Sajjad M, Qian M, Haq MZU, Tahir A, Farooq MA, Wei L, Shi S, Zhou K, Yao Q. Glutathione and ascorbic acid accumulation in Mango pulp under enhanced UV-B based on transcriptome. Antioxidants. 2024;13(11):1429.

Article

CAS

PubMed

PubMed Central

Google Scholar

Wu X, Li J, Wei J, Tong K, Xie Y, Chang Q, Yu X, Li B, Lu M, Fan C. Multi-residue analytical method development and dietary exposure risk assessment of 345 pesticides in Mango by LC-Q-TOF/MS. Food Control. 2025;170:111016.

Article

CAS

Google Scholar

Simontacchi M, Galatro A, Ramos-Artuso F, Santa-María GE. Plant survival in a changing environment: the role of nitric oxide in plant responses to abiotic stress. Front Plant Sci. 2015;6:977.

Article

PubMed

PubMed Central

Google Scholar

Singh VP, Singh S, Prasad SM, Parihar P. UV-B radiation: from environmental stressor to regulator of plant growth. Wiley Online Library; 2017.

Sharma S, Chatterjee S, Kataria S, Joshi J, Datta S, Vairale MG, Veer V. A review on responses of plants to UV-B radiation related stress. UV‐B Radiation: Environ Stressor Regulator Plant Growth 2017:75–97.

Shi C, Liu H. How plants protect themselves from ultraviolet-B radiation stress. Plant Physiol. 2021;187(3):1096–103.

Article

CAS

PubMed

PubMed Central

Google Scholar

Fotopoulos V, De Tullio MC, Barnes J, Kanellis AK. Altered stomatal dynamics in ascorbate oxidase over-expressing tobacco plants suggest a role for dehydroascorbate signalling. J Exp Bot. 2008;59(4):729–37.

Article

CAS

PubMed

Google Scholar

Foyer CH, Noctor G. Redox homeostasis and signaling in a higher-CO2 world. Annu Rev Plant Biol. 2020;71(1):157–82.

Article

CAS

PubMed

Google Scholar

Pignocchi C, Foyer CH. Apoplastic ascorbate metabolism and its role in the regulation of cell signalling. Curr Opin Plant Biol. 2003;6(4):379–89.

Article

CAS

PubMed

Google Scholar

Stevens R, Truffault V, Baldet P, Gautier H. Ascorbate oxidase in plant growth, development, and stress tolerance. Ascorbic acid in plant growth. Dev Stress Tolerance 2017:273–95.

Mellidou I, Kanellis AK. Revisiting the role of ascorbate oxidase in plant systems. J Exp Bot. 2024;75(9):2740–53.

Article

CAS

PubMed

PubMed Central

Google Scholar

De Tullio M, Guether M, Balestrini R. Ascorbate oxidase is the potential conductor of a symphony of signaling pathways. Plant Signal Behav. 2013;8(3):e23213.

Article

PubMed

PubMed Central

Google Scholar

Singh RR, Nobleza N, Demeestere K, Kyndt T. Ascorbate oxidase induces systemic resistance in sugar beet against cyst nematode heterodera schachtii. Front Plant Sci. 2020;11:591715.

Article

PubMed

PubMed Central

Google Scholar

Batth R, Singh K, Kumari S, Mustafiz A. Transcript profiling reveals the presence of abiotic stress and developmental stage specific ascorbate oxidase genes in plants. Front Plant Sci. 2017;8:198.

Article

PubMed

PubMed Central

Google Scholar

Pignocchi C, Fletcher JM, Wilkinson JE, Barnes JD, Foyer CH. The function of ascorbate oxidase in tobacco. Plant Physiol. 2003;132(3):1631–41.

Article

CAS

PubMed

PubMed Central

Google Scholar

Sanmartin M, Pateraki I, Chatzopoulou F, Kanellis AK. Differential expression of the ascorbate oxidase multigene family during fruit development and in response to stress. Planta. 2007;225:873–85.

Article

CAS

PubMed

Google Scholar

Brun A, Smokvarska M, Wei L, Chay S, Curie C, Mari S. MCO1 and MCO3, two putative ascorbate oxidases with ferroxidase activity, new candidates for the regulation of apoplastic iron excess in Arabidopsis. Plant Direct. 2022;6(11):e463.

Article

CAS

PubMed

PubMed Central

Google Scholar

Fotopoulos V, Kanellis AK. Altered apoplastic ascorbate redox state in tobacco plants via ascorbate oxidase overexpression results in delayed dark-induced senescence in detached leaves. Plant Physiol Biochem. 2013;73:154–60.

Article

CAS

PubMed

Google Scholar

Zhang Y, Li H, Shu W, Zhang C, Zhang W, Ye Z. Suppressed expression of ascorbate oxidase gene promotes ascorbic acid accumulation in tomato fruit. Plant Mol Biol Rep. 2011;29:638–45.

Article

CAS

Google Scholar

Garchery C, Gest N, Do PT, Alhagdow M, Baldet P, Menard G, et al. A diminution in ascorbate oxidase activity affects carbon allocation and improves yield in tomato under water deficit. Plant Cell Environ. 2013;36(1):159–75.

Article

CAS

PubMed

Google Scholar

Potters G, Horemans N, Bellone S, Caubergs RJ, Trost P, Guisez Y, et al. Dehydroascorbate influences the plant cell cycle through a glutathione-independent reduction mechanism. Plant Physiol. 2004;134(4):1479–87.

Article

CAS

PubMed

PubMed Central

Google Scholar

Pan Z, Chen L, Wang F, Song W, Cao A, Xie S, et al. Genome-wide identification and expression analysis of the ascorbate oxidase gene family in Gossypium hirsutum reveals the critical role of GhAO1A in delaying dark-induced leaf senescence. Int J Mol Sci. 2019;20(24):6167.

Article

CAS

PubMed

PubMed Central

Google Scholar

Singh K, Gupta R, Shokat S, Iqbal N, Kocsy G, Pérez-Pérez JM, et al. Ascorbate, plant hormones and their interactions during plant responses to biotic stress. Physiol Plant. 2024;176(4):e14388.

Article

CAS

PubMed

Google Scholar

Verma V, Ravindran P, Kumar PP. Plant hormone-mediated regulation of stress responses. BMC Plant Biol. 2016;16:1–10.

Article

Google Scholar

Yadav A, Singh D, Lingwan M, Yadukrishnan P, Masakapalli SK, Datta S. Light signaling and UV-B‐mediated plant growth regulation. J Integr Plant Biol. 2020;62(9):1270–92.

Article

CAS

PubMed

Google Scholar

Yu Z, Duan X, Luo L, Dai S, Ding Z, Xia G. How plant hormones mediate salt stress responses. Trends Plant Sci. 2020;25(11):1117–30.

Article

CAS

PubMed

Google Scholar

Jansen MA, Coffey AM, Prinsen E. UV-B induced morphogenesis: four players or a quartet? Plant Signal Behav. 2012;7(9):1185–7.

Article

CAS

PubMed

PubMed Central

Google Scholar

Vanhaelewyn L, Prinsen E, Van Der Straeten D, Vandenbussche F. Hormone-controlled UV-B responses in plants. J Exp Bot. 2016;67(15):4469–82.

Article

CAS

PubMed

Google Scholar

Vandenbussche F, Van Der Straeten D. The role of ethylene in plant growth and development. Annual Plant Reviews 44: Plant Hormone Ethyl. 2012;44:219–41.

Article

CAS

Google Scholar

Sun Z, Wen C, Chen Z, Zhang Qa, Fang L, Li J, Jiang S, Cao S. A role for Ethylene-Insensitive 2 gene in the regulation of the ultraviolet-B response in Arabidopsis. Acta Physiol Plant. 2011;33:1025–30.

Article

CAS

Google Scholar

Choudhary KK, Singh S, Agrawal M, Agrawal S. Role of jasmonic and Salicylic acid signaling in plants under UV-B stress. Jasmonates Salicylates Signal Plants 2021:45–63.

Rao MV, Paliyath G, Ormrod DP, Murr DP, Watkins CB. Influence of salicylic acid on H2O2 production, oxidative stress, and H2O2-metabolizing enzymes (salicylic acid-mediated oxidative damage requires H2O2). Plant Physiol. 1997;115(1):137–49.

Article

CAS

PubMed

PubMed Central

Google Scholar

Durner J. DF Klessig 1995 Inhibition of ascorbate peroxidase by Salicylic acid and 2, 6-dichloroisonicotinic acid, two inducers of plant defense responses. Proc Natl Acad Sci 92 24 11312–6.

Article

CAS

PubMed

PubMed Central

Google Scholar

Esaka M, Fujisawa K, Goto M, Kisu Y. Regulation of ascorbate oxidase expression in pumpkin by auxin and copper. Plant Physiol. 1992;100(1):231–7.

Article

CAS

PubMed

PubMed Central

Google Scholar

SANMARTIN ARTIÑANO M. Regulation of melon ascorbate oxidase gene expression and effect of its modification in Trangenic tobacco and melon plants. Universitat de València; 2002.

Duvaud S, Gabella C, Lisacek F, Stockinger H, Ioannidis V, Durinx C. Expasy, the Swiss bioinformatics resource portal, as designed by its users. Nucleic Acids Res. 2021;49(W1):W216-27.

Article

CAS

PubMed

PubMed Central

Google Scholar

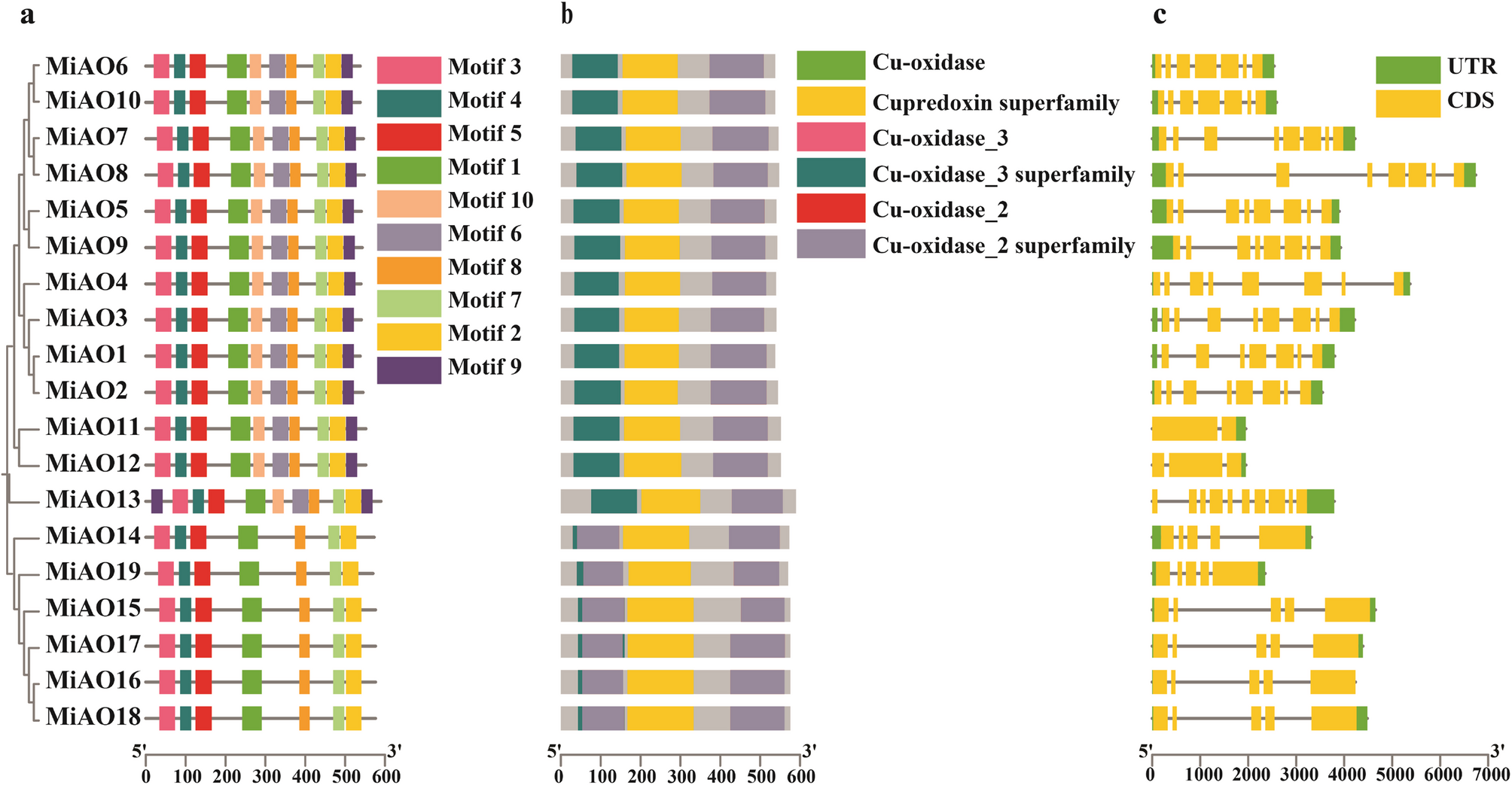

Bailey TL, Johnson J, Grant CE, Noble WS. The MEME suite. Nucleic Acids Res. 2015;43(W1):W39-49.

Article

CAS

PubMed

PubMed Central

Google Scholar

Wang J, Chitsaz F, Derbyshire MK, Gonzales NR, Gwadz M, Lu S, et al. The conserved domain database in 2023. Nucleic Acids Res. 2023;51(D1):D384-8.

Article

CAS

PubMed

Google Scholar

Chen C, Chen H, Zhang Y, Thomas HR, Frank MH, He Y, et al. TBtools: an integrative toolkit developed for interactive analyses of big biological data. Mol Plant. 2020;13(8):1194–202.

Article

CAS

PubMed

Google Scholar

Chen Q, Han Z, Jiang H, Tian D, Yang S. Strong positive selection drives rapid diversification of R-genes in Arabidopsis relatives. J Mol Evol. 2010;70:137–48.

Article

CAS

PubMed

Google Scholar

Tahir ul Qamar M, Sadaqat M, Zhu X-T, Li H, Huang X, Fatima K, Almutairi MM, Chen L-L. Comparative genomics profiling revealed multi-stress responsive roles of the CC-NBS-LRR genes in three Mango cultivars. Front Plant Sci. 2023;14:1285547.

Article

PubMed

PubMed Central

Google Scholar

Wang Y, Tang H, DeBarry JD, Tan X, Li J, Wang X, et al. MCScanX: a toolkit for detection and evolutionary analysis of gene synteny and collinearity. Nucleic Acids Res. 2012;40(7):e49–49.

Article

Google Scholar

Tamura K, Stecher G, Kumar S. MEGA11: molecular evolutionary genetics analysis version 11. Mol Biol Evol. 2021;38(7):3022–7.

Article

CAS

PubMed

PubMed Central

Google Scholar

Lescot M, Déhais P, Thijs G, Marchal K, Moreau Y, Van de Peer Y, Rouzé P, Rombauts S. PlantCARE, a database of plant cis-acting regulatory elements and a portal to tools for in Silico analysis of promoter sequences. Nucleic Acids Res. 2002;30(1):325–7.

Article

CAS

PubMed

PubMed Central

Google Scholar

Li B, Zhang L, Zhu L, Cao Y, Dou Z, Yu Q. HDAC5 promotes intestinal sepsis via the Ghrelin/E2F1/NF-κB axis. FASEB J. 2021;35(7):e21368.

Article

CAS

PubMed

Google Scholar

Zhang B, Wang O, Qin J, Liu S, Sun S, Liu H, Kuang J, Jiang G, Zhang W. cis-Acting elements and trans-acting factors in the transcriptional regulation of Raf kinase inhibitory protein expression. PLoS ONE. 2013;8(12):e83097.

Article

PubMed

PubMed Central

Google Scholar

Biłas R, Szafran K, Hnatuszko-Konka K, Kononowicz AK. Cis-regulatory elements used to control gene expression in plants. Plant Cell, Tissue and Organ Culture (PCTOC). 2016;127:269–87.

Article

Google Scholar

Pignocchi C, Kiddle G, Hernández I, Foster SJ, Asensi A, Taybi T, et al. Ascorbate oxidase-dependent changes in the redox state of the apoplast modulate gene transcript accumulation leading to modified hormone signaling and orchestration of defense processes in tobacco. Plant Physiol. 2006;141(2):423–35.

Article

CAS

PubMed

PubMed Central

Google Scholar

Xu X, Miao X, Deng N, Liang M, Wang L, Jiang L, Zeng S. Identification of ascorbate oxidase genes and their response to cold stress in citrus sinensis. Agriculture. 2024;14(9):1643.

Article

CAS

Google Scholar

Madhu, Kaur A, Singh K, Upadhyay SK. Ascorbate oxidases in bread wheat: gene regulatory network, transcripts profiling, and interaction analyses provide insight into their role in plant development and stress response. Plant Growth Regul. 2024;103(1):209–24.

Article

Google Scholar

Skorupa M, Szczepanek J, Yolcu S, Mazur J, Tretyn A, Tyburski J. Characteristic of the ascorbate oxidase gene family in beta vulgaris and analysis of the role of AAO in response to salinity and drought in beet. Int J Mol Sci. 2022;23(21):12773.

Article

CAS

PubMed

PubMed Central

Google Scholar

Bailey TL, Boden M, Buske FA, Frith M, Grant CE, Clementi L, et al. MEME SUITE: tools for motif discovery and searching. Nucleic Acids Res. 2009;37(suppl2):W202-8.

Article

CAS

PubMed

PubMed Central

Google Scholar

Xu G, Guo C, Shan H, Kong H. Divergence of duplicate genes in exon–intron structure. Proc Natl Acad Sci U S A. 2012;109(4):1187–92.

Article

CAS

PubMed

PubMed Central

Google Scholar

Long M, Deutsch M. Intron—exon structures of eukaryotic model organisms. Nucleic Acids Res. 1999;27(15):3219–28.

Article

PubMed

PubMed Central

Google Scholar

Tian R, Yang Y, Chen M. Genome-wide survey of the amino acid transporter gene family in wheat (Triticum aestivum L.): identification, expression analysis and response to abiotic stress. Int J Biol Macromol. 2020;162:1372–87.

Article

CAS

PubMed

Google Scholar

Innan H, Kondrashov F. The evolution of gene duplications: classifying and distinguishing between models. Nat Rev Genet. 2010;11(2):97–108.

Article

CAS

PubMed

Google Scholar

Zhang J. Evolution by gene duplication: an update. Trends Ecol Evol. 2003;18(6):292–8.

Article

Google Scholar

Tang H, Bowers JE, Wang X, Ming R, Alam M, Paterson AH. Synteny and collinearity in plant genomes. Science. 2008;320(5875):486–8.

Article

CAS

PubMed

Google Scholar

Lynch M, Conery JS. The evolutionary fate and consequences of duplicate genes. Science. 2000;290(5494):1151–5.

Article

CAS

PubMed

Google Scholar

Wu A, Hao P, Wei H, Sun H, Cheng S, Chen P, et al. Genome-wide identification and characterization of glycosyltransferase family 47 in cotton. Front Genet. 2019;10:824.

Article

CAS

PubMed

PubMed Central

Google Scholar

Ulmasov T, Murfett J, Hagen G, Guilfoyle TJ. Aux/IAA proteins repress expression of reporter genes containing natural and highly active synthetic auxin response elements. Plant Cell. 1997;9(11):1963–71.

CAS

PubMed

PubMed Central

Google Scholar

Gilmartin PM, Memelink J, Hiratsuka K, Kay SA, Chua N-H. Characterization of a gene encoding a DNA binding protein with specificity for a light-responsive element. Plant Cell. 1992;4(7):839–49.

CAS

PubMed

PubMed Central

Google Scholar

Tran L-SP, Nakashima K, Sakuma Y, Simpson SD, Fujita Y, Maruyama K, et al. Isolation and functional analysis of Arabidopsis stress-inducible NAC transcription factors that bind to a drought-responsive cis-element in the early responsive to dehydration stress 1 promoter. Plant Cell. 2004;16(9):2481–98.

Article

CAS

PubMed

PubMed Central

Google Scholar

Shu X, Jiang Y, Wen T, Lu S, Yao L, Meng F. Association of hormone replacement therapy with increased risk of meningioma in women: a hospital-based multicenter study with propensity score matching. Asia Pac J Clin Oncol. 2019;15(5):e147-53.

Article

PubMed

Google Scholar

Li N, Euring D, Cha JY, Lin Z, Lu M, Huang L-J, Kim WY. Plant hormone-mediated regulation of heat tolerance in response to global climate change. Front Plant Sci. 2021;11:627969.

Article

PubMed

PubMed Central

Google Scholar

Li H, Guo Y, Lan Z, Xu K, Chang J, Ahammed GJ, et al. Methyl jasmonate mediates melatonin-induced cold tolerance of grafted watermelon plants. Hortic Res. 2021. https://doi.org/10.1038/s41438-021-00496-0.

Article

PubMed

PubMed Central

Google Scholar

Tong X-m, Zhang S-y, Song T, Xu W-h, Lin X-n, Shu J, et al. Effects of gonadotropin-releasing hormone antagonists on the expression of vascular endothelial growth factor and its receptors in a rat model of ovarian hyperstimulation syndrome. Chin Med J. 2008;121(23):2434–9.

Article

CAS

PubMed

Google Scholar

Potters G, Pasternak TP, Guisez Y, Palme KJ, Jansen MA. Stress-induced morphogenic responses: growing out of trouble? Trends Plant Sci. 2007;12(3):98–105.

Article

CAS

PubMed

Google Scholar

Maurel C, Tournaire-Roux C, Verdoucq L, Santoni V. Hormonal and environmental signaling pathways target membrane water transport. Plant Physiol. 2021;187(4):2056–70.

Article

CAS

PubMed

PubMed Central

Google Scholar

Sun Q, Li X, Sun L, Sun M, Xu H, Zhou X. Plant hormones and phenolic acids response to UV-B stress in rhododendron Chrysanthum pall. Biol Direct. 2024;19(1):40.

Article

CAS

PubMed

PubMed Central

Google Scholar

Shuai H, Meng Y, Luo X, Chen F, Zhou W, Dai Y, Qi Y, Du J, Yang F, Liu J. Exogenous auxin represses soybean seed germination through decreasing the gibberellin/abscisic acid (GA/ABA) ratio. Sci Rep. 2017;7(1):12620.

Article

PubMed

PubMed Central

Google Scholar

Shu K, Qi Y, Chen F, Meng Y, Luo X, Shuai H, et al. Salt stress represses soybean seed germination by negatively regulating GA biosynthesis while positively mediating ABA biosynthesis. Front Plant Sci. 2017;8:1372.

Article

PubMed

PubMed Central

Google Scholar

Shan T, Gul B, Rafique M, Jabeen A, Gurmani AR, Ortas I. Cereals and phytohormones under UV stress. Sustainable remedies for abiotic stress in cereals. Springer; 2022. pp. 425–41.

Hayes S, Velanis CN, Jenkins GI, Franklin KA. UV-B detected by the UVR8 photoreceptor antagonizes auxin signaling and plant shade avoidance. Proc Natl Acad Sci U S A. 2014;111(32):11894–9.

Article

CAS

PubMed

PubMed Central

Google Scholar

Vanhaelewyn L, Van Der Straeten D, De Coninck B, Vandenbussche F. Ultraviolet radiation from a plant perspective: the plant-microorganism context. Front Plant Sci. 2020;11:597642.

Article

PubMed

PubMed Central

Google Scholar

Escobar Bravo R, Chen G, Grosser K, Van Dam NM, Leiss KA, Klinkhamer PG. Ultraviolet radiation enhances salicylic acid-mediated defense signaling and resistance to Pseudomonas syringae DC3000 in a jasmonic acid-deficient tomato mutant. Plant Signal Behav. 2019;14(4):e1581560.

Article

PubMed

PubMed Central

Google Scholar

Müller R, Acosta-Motos JR, Großkinsky DK, Hernández JA, Lütken H, Barba-Espin G. UV-B exposure of black Carrot (Daucus Carota ssp. Sativus var. atrorubens) plants promotes growth, accumulation of anthocyanin, and phenolic compounds. Agronomy. 2019;9(6):323.

Article

Google Scholar

Czarnocka W, Karpiński S. Friend or foe? Reactive oxygen species production, scavenging and signaling in plant response to environmental stresses. Free Radic Biol Med. 2018;122:4–20.

Article

CAS

PubMed

Google Scholar

Tyagi S, Shumayla, Singh SP, Upadhyay SK. Role of superoxide dismutases (SODs) in stress tolerance in plants. Mol Approaches Plant Biology Environ Challenges 2019:51–77.

Tyagi S, Shah A, Karthik K, Rathinam M, Rai V, Chaudhary N, Sreevathsa R. Reactive oxygen species in plants: an invincible fulcrum for biotic stress mitigation. Appl Microbiol Biotechnol. 2022;106(18):5945–55.

CAS

PubMed

Google Scholar

Karpinska B, Zhang K, Rasool B, Pastok D, Morris J, Verrall SR, et al. The redox state of the apoplast influences the acclimation of photosynthesis and leaf metabolism to changing irradiance. Plant Cell Environ. 2018;41(5):1083–97.

Article

CAS

PubMed

Google Scholar

Zhu M, Liu Q, Liu F, Zheng L, Bing J, Zhou Y, Gao F. Gene profiling of the ascorbate oxidase family genes under osmotic and cold stress reveals the role of AnAO5 in cold adaptation in ammopiptanthus nanus. Plants. 2023;12(3):677.

Article

CAS

PubMed

PubMed Central

Google Scholar

Messerschmidt A. Multi-copper oxidases. World Scientific; 1997.

Yamamoto A, Bhuiyan MNH, Waditee R, Tanaka Y, Esaka M, Oba K, et al. Suppressed expression of the apoplastic ascorbate oxidase gene increases salt tolerance in tobacco and Arabidopsis plants. J Exp Bot. 2005;56(417):1785–96.

Article

CAS

PubMed

Google Scholar

Sanmartin M, Drogoudi PD, Lyons T, Pateraki I, Barnes J, Kanellis AK. Over-expression of ascorbate oxidase in the Apoplast of Transgenic tobacco results in altered ascorbate and glutathione redox States and increased sensitivity to Ozone. Planta. 2003;216:918–28.

Article

CAS

PubMed

Google Scholar