Generally speaking, tracking China’s exchange rate is about as exciting as watching paint dry because nothing ever happens. The RMB has been materially undervalued for many years now. The resulting trade surplus, which is growing ever bigger, means China is having to intervene massively in foreign exchange markets to stop the RMB from rising against the Dollar. It’s impossible to see that intervention because China stopped using its central bank to do this intervention, most likely shifting it to state banks where it’s difficult to monitor. The end-result is that the RMB remains heavily manipulated and not much ever happens.

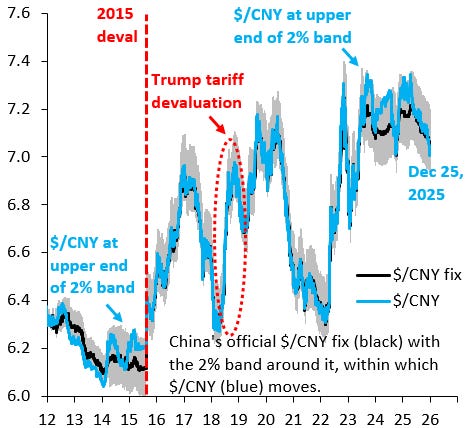

But every once in a while, markets get excited because they think something big is happening. That’s the case now. The chart above shows the bilateral RMB exchange rate versus the Dollar. The official anchor for this exchange rate is the “fix,” which is the black line. The fix gets announced every morning in Beijing and the actual $/CNY exchange rate (blue line) then fluctuates within a two percent band around the fix (gray shaded area). For a long time after the pandemic, $/CNY was plastered against the upper end of the band, the “weak” end of the band. This is typically taken to mean there’s depreciation pressure on the RMB (I think that’s nonsense given how much hidden intervention is happening, but let’s not get into that here). But recently, the $/CNY has fallen below the fix and is approaching the lower end of the band, which has people buzzing Beijing could be shifting its stance on the RMB and might – finally – allow appreciation to reduce chronic undervaluation.

That isn’t what’s happening. As the chart above shows, the Dollar has been falling against the rest of the G10 recently (black line). The drop in $/CNY is just offsetting that Dollar weakness, so that the trade-weighted RMB stays more or less stable (blue line). So the recent appreciation of the RMB against the Dollar doesn’t signal a change of heart in Beijing. There is no “true” appreciation going on.

Underlying all this is the question whether China can ever be expected to abandon its mercantilist growth model. I have a short- and a medium-term answer to this. In the short term, it’s fair to say that China emerged victorious from the rare earths stand-off a few months ago. That shouldn’t have been allowed to happen in my opinion, but the US played its hand very poorly in those negotiations. In the medium term, China is gunning to be the world’s leading exporter of all things electrification. There’s just no sign it’s abandoning its mercantilist ways.