Since 2000, Egypt has recorded an annual growth in municipal solid waste exceeding 36%. However, Egyptian authorities have not conducted studies on household waste management awareness or practices19. Furthermore, with a predicted population of 160 million by 2050, water availability is expected to decrease to less than 350 m2 per capita per year20. It was also noticed that, since 2001, frequent power interruptions have been a continuous problem21. Therefore, it is critical to improve public knowledge about conservation and sustainable practices.

KAP of participants

SWM

In Egypt, KAP of SWM was studied among municipal solid waste workers, health workers, and students, staff, and employees of educational institutes22,23,24. Whereas this study is just limited to households. Municipal SWM in Egypt is considered a significant challenge due to rapid population growth, low awareness, high illiteracy rates, unregulated slum areas, inadequate waste collection and disposal systems, and limited financial resources25.

Based on the results, it was found that the overall mean scores of the participants’ knowledge, attitude, and practice for SWM were (4.73 ± 1.77), (27.38 ± 3.34), and (4.09 ± 1.15) out of 7, 35, and 8, respectively, as displayed in [Table 3]. This reveals that participants had a high knowledge and attitude toward municipal SWM. However, their practices were moderate.

Contrary to this study’s results, it was stated that rural women in the rural villages of El-Gharbia Governorate had poor knowledge and practice regarding SWM, yet they had a positive attitude26. This might be due to the lack of awareness regarding improper solid waste disposal and management, environmental impact, and the lack of awareness campaigns in Egyptian rural areas. At one of the Sohag governorate villages in Egypt, the families’ knowledge, attitudes, and practices regarding household waste management improved after the implementation of a health awareness package25.

Water and energy conservation

Regarding water and energy conservation KAP, as displayed in Table 6, the overall mean scores were (5.5 ± 1.7), (37.88 ± 4.7), and (3.8 ± 1.4) out of 8, 45, and 8, respectively. Participants showed high Knowledge and attitude, but low practice levels. This agreed with the results of a study indicating that the UK had positive knowledge and attitudes towards water conservation, but showed poor practices9. The same results were found in Spring City, China27. Likewise, the people of Gaza had good water and energy conservation awareness and attitudes in their houses28.

In a survey conducted in four governorates in Egypt (Cairo, El-Minya, Assiut, and Sohag), a strong correlation was found between participants’ knowledge of the water crisis and their readiness to implement water conservation techniques8.

As for energy saving in Egypt, there was a lack of data related to household KAP. Sustainable consumption was only studied among university students29,30.

Effect of gender

SWM

According to Table 3, there was a statistical significance between female participants and their knowledge and practices regarding solid waste management. They had higher mean SWM knowledge and practice than males. As per a survey conducted in 2005, it was reported that gender can influence domestic SWM perceptions7.

In Egypt, women are seen as the primary generators of municipal SW because they are known to be preoccupied with all household tasks, including preparing food, shopping, and housekeeping, which involves managing and disposing of SW26. On the other hand, working females are more dependent on readymade products, leading to increased solid waste31. This aligns with the results of a study in Sohag, Egypt, where more than two-thirds of waste managers at the household level were females25. Furthermore, another study found that young Egyptian females have good knowledge regarding the use and hazards of plastic bag disposal, while older females over 40 had good practice32.

Water and energy conservation

Gender norms directly impact the public’s beliefs regarding expectations of home duties33. In this study, a statistically significant difference in KAP between genders was revealed; females showed better knowledge and attitude than males, as demonstrated in Table 6. The results were the same as in the two studies that analyzed the KAP of individuals regarding water and energy conservation34,35. This also agrees with the findings of a study conducted among university students in Egypt, which found that female students showed better knowledge and practice than male students29.

On the other hand, the findings contradicted a study conducted in 2024, which reported that females in Egypt had a lower level of awareness regarding the water crisis8. The contradiction may be due to the variation in how awareness and knowledge terms were defined and measured. Also, the geographical scope of the two studies may offer a key explanation for the contradiction.

Effect of age

SWM

The statistical analysis, in Table 3, showed that age had a significant effect on both knowledge (p < 0.001) and practice (p = 0.001) in WM. Nevertheless, there were no significant differences in attitude within different age groups (p = 0.126). The (31–40) age group had the highest knowledge level (5.20 ± 1.49), while the (41–50) age group exhibited the best practices (4.50 ± 1.25). The (18–20) age group had the lowest knowledge and practice levels (3.36 ± 1.78) and (3.72 ± 1.23), respectively. This almost complies with a study conducted in Palestine, where the knowledge and practice levels were much higher in the age group (25–44) than those aged (18–24)36. It also aligns with the findings of a study conducted in Egypt, which focused solely on the disposal of plastic bags. The young age group < 40 demonstrated high knowledge, while people aged > 40 exhibited the best practice32.

However, another study that specifically focused on waste segregation as a type of SWM practice concluded that respondents aged between 50 and 65 segregated more often than those aged between 35 and 4937.

In Egypt, middle-aged groups balance family duties with perceptions gained from education and media, while younger individuals lack maturity due to their limited real-world experiences. In contrast, older generations tend to exhibit practices shaped by their accumulated habits and responsibilities. This is consistent with the Theory of Planned Behavior, which implies that age has an impact on the perceived behavioral control through experience38.

Water and energy conservation

A one-way ANOVA, as demonstrated in Table 6, revealed statistically significant differences in knowledge, attitude, and practice in terms of water and energy conservation over different age groups. The (41–50) age group had the highest knowledge score (6.18 ± 1.37), while the (18–20) age group had the lowest practice score (3.39 ± 1.20). On the other hand, the 51 + age group had the highest attitude, with a score of (39.54 ± 3.26). Local socio-economic and cultural factors can explain the findings in the Egyptian setting. People of the age (41–50) possibly have the highest knowledge because of their role as household decision makers. On the other hand, the low practice level at the age of 18–20 may reflect their limited responsibilities for utility bills, while a positive attitude in those over 51 may be due to the traditional values of economy in Egyptian culture. However, this positive attitude may not lead to good practice if they lack access to modern water-saving technologies and modern appliances.

These results agree with prior studies showing that elderly individuals conserve water more frequently39,40. Furthermore, it was confirmed in another study that people aged 35 will consume 26% more energy than people aged 7041. This could be due to the observation that older people have fewer home appliances than younger ones, which leads to a decrease in energy consumption42.

Effect of marital status

SWM

The results, displayed in Table 3, show a significant difference in knowledge scores between single and married individuals (p < 0.001). Those who were married (5.00 ± 1.59) had much higher knowledge levels than single participants. Meanwhile, no significant variations were found between the groups regarding their attitudes and practices towards SWM.

This is in agreement with the results of two studies conducted in 2021 and 2022, which found that marital status is non-significant in household solid waste practice37,43. At the same time, two different studies discovered an association between marital status and improper solid waste management44,45.

In Egypt, marriage indicates moving to an independent household, leading couples to engage in daily SWM. However, there were no significant differences in attitudes and practices, which means that while marriage can aid in gaining knowledge, these attitudes and practices might be hindered. This is due to poor recycling infrastructure and inconsistent waste collection.

Water and energy conservation

The analysis from [Table 6] stated that married participants reported better practices (p = 0.006) compared to single individuals. However, no significant difference in knowledge levels was observed between the two groups (p = 0.052).

Married people adopted more energy-saving behaviors than the others46. This can be attributed to the economic pressure that marriage causes in Egypt, as it exposes married couples to the financial cost of utility bills. This creates motivation towards water and energy conservation. On the other hand, it was concluded in another study that married people tend to save less water than singles39. The contradiction may be due to cultural differences in water availability, utility bills, and housing situations.

Effect of education

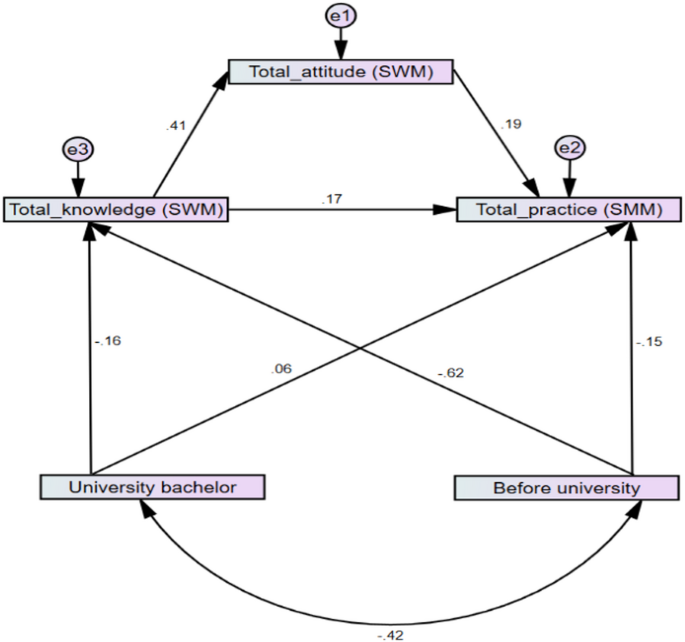

The path analysis model, shown in Figs. 1 and 2 and stated in Tables 5 and 8, proved that higher education levels improve the knowledge level of SWM as well as water & energy conservation. This, in turn, will enhance attitudes and sustainable practices. The results indicated that education level was the most important factor affecting participants’ KAP.

SWM

The results highlighted a significant association between the education level and solid waste management KAP (p < 0.001). Moreover, a pattern was discovered, as mean scores improved from the Before university to the University and Postgraduate groups. [Table 3] showed that postgraduates and university students have higher mean KAP scores for SWM, (4.95 ± 1.49) & (5.55 ± 1.26) respectively, than those with lower educational levels.

Education levels had an impact on the awareness, attitude, and practices of SWM47,48. Nowadays, the higher education system in Egypt includes more topics regarding environmental science and sustainability, which equip students with essential knowledge49. Being skilled in English and digital literacy also allowed them to better understand global sustainability issues.

Water and energy conservation

It was also noted that an increase in education level leads to an enhancement in the KAP of water and energy conservation, based on the results from [Table 6]. Several studies support the belief that households with high education levels frequently have stronger intentions toward water or energy conservation40,50,51.

A significant observation in this study’s results was that improved knowledge of water and energy conservation promotes positive attitudes, leading to enhanced practices. The model showed that knowledge does not automatically result in action. Instead, it creates a favorable mindset and a sense of responsibility. This strengthened attitude serves as the crucial step, eventually motivating individuals to adopt sustainable behaviors in their daily lives.

Financial challenges and rising utility bills often increase households’ need for practical and cost-effective approaches. Families tend to actively seek advice on reducing consumption, such as understanding appliance energy use, taking shorter showers, and using appliances more efficiently. This knowledge becomes essential for financial survival. However, the stress of managing limited finances can hinder engagement with broader information campaigns and education focused on long-term environmental benefits. High initial costs of energy-efficient appliances or water-saving technologies can make them seem irrelevant. Thus, while financial strain may raise interest in immediate, low-cost savings, it can limit curiosity about knowledge that requires financial commitment or does not result in quick bill reductions.

In Egypt, water scarcity is a pressing issue that strengthens the connection between attitude and action52. Due to limited resources and economic pressure, education is considered vital for providing individuals with the knowledge needed to mitigate sustainability challenges49.

Home appliances practice

Around 47% stated that their home appliances were more than 5 years old, as shown in Table 9. Older appliances may have lower energy efficiency compared to contemporary models53, and this raises a conflict between environmental regulations and residential energy use. On one side, keeping these appliances may increase energy consumption and greenhouse gas emissions. On the other hand, appliance replacement would result in a significant amount of e-waste. The recycling and management of e-waste have a considerable environmental impact54. As a result, a trade-off exists between enhancing energy efficiency and addressing the environmental effects of appliance manufacturing and disposal. This is further complicated by the study results, which indicate a knowledge gap. Many respondents were unaware of their appliances’ age, indicating a potential lack of awareness about long-term energy costs and the environmental impacts associated with appliance ownership.

The long lifespan of home appliances confuses consumers as to whether to replace or fix their devices, and each phase of the home appliance life cycle affects the environment. The correlation between life span, repair frequency, and maintenance behavior was assessed, and it was suggested that the environmental effects of early replacement for household devices might differ based on numerous factors, including the appliance type, the new model’s energy efficiency, and the methods employed for disposing of the old appliance55,56.

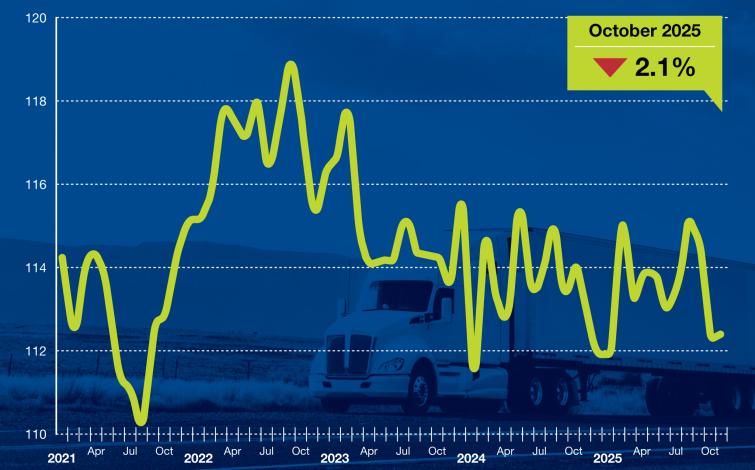

The most reported devices used in the week, as presented in Fig. 3, were kettles, gas heaters, microwaves, and fans, with percentages of 77.6%, 67%, 66.4%, and 60.5%, respectively. The survey did not include fridges, TVs, computers, or laptops in this question, as it was assumed that these are the most used devices in every house. For example, fridges work nonstop the whole day. Considering the climate conditions and culture, the observed usage frequencies make sense. However, one of the main factors influencing energy demand is the significant use of air conditioners, particularly by households that own them (24.5% have two or more units). The number of home appliances has increased over the last 20 years. The frequency of using these appliances plays a significant role in energy consumption57. About 70% of houses’ carbon dioxide emissions are generated from home appliances. Air conditioners, refrigerators, and televisions are responsible for half of those carbon dioxide emissions58. Other studies revealed that unreasonable usage and purchasing habits of home appliances were the leading causes of energy waste in houses59. According to the Egyptian Electricity Holding Company, Domestic energy consumption was responsible for more than half of the total energy consumption in Egypt60.

Study limitations

The current study has several limitations. The non-randomized sampling and reliance on an online questionnaire likely introduced selection bias, favoring those with internet access and digital literacy. Accordingly, there was an overrepresentation of highly educated participants compared to the national average, and the sample did not fully represent all Egyptian governorates, limiting the generalizability of the findings. In addition, self-reported data may have introduced biases, such as recall or social desirability bias. Although the study measured attitudes and behaviors effectively, it may have failed to detect the value-action gap that arises from external barriers such as financial constraints.