- Tomago Aluminium welcomes continued collaboration on future operations Rio Tinto

- Australia news live: states reject PM’s $20bn health deal; measles alert for several locations in Sydney The Guardian

- Federal politics live: States and territories reject Commonwealth public hospital funding offer Australian Broadcasting Corporation

- Major smelter’s future secured after taxpayer bailout The Canberra Times

- Australia’s Albanese Pledges Deal to Save Rio Aluminum Plant Bloomberg.com

Category: 3. Business

-

Tomago Aluminium welcomes continued collaboration on future operations – Rio Tinto

-

5 year RDTI review strong business backing economic impact

By Brendan Ng, David Creagh and Aaron Thorn

The Ministry of Business, Innovation and Employment first five-year evaluation report of the Research and Development tax incentive regime asked whether the 15% R&D Tax Incentive tax credit (RDTI) is encouraging more businesses to undertake R&D and whether the government is getting “bang for the buck” on the investment.

What are the reports key findings?

For those who haven’t yet discovered it (we know you’re out there!), the RDTI was introduced in April 2019 and provides a 15% tax credit on eligible R&D expenditure. The purpose of the RDTI is to broaden access to R&D support and stimulate innovation.

The Report considered whether the 15% tax credit is incentivising further R&D to be undertaken and its effect on growth on New Zealand’s economy. In summary:

- Projected economy-wide benefit of the RDTI: 4.2 times government investment, equating to a boost to New Zealand’s GDP of $6.8 billion over the five-year period.

- Total additional R&D expenditure: $1.833 billion (present value) – with supported firms on average spending $274,000 more on R&D annually.

- “Bang for the buck” (BFTB) ratio (additional expenditure per dollar of support provided) is 1.4, consistent with OECD benchmarks. This compares to a BFTB ratio of 0.83 under the Growth Grant regime.

- Net impact after government costs: $221 million.

- Innovation gains appear two years post-support, with a 6.1 percentage point increase in innovation rates, with supported firms showing higher growth in output, capital, and employment.

- No significant productivity effect has yet emerged, reflecting the short evaluation window.

The RDTI regime seems to have achieved its goal, with key figures for the 2020-2024 period being:

- 1,752 firms supported, with $1.074 billion in tax credits provided.

- By 2023, supported firms accounted for 65% of total business R&D expenditure, compared to 44% under Growth Grants.

This all seems to suggest that the RDTI has made a positive impact and is a welcome addition to the New Zealand innovation landscape. However, behind the numbers there may be other considerations.

So, is the R&D tax incentive working as intended?

Short answer: yes. Long answer: there is room for improvement.

The report, prepared by Motu Economic and Public Policy Research and The University of Otago, is overwhelmingly positive in relation to the RDTI, noting that firms supported by the RDTI spent more on RDTI than they would have in the absence of RDTI support and that it is outperforming the Growth Grant scheme it replaced. The report states that given the rate of recent change in New Zealand’s approach to supporting business R&D, and the potentially positive impact of stability on business decision making, there appears to be a strong case for preserving a stable support mechanism (i.e. the RDTI regime) in the medium term.

However, there is unpredictability in the processing time for Supplementary Returns – which extends the time between businesses outlay on the R&D and when it received the incentive – and a lack of discretionary powers available to the Commissioner of Inland Revenue that is disproportionately penalising companies for minor missteps.

Is New Zealand’s RDTI scheme globally competitive?

The Report briefly covers how the RDTI regime compares with similar overseas regimes, but notes that there are difficulties in comparison given different externalities and design features. Australia is the best and easiest comparison and the report found that Australia’s scheme may be more generous for SMEs and offer more flexibility for overseas and software R&D. However, the tightening of the requirements for Overseas Findings has had a significant impact on the ability to claim overseas costs in the Australian scheme.

The Report also notes that Inland Revenue takes a vigorous approach to reviewing eligible R&D expenditure, and the rates of revision following review appear to reflect a greater level of expenditure scrutiny when compared with some overseas schemes.

Deloitte’s experience has been that the additional certainty provided by the RDTI’s review process, which culminates with the issuance of a binding approval for the R&D activities, far outweighs the additional administrative burden of the review process. The report notes that these review processes are rare amongst R&D tax credit policies and are effective safeguards against error and fraud. This should hopefully protect New Zealand’s RDTI scheme from some of the issues with R&D incentive schemes that have been encountered overseas.

What else did we find interesting in the report?

The Report covered feedback from stakeholders on how well the RDTI is working for them. Some of the feedback noted:

- High compliance costs, particularly for firms spending under $300,000 on R&D.

- Administrative delays in processing Supplementary Returns.

- Restrictive software eligibility rules misaligned with the standard iterative development process.

- Policy instability which undermines confidence and planning.

Much of this aligns with the feedback Deloitte has heard on the RDTI, however we do note that many of these grumbles have fallen away as businesses gain a better understanding of the RDTI with time. In particular, R&D in the software development space is a very strong area of claim, with Officials and guidance supporting the inclusion of software R&D in the RDTI regime. We recommend reaching out if you have any queries on whether your software development work would qualify as an eligible R&D activity.

The Report doesn’t directly suggest immediate action is undertaken to make changes to the RDTI, but it does provide a number of suggested recommendations, including:

- Maintain policy stability to support long-term planning.

- Streamline compliance for smaller firms, possibly through simplified approval processes.

- Revisit software eligibility rules and clarify guidance.

- Introduce greater discretionary powers for the Commissioner of Inland Revenue to enable the correction of administrative errors.

It is notable that tiered credit rates (with a credit rate greater than 15% for the first $300k of R&D spend) and higher overseas expenditure caps were modelled and were found to deliver negative net impacts (based on various assumptions).

The report notes that the administrative challenges with running the scheme have swung from the initial overly restrictive application of the eligibility tests at the General Approval application stage to unpredictability in the processing times for Supplementary Returns. Underlying this are the challenges compliance officers encounter in determining the scope of the approved activities in the claim and therefore whether a particular expense relates to the approved activities. To help resolve this, the Inland Revenue and Callaghan Innovation (who have now moved into MBIE) teams are increasing their integration, with the Callaghan team beginning to receive Supplementary Returns to review for the first time.

Overall, it is clear from the Report that there are changes that could be made to the RDTI regime to enhance the benefits it provides both businesses and New Zealand alike.

What’s next?

The current Government hasn’t commented on the released Report, so it’s hard to say whether any changes will come out of it. However, we do understand that the RDTI is being considered, amongst other things, in relation to the Government’s Going for Growth initiative. Additionally, the increased scrutiny of the link between activities approved in General Approval applications and expenditure claimed reinforces the need to ensure the project’s costs are considered comprehensively at the General Approval stage.

If you have any questions on what changes might be coming to the RDTI, or if you have any questions on whether your business would qualify for the 15% tax credit, please get in touch with your usual Deloitte advisor.

Continue Reading

-

Final two shortfall penalty guidance documents published

Ms B carries on a business through her company, C Ltd. In each of the 2012–2017 tax years she provides management services to C Ltd and, in return, C Ltd pays her a salary of between $150,000 and $200,000.

In the 2018 tax year, C Ltd’s revenue reduces due to adverse market conditions. C Ltd also requires funds to meet capital expenditure. Ms B decides to forego her salary so C Ltd can pay for the capital expenditure and meet its ongoing operating costs.

By the start of the 2020 tax year, market conditions have improved, and C Ltd has met its capital expenditure needs and is trading near the levels it was trading at before the 2018 tax year. Despite this, C Ltd does not resume paying Ms B a salary. This creates a shortfall in the funds Ms B needs to meet her private expenditure. Ms B funds the shortfall using periodic borrowings obtained from C Ltd, and C Ltd funds the borrowings out of retained earnings. The borrowings are repayable on demand and interest is charged at the fringe benefit tax rate. All interest is capitalised at year end. The advances are recorded in a loan account Ms B maintains with C Ltd. At the end of the 2025 tax year, the account balance is $950,000.

The Commissioner considers s BG 1 of the ITA 2007 applies to the loan advances in the 2020–2025 tax years and proposes to treat the advances as income under s GA 1 of the ITA 2007. Ms B disputes this. In support of her position, she contends:

- the amounts she received cannot be taxed as income because they are loan advances

- the terms on which the advances were made are not objectionable because they are typical of the terms used in related-party transactions

- her initial decision to stop being paid a salary had a commercial purpose of leaving funds in C Ltd to be used for business purposes

- a person is entitled to live off capital, and under the loan she received advances of capital that she intends to repay.

Continue Reading

-

Emissions Trading Scheme for non-forestry industries

By Annamaria Maclean and Andrea Scatchard

Inland Revenue has released its final interpretation statement ‘Income tax and GST – industries other than forestry registered in Emissions Trading Scheme’ (IS 25/24). This statement applies to industries participating in the Emissions Trading Scheme (ETS) (excluding forestry, which is subject to separate tax treatment) and encompasses emissions-intensive and trade-exposed sectors, as well as those engaged in removal activities and certain horticultural operations.

The interpretation statement addresses the intricacies of ETS-related rules for non-forestry industries and should be carefully reviewed by affected parties.

In summary, the interpretation statement outlines that businesses may claim deductions for emissions liabilities incurred, calculated according to the number of New Zealand emission units (NZUs) required to be surrendered based on production levels and on an accrual accounting basis.

NZUs can be obtained through purchase in the open market or, in some cases, received as “free NZUs” as an annual government subsidy. The statement clarifies that NZUs are considered revenue account property, with specific valuation requirements upon acquisition and at balance date. Additional complexity arises when businesses are allocated free NZUs; rather than reducing the emissions liability deduction due to receipt of free NZUs, the market value of these units at balance date generates income that offsets the emissions liability deduction.

Challenges may also occur if there is a shortfall or excess in the number of free NZUs provided or when a business’s balance date does not correspond with the emissions year’s calendar period.

The statement highlights the complexity in accurately monitoring and documenting all purchased and free NZUs held, including their valuation and method of disposal (whether sold or surrendered) from a tax perspective, noting this may differ from NZU register records. As part of robust tax governance, it is essential for impacted taxpayers to monitor compliance and assess their tax positions annually to ensure that they are following the guidance outlined in the interpretation statement.

Many submitters on the exposure draft of the interpretation statement highlighted the significant complexity inherent in the current ETS regime for non-forestry industries. Submitters have advocated for legislative reforms aimed at simplifying the regime’s application and reducing administrative burdens for affected taxpayers.

Among the changes proposed by submitters are measures to remove the taxation of stockpiled free NZUs that have not been surrendered (or sold) to offset an emissions liability in an income year. Additionally, there are calls to allow taxpayers to calculate emissions liabilities and allocation of NZUs based on the emissions year that ends within their income year (much like inclusion of income from limited partnerships and CFCs), which would facilitate easier tracking and reconciliation of NZUs and associated tax obligations.

It is understood that these submissions have been forwarded to the Inland Revenue Tax Policy team for consideration. We will continue to monitor developments and keep readers informed regarding any future changes that may arise from this ongoing review process.

Please reach out to your usual Deloitte advisor if you have any queries on the ETS regime.

Continue Reading

-

Software development and SaaS expenditure under policy spotlight

By Joe Hope, Brendan Ng and Robyn Walker

Back in 1993, the internet was something you dialled into (if you’d even heard of it), the cloud referred to actual clouds, and software came on floppy disks. Needless to say, a lot has changed since then.

Yet surprisingly, New Zealand’s tax laws and guidance for software still carry traces of that bygone era. Recognising the need for change, Inland Revenue has launched consultation on the income tax treatment of software development expenditure and the costs of configuring and customising Software-as-a-Service (SaaS).

What’s on the table?

At this stage… not much in terms of proposals. The consultation isn’t advancing specific policy options yet. Instead, it seeks to identify the challenges businesses face when determining the tax treatment of software-related expenditure and clarify which costs should be immediately deductible and which should be capitalised and depreciated. Detailed policy proposals are expected in a later round of consultation.

That said, the paper does hint at Inland Revenue’s thinking on software development and SaaS customisation costs. Here’s what you need to know.

Software development expenditure

The paper first looks at expenditure on software developed for sale or licensing, asking whether current approaches provide an appropriate basis for deductibility or depreciation. It outlines three main approaches currently in use:

1. Trading stock approach

In 1993, Inland Revenue’s position was that software development costs should be immediately deductible as the cost of producing trading stock. This made sense when software was sold on disks or CDs. Today, with software typically licensed or delivered as a service, Inland Revenue considers this approach outdated except where there is a full copyright assignment as part of an outright sale.

2. Depreciation approach

These days, software is typically distributed under non-exclusive licences or as a service, rather than sold outright, meaning it no longer qualifies as trading stock. Recognising this, Inland Revenue issued an issues paper in 2016 stating that software development expenditure should generally be capitalised as depreciable intangible property, with depreciation deductions applying when the software is available for use.

Under this approach:

- The applicable depreciation rates are 50% (diminishing value) or 40% (straight line).

- Upgrades can be capitalised and depreciated.

- Abandoned projects may qualify for a deduction under section DB 40B of the Income Tax Act 2007.

- Timing depends on asset recognition and whether the R&D rules apply.

Notably, this 2016 view was never finalised as Inland Revenue and tax administrations around the world continued to grapple with tax implications of software. However, most taxpayers would be using the depreciation approach (or the R&D approach described below), which often leads to questions of what expenditure, how much expenditure, and when expenditure should be capitalised. These questions are particularly relevant when considering the iterative nature of software development, especially in relation to maintenance and upgrades, and whether there is actually an upgrade or an improvement to the software.

3. R&D approach

Under section DB 34 of the Income Tax Act 2007, expenditure meeting the IFRS accounting definition of research or development (see NZ IAS 38 ‘Intangible Assets’) can be fully deducted in the year incurred or carried forward until an intangible asset must be recognised. Depreciation then applies to any remaining capital expenditure not covered by this section.

The paper acknowledges that applying section DB 34 can be challenging in practice. From our experience section DB 34 can provide businesses with a lot of clarity and reduce their compliance costs, however it is important to consider all the requirements for applying NZ IAS 38 and make sure that appropriate processes are put into place to be certain the appropriate position is taken.

The consultation paper also highlights that section DB 34 can result in asymmetric results. That is, expenditure can be deducted under section DB 34 but gains from the sale of assets created from the R&D may be non-taxable capital gains. Inland Revenue suggest a more symmetrical approach is justified, indicating this is likely something Inland Revenue will look at in more detail in the next round of consultation.

Inland Revenue’s view

Inland Revenue concludes that the current approaches to determining deductibility are broadly acceptable. However, they are seeking feedback on whether the unique nature of software development creates incorrect outcomes and whether alternative methods are warranted.

Software-as-a-Service (SaaS)

The second half of the consultation paper addresses configuration and customisation costs incurred by taxpayers licensed to use a SaaS application owned by a third party. In these arrangements, the SaaS provider hosts the software on its own cloud infrastructure and grants customers the right to use it. Business customers often require changes to the standard application of this software, which fall into two categories:

- Configuration: Adjusting settings within existing code.

- Customisation: Modifying or adding code to create new functionality.

For accounting purposes, the key question is whether any configuration or customisation creates an intangible asset. If no intangible asset is recognised (because the customer doesn’t control the software or no new resource separate from the software and controlled by the customer is created), costs are generally expensed.

For tax purposes, Inland Revenue’s 2023 interpretation guideline (covered in a previous Tax Alert) clarified that SaaS configuration and customisation costs may, depending on circumstances, be deductible as development expenditure or treated as relating to depreciable intangible property. But issues have emerged.

Under current law, deductions are allowed only if they meet section DA 1 (the general permission) and aren’t denied by the capital limitation in section DA 2(1). Inland Revenue considers the general permission to be met, but the capital limitation likely to apply, with the result being that the costs must be capitalised. Depending on the terms of the SaaS arrangement, a taxpayer may then be able to depreciate the right to use software under either the depreciable intangible property or fixed life intangible property rules.

Alternatively, even if the capital limitation does apply, section DB 34 could override this limitation if the costs qualify as “research” or “development” under NZ IAS 38, allowing the costs to be immediately expensed. The guidelines conclude that SaaS C&C costs are unlikely to be research but could be development; but would only fall under section DB 34 where the development work is undertaken in-house (i.e. not by a third party such as the SaaS provider).

From here, the consultation paper concludes that allowing SaaS C&C costs to be deductible under section DB 34 is not “tenable” from a policy perspective, though gives no reasoning other than the compliance burden. Instead, the paper suggests the best approach is for taxpayers to capitalise and depreciate all SaaS C&C costs—though officials are open to feedback on other approaches that may minimise compliance costs.

Deloitte’s view

Deloitte disagrees with Inland Revenue’s conclusion that allowing SaaS C&C costs to be deductible is untenable. Aligning the tax treatment with the IFRS treatment would be simpler, as SaaS costs expensed for accounting purposes are often hard to identify and capitalise for tax. Divergence between accounting and tax treatment creates unnecessary compliance costs for what is a minor timing difference (depreciation over roughly two and a half years given high depreciation rates for software). A separate rule / de minimis rule for those taxpayers who do not follow IFRS would also help.

Next steps

Submissions on the consultation close on 30 January 2026.

If you have questions about software or SaaS tax treatment, or if you would like to make a submission, please contact your usual Deloitte advisor.

Continue Reading

-

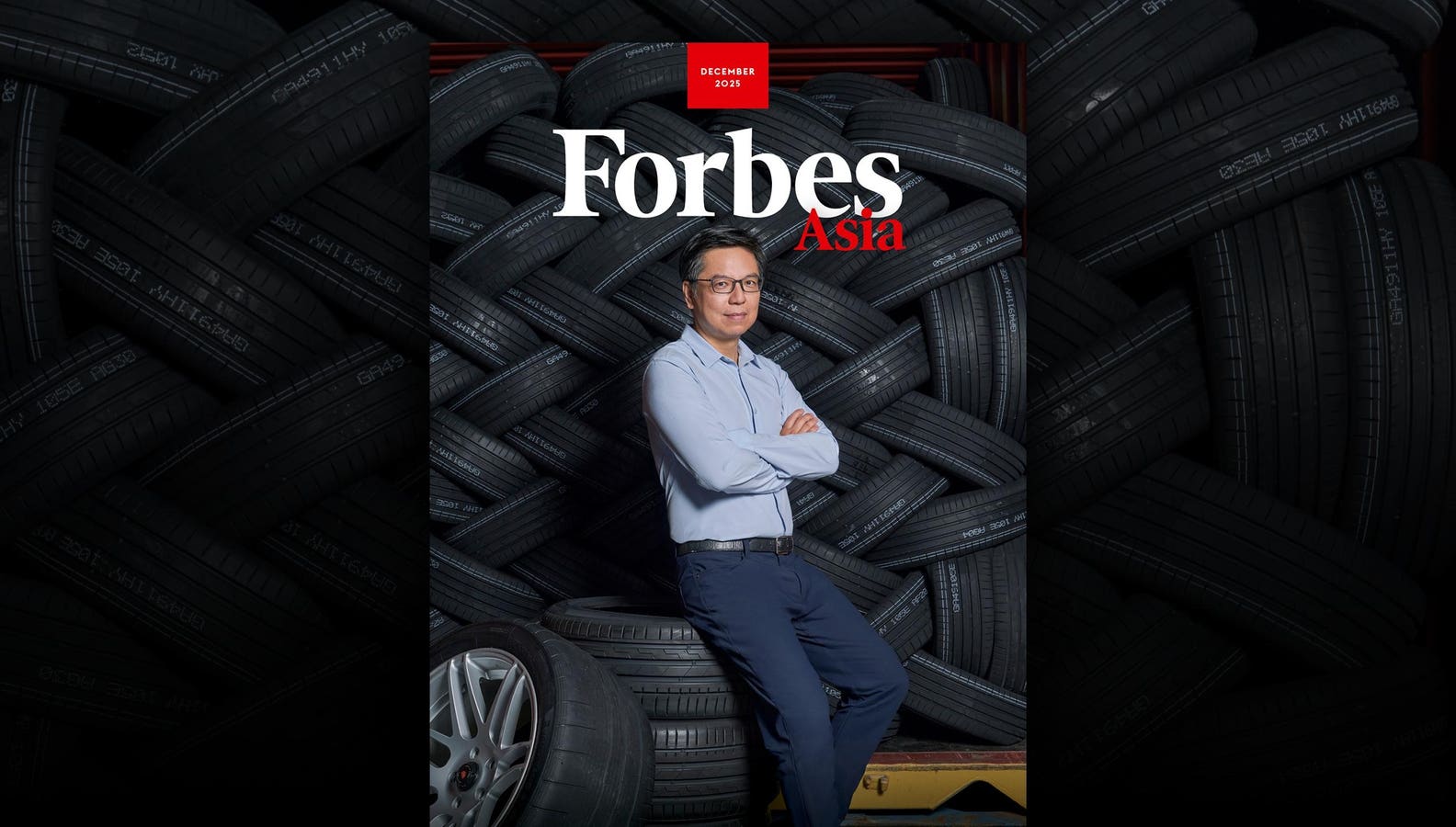

Get A Ringside View On Giti Tire’s EV-Powered Race To Catch Up With The World’s Leading Tiremakers

Forbes Asia December Issue

Forbes Asia

As an eventful 2025 draws to a close, it’s worth reflecting on its biggest moments. Few pundits could have predicted that this year would bring us a new spectator sport: trade policy. The muscular tariff regime of Trump 2.0 unleashed turmoil that governments and businesses around the world scrambled to address. Some were better prepared than others, such as the protagonist of our cover story, former medical doctor Enki Tan, now executive chairman of Singapore-headquartered Giti Tire, a tiremaker with Indonesian roots.

Tan’s global ambitions for Giti (pronounced “GT”) spurred him to invest $560 million in building a U.S. factory in 2017 to be closer to the company’s American customers. In another prescient move, Tan went all out to sharpen Giti’s technological edge in a growing segment of the market: tires for electric vehicles. In September, Chinese EV giant BYD’s new electric hypercar, sporting Giti’s wheels, notched a speed record of nearly 500 kilometers per hour to become the world’s fastest production car. As Tan disclosed to our contributing editor Ardian Wibisono, tires these days are loaded with much more than meets the eye: “I have people telling me, ‘Hey, they’re very easy to make. You just pour the rubber inside the mold and then the tire comes out.’ It’s not so easy.”

Indeed, it wasn’t an easy year either for the tycoons on the accompanying list of Indonesia’s 50 Richest as a spell of civil unrest marked by street protests made investors skittish. Despite the uncertainty, the benchmark stock index was up by double-digits, resulting in the combined wealth of the country’s richest, ably compiled by our wealth team, crossing $300 billion.

Halter founder and CEO Craig Piggott

Adam Bove

Scaling up to the billion-dollar valuation mark is an uncommon feat for companies in New Zealand. One among a handful of Kiwi unicorns is agritech firm Halter, profiled by our reporter Catherine Wang. Halter’s founder and CEO Craig Piggott, who grew up on his parents’ dairy farm in Matamata, a town immortalized as a filming location of Lord of the Rings, created a solar-powered smart collar for cows to help farmers manage their herds through virtual fencing technology. An alum of our 30 Under 30 Asia list of young achievers (class of 2021), Piggott is looking further afield to the U.S. as Halter’s next growth market.

Forbes Asia’s 2025 Heroes Of Philanthropy

Illustrations by Marco Lawrence for Forbes Asia

In a month that marks the season of giving, we present a selection of Asia-Pacific’s notable givers in our annual Heroes of Philanthropy list. This unranked group, curated by a team led by editorial director Rana Wehbe Watson, spotlights wealthy individuals and families backing worthy causes, such as supporting young women studying science, technology, engineering and mathematics.

To round up the philanthropy theme is a stateside story about billionaire couple Cari Tuna, a former journalist, and her husband, Facebook cofounder Dustin Moskovitz, who are giving away the bulk of their multibillion-dollar fortune as fast as they can. Their charity, Coefficient Giving, backs a range of causes, such as AI safety research.

As the year turns, a heads-up about what we should brace for: Speed of Change, the theme of our Forbes Global CEO Conference to be held in Singapore in the fourth quarter of 2026. As always comments welcome at executiveeditor@forbesasia.com.

Continue Reading

-

The data breach that rocked ‘South Korea’s Amazon’

Online retailer Coupang is known as South Korea’s Amazon and built its reputation on its overnight “rocket delivery” service, but it has been a lot slower to respond to a hack that leaked the personal information of nearly two-thirds of the country’s population.

Coupang said South Korea’s worst-ever data breach began through its overseas servers in June, but it only became aware of it in November. The company’s chief executive resigned this week, but Bom Kim, its Korean-American founder and chair, has yet to offer any personal apology.

The hack compromised personal information including names and phone numbers, as well as email and shipping addresses, of more than 33mn active and former users, according to police.

President Lee Jae Myung has called the case a wake-up call for stronger cyber security, calling it “astonishing” that Coupang, South Korea’s largest online retailer by market share, did not detect the breach for five months.

“The wrong practice of not giving necessary care for protecting personal data, which is a key asset in the age of artificial intelligence and digitisation, must be completely changed,” Lee said last week.

Coupang is South Korea’s largest online retailer, with 22.7% market share last year, according to the Ministry of Data and Statistics © SeongJoon Cho/Bloomberg Coupang, which boasts 25mn active users and offers services ranging from food delivery to streaming, said it had yet to establish full details of the cause and scope of the hack.

But former chief executive Park Dae-jun told a parliamentary hearing a week before his resignation that a former software developer was behind the attack.

Park said the alleged perpetrator was a Chinese national involved in authentication tasks at Coupang before his contract ended last December and he was believed to have returned to China.

Coupang’s chief information security officer, Brett Matthes, testified that the alleged perpetrator had a “privileged role” in the company that would have given him access to a private encryption key, which allowed him to generate a forged token to impersonate a customer.

Choi Min-hee, a member of South Korea’s National Assembly, said in a statement that the former employee used the key, which was still active even after he left the company, to access customer information, citing information she had received from Coupang.

Coupang has said its users’ login credentials, credit card numbers and payment details were not affected by the hack, but officials and legislators have warned that citizens could be vulnerable to targeted phishing attacks using the leaked information. “It is like the keys of almost everyone’s homes in Korea are stolen,” said National Assembly member Choi Hyung-du.

Coupang has said its users’ login credentials, credit card numbers and payment details were not affected by the hack © SeongJoon Cho/Bloomberg The company said in a statement to the Financial Times that after learning of the breach on November 18 it immediately reported it to authorities, blocked the unauthorised access route and strengthened internal monitoring. It said it would “significantly enhance our information security to prevent recurrences and will do everything we can do to recover trust”.

But legislators have lambasted Coupang for what they say is a lack of caution and a slow response. They are demanding that founder and chair Kim come forward and apologise himself. He has been summoned to a second parliamentary hearing next week.

Lee Hoon-ki, a lawmaker at last week’s hearing, suggested Coupang had been “negligent” about security issues as it rapidly expanded. Founded in 2010 as a website offering deals to group buyers, the company has seen its revenues soar more than 30-fold in the past decade to $30.2bn last year. It received a $3bn investment from SoftBank in 2015 and listed in New York in 2021 after the Covid-19 pandemic fuelled growth further.

Cyber security experts said Coupang was far from alone, with several high-profile cases contributing to what they expected to be South Korea’s worst year for large-scale data breaches.

SK Telecom, the country’s largest mobile carrier, was fined $97mn this year over the leak of information on 25mn customers. Telecoms rival KT and credit card provider Lotte Card also reported data breaches.

Upbit, the country’s dominant cryptocurrency exchange, suffered a hack last month that led to the unauthorised withdrawal of Won44.5bn ($30mn) in cryptocurrency.

Lee Chan-jin, governor of the Financial Supervisory Service, said South Korean companies’ investment in cyber security remained “awfully inadequate” compared with countries such as the US.

Simon Choi, chief technology officer of cyber security start-up StealthMole Intelligence, said businesses should see paying for data protection as insurance.

“If you talk to bosses of big companies, they often say there are too many offline issues to take care of, so cyber security often takes a back seat,” he said. “They scramble to invest more belatedly when major incidents happen, but prevention is more important.”

Cyber security experts said several high-profile cases had contributed to what they expected to be South Korea’s worst year for large-scale data breaches © Ed Jones/AFP via Getty Images Kang Hoon-sik, the president’s chief of staff, said in a meeting with senior administration officials that the major data leaks in recent years showed “structural loopholes” in South Korea’s personal information protection and the Coupang case was an opportunity to improve the country’s punitive damages system.

Lawmakers have called for Coupang, which reported Won41tn in sales last year, to pay Won1.2tn in penalties under a law that allows companies that fail to implement adequate data protection measures to be fined up to 3 per cent of their revenue.

The country’s Personal Information Protection Act also allows punitive damages of up to five times actual harm if personal data is leaked due to wilful misconduct or gross negligence.

But the clause, introduced in 2015 after leaks involving credit card companies, and the 3 per cent rule have rarely been enforced.

“US companies have to pay huge damages if they lose class action lawsuits over data breaches,” said Wi Jong-hyun, business professor at Chung-Ang University in Seoul. “But Korean companies are not afraid of this because penalties are weak and there are few cases of collective legal action.”

Market tracker IGAWorks said the data leak had caused Coupang’s daily active users to fall by about 2mn to 16mn. JPMorgan analysts said in a note that customer departures were likely to be “limited”, citing the company’s “unrivalled market positioning and Korean customers being seemingly less sensitive to data breach issues” than consumers elsewhere.

Coupang controlled 22.7 per cent of the local e-commerce market last year, followed by Naver with 20.7 per cent, according to the Ministry of Data and Statistics.

But Chung Da-hye, a 45-year-old office worker in Seoul, said she recently quit Coupang’s paid membership to express her anger over the incident.

“I love Coupang’s dawn delivery of fresh produce, but it is so disappointing to see the company’s response to the data breach,” she said. “They are making all their money here in Korea, but Bom Kim doesn’t show up to apologise. No one is taking responsibility.”

Continue Reading

-

What’s next for Indonesia’s battery ambitions? Key insights from Climateworks’ latest analysis

Indonesia has the raw ingredients to play a major role in the global battery transition: vast nickel reserves, growing refining capacity and strong investor interest.

Our latest analysis shows that natural endowments are a necessary condition for long-term leadership in the sector, but alone are not sufficient.

The country’s trajectory will depend on choices about technology pathways, industrial strategy and how sustainability is embedded going forward.

What is the current state of Indonesia’s battery industry?

Indonesia has successfully downstreamed nickel and the nation now accounts for a large share of the global nickel supply.

But its domestic battery ecosystem is focused primarily on electric vehicle usage, and its development is patchy.

Indonesia’s domestic battery ecosystem is mainly focused on electric vehicles. (Unsplash: chuttersnap) Upstream mining and some refining are robust, while midstream battery cell and pack manufacturing remain limited and geographically dispersed.

Without scaling midstream capacity, Indonesia risks being pigeonholed as a supplier of feedstock rather than a maker of finished battery systems.

If Indonesia leads in nickel supply, won’t it lead in battery supply too?

Battery technology is evolving, and global battery supply is not just about nickel.

While lithium-nickel-manganese-cobalt chemistries (NMC) deliver high energy density and favour certain vehicle types, lithium-iron-phosphate (LFP) batteries are cheaper, simpler and increasingly competitive in many Asian markets.

LFP does not rely on nickel and Indonesia does not have domestic lithium – meaning chemistry choices strongly influence trade relationships and the feasibility of an entirely domestic industry.

Nickel may be the starting point, but it does not need to be the destination.

Our analysis has identified these gaps and demonstrates how current policy levers – including protectionist rules, investment incentives and local content requirements – have steered investment but not consistently established a comprehensive, sustainable battery value chain.

What risks can Indonesia prioritise to meet its battery goals?

Environmental and social risks are central to Indonesia’s battery ambitions.

Mining and refining operations have already drawn scrutiny for their impacts on water quality, air pollution and community wellbeing.

As global buyers – from EV manufacturers to clean-energy developers – raise expectations around ethical sourcing, these issues increasingly shape market access and long-term competitiveness.

The carbon intensity of battery production is also heavily influenced by the electricity used in processing and manufacturing.

Facilities reliant on coal-fired power – especially those in industrial parks with captive plants – face higher lifecycle emissions, making their products less attractive in markets that implement carbon-based trade rules or low-emission procurement standards.

How can Indonesia avoid these risks?

Remaining competitive requires pairing growth with credibility.

Robust safeguards, transparent supply chains and emerging tools such as battery passports and verifiable recycling standards are essential.

These methods of demonstrating credibility show responsible practices from mine to finished product, protecting communities and meeting the demands of increasingly scrutiny-driven global markets.

So what can policymakers and industry do?

Climateworks, in partnership with the Purnomo Yusgiantoro Center (PYC), has brought together stakeholders and undertaken analysis to explore these options.

The results of this consultation suggests practical levers:

- Publish a national battery roadmap that aligns industrial, energy and environmental planning.

- Tie fiscal incentives to technology transfer, research and development collaboration, and clean-energy use.

- Invest in midstream capacity and workforce development.

- Seed a domestic recycling sector to recover critical materials and reduce long-term reliance on unprocessed ores.

The study’s final stakeholder consultation session with governments and industries was held on 8 December 2025 at the headquarters of Indonesia’s Chambers of Commerce and Industry. (Climateworks Centre) Indonesia’s battery future is not preordained.

The nation can still avoid a narrow, nickel-centric outcome that leaves downstream value and decarbonisation opportunities elsewhere.

With thoughtful policy design – from conditional incentives to stronger sustainability rules – Indonesia can capture more value, create resilient jobs, and reduce environmental harm.

Climateworks and PYC are working together to develop a roadmap for critical mineral processing for the low-carbon battery industry between Indonesia and Australia, laying the foundation for future investments and collaborative efforts to meet the rising demand for clean energy technologies.

Read more on climate solutions:

Continue Reading

-

Black-market oil buyers will push Venezuela for bigger discounts following US seizure – starving Maduro of much-needed revenue

The U.S. seizure of an oil tanker off the Venezuelan coast looks designed to further squeeze the economy of President Nicolás Maduro’s country.

The Dec. 10, 2025, operation – in which American forces descended from helicopters onto the vessel – follows months of U.S. military buildup in the Caribbean and was immediately condemned by the Venezuelan government as “barefaced robbery and an act of international piracy.”

But what exactly is the Trump administraion’s aim in going after the tanker, and how could this impact the already beleaguered economy of Venezuela? The Conversation U.S. turned to Rice University’s Francisco J. Monaldi, an expert on Latin American energy policy, for answers.

What do we know about the tanker that was seized?

The seized tanker, which according to reports is a 20-year-old vessel called the Skipper, is a supertanker that can carry around 2 million barrels of oil.

According to the Trump administration, the vessel was heading to Cuba. But because of the size of the ship, I strongly suspect that the final destination was likely China – tankers the size of the seized one don’t tend to be used to take oil across the Caribbean to Cuba. The ones used for that task are far smaller.

This particular tanker was sanctioned by the U.S. Treasury in 2022 due to it carrying prohibited Iranian oil. At the time, it was claimed that the ship – then called Adisa – was controlled by Russian oil magnate Viktor Artemov and was engaged in an oil smuggling network.

Attorney General Pam Bondi released a video of the seizure on X.

So the latest U.S. seizure was, on the surface, unrelated to the sanctions placed on Venezuela by U.S. authorities in 2019 and expanded in 2020 to include secondary sanctions – that is, on countries that do business on the targeted nation or company.

As such, Venezuelan officials have said this is unprecedented. And they are largely right. While there have been a few occasions in which Iranian tankers have been seized due to sanctions busting, this is the first time that there has been a seizure of a vessel departing Venezuela and with a Venezuelan crew.

The Trump administration has signaled that it is not only seizing the cargo but the ship itself – which would represent a significant loss for the company owning the ship. The loss will be borne by the company, not Venezuela, as it was under a “Free on Board” contract, meaning that as soon as it left Venezuela the buyer takes responsibility for it.

Nonetheless, this is a significant escalation of the pressure campaign on Venezuela, which looks set to continue. Reuters has reported that around 30 other tankers near Venezuela have some kind of sanction against them. They form part of a large shadow fleet that try to skirt sanctions through hiding their identity while transporting oil from Russia, Venezuela and Iran.

The signal from U.S. officials is that they are prepared to go after more vessels and further squeeze Venezuela’s oil revenues through fresh sanctions.

How often they will seize vessels is not known, but the clear threat from the White House is that the U.S. will continue with this seizure campaign.

How important are oil exports to Venezuela?

Venezuela’s economy is tremendously dependent on oil production.

We do not have exact figures, as the Venezuela government has not published them in seven years, but most analysts believe oil constitutes north of 80% of all of the country’s exports – some even put this figure above 90%.

Most of that oil goes to the black market, and a majority ends up with independent refiners in China. State-owned enterprises in China tend not to buy this oil because they do not want to fall foul of the sanctions regime. But Beijing tends to turn a blind eye to tankers heading to non-state entities, especially if those tankers have hidden their true identity so it doesn’t look like they are coming from Venezuela.

Oil production makes up a large chunk of Venezuela’s economy.

Federico Parra/AFP via Getty Images

Around 80% of Venezuelan oil goes to China in this way; around 17% goes to the U.S. through a license awarded by the U.S. Treasury to oil giant Chevron. And 3% goes to Cuba, which tends to be subsidized by the Venezuelan government.

Venezuela’s economy itself is also very dependent on oil, with the sector making up about 20% of total GDP, more than any other industry. And when it comes to government income, the oil sector makes up north of 50%.

How have US actions affected Venezuelan oil production?

It is important to know that even before U.S. sanctions began in 2019, Venezuela’s oil production was in severe decline.

In 1998, before Hugo Chávez, the leftist military officer who became a populist president, came to power, oil production peaked at around 3.4 million barrels a day. By the time Chávez died and Maduro succeeded him in 2013, it had fallen to 2.7 million barrels a day.

When U.S. sanctions targeting the state-owned oil company, Petróleos de Venezuela, were enacted in 2019, production was down to 1.3 million barrels a day – but that had already been affected by the other financial sanctions that came in two years earlier.

The oil sanctions of 2019 closed the U.S. market, taking away half a million barrels a day that at the time headed from Venezuela to the U.S. As a result, Venezuela had to increase oil sales to India and China.

But then the 2020 secondary sanctions, which apply to countries doing business with Venezuela, came in. As a result, Europe and India stopped buying Venezuelan oil, meaning that its only markets were Cuba and China. Of course, that year also saw the onset of the COVID-19 pandemic, which resulted in a massive cooling of the oil market globally.

Venezuelan oil production collapsed to 400,000 barrels a day that year. Today it has recovered to around 1 million barrels a day. This has been helped by the U.S. allowing Chevron – which, after Petróleos de Venezuela, is the second-largest oil company operating in the country – to continue production.

How does Venezuela get around oil sanctions?

Venezuela relies on a shadow fleet to help it skirt U.S. sanctions. These vessels hide their identity by using false flags and false names.

Companies often take a tanker that is going to be retired and change the identity, put on a new coat of paint and make sure transponders – devices that transmit radio signals to give a map reading – are doctored so that it looks like the ship is in a different place altogether.

These ships arrive in Venezuela, pick up oil and then set sail. Sometimes they then transfer the cargo to another ship – which carries huge environmental risks. And then it arrives typically in Malaysia, where it takes on a Malaysian identity and on it goes to China.

What impact has this latest seizure had on the price of oil?

The seizure had little impact on global oil prices, because of exiting oversupply and due to the fact that Venezuela makes up only around 1% of the overall market. That could change, depending on how aggressive the U.S. gets. But the Trump administration will be mindful that it doesn’t want to see domestic prices rise as a result.

Venezuelan leader Nicolás Maduro faces growing pressure over his country’s economic problems.

Pedro Rances Mattey/Anadolu via Getty Images

As to the price of Venezuelan oil, that could be more drastic. Venezuelan oil is already sold at a discount on the black market because of the existing risk relating to the sanctions. This latest action is likely to widen these discounts even further.

In addition, Venezuela has until now required companies to pay some of the payment for oil cargo upfront – and a lot will be unwilling to do so now, due to high costs involved in a U.S. seizure. For example, a tanker of 2 million barrels, even with the current discount, will be worth around US$100 millon – no one wants to risk that much money. So very few buyers will be willing to prepay. Instead they will expect Venezuela to share the risk.

The bottom line for Maduro is that the only way to get someone to buy Venezuelan oil amid the heightened risk of this moment is to offer higher discounts with fewer prepayments. Besides discounts, export volumes could also be affected and that in turn would lead to production cuts, which are costly to reverse.

And all this will further choke off the already limited revenue that Maduro is relying on to keep Venezuela’s government functioning.

Continue Reading

-

Asian Stocks Jump After Global Gauge Hits New Peak: Markets Wrap

(Bloomberg) — Asian stocks rallied after gauges of US and global equities hit fresh records, with sentiment boosted by this week’s Federal Reserve’s rate cut and its upbeat assessment of the US economy.

MSCI Inc.’s index of Asian shares was up 0.9% on Friday, poised for its highest close in about a month. Japan’s Topix led regional gains, with financials favored on bets that a Bank of Japan interest-rate hike next week is all but certain. Chinese equities underperformed after the nation’s leadership signaled it will maintain economic support but refrain from ramping up stimulus next year.

While the S&P 500 climbed 0.2% to an all-time high on Thursday, some caution for tech names persisted. Shares of Broadcom Inc., a chip company vying with Nvidia Corp. for AI computing revenue, slid in late trading after its sales outlook for red-hot market failed to meet investors’ lofty expectations. S&P 500 futures were steady on Friday though contracts on the tech-heavy Nasdaq 100 fell 0.1%.

Thursday’s price action lifted the MSCI All Country World Index — one of the broadest measures of the stock market — to a new closing high. Up nearly 21% in 2025, it is on track for its best year since 2019.

“The momentum should continue into year-end. With rate cuts underway, a new Fed chair on deck, and earnings trending higher, the bull market looks positioned to extend into 2026,” said Gina Bolvin, President of Bolvin Wealth Management Group. “As more companies adopt AI, participation should broaden and sectors beyond the Magnificent Seven may start to show strength.”

Delivering a third consecutive interest-rate reduction on Wednesday, Fed Chair Jerome Powell voiced optimism that the US economy will strengthen as the inflationary impact from tariffs fades away. While officials maintained their outlook for just one cut in 2026, traders have stuck to bets for two such moves.

The Fed now expects the US economy to grow by 2.3% next year, up from its previous projection of 1.8%, while anticipating that the pace of inflation will slow to 2.4%.

An index of the dollar traded around a two-month low on Friday and was on track for a third weekly loss. Yields on 10-year Treasuries were little changed after a small gain on Thursday, when data showed that initial jobless claims rose more than expected in the Dec. 6 week.

“The Fed’s ‘hawkish-but-bullish’ cut last night reinforces this: stronger 2026 growth, faster disinflation,” said Florian Ielpo, head of macro at Lombard Odier Investment Managers. “Cuts are continuing, but they’re no longer automatic — and that’s usually a constructive backdrop for equities.”

In Asia, Thailand markets were in focus after Prime Minister Anutin Charnvirakul moved to dissolve parliament, setting the stage for an early election after reports of a key political party backing his minority government moving to withdraw its support.

Elsewhere, copper climbed to a fresh record high on Thursday and most other industrial metals rose after the Fed move. Gold steadied after three days of gains, supported by the prospect of further monetary easing in the US, while silver traded near a record high. Oil rallied from its lowest close in almost two months and Bitcoin flip-flopped in a tight range around $92,500.

The tech sector continues to be on traders’ radar after dominating much of the recent market action following Oracle Corp.’s results — which brought worries about valuations and whether heavy spending on AI infrastructure will pay off back into focus.

“The effect of Oracle has been greater than the Fed. This already tells us everything as we’ve been witnessing a strong concentration and one theme — AI — leading the market,” said Alberto Tocchio, a portfolio manager at Kairos Partners. “This doesn’t mean that AI is gone or it’s a bubble, but we need to focus on a wider scale.”

Corporate News

SoftBank Group Corp. is studying potential acquisitions including data center operator Switch Inc., as billionaire founder Masayoshi Son ramps up the search for deals that can help it ride the AI-fueled boom in digital infrastructure, people with knowledge of the matter said. Walt Disney Co. is licensing iconic characters including Mickey Mouse and Cinderella to OpenAI for use on its artificial intelligence video platform and has agreed to take a $1 billion stake in the startup. Huawei Technologies Co. and manufacturing partner Semiconductor Manufacturing International Corp. are making advances in chip production technology despite US attempts to limit their progress, according to analysis of a new phone’s components by research firm TechInsights. China’s internet search leader Baidu Inc. is seeing a fresh wave of bullish calls from analysts thanks to the possible listing of its chip unit Kunlunxin. OpenAI is rolling out a new artificial intelligence model designed to make ChatGPT better at coding, science and a wide range of work tasks, weeks after Alphabet Inc.’s Google put the startup on defense with the well-received launch of Gemini 3. Sembcorp Industries Ltd. agreed to buy Australian power generator and retailer Alinta Energy Pty for A$6.5 billion ($4.3 billion) in enterprise value, furthering the Singaporean company’s ambitions to expand outside its home market. Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 11:30 a.m. Tokyo time Japan’s Topix rose 1.6% Australia’s S&P/ASX 200 rose 1.2% Hong Kong’s Hang Seng rose 1% The Shanghai Composite fell 0.4% Euro Stoxx 50 futures rose 0.3% Currencies

The Bloomberg Dollar Spot Index was little changed The euro was little changed at $1.1734 The Japanese yen was little changed at 155.70 per dollar The offshore yuan was little changed at 7.0536 per dollar Cryptocurrencies

Bitcoin fell 0.5% to $92,380.85 Ether was little changed at $3,248.42 Bonds

The yield on 10-year Treasuries was little changed at 4.15% Australia’s 10-year yield was little changed at 4.72% Commodities

West Texas Intermediate crude rose 0.7% to $58.02 a barrel Spot gold fell 0.1% to $4,275.28 an ounce This story was produced with the assistance of Bloomberg Automation.

–With assistance from Joanna Ossinger and Richard Henderson.

©2025 Bloomberg L.P.

Continue Reading