Brings Together Airlines with Similar Flexible Capacity Models Serving 22 Million Annual Customers, Nearly 175 Cities, With More Than 650 Routes, and 195 Aircraft

Complementary Route Networks, Diversified Fleet, and Third-Party Travel Business Expand Choice, and Service for Passengers, Allowing Them to Reach More U.S. and International Vacation Destinations

Strengthens Diversified Operations with Long-Term, Contractual Charter and Cargo Customers

Strong Margins and Balance Sheet Support Growth Drive Shareholder Returns

Expected to Generate $140 Million in Annual Synergies by Year 3 Post Close; Accretive to EPS Year 1 Post Closing While Enhancing Long Term Financial Returns

Larger Loyalty Program Will Boost Rewards with Expanded Earning Options, Richer Benefits, and Greater Flexibility for Travelers

More Opportunities for Team Members with a Shared Commitment to People and Service

Committed to Maintaining Significant Presence in Minneapolis-St. Paul as an Important Base of Operations and Key Anchor City

Investor Conference Call Scheduled for Monday, January 12 at 8:30 AM Eastern Time

LAS VEGAS and MINNEAPOLIS, Jan. 11, 2026 /PRNewswire/ — Allegiant (NASDAQ: ALGT) and Sun Country Airlines (NASDAQ: SNCY) today announced a definitive merger agreement under which Allegiant will acquire Sun Country in a cash and stock transaction at an implied value of $18.89 per Sun Country share. Sun Country shareholders will receive 0.1557 shares of Allegiant common stock and $4.10 in cash for each Sun Country share owned, representing a premium of 19.8% over Sun Country’s closing share price of $15.77 on January 9, 2026, and 18.8% based on the 30-day volume-weighted average price. The transaction values Sun Country at approximately $1.5 billion, inclusive of $0.4 billion of Sun Country’s net debt. Upon closing, Allegiant and Sun Country shareholders will own approximately 67% and 33%, respectively, of the combined company on a fully diluted basis.

The combination will create a leading leisure-focused U.S. airline, expanding service to more popular vacation destinations across the United States, as well as international destinations, and providing more people with access to affordable, convenient air travel. Allegiant and Sun Country are well positioned to create one of the most adaptable and resilient airline models in the industry, with the ability to respond quickly to changing market conditions, traveler demand, and charter and cargo partner needs. The combination of two financially strong leisure carriers in the U.S. will create benefits for customers, communities, employees, and partners by enhancing stability, expanding opportunities, and enabling continued investment and innovation.

Gregory C. Anderson, Allegiant CEO, said, “This combination is an exciting next chapter in Allegiant and Sun Country’s shared mission in providing affordable, reliable, and convenient service from underserved communities to premier leisure destinations. We have long admired Sun Country for their well-run, flexible, and diversified business model that optimizes for year-round utilization and strong margins. Together, our complementary networks will expand our reach to more vacation destinations including international locations. With our combined strengths– including operational excellence, consistent profitability, strong balance sheets, and fleet ownership, we will create an even more resilient and agile airline that delivers greater value to travelers, partners, Team Members, shareholders, and the communities we serve.”

Jude Bricker, Sun Country President & CEO, said, “Over Sun Country’s 43-year history, we have grown to become one of the nation’s most respected low-cost, leisure airlines with a unique business model for serving scheduled service and charter passengers as well as delivering cargo, with a strong brand and deep roots in Minnesota. Today marks an exciting next step in our history as we join Allegiant to create one of the leading leisure travel companies in the U.S. We are two customer-centric organizations, deeply committed to delivering affordable travel experiences without compromising on quality. Importantly, we believe this transaction delivers significant value to Sun Country shareholders and an opportunity to continue to benefit from our growth plans as a combined company.”

A Shared Commitment to Affordable Leisure Travel for Our Combined 22 Million Annual Passengers

Both Allegiant and Sun Country have built their businesses with a focus on connecting travelers to the places they love, with a commitment to value, convenience, and customer choice. The combined airline will offer:

- Complementary footprint provides more destinations, more often: The combination brings together complementary route networks across Allegiant’s small and mid-sized localities and Sun Country’s larger cities and will provide more than 650 routes, including 551 Allegiant routes and 105 Sun Country routes. This combination will connect MSP to Allegiant’s mid-sized markets, and expand nonstop service to popular vacation spots, with a continued focus on underserved markets across the U.S. while expanding opportunities into international locations.

- Expanded international service: With access to Sun Country’s vast international network across Mexico, Central America, Canada, and the Caribbean, the combined airline will offer Allegiant customers access to expanded service from its small and mid-sized cities to 18 international destinations.

- Greater scheduling agility, improved reliability, and dynamic route planning enhance on-time performance: Integrated scheduling and fleet management will enhance on-time performance. The combined airline’s flexible capacity will match demand during peak leisure travel seasons and days of the week, while leveraging year-round charter and cargo operations to maximize profitability. By rapidly adjusting and expanding passenger and charter routes to support emerging vacation trends and expertly matching demand trends, the combined company can better service underserved markets and meet charter and cargo customer demands.

- Enhanced loyalty rewards program: Expanded frequent flyer and membership benefits, combining the best of both airlines’ programs. Adding Sun Country’s more than 2 million members to Allegiant’s 21 million member base further enhances the relevance of the combined program, driving greater customer rewards.

Opportunities for Our Teams Flying Together

Allegiant and Sun Country share cultures rooted in respect, teamwork, and opportunity, where employees are empowered to grow their careers and contribute to a mission they believe in: connecting communities and helping travelers reach the places they love. As part of a leading leisure-focused airline, employees will have increased opportunities, including:

- Career growth: A larger network and fleet will create new roles, advancement opportunities, and cross-training possibilities across the combined airline.

- Shared culture of service: Both airlines’ emphasis on safety, hospitality, and affordable leisure travel will remain central to training, operations, and customer care.

- Seasonal stability: In addition to expanded leisure travel opportunities, the combined airline’s diversified operations, including Sun Country’s long-term charter contracts and cargo partnerships, will create more year-round flying opportunities for pilots, crews, and operations personnel. This stability supports career growth, cross-training, and operational efficiency across the network.

- Employee engagement: Continued investment in programs that support professional development and recognition of team member contributions.

Allegiant and Sun Country will work closely with employees and their unions — including pilots, flight attendants, mechanics, ground staff, and dispatchers — to ensure a smooth and transparent integration process. Existing collective bargaining agreements will remain in effect, and the companies will follow all processes required under the Railway Labor Act. Both companies share a goal to support employees throughout the transition, creating a unified team for the future.

Creating Outsized, Long-Term Value for Shareholders

The combination of Allegiant and Sun Country brings together two profitable airlines with strong balance sheets and is expected to deliver immediate and sustained value to shareholders of both companies through significant long-term growth potential and enhanced financial strength, including:

- Synergy realization: Allegiant expects to achieve $140 million in annual synergies within three years following the closing and integration, primarily driven by the ability to provide more customers with more options across the combined network. Expected cost savings and revenue synergies are also expected from scale efficiencies, fleet optimization, and procurement.

- EPS accretion: Transaction expected to be accretive to earnings per share one year post closing, while enhancing long-term financial results.

- Balance sheet flexibility and leverage: The combined company expects Net Adjusted Debt[1] to EBITDAR of less than 3.0x at closing and to maintain balance sheet flexibility post-closing.

- Diversified operations: Sun Country remains a major narrow-body freighter operator in the U.S., with its multi-year agreement with Amazon Prime Air, as well as its charter contracts with casinos, Major League Soccer, collegiate sports teams, and the Department of Defense. With the addition of Allegiant’s existing charter business, the combined airline will benefit from a further diversified business model that balances demand cycles, provides stable revenue streams, and maximizes aircraft and crew utilization.

- Enhanced fleet optimization and leverage: Owning and operating both Airbus and Boeing aircraft – with the ability to source additional aircraft from new and existing markets – will enable the company to deploy aircraft where they deliver the greatest operational and financial benefit. The combined airline will have the scale to more fully utilize Allegiant’s 737 MAX fleet and order book, improving fuel efficiency and capacity. On closing, the combined airline will operate approximately 195 aircraft, with 30 on order and an additional 80 options.

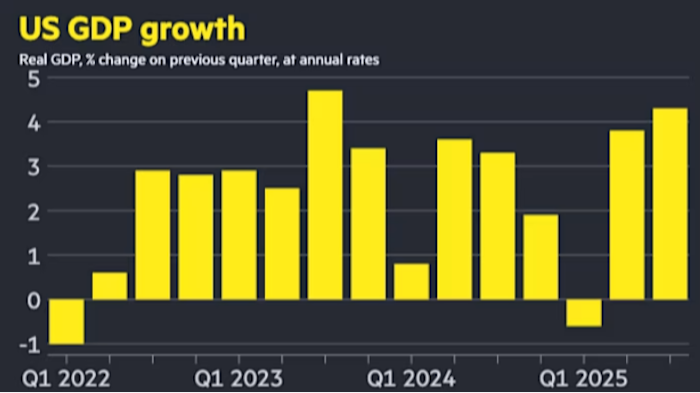

- Financial resilience through economic cycles: The combined airline’s diversified revenue streams, including its high ancillary revenues and long-term contracts in cargo and charter that are able to pass through fuel risk to the end customer, are expected to provide greater resilience through economic cycles.

Leadership, Governance, and Footprint

Following close, Allegiant will continue to be the publicly held parent company and the combined company will continue under the Allegiant name. However, each airline will operate separately until the airline operations obtain a single operating certificate from the FAA which consolidates the airlines’ operations, procedures, and safety protocols into one framework. There will be no immediate impact to ticketing, flight schedules, and travel experience, or the Sun Country brand, and customers can continue to book and fly with Allegiant and with Sun Country as they do today.

Upon closing, Allegiant CEO Gregory C. Anderson will serve as Chief Executive Officer of the combined company, and Robert Neal will serve as President and Chief Financial Officer. Sun Country President and CEO Jude Bricker will join the Board of Directors, alongside two additional Sun Country Board members, expanding the size of the Allegiant board to 11. Maury Gallagher, Chairman of the Board of Allegiant, will serve as Chairman of the Board of the combined company. Jude Bricker will serve as an advisor to Mr. Anderson to help ensure a smooth and successful integration.

The combined company will be headquartered in Las Vegas and will maintain a significant presence in Minneapolis-St. Paul where Sun Country is based.

Timing and Approvals

The transaction has been unanimously approved by the boards of directors of both companies and is expected to close in the second half of 2026, subject to receipt of U.S. federal antitrust clearance and other required regulatory approvals, the approval of both companies’ shareholders and other customary closing conditions.

Investor Conference Call and Transaction Website Details

Allegiant and Sun Country will conduct a live conference call and webcast to discuss the transaction tomorrow, January 12, 2026, at 8:30 AM ET. A live broadcast of the conference call will be available via the Company’s Investor Relations website homepage at http://ir.allegiantair.com.

The webcast and accompanying presentation slides will be available on both the Allegiant website and Sun Country website, as well as www.SoaringForLeisure.com, a joint website dedicated to the transaction.

Advisors

Barclays is serving as financial advisor, and Skadden, Arps, Slate, Meagher & Flom LLP is serving as legal advisor, and FGS Global is serving as strategic communications advisor to Allegiant.

Goldman Sachs & Co. LLC is serving as financial advisor and Milbank LLP is serving as legal advisor, and Collected Strategies is serving as strategic communications advisor to Sun Country.

Allegiant – Together We FlyTM

Las Vegas-based Allegiant (NASDAQ: ALGT) is an integrated travel company with an airline at its heart, focused on connecting customers with the people, places, and experiences that matter most. Since 1999, Allegiant Air has linked travelers in small-to-medium cities to world-class vacation destinations with all-nonstop flights and industry-low average fares. Today, Allegiant’s fleet serves communities across the nation, with base airfares less than half the cost of the average domestic roundtrip ticket. For more information, visit us at Allegiant.com. Media information, including photos, is available at http://gofly.us/iiFa303wrtF

About Sun Country

Sun Country Airlines is a new breed of hybrid low-cost air carrier, whose mission is to connect guests to their favorite people and places to create lifelong memories and transformative experiences. Sun Country dynamically and synergistically deploys shared resources for our passenger service, including scheduled service and charter, and cargo service segments. Based in Minnesota, we focus on serving leisure and visiting friends and relatives (“VFR”) passengers and charter customers and providing cargo service to Amazon, with flights throughout the United States and to destinations in Mexico, Central America, Canada, and the Caribbean.

For photos, b-roll and additional company information, visit https://www.stories.suncountry.com/multimedia

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements under the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, Section 27A of the Securities Act of 1933 and the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not historical facts and often can be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “guidance,” “anticipate,” “intend,” “plan,” “estimate”, “project”, “hope” or similar expressions. Forward-looking statements in this communication are based on Allegiant’s and Sun Country’s current expectations, estimates and projections about the expected date of closing of the proposed transaction and the potential benefits thereof, their respective businesses and industries, management’s beliefs and certain assumptions made by Allegiant and Sun Country, all of which are subject to change. Forward-looking statements in this communication may relate to, without limitation, the benefits of the proposed transaction, including future financial and operating results; the parties’ respective plans, objectives, expectations and intentions; the expected timing and likelihood of completion of the proposed transaction; expected synergies of the proposed transaction; the timing and result of various regulatory proceedings related to the proposed transaction; the ability to execute and finance current and long-term business, operational, capital expenditures and growth plans and strategies; the impact of increased or increasing transaction and financing costs associated with the proposed transaction or otherwise, as well as inflation and interest rates; and the ability to access debt and equity capital markets.

Forward-looking statements involve risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements and caution must be exercised in relying on forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to, the following: the occurrence of any event, change or other circumstance that could give rise to the right of one or both of the parties to terminate the definitive merger agreement for the proposed transaction; the risk that potential legal proceedings may be instituted against Allegiant or Sun Country and result in significant costs of defense, indemnification or liability; the possibility that the proposed transaction does not close when expected or at all because required stockholder approvals, required regulatory approvals or other conditions to closing are not received or satisfied on a timely basis or at all (and the risk that such regulatory approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction); the risk that the combined company will not realize expected benefits, cost savings, accretion, synergies and/or growth from the proposed transaction or that any of the foregoing may take longer to realize or be more costly to achieve than expected; disruption to the parties’ businesses as a result of the announcement and pendency of the proposed transaction; the costs associated with the anticipated length of time of the pendency of the proposed transaction, including the restrictions contained in the definitive merger agreement on the ability of each of Sun Country and Allegiant to operate their respective businesses outside the ordinary course consistent with past practice during the pendency of the proposed transaction; the diversion of Allegiant’s and Sun Country’s respective management teams’ attention and time from ongoing business operations and opportunities on acquisition-related matters; the risk that the integration of Sun Country’s operations will be materially delayed or will be more costly or difficult than expected or that Allegiant is otherwise unable to successfully integrate Sun Country’s businesses into its businesses; the possibility that the proposed transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; reputational risk and potential adverse reactions of Allegiant’s or Sun Country’s customers, suppliers, employees, labor unions or other business partners, including those resulting from the announcement or completion of the proposed transaction; the dilution caused by Allegiant’s issuance of additional shares of its common stock in connection with the consummation of the proposed transaction; a material adverse change in the business, condition or results of operations of Allegiant or Sun Country; changes in domestic or international economic, political or business conditions, including those impacting the airline industry (including customers, employees and supply chains); Allegiant’s and Sun Country’s ability to successfully implement their respective operational, productivity and strategic initiatives; the outcome of claims, litigation, governmental proceedings and investigations involving Allegiant or Sun Country; and a cybersecurity incident or other disruption to Sun Country’s or Allegiant’s technology infrastructure.

Forward-looking statements in this communication are qualified by and should be read together with, the risk factors set forth above and the risk factors included in Allegiant’s and Sun Country’s respective annual and quarterly reports as filed with the Securities and Exchange Commission (the “SEC”), and readers should refer to such risks, uncertainties and risk factors in evaluating such forward-looking statements. In addition, the risk factors discussed above are not exhaustive and they, along with other risk factors, will be more fully discussed in the registration statement and joint proxy statement/prospectus to be filed with the SEC in connection with the proposed transaction.

The forward-looking statements in this communication are made only as of the date they were first issued, and unless otherwise required by applicable securities laws, Allegiant and Sun Country disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Important Additional Information and Where to Find It

In connection with the proposed transaction, Allegiant intends to file with the SEC a registration statement on Form S-4 (the “Registration Statement”), which will include a prospectus with respect to the shares of Allegiant’s common stock to be issued in the proposed transaction and a joint proxy statement for Allegiant’s and Sun Country’s respective stockholders (the “Joint Proxy Statement/Prospectus”). The definitive joint proxy statement (if and when available) will be mailed to stockholders of Allegiant and Sun Country. Each of Allegiant and Sun Country may also file with or furnish to the SEC other relevant documents regarding the proposed transaction. This communication is not a substitute for the Registration Statement, the Joint Proxy Statement/Prospectus or any other document that Allegiant or Sun Country may file with the SEC or send to their respective stockholders in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF ALLEGIANT AND SUN COUNTRY ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION WHEN THEY BECOME AVAILABLE, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE INTO THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING ALLEGIANT, SUN COUNTRY, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders of Allegiant and Sun Country may obtain free copies of these documents and other documents filed with the SEC by Allegiant or Sun Country through the website maintained by the SEC at http://www.sec.gov or from Allegiant at its website, https://ir.allegiantair.com/financials/sec-filings/default.aspx, or from Sun Country at its website, https://ir.suncountry.com/financials/sec-filings. Documents filed with the SEC by Allegiant will be available free of charge by accessing Allegiant’s website at https://ir.allegiantair.com/financials/sec-filings/default.aspx, or alternatively by directing a request by mail to Allegiant’s Investor Relations department, 1201 North Town Center Drive, Las Vegas, NV 89144, and documents filed with the SEC by Sun Country will be available free of charge by accessing Sun Country’s website at https://ir.suncountry.com/financials/sec-filings, or alternatively by directing a request by mail to Sun Country’s Investor Relations department, 2005 Cargo Road, Minneapolis, MN 55450.

Participants In The Solicitation

Allegiant, Sun Country and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Allegiant and Sun Country in connection with the proposed transaction under the rules of the SEC.

Information about the interests of the directors and executive officers of Allegiant and Sun Country and other persons who may be deemed to be participants in the solicitation of stockholders of Allegiant and Sun Country in connection with the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the Joint Proxy Statement/Prospectus, which will be filed with the SEC.

Information about the directors and executive officers of Allegiant, their ownership of Allegiant common stock and Allegiant’s transactions with related persons can also be found in the Allegiant Annual Report and Allegiant’s definitive proxy statement in connection with its 2025 annual meeting of stockholders, as filed with the SEC on Schedule 14A on April 30, 2025 (the “Allegiant 2025 Proxy Statement”), and other documents subsequently filed by Allegiant with the SEC, which are available on its website, https://ir.allegiantair.com/financials/sec-filings/default.aspx. Such information is set forth in the sections entitled “Proposal No. 1 – Election of Directors”, “Proposal No. 2 – Advisory (non-binding) Vote on Executive Compensation”, “Proposal No. 3 – Approval of Amendment to Allegiant 2022 Long-Term Incentive Plan to Increase Number of Shares Available”, “Executive Compensation” and “Related Party Transactions” of the Allegiant 2025 Proxy Statement. To the extent holdings of Allegiant common stock by the directors and executive officers of Allegiant have changed from the amounts of Allegiant common stock held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC, which are available at https://www.sec.gov/edgar/browse/?CIK=1362468&owner=exclude under the tab “Ownership Disclosures”.

Information about the directors and executive officers of Sun Country, their ownership of Sun Country common stock and Sun Country’s transactions with related persons can also be found in the definitive proxy statement for Sun Country’s 2025 annual meeting of stockholders, as filed with the SEC on Schedule 14A on April 25, 2025 (which is available at https://ir.suncountry.com/financials/sec-filings), and other documents subsequently filed by Sun Country with the SEC. Such information is set forth in the sections entitled “Proposal 1– Reelection of Directors”, “Proposal 2 – Non-binding (Advisory) Vote to Approve the Compensation of Our Named Executive Officers”, “Executive Compensation”, “Certain Relationships and Related Person Transactions” and “Security Ownership of Certain Beneficial Owners and Management” of such definitive proxy statement. Please also refer to Sun Country’s subsequent Current Reports, as filed with the SEC on Form 8-K on September 22, 2025 (which is available at https://ir.suncountry.com/financials/sec-filings) and on October 30, 2025, regarding subsequent changes to Sun Country’s Board of Directors and executive management following the filing of such definitive proxy statement. To the extent holdings of Sun Country common stock by the directors and executive officers of Sun Country have changed from the amounts of Sun Country common stock held by such persons as reflected in the definitive proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC, which are available at https://www.sec.gov/edgar/browse/?CIK=1743907&owner=exclude under the tab “Ownership Disclosures”.

Free copies of these documents may be obtained as described above.

No Offer or Solicitation

This communication is for informational purposes only and does not constitute, or form a part of, an offer to sell, an offer to buy, or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, and there shall be no sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Contacts

Allegiant

Media Inquiries:

[email protected]

FGS Global:

[email protected]

Investor Inquiries:

[email protected]

Sun Country

Media Inquiries:

Wendy Burt

[email protected]

Collected Strategies:

Jim Golden, Tali Epstein, Kiki Torpey

[email protected]

Investor Relations:

Chris Allen

[email protected]

1 Adjusted Net Debt / Adjusted EBITDAR defined as (Total Debt + Operating Leases – Cash) / LTM Adjusted EBITDAR.

SOURCE Allegiant Travel Company