Almost a million young people are not in education, employment or training. Employers are freezing their hiring plans. Unemployment is at a four-year high. Not all is right in the UK jobs market, and the outlook is getting worse.

Typically it takes a full-blown recession to spark the type of growth in unemployment that Britain is witnessing today. About 100,000 jobs have been lost from company payrolls in the past year, and the official jobless rate has hit 4.8%, up from 4.1% a year earlier. More than 9 million working-age adults are neither in employment nor looking for a job.

But while this alone ought to be worrying enough, underneath these headline statistics are two troubling trends: a dramatic increase in youth unemployment and rising levels of ill health.

This week the government will respond. Sir Charlie Mayfield, a former chair of John Lewis , is expected to publish his Keep Britain Working review, outlining his recommendations for the government and business to do more to tackle rising levels of worklessness.

Commissioned by ministers last year, Mayfield believes businesses must do significantly more to help people with work-limiting health conditions and those with disabilities. Support for mental health in particular is key.

“This issue is a nasty one,” Mayfield told me recently at Labour’s party conference in Liverpool. “There is a tremendous opportunity to do better.

“It is absolutely huge in the context of what it means for those people individually, in terms of what it means for the productive capacity that is not then available to the economy, and therefore the implications that has for growth.”

As many as one in five working-age adults across the country are either not in employment or currently seeking a job, a position statisticians describe as “economically inactive”. For almost 3 million, the main reason is long-term ill-health, which is near to its highest level on record.

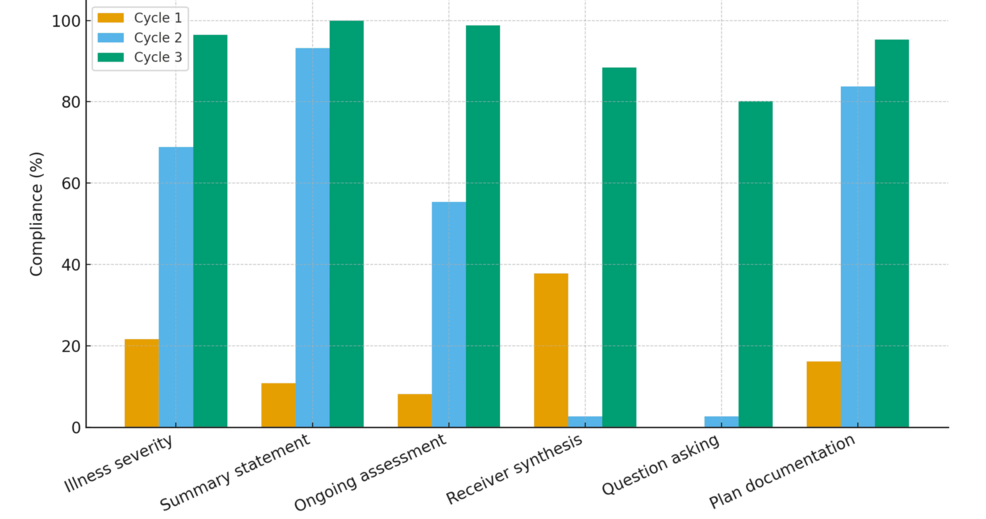

Most of the increase has been down to the health of young people. Between 2015 and 2024, the number of people with work-limiting conditions rose by 900,000, or 32%, for 50- to 64-year-olds. For those aged 16 to 34, the rise was 1.2 million, or 77%.

More than a quarter of 16- 24-year-olds who are not in education, employment or training (Neet) are inactive because of disability and ill-health, according to the Resolution Foundation. That figure has more than doubled since 2005.

Separate analysis published this week by the TUC shows that unemployment for people with disabilities has jumped to the highest rate since before the Covid pandemic, and stands at more than double that of the rate for non-disabled people.

With the Mayfield review, the TUC chief, Paul Nowak, believes Labour has an opportunity to turn the page on a decade of Tory neglect of disabled workers. But it will require ministers to take action. “Our employment system is failing disabled people,” he said. “We can’t carry on as we are.”

The big question is how to respond. Who is best placed to help young people, and those with health conditions, to get on in the world of work?

Ahead of Rachel Reeves’s budget, business leaders have made clear that their capacity to do much more is at breaking point. But with the public finances in a tight spot, the government, too, has limited room for manoeuvre.

On 26 November, the chancellor will be expected to flesh out her promise of a “youth guarantee”, announced at Labour’s annual conference in Liverpool. Investment in skills, training, apprenticeships and further eduction will also be key. The TUC is warning Reeves against taking a renewed shot at cutting disability benefits, urging her to reform the Access to Work scheme, and to raise statutory sick pay.

after newsletter promotion

Getting more people into work would be a much better way to cut spending on benefits. It would also benefit the economy: if the UK matched the lowest Neet rate among OECD countries, that could deliver a boost to the economy of £69bn.

For business, bosses feel in a strong position to push back against any new government requests to play a bigger role. Unless, of course, it involves a tax break or subsidy. After the chancellor’s last budget raised employer national insurance contributions (NICs) by £25bn, corporate lobbyists feel emboldened.

On the one hand, they have a point. Alongside this tax rise, a higher living wage, elevated borrowing costs, sticky inflation and a sluggish economic outlook, companies are under significant pressure. These headwinds are among the reasons why the jobs market is faltering. Business groups also warn that Labour’s “make work pay” employment rights bill would make matters worse.

Job vacancies have fallen most in the sectors hurt most by the rising cost of employment and fading consumer demand; retail, leisure and hospitality are among the hardest hit. However, these places are also typically the first ports of call for young people and those with health issues who are hoping to get back into the jobs market.

But employers refusing to do more to help them would be massively short-termist. Without support, the rise in people standing outside the jobs market will deprive business of potential employees and customers; unemployment would rise further, the economy would suffer, and the public finances would deteriorate. Nobody wins.

“Investment in employee health and wellbeing should not be a burden,” Mayfield told me in Liverpool. “It actually should be something that is both increasingly necessary and also highly returning for employers.

“What we have to figure out is, how do we create the circumstances where more employers both feel and experience that?”

Businesses might well be under pressure. But equally they cannot opt out either, and say: “Nothing to do with us.” We live in a society where we are all connected.