- Turkish Banks Monitor: 3Q25 – Data File Fitch Ratings

- Fitch affirms Garanti BBVA’s ’BB-’ rating, revises outlook to positive Investing.com

- Fitch upgrades outlook for 22 Turkish banks to ‘positive’ Türkiye Today

- Fitch upgrades Turkiye’s outlook to positive, keeps BB minus rating Fibre2Fashion

- Fitch Raises Turkey’s Credit Outlook to Positive TradingView

Category: 3. Business

-

Turkish Banks Monitor: 3Q25 – Data File – Fitch Ratings

-

Our CIOs on Modern Mercantilism, AI, and Managing Money Today—Bridgewater Associates

Disclaimer & Agreement

Bridgewater Associates, LP is a global investment management firm. Bridgewater Associates, LP advises certain private investment funds and institutional clients, and is not available to provide investment advisory or similar services to most other investors. This website is a resource for audiences other than investors such as potential employees, researchers, students, counterparties and industry participants. Bridgewater Associates, LP believes it is useful for such persons to have an accurate source of relevant information. Under no circumstances should any information presented on this website be construed as an offer to sell, or solicitation of any offer to purchase, any securities or other investments. This website does not contain the information that an investor should consider or evaluate to make a potential investment. Offering materials relating to investments in entities managed by Bridgewater Associates, LP are not available to the general public.

To view this content, you must agree to the following terms, in addition to and supplementing the Bridgewater Terms of Use and Privacy Policy:

I confirm to Bridgewater Associates, LP and agree that:

- I am entering this website only to obtain general information regarding Bridgewater Associates, LP and not for any other purpose.

- I understand that investments managed by Bridgewater Associates, LP are not available to the general public.

- I understand that this website does not contain the information I would need to consider for an investment, and that such information is only available to a limited group of persons and institutions meeting specified criteria.

- I understand that this website has not been reviewed or approved by, filed with, or otherwise furnished to any governmental or similar authority, and is intended only to provide limited information to members of the public who have a legitimate interest in that information for reasons unrelated to making investments.

- I understand that when Bridgewater Associates, LP makes third party information available, Bridgewater generally will not have verified statements made by the third party, and the presentation of information may omit important information.

- I understand that third party materials such as live interviews made available by Bridgewater Associates, LP generally will not have been edited by Bridgewater and statements in those materials by individuals associated with Bridgewater should be understood in the conversational context in which they were made, which may include providing historical background.

- The content constitutes the proprietary intellectual property of Bridgewater or its licensors and that I will not directly or indirectly copy, modify, recast, create derivative works, post, publish, display, redistribute, disclose, or make available the content, in whole or in part, to any third parties, or assist others to do the same, or otherwise make any commercial use of the content without the prior written consent of Bridgewater.

By registering my information below and clicking “Agree,” I certify that I have read, understand and agree to the foregoing Disclaimer, Terms of Use and Privacy Policy.

Continue Reading

-

Business interruption cover – furlough payments and savings clauses – Simmons & Simmons

- Business interruption cover – furlough payments and savings clauses Simmons & Simmons

- FCA Rejects Business COVID Claim Deadline Extension Bid Law360

- OPINION: Covid insurance claims – pubs are racing the clock The Morning Advertiser

- FCA rejects hospitality sector’s call to extend pandemic BI claims deadline Insurance Business

Continue Reading

-

Kirkland Represents Fangzhou Jianke on its Top-up Placing | News

Kirkland & Ellis represented Fangzhou Inc. (Fangzhou Jianke, HKEX: 6086) on its issuance of 45,181,000 shares through a top-up placement. The placing was announced on January 27, 2026 and completed on February 2, 2026. Guotai Junan Securities (Hong Kong) Limited acts as its sole placing agent.

The net proceeds from the placing, after deducting all costs and expenses, amounted to approximately HK$144.3 million.

Read the transaction announcement

The Kirkland team included capital markets lawyers Mengyu Lu and Sierra Tao.

Continue Reading

-

Farmer sentiment drops sharply at start of 2026 as economic concerns increase

WEST LAFAYETTE, Ind., Feb. 3, 2026 /PRNewswire/ — Farmer sentiment weakened sharply in January, as the Purdue University/CME Group Ag Economy Barometer fell 23 points from December to a reading of 113. The decline reflected growing pessimism about both current conditions and the future outlook for U.S. agriculture; the Current Conditions Index dropped 19 points to 109, while the Future Expectations Index fell 25 points to 115. The largest shift was in producers’ long-term outlook for U.S. agriculture, with the index that measures expectations for widespread good and bad times over the next five years falling to its lowest level since September 2024. Producers also expressed greater concern about agricultural exports than last month. The survey was conducted Jan. 12-16, coinciding with the U.S. Department of Agriculture’s release of the World Agricultural Supply and Demand Estimates report on Jan. 12.

Producers reported worsening farm financial conditions compared with a year earlier. Half of the farmers surveyed indicated that their operations were worse off than a year earlier. Looking ahead to the next 12 months, more producers expect conditions to worsen than to improve. Thirty percent of respondents anticipate weaker financial performance in the coming year, compared with 20% who expect improvement. Reflecting this more cautious outlook, the Farm Capital Investment Index fell 11 points in January to 47, its lowest level since October 2024. Just 4% of producers said they plan to increase farm machinery purchases over the next year.

“What stands out this month is the growing number of producers who report that higher operating-loan needs stem from carrying over unpaid debt from the previous year,” said Michael Langemeier, the barometer’s principal investigator and director of Purdue’s Center for Commercial Agriculture. “That points to increasing financial pressure heading into the year ahead.”

Since 2020, each January barometer survey has included questions about farmers’ operating loans for the upcoming year. Twenty-one percent of respondents said they expect to have a larger operating loan compared with a year earlier, up from 18% last year. Among producers anticipating an increase, 31% cited carryover of unpaid operating debt from the prior year as the primary reason. This percentage has risen steadily in recent years, increasing from just 5% in 2023 to 17% in 2024 and 23% in 2025. The results align with producers’ growing concerns about farm financial performance.

Producers also expressed increased pessimism about the outlook for U.S. agricultural exports in January. When asked about export prospects over the next five years, 16% of respondents said they expect exports to decline, up from 5% in December. Concerns were even greater among corn and soybean farmers when the question specifically addressed soybeans, a key agricultural export. This month, 21% of corn and soybean producers said they expect soybean exports to decline over the next five years, compared with 13% the previous month. Increasing competition from Brazil is also weighing heavily on producers’ minds. Eighty percent of corn and soybean producers said they were concerned or very concerned about the competitiveness of U.S. soybean exports relative to Brazil, including 44% stating they were very concerned.

Producers remained optimistic about short-term farmland values in January, while their longer-term outlook became more cautious. The Short-Term Farmland Value Expectations Index was unchanged at 117. After reaching a record high in December, the Long-Term Farmland Value Expectations Index fell 14 points in January to a reading of 152. Respondents cited alternative investment opportunities, net farm income and interest rates as the factors expected to have the greatest influence on farmland values.

The January survey asked corn and soybean producers how they expect to use payments from the Farmer Bridge Assistance Program announced in late December. More than half of respondents said they plan to use the payments to pay down debt, while 25% indicated the funds would be used to improve working capital. The remaining respondents said the payments would go toward family living expenses (10%) or investment in farm machinery (12%).

Producers’ broader outlook for the U.S. economy also softened. As in recent months, respondents were asked whether the U.S. is headed in the “right direction” or on the “wrong track.” In January, 62% of producers said the U.S. is headed in the “right direction,” down from 75% in December 2025.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.About CME Group

As the world’s leading derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, cryptocurrencies, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing.CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec is a trademark of BrokerTec Americas LLC and EBS is a trademark of EBS Group LTD. The S&P 500 Index is a product of S&P Dow Jones Indices LLC (“S&P DJI”). “S&P®”, “S&P 500®”, “SPY®”, “SPX®”, US 500 and The 500 are trademarks of Standard & Poor’s Financial Services LLC; Dow Jones®, DJIA® and Dow Jones Industrial Average are service and/or trademarks of Dow Jones Trademark Holdings LLC. These trademarks have been licensed for use by Chicago Mercantile Exchange Inc. Futures contracts based on the S&P 500 Index are not sponsored, endorsed, marketed, or promoted by S&P DJI, and S&P DJI makes no representation regarding the advisability of investing in such products. All other trademarks are the property of their respective owners.

About Purdue University

Purdue University is a public research university leading with excellence at scale. Ranked among top 10 public universities in the United States, Purdue discovers, disseminates and deploys knowledge with a quality and at a scale second to none. More than 106,000 students study at Purdue across multiple campuses, locations and modalities, including more than 57,000 at our main campus locations in West Lafayette and Indianapolis. Committed to affordability and accessibility, Purdue’s main campus has frozen tuition 14 years in a row. See how Purdue never stops in the persistent pursuit of the next giant leap — including its integrated, comprehensive Indianapolis urban expansion; the Mitch Daniels School of Business; Purdue Computes; and the One Health initiative — at https://www.purdue.edu/president/strategic-initiatives.Source: Michael Langemeier, mlangeme@purdue.edu, 765-494-9557

CME-G

SOURCE CME Group

Continue Reading

-

Better by the dozen: Car and Driver announces Editors’ Choice awards for 12 Porsche models

1. All information offered on Porsche Newsroom, including but not limited to, texts, images, audio and video documents, are subject to copyright or other legislation for the protection of intellectual property. They are intended exclusively for use by journalists as a source for their own media reporting and are not intended for commercial use, in particular for advertising purposes. It is not permitted to pass on texts, images, audio or video data to unauthorised third parties.

2. All logos and trademarks mentioned on Porsche Newsroom are trademarks of Dr. Ing. h.c. F. Porsche AG (hereinafter: Porsche AG), unless otherwise stated.

3. All contents of Porsche Newsroom are carefully researched and compiled. Nevertheless, the information may contain errors or inaccuracies. Porsche AG does not accept any liability with respect to the results that may be achived through the use of the information, in particular with respect to accuracy, up-to-dateness and completeness.

4. Insofar as Porsche Newsroom provides information concerning vehicles, the data refers to the German market. Statements concerning standard equipment and statutory, legal and tax regulations and repercussion are valid for the Federal Public of Germany only.

5. With respect to the use of Porsche Newsroom, technical faults such as, delays to news transmission, cannot be ruled out. Porsche AG does not accept any liability for any resulting damage.

6. Insofar as Porsche Newsroom provides links to the internet sites of third parties, Porsche AG does not accept any responsibility for the content of the linked sites. On using the links, the user leaves the Porsche AG information products.

7. In agreeing to these rights of use, the user shall be obliged to refrain from any improper use of Porsche Newsroom.

8. In the event of improper use, Porsche AG reserves the right to block access to Porsche Newsroom.

9. Should one or more provisions of these terms and conditions be or become invalid, this shall not affect the validity of the remaining provisions.

Continue Reading

-

AbbVie Submits Regulatory Applications to FDA and EMA for Upadacitinib (RINVOQ®) in Adults and Adolescents With Vitiligo

AbbVie Submits Regulatory Applications to FDA and EMA for Upadacitinib (RINVOQ®) in Adults and Adolescents With Vitiligo

- Submissions are supported by data from the Phase 3 Viti-Up clinical studies demonstrating upadacitinib achieved the co-primary endpoints of at least a 50% improvement in total body re-pigmentation (T-VASI 50) and at least a 75% improvement in facial re-pigmentation (F-VASI 75) from baseline at week 48.1

- If approved, upadacitinib will be the first systemic medication available for patients with vitiligo, addressing important treatment needs for those living with the chronic, unpredictable autoimmune disease.

NORTH CHICAGO, Ill., Feb. 3, 2026 /PRNewswire/ — AbbVie (NYSE: ABBV) today announced that it has submitted applications for a new indication to the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) for upadacitinib (RINVOQ®; 15 mg, once daily) for the treatment of adult and adolescent patients living with non-segmental vitiligo (NSV). The regulatory submissions to the FDA and EMA are supported by previously announced results from the Viti-Up studies evaluating the safety and efficacy of upadacitinib in patients with NSV.

Vitiligo is a chronic, autoimmune disease that imposes a significant psychosocial burden, profoundly affecting an individual’s confidence, identity and daily life.2 NSV, the most common form of vitiligo (afflicting approximately 84% of patients), is marked by symmetrical and bilateral depigmented white patches and is prone to unpredictable progression even after long periods of stability.3-6 Vitiligo management is anchored in three primary treatment goals: disease stabilization, re-pigmentation, and maintaining re-pigmentation.7-9 There are currently no approved systemic medicines for achieving these treatment goals in vitiligo.

“Many patients experience ongoing frustration due to the unpredictability of non-segmental vitiligo spread and the lack of systemic treatment options that can stabilize disease progression and achieve skin re-pigmentation,” said Kori Wallace, M.D., Ph.D., vice president, global head of immunology clinical development, AbbVie. “The Viti-Up clinical studies explored these treatment gaps in vitiligo care and reinforced AbbVie’s dedication to providing the first systemic treatment for patients, aiming to evolve the vitiligo treatment landscape.”

About Viti-Up Clinical Studies1

Upadacitinib M19-044 was conducted under a single protocol encompassing two replicate Phase 3 studies (Study 1 and Study 2) with independent randomization, investigative sites, data collection, analysis and reporting for each study. The studies were designed to evaluate the efficacy, safety and tolerability of upadacitinib in adult and adolescent patients (ages 12 and older) living with non-segmental vitiligo (NSV) who were eligible for systemic therapy. In Period A of both studies, participants were randomized in a 2:1 ratio to receive either upadacitinib 15 mg once daily or placebo for 48 weeks. Participants who completed Period A were eligible to enter Period B, a 112-week open-label extension in which all patients received upadacitinib 15 mg once daily. In total, Study 1 and Study 2 Periods A and B span 160 weeks. The two studies randomized 614 participants with NSV across 90 sites worldwide. More information on these studies can be found at www.clinicaltrials.gov (NCT06118411).The co-primary endpoints were based on the achievement of Total Vitiligo Area Scoring Index (T-VASI) 50, defined as at least 50% reduction in T-VASI from baseline, at week 48, and the achievement of Facial Vitiligo Area Scoring Index (F-VASI) 75, defined as at least 75% reduction in F-VASI from baseline, at week 48 with the treatment of upadacitinib 15 mg compared with placebo in adults and adolescents with NSV.

The secondary endpoints include the achievement of F-VASI 50, defined as at least a 50% reduction in F-VASI from baseline, at week 48, and the achievement of F-VASI 75, defined as at least a 75% reduction in facial vitiligo area from baseline, at week 24. These endpoints were designed to assess the degree and timing of re-pigmentation on the face, an area among the most visible and psychosocially impactful for people living with NSV.

About Vitiligo

Vitiligo is a chronic, autoimmune disease that imposes a significant psychosocial burden, profoundly affecting an individual’s confidence, identity, and daily life. Non-segmental vitiligo (NSV), the most common form of vitiligo (afflicting approximately 84% of patients), is marked by symmetrical and bilateral depigmented white patches and is prone to unpredictable progression even after long periods of stability. While location varies, many patients report patches on critical areas such as the face, feet, hands and groin. Vitiligo management is anchored in three primary treatment goals: disease stabilization, re-pigmentation and maintaining re-pigmentation.About RINVOQ® (upadacitinib)

Discovered and developed by AbbVie scientists, RINVOQ is a JAK inhibitor that is being studied in several immune-mediated inflammatory diseases. Based on enzymatic and cellular assays, RINVOQ demonstrated greater inhibitory potency for JAK-1 vs JAK-2, JAK-3, and TYK-2. The relevance of inhibition of specific JAK enzymes to therapeutic effectiveness and safety is not currently known.Upadacitinib (RINVOQ) is being studied in Phase 3 clinical trials for alopecia areata, hidradenitis suppurativa, Takayasu arteritis, systemic lupus erythematosus, and vitiligo. The use of upadacitinib in non-segmental vitiligo is not approved, and its safety and efficacy have not been evaluated by regulatory authorities.

RINVOQ (upadacitinib) U.S. Uses and Important Safety Information10

RINVOQ is a prescription medicine used to treat:

- Adults with moderate to severe rheumatoid arthritis (RA) when 1 or more medicines called tumor necrosis factor (TNF) blockers have been used, and did not work well or could not be tolerated.

- Adults with active psoriatic arthritis (PsA) when 1 or more medicines called TNF blockers have been used, and did not work well or could not be tolerated.

- Adults with active ankylosing spondylitis (AS) when 1 or more medicines called TNF blockers have been used, and did not work well or could not be tolerated.

- Adults with active non-radiographic axial spondyloarthritis (nr-axSpA) with objective signs of inflammation when a TNF blocker medicine has been used, and did not work well or could not be tolerated.

- Adults with giant cell arteritis (GCA).

- Adults with moderate to severe ulcerative colitis (UC) when 1 or more medicines called TNF blockers have been used and did not work well or could not be tolerated, or after taking a different injection or pill (systemic therapy) when your healthcare provider does not recommend TNF blockers.

- Adults with moderate to severe Crohn’s disease (CD) when 1 or more medicines called TNF blockers have been used and did not work well or could not be tolerated, or after taking a different injection or pill (systemic therapy) when your healthcare provider does not recommend TNF blockers.

It is not known if RINVOQ is safe and effective in children with ankylosing spondylitis, non-radiographic axial spondyloarthritis, ulcerative colitis, or Crohn’s disease.

- Adults and children 12 years of age and older with moderate to severe eczema (atopic dermatitis [AD]) that did not respond to previous treatment and their eczema is not well controlled with other pills or injections, including biologic medicines, or the use of other pills or injections is not recommended.

It is not known if RINVOQ is safe and effective in children under 12 years of age with atopic dermatitis.

It is not known if RINVOQ LQ is safe and effective in children with atopic dermatitis.

RINVOQ/RINVOQ LQ is a prescription medicine used to treat:

- Children 2 years of age and older with active polyarticular juvenile idiopathic arthritis (pJIA) when 1 or more medicines called TNF blockers have been used, and did not work well or could not be tolerated.

- Children 2 to less than 18 years of age with active psoriatic arthritis (PsA) when 1 or more medicines called TNF blockers have been used, and did not work well or could not be tolerated.

It is not known if RINVOQ/RINVOQ LQ is safe and effective in children under 2 years of age with polyarticular juvenile idiopathic arthritis or psoriatic arthritis.

IMPORTANT SAFETY INFORMATION FOR RINVOQ/RINVOQ LQ (upadacitinib)

What is the most important information I should know about RINVOQ*?

RINVOQ may cause serious side effects, including:

- Serious infections. RINVOQ can lower your ability to fight infections. Serious infections have happened while taking RINVOQ, including tuberculosis (TB) and infections caused by bacteria, fungi, or viruses that can spread throughout the body. Some people have died from these infections. Your healthcare provider (HCP) should test you for TB before starting RINVOQ and check you closely for signs and symptoms of TB during treatment with RINVOQ. You should not start taking RINVOQ if you have any kind of infection unless your HCP tells you it is okay. If you get a serious infection, your HCP may stop your treatment until your infection is controlled. You may be at higher risk of developing shingles (herpes zoster).

- Increased risk of death in people 50 years and older who have at least 1 heart disease (cardiovascular) risk factor.

- Cancer and immune system problems. RINVOQ may increase your risk of certain cancers. Lymphoma and other cancers, including skin cancers, can happen. Current or past smokers are at higher risk of certain cancers, including lymphoma and lung cancer. Follow your HCP’s advice about having your skin checked for skin cancer during treatment with RINVOQ. Limit the amount of time you spend in sunlight. Wear protective clothing when you are in the sun and use sunscreen.

- Increased risk of major cardiovascular (CV) events, such as heart attack, stroke, or death, in people 50 years and older who have at least 1 heart disease (CV) risk factor, especially if you are a current or past smoker.

- Blood clots. Blood clots in the veins of the legs or lungs and arteries can happen with RINVOQ. This may be life-threatening and cause death. Blood clots in the veins of the legs and lungs have happened more often in people who are 50 years and older and with at least 1 heart disease (CV) risk factor.

- Allergic reactions. Symptoms such as rash (hives), trouble breathing, feeling faint or dizzy, or swelling of your lips, tongue, or throat, that may mean you are having an allergic reaction have been seen in people taking RINVOQ. Some of these reactions were serious. If any of these symptoms occur during treatment with RINVOQ, stop taking RINVOQ and get emergency medical help right away.

- Tears in the stomach or intestines. This happens most often in people who take nonsteroidal anti-inflammatory drugs (NSAIDs) or corticosteroids. Get medical help right away if you get stomach-area pain, fever, chills, nausea, or vomiting.

- Changes in certain laboratory tests. Your HCP should do blood tests before you start taking RINVOQ and while you take it. Your HCP may stop your RINVOQ treatment for a period of time if needed because of changes in these blood test results.

Do not take RINVOQ if you are allergic to upadacitinib or any of the ingredients in RINVOQ. See the Medication Guide or Consumer Brief Summary for a complete list of ingredients.

What should I tell my HCP BEFORE starting RINVOQ?

Tell your HCP if you:- Are being treated for an infection, have an infection that won’t go away or keeps coming back, or have symptoms of an infection, such as:

̶ Fever, sweating, or chills

̶ Shortness of breath

̶ Warm, red, or painful skin or

sores on your body

̶ Muscle aches

̶ Feeling tired

̶ Blood in phlegm

̶ Diarrhea or stomach

pain

̶ Cough

̶ Weight loss

̶ Burning when urinating or urinating

more often than normal

- Have TB or have been in close contact with someone with TB.

- Are a current or past smoker.

- Have had a heart attack, other heart problems, or stroke.

- Have or have had any type of cancer, hepatitis B or C, shingles (herpes zoster), blood clots in the veins of your legs or lungs, diverticulitis (inflammation in parts of the large intestine), or ulcers in your stomach or intestines.

- Have other medical conditions, including liver problems, low blood cell counts, diabetes, chronic lung disease, HIV, or a weak immune system.

- Live, have lived, or have traveled to parts of the country, such as the Ohio and Mississippi River valleys and the Southwest, that increase your risk of getting certain kinds of fungal infections. If you are unsure if you’ve been to these types of areas, ask your HCP.

- Have recently received or are scheduled to receive a vaccine. People who take RINVOQ should not receive live vaccines.

- Are pregnant or plan to become pregnant. Based on animal studies, RINVOQ may harm your unborn baby. Your HCP will check whether or not you are pregnant before you start RINVOQ. You should use effective birth control (contraception) to avoid becoming pregnant during treatment with RINVOQ and for 4 weeks after your last dose.

- There is a pregnancy surveillance program for RINVOQ. The purpose of the program is to collect information about the health of you and your baby. If you become pregnant while taking RINVOQ, you are encouraged to report the pregnancy by calling 1-800-633-9110.

- Are breastfeeding or plan to breastfeed. RINVOQ may pass into your breast milk. Do not breastfeed during treatment with RINVOQ and for 6 days after your last dose.

Tell your HCP about all the medicines you take, including prescription and over-the-counter medicines, vitamins, and herbal supplements. RINVOQ and other medicines may affect each other, causing side effects.

Especially tell your HCP if you take:

- Medicines for fungal or bacterial infections

- Rifampicin or phenytoin

- Medicines that affect your immune system

If you are not sure if you are taking any of these medicines, ask your HCP or pharmacist.

What should I avoid while taking RINVOQ?

Avoid food or drink containing grapefruit during treatment with RINVOQ as it may increase the risk of side effects.What should I do or tell my HCP AFTER starting RINVOQ?

- Tell your HCP right away if you have any symptoms of an infection. RINVOQ can make you more likely to get infections or make any infections you have worse.

- Get emergency help right away if you have any symptoms of a heart attack or stroke while taking RINVOQ, including:

- Discomfort in the center of your chest that lasts for more than a few minutes or that goes away and comes back

- Severe tightness, pain, pressure, or heaviness in your chest, throat, neck, or jaw

- Pain or discomfort in your arms, back, neck, jaw, or stomach

- Shortness of breath with or without chest discomfort

- Breaking out in a cold sweat

- Nausea or vomiting

- Feeling lightheaded

- Weaknesses in one part or on one side of your body

- Slurred speech

- Tell your HCP right away if you have any signs or symptoms of blood clots during treatment with RINVOQ, including:

̶ Swelling

̶ Pain or tenderness in one or both legs

̶ Sudden unexplained chest or upper back pain

̶ Shortness of breath or difficulty breathing

- Tell your HCP right away if you have a fever or stomach-area pain that does not go away, and a change in your bowel habits.

What are other possible side effects of RINVOQ?

Common side effects include upper respiratory tract infections (common cold, sinus infections), shingles (herpes zoster), herpes simplex virus infections (including cold sores), bronchitis, nausea, cough, fever, acne, headache, swelling of the feet and hands (peripheral edema), increased blood levels of creatine phosphokinase, allergic reactions, inflammation of hair follicles, stomach-area (abdominal) pain, increased weight, flu, tiredness, lower number of certain types of white blood cells (neutropenia, lymphopenia, leukopenia), muscle pain, flu-like illness, rash, increased blood cholesterol levels, increased liver enzyme levels, pneumonia, low number of red blood cells (anemia), and infection of the stomach and intestine (gastroenteritis).A separation or tear to the lining of the back part of the eye (retinal detachment) has happened in people with atopic dermatitis treated with RINVOQ. Call your HCP right away if you have any sudden changes in your vision during treatment with RINVOQ.

Some people taking RINVOQ may see medicine residue (a whole tablet or tablet pieces) in their stool. If this happens, call your HCP.These are not all the possible side effects of RINVOQ.

How should I take RINVOQ/RINVOQ LQ?

RINVOQ is taken once a day with or without food. Do not split, crush, or chew the tablet. Take RINVOQ exactly as your HCP tells you to use it. RINVOQ is available in 15 mg, 30 mg, and 45 mg extended-release tablets. RINVOQ LQ is taken twice a day with or without food. RINVOQ LQ is available in a 1 mg/mL oral solution. RINVOQ LQ is not the same as RINVOQ tablets. Do not switch between RINVOQ LQ and RINVOQ tablets unless the change has been made by your HCP.

*Unless otherwise stated, “RINVOQ” in the IMPORTANT SAFETY INFORMATION refers to RINVOQ and RINVOQ LQ.This is the most important information to know about RINVOQ. For more information, talk to your HCP.

You are encouraged to report negative side effects of prescription drugs to the FDA. Visit www.fda.gov/medwatch or call 1-800-FDA-1088.

If you are having difficulty paying for your medicine, AbbVie may be able to help. For U.S. patients, visit AbbVie.com/PatientAccessSupport to learn more.

Please click here for the Full Prescribing Information and Medication Guide.

Globally, prescribing information varies; refer to the individual country product label for complete information.

About AbbVie

AbbVie’s mission is to discover and deliver innovative medicines and solutions that solve serious health issues today and address the medical challenges of tomorrow. We strive to have a remarkable impact on people’s lives across several key therapeutic areas including immunology, oncology and neuroscience – and products and services in our Allergan Aesthetics portfolio. For more information about AbbVie, please visit us at www.abbvie.com. Follow @abbvie on LinkedIn, Facebook, Instagram, X and YouTube.Forward-Looking Statements

Some statements in this news release are, or may be considered, forward-looking statements for purposes of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “project” and similar expressions and uses of future or conditional verbs, generally identify forward-looking statements. AbbVie cautions that these forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those expressed or implied in the forward-looking statements. Such risks and uncertainties include, but are not limited to, challenges to intellectual property, competition from other products, difficulties inherent in the research and development process, adverse litigation or government action, changes to laws and regulations applicable to our industry, the impact of global macroeconomic factors, such as economic downturns or uncertainty, international conflict, trade disputes and tariffs, and other uncertainties and risks associated with global business operations. Additional information about the economic, competitive, governmental, technological and other factors that may affect AbbVie’s operations is set forth in Item 1A, “Risk Factors,” of AbbVie’s 2024 Annual Report on Form 10-K, which has been filed with the Securities and Exchange Commission, as updated by its Quarterly Reports on Form 10-Q and in other documents that AbbVie subsequently files with the Securities and Exchange Commission that update, supplement or supersede such information. AbbVie undertakes no obligation, and specifically declines, to release publicly any revisions to forward-looking statements as a result of subsequent events or developments, except as required by law.References

1.

AbbVie. Data on file ABVRRTI82545

2.

Krüger C, Schallreuter KU. Int J Dermatol. 2012;51(10):1206–12

3.

Ezzedine K, et al. Lancet. 2015;386(9988):74–84

4.

Mazzei Weiss ME. Cutis. 2020;105(4):189–90

5.

Ezzedine K, Lim HW, Suzuki T, et al. Revised classification/nomenclature of vitiligo and related issues: the Vitiligo Global Issues Consensus Conference. Pigment Cell Melanoma Res. 2012;25(3):E1-13

6.

Taneja N, Sreenivas V, Sahni K, Gupta V, Ramam M. Disease Stability in Segmental and Non-Segmental Vitiligo. Indian Dermatol Online J. 2021 Aug 2;13(1):60-63. doi: 10.4103/idoj.IDOJ_154_21. PMID: 35198469; PMCID: PMC8809159

7.

Hlača N, Žagar T, Kaštelan M, Brajac l, Prpić-Massari L. Current concepts of vitiligo immunopathogenesis. Biomedicines. 2022;10(7):1639. doi:10.3390/biomedicines10071639

8.

Abdel-Malek ZA, Jordan C, HoT, Upadhyay PR, Fleischer A, Hamzavi l.. The enigma and challenges of vitiligo pathophysiology and treatment. Pigment Cell Melanoma Res. 2020;33(6):778-787. doi:10.1111/pcmr.12878

9.

Birlea SA, Goldstein NB, Norris DA. Repigmentation through melanocyte regeneration in vitiligo. Dermatol Clin. 2017;35(2):205-218. doi:10.1016/j.det.2016.11.015

10.

RINVOQ [Package Insert]. North Chicago, IL: AbbVie Inc.; 2025

SOURCE AbbVie

Continue Reading

-

A&O Shearman on Perpetual Hybrid

Terna S.p.A. has completed the placement of a perpetual, subordinated, hybrid, non-convertible European Green Bond issue with a nominal value of EUR850 million, intended for institutional investors.

This transaction represents, for Terna and for the domestic market as a whole, the first perpetual hybrid bond issuance in Green Bond Standard format (i.e., in line with the requirements of EU Regulation 2023/2631 on so-called “green bonds”).

A&O Shearman advised the financial institutions acting as joint Lead managers in the transaction.

In accordance with EU Regulation 2023/2631, it is expected that the net proceeds from the issue will be used to finance or refinance the Company’s “eligible green projects”, identified or to be identified based on Terna’s Green Bond Framework, drawn up in July 2025 and aligned to the “Green Bond Principles 2025”, published by the International Capital Market Association (ICMA), and to the EU Taxonomy, aimed at facilitating sustainable investments.

The issue is structured as a single tranche bond and will pay a fixed annual coupon of 3.875% until the first reset date (February 2, 2032). From this date, should the bond have not been called, the hybrid bond will pay annual interests equal to the five-year Euro Mid-Swap rate plus an initial spread of 123 basis points. This will be increased by a further spread of 25 basis points from February 2, 2037 and an additional increase of 75 basis points from February 2, 2052.

The bond is documented under Terna’s EUR4 billion Euro Medium Term Notes (EMTN) program, approved in June 2025 by CONSOB and admitted to listing on the MOT—Mercato Obbligazionario Telematico—managed by the Italian Stock Exchange (Borsa Italiana).

The A&O Shearman team was led by partners Alessandra Pala and Cristiano Tommasi, supported by associate Marco Mazzurco and trainee Antonio Iuliano. Counsel Elia Ferdinando Clarizia advised on tax-related matters.

Continue Reading

-

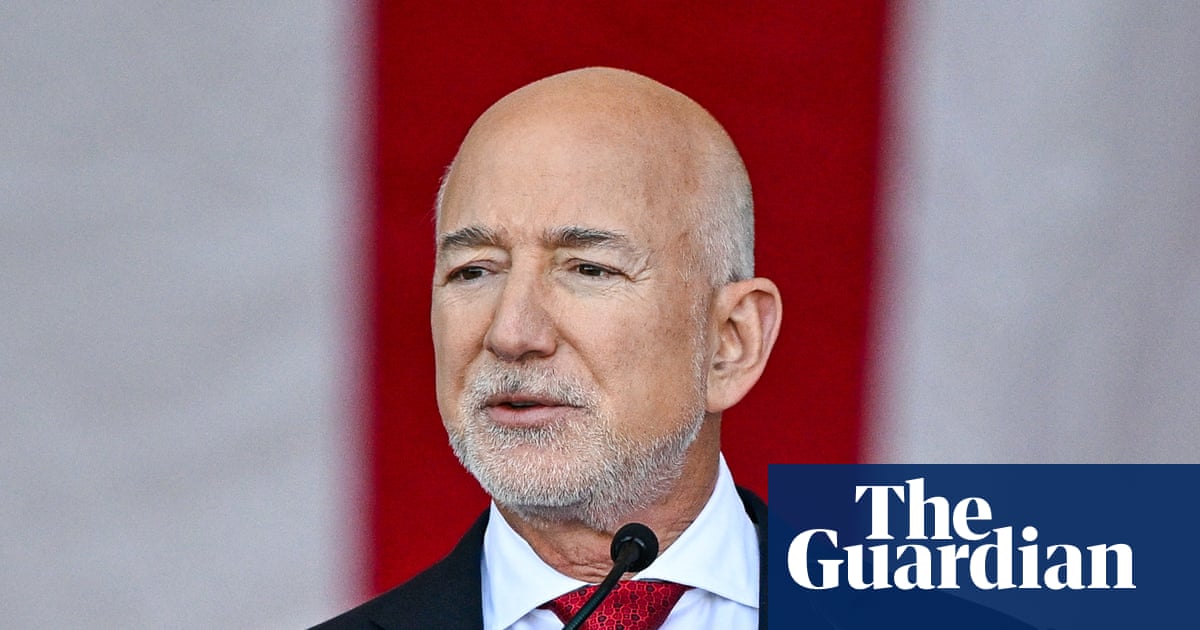

Washington Post owner Jeff Bezos stays silent as employees brace for cuts | Washington Post

While Washington Post employees remain in the dark about an impending round of cuts that could dramatically reshape the publication, the man that many hoped could soften or stop the blow, owner Jeff Bezos, has remained silent.

So far, three staff-organized letters sent by Post employees to Bezos imploring him to protect the Post’s robust coverage have gone unanswered.

The first plea went to Bezos on 25 January, when about 60 people signed a letter asking him to protect the company’s foreign news operation, which is rumored to be a major target of cost-cutting.

Two days later, employees sent Bezos a letter asking him to preserve the newspaper’s local coverage, which is also said to be at risk for heavy cuts.

“Should you allow Post management to lay off the local staff, which has been cut in half in the last five years, the effect on this region and the people in it will be immeasurable,” the staffers wrote. “We care deeply about the DC area, and we know you do, too.”

At the end of last week, the publication’s White House reporters sent a letter to Bezos urging him to avoid cutting coverage areas central to its readership. Post staffers have also filmed and posted videos on social media urging Bezos to “#savethepost”.

While Post chief executive Will Lewis has been included on at least one of the emails, the letters have been addressed to Bezos, who some staffers hope might be more persuadable. (Matt Murray, the Post’s top editor, has had private discussions with several Post journalists in recent weeks, according to a source with knowledge of the situation.)

“As the Post’s [owner], Bezos is ultimately making the call on these cuts,” said a Post staffer who signed one of the letters but was not authorized to comment. “He also has enough money to do whatever he chooses here. Reporters across the newsroom want to be sure he understands the magnitude of the devastating cuts that we all expect are coming.”

Emails sent by the Guardian to Bezos and a representative at the company he founded, Amazon, have not been returned. A Post spokesperson declined to comment on the rumored cuts.

The Post staffer described the mood at the paper as “funereal”, with many expecting the cuts to come in the next few days – though the publication still has not acknowledged or confirmed that anything is happening. A rally to protest the cuts has been scheduled for outside the Post’s headquarters on Thursday.

On Monday, the union representing most Post employees called out Bezos in a series of posts on Twitter/X. “If @JeffBezos follows through with his reported plan to decimate the Post’s newsroom, it will be a huge indictment of his supposed business prowess,” the account wrote. “How else to explain his failure to monetize some of the world’s most award-winning, agenda-setting journalism?”

Some Post staffers also noted that Bezos has not yet commented on the 14 January raid of a Post reporter’s home, even though many groups that advocate for journalists decried the government’s tactics as unprecedented and dangerous. Cameron Barr, a former managing editor of the Post, called out Bezos for his silence in a post on LinkedIn, writing: “It’s not just the chest-thumping overreach of the Trump administration that will crush American freedoms – it’s the silence of its enablers.”

Amazon and Bezos have also faced criticism for spending approximately $75m to acquire and promote a documentary about Melania Trump – particularly after Bezos faced accusations of cozying up to Trump by killing the Post’s planned endorsement last fall of Kamala Harris for president.

Glenn Kessler, who ended a 27-year-long career at the Post last year, expressed cautious optimism about the campaign to reach Bezos. “That kind of pushback might have an impact,” he said. “We don’t really know until we see what the actual result is.”

Kessler said he and a few other reporters had lunch with Bezos, who purchased the paper in 2013, after Donald Trump’s victory in the 2016 election. “He wanted to hear war stories and that sort of thing,” he recalled. “He was quite interested in what people did. He had this great laugh, and he seemed quite engaged.”

But Kessler was heavily critical of Bezos’s handling of the Harris endorsement and his decision to refocus the section’s opinion page to prioritize writing “in support and defense of two pillars: personal liberties and free markets”, decisions that led to the resignation of a top editor and quickly cost the Post hundreds of thousands of subscribers.

“Even before these cuts, you can question the quality of Bezos’s stewardship,” Kessler said. “The sense I get is that he’s not nearly as engaged with the Post as he once was. If you’re not really that engaged or invested in the thing that you own, the easiest thing to do is to cut back the money you’re losing on it.”

“I think it’s hard to overestimate how excited the journalists and editors were when Bezos bought the company,” recalled political journalist Chris Cillizza, who worked at the Post from 2006 to 2017. “The richest man in the world buys the company and he says all the right things. I think people were slower to see that something had changed because they wanted to believe so badly that the original sense we had of Bezos was it.”

Cillizza remembered being skeptical when Bezos said he intended the Post to be profitable. “I remember thinking to myself even then, in 2013: ‘Man, that’s going to be tough.’”

While Bezos has stayed silent about potential cuts to the Post, and ignored an effort by the union last year to get him to visit the newspaper, he was more visibly engaged with one of his other companies on Monday, the spaceflight startup Blue Origin.

Bezos was on hand to meet secretary of defense Pete Hegseth, who last November called the Post’s reporting “fake news”, during a visit to the company’s facility in Florida. “Great to see you,” Bezos told Hegseth. “Welcome – it’s an honor to have you.”

Continue Reading

-

53% EU enterprises used paid cloud services in 2025 – News articles

In 2025, 52.7% of EU enterprises used paid cloud computing services (i.e. online services used to access software, computing power, storage capacity, etc.), marking a 7.4 percentage point (pp) increase compared with 2023. A more substantial increase was registered compared with 2014, when 17.8% of enterprises used paid cloud services.

The highest shares of enterprises that used paid cloud computing services in 2025 were recorded in Finland (79.2%), Italy (75.6%) and Malta (74.9%). At the other end of the scale, less than a quarter of enterprises in Romania (24.9%), Greece (24.3%) and Bulgaria (17.8%) used such paid services.

Between 2023 and 2025, the use of paid cloud computing services increased in most countries, with Lithuania (+19.7 pp), Italy (+14.2 pp) and France (+13.7 pp) experiencing the highest rise.

Source dataset: isoc_cicce_use

E-mail, office software and file storage – most popular cloud services in 2025

Data show that in 2025, most EU enterprises used paid cloud computing for e-mail services (85.2%), office software (71.7%) and file storage (71.5%). Security software applications (65.5%), finance or accounting software applications (58.2%) and hosting for the enterprise’s database (45.5%) were also popular.

Enterprises also used paid cloud service for enterprise resource planning software (30.1%), computing power to run the enterprise’s own software (28.2%), customer relationship management software (27.9%) and lastly, for computing platforms for application development, testing or deployment (26.1%).

Source dataset: isoc_cicce_use

Continue Reading