- Broadcom Strengthens Strategic Partnership with NEC to Drive Modern Private Cloud with VMware Cloud Foundation Broadcom

- Broadcom Strengthens Strategic Partnership with NEC to Drive Modern Private Cloud with VCF Broadcom

- What Broadcom (AVGO)’s VMware Cloud Foundation Upgrades Mean for Cloud and AI Strategy Yahoo Finance

- Broadcom launches open ecosystem for VMware Cloud Foundation CIO Dive

- Broadcom Advances Open Ecosystem for VMware Cloud Foundation with New Certification Programs and Collaborations Quiver Quantitative

Category: 3. Business

-

Broadcom Strengthens Strategic Partnership with NEC to Drive Modern Private Cloud with VMware Cloud Foundation – Broadcom

-

Aberdeen’s hydrogen bus return faces further delay

The reintroduction of Aberdeen’s hydrogen bus fleet is facing a fresh delay, with no firm date set as to when it will return to operation.

The 15 vehicles have been off the road for over a year following problems with fuelling stations.

The buses, which are owned by Aberdeen City Council (ACC), but operated by First Bus on its city network, have been out of action since September last year, after technical problems at the city’s two fuelling stations, at Kittybrewster and Cove.

It was hoped they would return in the summer, but a new hydrogen production hub is still to come on stream, and the local authority does not know when they will be able to take passengers again.

In April, ACC said that while the buses were being refurbished, it hoped new mobile fuelling facilities at Kittybrewster and the First Bus King Street depot would allow the buses to return in the summer.

A new Hydrogen Production Hub is still due to come on stream at TECA, near Aberdeen International Airport, next year.

An ACC spokesperson said: “The buses have been off the road due to a lack of hydrogen supply.

“Prior to being back in operation, the buses will require to undertake some testing as part of a recommissioning process.

“Recommissioning works are underway on the fleet with road testing expecting to commence within the coming weeks.”

Continue Reading

-

NHS Grampian could drill deep into ground for heat from granite

Getty Images

Getty ImagesNHS Grampian is looking into the possibility of geothermal heat in Aberdeen NHS Grampian is looking into whether it should drill deep underground in Aberdeen to source heat from granite.

The potential geothermal heat project could ultimately mean drilling a borehole to a depth of 1.5 miles (2.5km).

It follows a feasibility study aimed at finding a way of cutting the health board’s heating bills, and NHS Grampian is now looking into funding options.

Deep geothermal technology works by pumping cold water deep underground, where it is warmed by the earth before then coming back hot enough to be used to help heat buildings.

It is most commonly used in volcanic countries such as Iceland, but also in the Eden Project visitor attraction.

A 3.1 mile (5km) well on the Cornwall site started to generate heat in June 2023 and started to supply heat as the weather became colder.

NHS Grampian said there was also “immense potential” for drilling for geothermal heat underground in Aberdeen.

You’ll have seen the postcard images of Icelandic geysers projecting bursts of hot water high into the air.

That water is heated by the hot volcanic rock close to the surface and is responsible for heating 90% of the country’s homes.

We obviously don’t have geysers in Scotland but in the north east we do have granite, both below the ground and in the fabric of the city’s buildings.

That unseen granite is ideal for holding and conducting the deep earth’s colossal heat.

Like with the naturally occurring geysers in Iceland, that heat is best brought to the surface in the water and so digging deep will create that constant flow of hot fluid that effectively fills up the radiators.

At a million pounds a kilometre, it’s an expensive hole.

But once the infrastructure is completed, the costs of producing that heat would be relatively cheap and genuinely renewable.

The feasibility study was completed by TownRock Energy in partnership with the health board.

It concluded that a geothermal solution could supply significant quantities of renewable heat for NHS Grampian’s main Foresterhill Health Campus in Aberdeen.

The next phase of the project would mean proving the viability of the technology proposed in the feasibility study.

It is estimated drilling the borehole would cost at least £2.45m.

NHS Grampian said the process used similar skills and technology to those used in the North Sea oil and gas industry.

NHS Grampian’s energy manager Michael Black said the energy bill for the Foresterhill Health Campus alone was about £1m a month.

He said that cost estimates compared to gas made a “strong” case for exploring the geothermal option further.

“But there is a huge amount of work to do with partners to look at the options on the table and explore potential funding sources,” Mr Black added.

‘Advances in engineering’

NHS Grampian is also exploring a larger project with the city’s two universities looking at the potential to heat local homes.

TownRock Energy chief executive David Townsend said: “The feasibility study enabled us to look in detail at how deep geothermal wells would have to be drilled to achieve the temperature and heat generating capacity we’d need for NHS Grampian, and start to build a business case for further development.

“The findings are promising so far, and an exploration drilling phase would prove the commercial viability of the system and determine how best to design and build it.”

He said that, with the right design, a geothermal system could produce enough heat not just for the Foresterhill campus but for other people in Aberdeen relying on gas.

“When people hear the word geothermal, they often think about areas like Iceland,” Mr Townsend said.

“But recent advances in engineering mean that lower temperature resources in geologically stable regions like Aberdeen are now viable.”

Continue Reading

-

Chubb Appoints Bill Hazelton Chief Operating Officer, North America Field Operations

Chubb Appoints Bill Hazelton Chief Operating Officer, North America Field Operations

NEW YORK, Nov. 18, 2025 /PRNewswire/ — Chubb today announced that Bill Hazelton has been appointed to Chief Operating Officer for North America Field Operations, effective December 1, 2025.

In this role, Bill will oversee the delivery of Chubb’s full portfolio of personal and commercial insurance products and services to agent and broker distribution partners through 48 branch offices across North America.

He will also assist in the day-to-day management of North America Field Operations, with a specific focus on deepening Chubb’s longstanding relationships with top trading partners, overseeing national distribution management, business development, and Chubb Insurance Solutions Agency Inc., ensuring alignment with strategic deliverables and fostering growth across all business segments. Bill will report to Chris Maleno, Senior Vice President, Chubb Group, Vice Chairman, North America Insurance and Division President, North America Field Operations.

“We are excited to welcome Bill back to Chubb. He comes to this role with a deep understanding of Chubb’s strong product and service capabilities, along with a deep network within our largest agents and brokers, as well as the unique needs of our clients,” said Maleno. “I am looking forward to working with Bill again as he leverages his expertise to manage and grow our distribution network and maintain Chubb’s top position in North America.”

Bill brings more than three decades of extensive industry experience in underwriting, claims and distribution partner management to the role. He most recently served as Executive Vice President & President of North America Insurance for Everest Group, Ltd. Prior to that, Bill served more than 18 years with Chubb, holding a variety of roles including Head of North America Industry Practices, Head of North America Claims and leadership roles in Chubb’s Real Estate & Hospitality and Construction Industry Practices and Environmental and Excess Casualty business units.

About Chubb

Chubb is a world leader in insurance. With operations in 54 countries and territories, Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance to a diverse group of clients. The company is defined by its extensive product and service offerings, broad distribution capabilities, exceptional financial strength and local operations globally. Parent company Chubb Limited is listed on the New York Stock Exchange (NYSE: CB) and is a component of the S&P 500 index. Chubb employs approximately 43,000 people worldwide. Additional information can be found at: www.chubb.com.

SOURCE Chubb

Continue Reading

-

Societe Generale issues its first digital bond in the United States on blockchain

Societe Generale successfully completed its first digital bond issuance in the United States, which was made using Broadridge Financial Solutions, Inc.’s tokenization capability on the Canton Network blockchain. The bonds were issued as security tokens registered by Societe Generale – FORGE (SG-FORGE), the subsidiary of Societe Generale dedicated to digital assets. DRW, a leading trading firm proven to drive innovation in markets, purchased the bonds, which are short-term floating rate debt securities linked to SOFR1.

This bond issuance represents one of the pioneering digital securities offerings to institutional investors in the United States. This milestone is a notable extension of Societe Generale’s capabilities in the digital asset space, following a series of successful tokenized issuances in Europe since 2019 executed by SG- FORGE2, which provides end-to-end services to issue and manage digital-native financial products registered on blockchain.

This U.S. inaugural digital bond has been issued on the Canton Network, initially developed by Digital Asset to enable instantaneous on-chain transfer of securities, while allowing the issuer and registrar to adhere to traditional capital markets practices and requirements.

The bonds are the first securities to be tokenized using Broadridge’s newly launched tokenization capability, which enables firms to issue securities in a digital format, providing increased transparency and traceability as well as improved velocity and settlement efficiency.

Broadridge and SG-FORGE used IntellectEU’s Catalyst Blockchain Manager to operate their nodes on the Canton Network’s decentralized interoperability infrastructure, known as the Global Synchronizer. Collectively, these tools enabled Societe Generale’s inaugural U.S. tokenized bond issuance and open the door to future opportunities for additional issuances and potentially other applications.

BNY, one of the leading third-party intermediaries supporting issuances within the global debt capital markets, will act as paying agent for the bonds. Mayer Brown served as legal advisor to Societe Generale on this digital bond issuance.

This successful transaction in the U.S. market is a meaningful step towards future tokenized asset issuances, including structured products. It demonstrates Societe Generale’s commitment to drawing on its financial structuring expertise and on SG-FORGE’s technological capabilities to deliver value-added services to its clients.

“The successful completion of this transaction highlights our industry-leading position in securities tokenization. It demonstrates Societe Generale’s capabilities to securely bring new instruments on-chain, in a sophisticated legal and regulatory environment,” said Jean-Marc Stenger, CEO of Societe Generale – FORGE.

“The issuance of these landmark digital bonds is an important step toward building the future of finance. As long-time advocates of innovation in financial markets, we believe tokenization has the potential to unlock efficiency, transparency, and broader access across the ecosystem. This reflects the growing momentum behind institutional adoption of digital-native assets,” said Chris Zuehlke, Global Head of Cumberland, the digital asset arm of DRW.

“By enabling the on-chain issuance of corporate debt on public blockchains, we are opening new distribution channels for issuers and their partners. This evolution expands our tokenization capabilities beyond US Treasuries into broader asset classes, enhancing their liquidity and utility as collateral in margin and secured funding functions. Broadridge is powering the next phase of tokenization by building the infrastructure underpinning on-chain capital markets, expanding liquidity, and widening investor access,” said Horacio Barakat, Head of Digital Innovation at Broadridge.

“We congratulate Societe Generale for advancing the digital evolution of capital markets, demonstrating how regulated institutions can issue and manage real-world financial instruments on-chain with the same rigor and confidence as traditional markets. By combining the proven structures of today’s financial system with the transparency, efficiency, and interoperability of digital infrastructure, this issuance showcases how tokenization can meaningfully enhance market operations and unlock new opportunities for institutions and investors,” said Yuval Rooz, CEO and Co-Founder of Digital Asset.

“Markets demand delivery, not just vision. Our capabilities enable issuers like Societe Generale to turn innovation into reality. Digital bonds bring efficiency, unlock new markets for issuers, and enhance liquidity and asset mobility. By leveraging BNY’s trusted services and operational reliability, we’re reshaping finance — providing seamless access to digital markets built on the strength of traditional market infrastructure,” said Cécile Nagel, Head of Corporate Trust at BNY.

1 SOFR: Secured Overnight Financing Rate published by the New York Federal Reserve.

2 Societe Generale-FORGE is not licensed, registered, or otherwise authorized in any capacity to conduct business or engage in commercial activities within the United States. See presentation below.Press contacts:

Societe Generale

Sarah Cohen Lippe_ +33 1 58 98 51 91_ sarah.cohen-lippe@socgen.com

Fanny Rouby_ +33 1 57 29 11 12_ fanny.rouby@socgen.com

Jim Galvin_+1 212 278 7131_ jim.galvin@sgcib.comContinue Reading

-

S&P Global Accelerates Private Markets Data Access with No-Code iLEVEL Snowflake Integration

S&P Global Accelerates Private Markets Data Access with No-Code iLEVEL Snowflake Integration

New integration enhances decision-making by enabling faster analysis across multiple datasets, reducing time-to-insights

NEW YORK, Nov. 18, 2025 /PRNewswire/ — S&P Global (NYSE: SPGI) has announced the launch of its iLEVEL Snowflake integration, a no-code solution that is designed to enable private markets investors to seamlessly extract core raw datasets from S&P Global’s iLEVEL portfolio monitoring platform directly to their Snowflake environment.

This integration continues to strengthen S&P Global’s position as a leading private markets intelligence provider and follows a series of strategic announcements in this space including a collaboration with Cambridge Associates and Mercer to provide comprehensive private markets intelligence, the agreement to acquire With Intelligence and the launch of the S&P Private Equity 50 Indices.

The new iLEVEL Snowflake offering enhances decision-making capabilities for private markets investors by enabling them to analyze iLEVEL data alongside other critical datasets within their Snowflake environment. By minimizing technical barriers and reducing time-to-insights, the integration empowers firms to make more informed investment decisions through comprehensive analysis of diverse data sources, while freeing up development teams to focus on high-value strategic initiatives.

“This launch represents a significant enhancement to iLEVEL’s connectivity offering and builds on our competitive position in the private markets space,” said Darren Thomas, Head of Enterprise Solutions at S&P Global Market Intelligence. “By combining iLEVEL’s comprehensive private markets data with Snowflake’s powerful analytics platform, we’re enabling our clients to unlock deeper insights and make more informed investment decisions faster than ever before.”

The integration leverages Snowflake’s secure data sharing to facilitate access and collaboration. Clients receive all historical iLEVEL data during initial setup, with subsequent syncs refreshing datasets with new updates. Users can monitor sync status through iLEVEL’s activity log and directly within Snowflake.

“By eliminating manual processes while maintaining enterprise-grade security, Snowflake secure data sharing removes technical friction and accelerates the journey to comprehensive data management,” said Kieren Kennedy, Global Vice President, Data Cloud Product Partners at Snowflake. “It represents exactly the kind of innovation our customers expect from the AI Data Cloud.”

The solution also provides access to additional S&P Global datasets available through the Snowflake Marketplace, including Company Financials, RatingsXpress® Credit Ratings and Sustainability data, enabling comprehensive analysis alongside private financial intelligence.

This integration builds upon previous collaboration between S&P Global and Snowflake. S&P Global was recently awarded Snowflake Financial Services Data Cloud Partner of the Year, read more here.

To learn more about S&P Global’s private markets insights and offerings, visit here.

Media Contacts:

Orla O’Brien

S&P Global

+1 857 407 8559

orla.obrien@spglobal.comErina Aoyama

S&P Global Market Intelligence

+1 917-755-7943

erina.aoyama@spglobal.comAbout S&P Global:

S&P Global (NYSE: SPGI) enables businesses, governments, and individuals with trusted data, expertise and technology to make decisions with conviction. We are Advancing Essential Intelligence through world-leading benchmarks, data, and insights that customers need in order to plan confidently, act decisively, and thrive economically in a rapidly changing global landscape.

From helping our customers assess new investments across the capital and commodities markets to guiding them through the energy expansion, acceleration of artificial intelligence, and evolution of public and private markets, we enable the world’s leading organizations to unlock opportunities, solve challenges, and plan for tomorrow – today. Learn more at www.spglobal.com.

SOURCE S&P Global

Continue Reading

-

Websites down after outage at network firm Cloudflare

Websites including X and Spotify have been hit by a major outage linked to Cloudflare.

Thousands of users reported issues with a host of different websites, including the film review site Letterboxd, which were impacted by technical issues at the internet network services business.

The DownDetector monitoring site, which was itself hit by the outage, showed a flurry of reported issues after 11am on Tuesday.

More than 10,000 DownDetector users reported issues related to Cloudflare.

A number of the websites affected, including X, came back online temporarily before suffering further problems.

Users saw a message on a number of the websites saying the issues were caused by an “internal server error on Cloudflare’s network”.

Cloudflare provides network and security services for many online businesses in order to help their websites and applications operate.

Continue Reading

-

The 6th Round of Bilateral Political Consultations between Pakistan and Finland

The 6th round of Bilateral Political Consultations between Pakistan and Finland was held today in Islamabad.

The Pakistan side was led by Additional Secretary Europe Muhammad Khalid Jamali and the Finnish side was led by Under-Secretary of State for Foreign and Security Policy Outi Holopainen.

The two sides discussed the entire spectrum of bilateral relations including cooperation in trade, investment, education, science and technology and climate change. Both sides also held a detailed exchange of views on global and regional issues of mutual interest.

The Additional Secretary (Europe) appreciated the positive momentum in bilateral ties and reaffirmed Pakistan’s commitment to further strengthen cooperation with Finland.

Furthermore, the Additional Secretary thanked the Finnish side for its support on Pakistan’s GSP Plus status and invited Finnish companies to participate in the upcoming Pakistan-EU Business Forum scheduled for April 2026.

It was agreed to hold the next round of consultations in Finland.

Islamabad

November 18, 2025Continue Reading

-

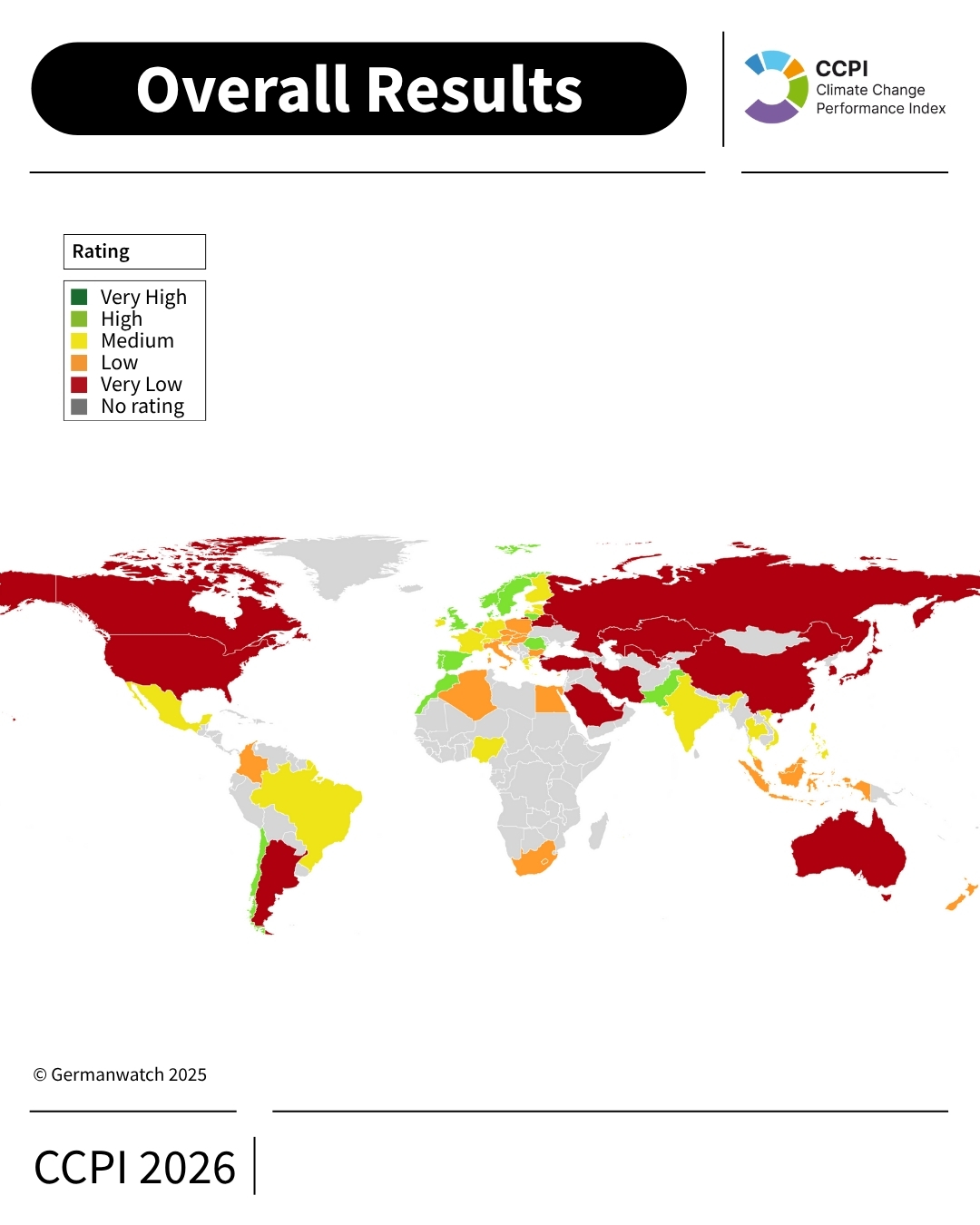

Press release: Climate Change Performance Index 2026

Climate ranking shows: The world is making progress, but the US and other Petrostates are resisting change

Germanwatch, NewClimate Institute, and CAN International publish the 21st edition of the Climate Change Performance Index (CCPI 2026): Denmark remains at the top, followed by UK and Morocco. Petrostates rank at the bottom: Saudi Arabia, Iran and USA. Dynamics in many G20 countries not yet strong enough.

Belém (18 Nov 2025). Ten years after the Paris Agreement, progress is clearly visible: Global per capita emissions are falling, renewable energies are growing massively, and more than 100 countries now have their own climate targets for net-zero emissions. However, the pace is still too slow to meet the Paris climate targets. The Climate Change Performance Index (CCPI) published today by Germanwatch and the NewClimate Institute also paints this ambivalent picture.

As in previous years, the top three ranks remain vacant. Countries must accelerate climate action to align with the Paris Agreement’s temperature limit. Denmark remains the top-ranked country (4th). It ranks first in climate policy and is among the only three countries that achieve a very high rating in the field of renewable energies – the country is a leader in offshore energy. Denmark is followed by the United Kingdom (5th), which has climbed one place compared to last year. Overall, the country’s years of climate policy efforts are paying off – for example the UK already had the coal phase-out last year. However, the country still has some catching up to do, especially when it comes to renewable energy (ranked ‘low‘). Morocco (6th) scores ‘good’ in all categories except renewable energies, where the trend is nevertheless ‘good’. The country still has very low per capita emissions and impresses with major investments in public transport and a respectable new climate target for 2035.

Niklas Höhne (NewClimate Institute), author of the CCPI: “While we cannot yet attest to any country having very good climate mitigation performance overall, there are pioneers in some categories who are demonstrating ambitious performance. Pakistan, for example, is a surprise contender in terms of emissions and energy consumption thanks to its very low per capita figures. As in previous years, Norway, Denmark and Sweden are setting the standards in renewable energies.”

In contrast, there are the countries that perform worst in the ranking. The three last-placed countries in the CCPI are Saudi Arabia (67th), Iran (66th), and the USA (65th). Thea Uhlich (Germanwatch), author of the CCPI: “The USA has suffered a particularly remarkable decline – ranking third to last in the overall standings just behind Russia. The largest oil- and gas-producing countries are virtually among themselves and show no sign of departing from fossil fuels as a business model. This means they are missing out on an opportunity to embrace the future.”

G20 countries: Only one good – ten very weak

“There is positive momentum for renewable energies and electrification worldwide. However, we also see a worrying picture among the major emitters – the G20 countries – with only one country in the ‘high’ category and ten in the ‘very low’ category,” says Uhlich. Although the G20 countries are responsible for more than 75 percent of global greenhouse gas (GHG) emissions and have a special responsibility, only one G20 country, the UK, achieves a ‘high‘ rating in the ranking. It is particularly worrying that ten G20 countries are still classified as ‘very low‘ (Turkey, China, Australia, Japan, Argentina, Canada, Korea, Russia, USA, Saudi Arabia), followed by three more in the low category: South Africa, Indonesia, and Italy.

The largest carbon emitter, China (54th), has improved by one place but – despite the dynamics on the way to the first electro state – still has a very low rating. Only in the area of climate policy is China achieving a ‘high‘.

In the first quarter of 2025, China’s emissions declined – this could be an indication that emissions in China have peaked. Although China is a pioneer in green technologies – there is an ongoing boom in electric cars, batteries and renewable energies – and has set a relatively ambitious climate target, it is simultaneously expanding its fossil fuel production. It is important for China that the expansion of renewable energy and e-mobility goes hand in hand with the phase-out of fossil fuels, not only to prevent emissions from rising further, but also to bring them down quickly.

India (23th), one of the largest emitters, is one of the biggest faller in this year’s ranking, landing in the ‘medium‘ category. Jan Burck (Germanwatch), author of the CCPI: “The decline in the ranking is due to a combination of factors. India ranks last in terms of emissions trends, as emissions have been rising steadily in recent years. At the same time, energy consumption is increasing. India has also lost many places in climate policy rankings mainly due to its lack of a plan to phase out coal or even a concrete phase-out date. If India will reduce the building of new coal power plants and continues the promising trend for renewables, the country can achieve a much better ranking again next year.”

Continue Reading